UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

________________

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

Ondas Holdings Inc.

__________________________________________________________

(Name of Registrant as Specified In Its Charter)

__________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required |

|||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

|||

|

|

||||

|

(2) |

Aggregate number of securities to which transaction applies: |

|||

|

|

||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

|

|

||||

|

(4) |

Proposed maximum aggregate value of transaction: |

|||

|

|

||||

|

(5) |

Total fee paid: |

|||

|

|

||||

|

☐ |

Fee paid previously with preliminary materials. |

|||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

|||

|

|

||||

|

(2) |

Form, Schedule or Registration Statement No.: |

|||

|

|

||||

|

(3) |

Filing Party: |

|||

|

|

||||

|

(4) |

Date Filed: |

|||

|

|

||||

Ondas Holdings Inc.

61 Old South Road, #495

Nantucket, Massachusetts 02554

October 7, 2021

Dear Fellow Ondas Stockholder:

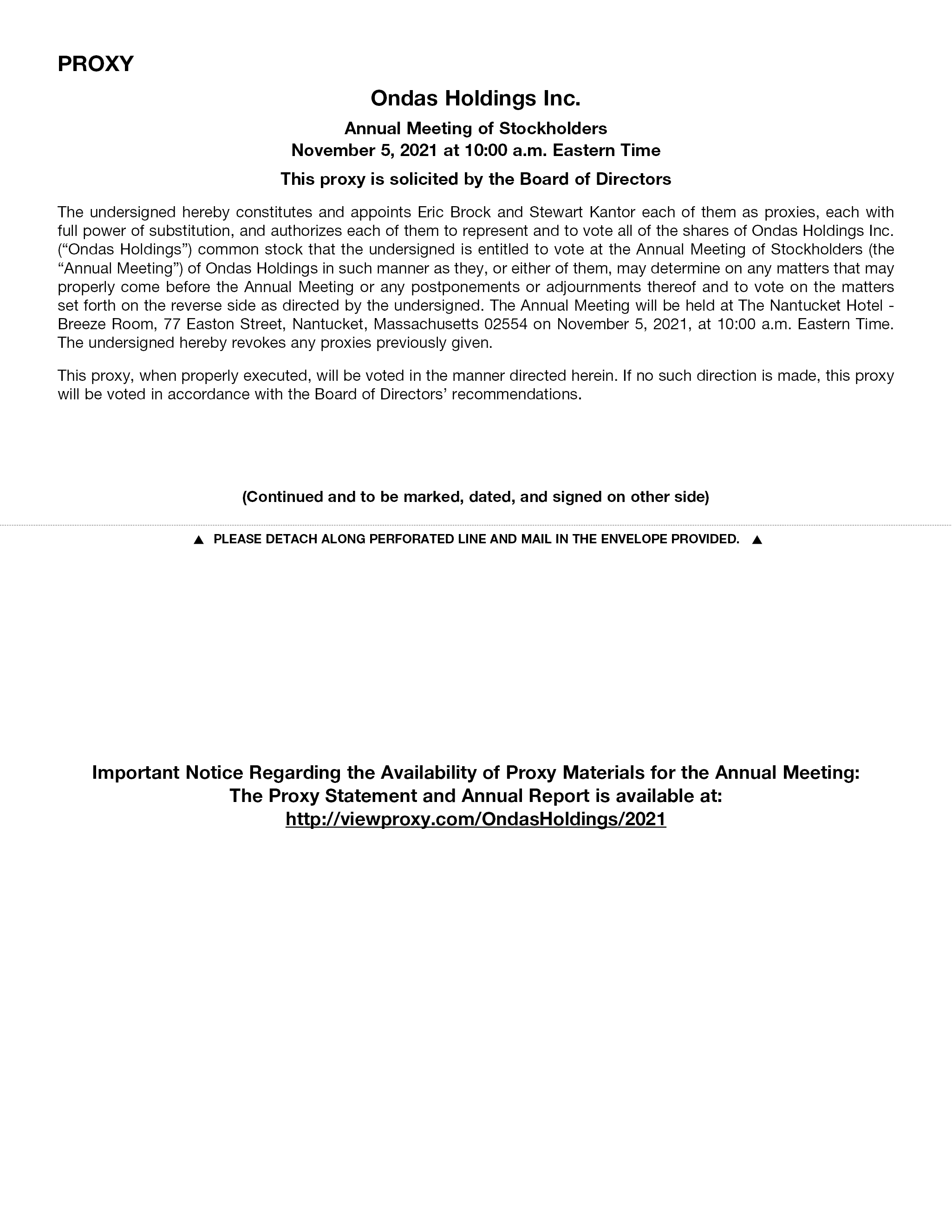

We are pleased to invite you to join us at the 2021 Annual Meeting of Stockholders of Ondas Holdings Inc. (“Ondas”) to be held on Friday, November 5, 2021 at 10:00 a.m. Eastern Time, at The Nantucket Hotel — Breeze Room, 77 Easton Street, Nantucket, Massachusetts 02554.

The accompanying Notice of Annual Meeting and Proxy Statement describes the specific matters to be voted upon at the Annual Meeting. Whether you own a few or many shares of Ondas stock and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented at the Annual Meeting. Your vote is important and we ask that you please cast your vote as soon as possible.

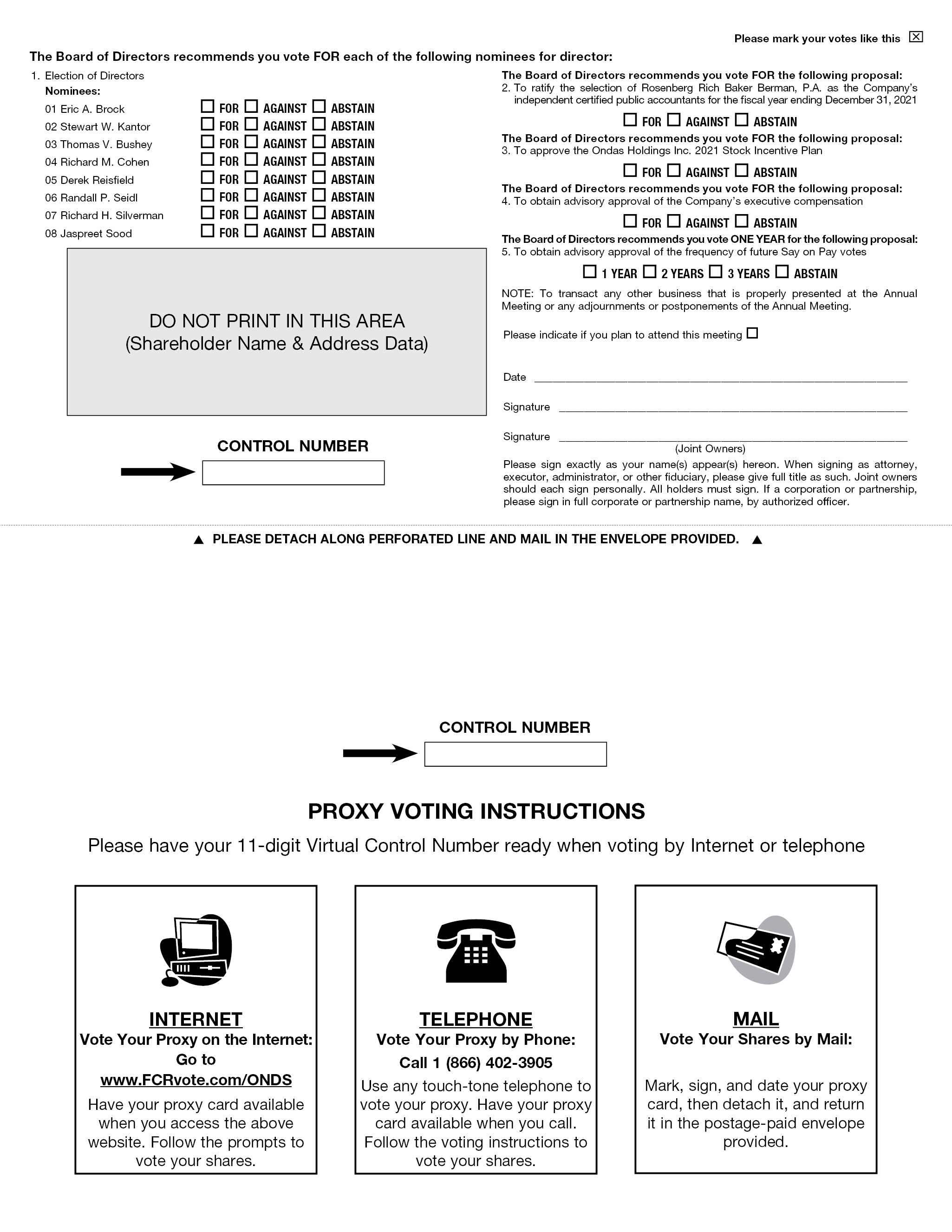

The Board of Directors recommends that you vote FOR the election of all the director nominees; FOR the ratification of the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2021; FOR the approval of the Ondas Holdings Inc. 2021 Stock Incentive Plan; FOR the advisory approval of the Company’s executive compensation (“Say on Pay”); and ONE YEAR for the advisory approval of the frequency of future Say on Pay votes. Please refer to the accompanying Proxy Statement for detailed information on each of the proposals and the Annual Meeting.

Sincerely,

Eric A. Brock

Chairman and Chief Executive Officer

Ondas Holdings Inc.

Ondas Holdings Inc.

61 Old South Road, #495

Nantucket, Massachusetts 02554

NOTICE OF THE 2021 ANNUAL MEETING OF STOCKHOLDERS

To Stockholders of Ondas Holdings Inc.:

The 2021 Annual Meeting of Stockholders of Ondas Holdings Inc. will be held on Friday, November 5, 2021 at 10:00 a.m. Eastern Time, at The Nantucket Hotel — Breeze Room, 77 Easton Street, Nantucket, Massachusetts 02554. The purpose of the Annual Meeting is to consider and vote upon the following proposals:

(1) Director Election Proposal — a proposal to elect eight directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified;

(2) Auditor Ratification Proposal — a proposal to ratify the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2021;

(3) 2021 Stock Incentive Plan Proposal — a proposal to approve the Ondas Holdings Inc. 2021 Stock Incentive Plan (“2021 Incentive Plan”);

(4) Say on Pay Proposal — a proposal to obtain advisory approval of the Company’s executive compensation;

(5) Frequency of Say on Pay Proposal — a proposal to obtain advisory approval of the frequency of future Say on Pay votes; and

(6) To transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

The close of business on September 27, 2021 has been fixed as the record date for the Annual Meeting (the “Record Date”). Only holders of record of Ondas Holdings Inc. common stock on the Record Date are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We cordially invite you to attend the Annual Meeting in person. Even if you plan to attend the Annual Meeting, we ask that you please cast your vote as soon as possible. As more fully described in the accompanying proxy statement, you may revoke your proxy and reclaim your right to vote at any time prior to its use.

Sincerely,

Stewart W. Kantor

President, Chief Financial Officer,

Treasurer, and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 5, 2021

The accompanying proxy statement and the 2020 Annual Report on Form 10-K are available at

http://viewproxy.com/OndasHoldings/2021.

PROXY STATEMENT

|

Page |

||

|

1 |

||

|

1 |

||

|

5 |

||

|

8 |

||

|

12 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

16 |

|

|

18 |

||

|

19 |

||

|

23 |

||

|

24 |

||

|

25 |

||

|

26 |

||

|

28 |

||

|

A-1 |

i

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of Ondas Holdings Inc. (“Ondas” or the “Company,” or “we,” “us,” and “our”) for use at our 2021 Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held on Friday, November 5, 2021 at 10:00 a.m. Eastern Time, at The Nantucket Hotel — Breeze Room, 77 Easton Street, Nantucket, Massachusetts 02554. If you will need directions to the Annual Meeting, or if you require special assistance at the Annual Meeting because of a disability, please contact Stewart Kantor at (888) 350-9994.

The close of business on September 27, 2021 has been fixed as the record date for the Annual Meeting (the “Record Date”). Only holders of record of Ondas common stock on the Record Date are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the Record Date, there were 40,607,723 shares of common stock issued and outstanding and entitled to vote at the Annual Meeting. This proxy statement and form of proxy are first being mailed to stockholders on or about October 7, 2021.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of our 2021 Annual Meeting?

Our 2021 Annual Meeting will be held to consider and vote upon the following proposals:

(1) Director Election Proposal — a proposal to elect eight directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified;

(2) Auditor Ratification Proposal — a proposal to ratify the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2021;

(3) 2021 Incentive Plan Proposal — a proposal to approve the Ondas Holdings Inc. 2021 Stock Incentive Plan (“2021 Incentive Plan”);

(4) Say on Pay Proposal — a proposal to obtain advisory approval of the Company’s executive compensation;

(5) Frequency of Say on Pay Proposal — a proposal to obtain advisory approval of the frequency of future Say on Pay votes; and

(6) to transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting only if you were an Ondas stockholder as of the Record Date or you hold a valid proxy for the Annual Meeting. You should be prepared to present photo identification for admittance. If your shares are held by a brokerage firm, bank, or a trustee, you should provide proof of beneficial ownership as of the Record Date, such as a bank or brokerage account statement or other similar evidence of ownership. Even if you plan to attend the Annual Meeting, please cast your vote as soon as possible.

What are the voting rights of Ondas stockholders?

Each stockholder of common stock is entitled to one vote per share on each of the eight director nominees and one vote per share on each other matter properly presented at the Annual Meeting for each share of common stock owned by that stockholder on the Record Date.

1

What constitutes a quorum?

The holders of a majority of the shares of stock, issued and outstanding and entitled to vote, shall be present in person or represented by proxy in order to constitute a quorum for the Annual Meeting. If you submit a properly executed proxy or voting instruction card or properly cast your vote via the Internet or telephone, your shares will be considered part of the quorum, even if you abstain from voting or withhold authority to vote as to a particular proposal. Under Nevada law, we also will consider as present for purposes of determining whether a quorum exists any shares represented by “broker non-votes.”

What are “broker non-votes?”

“Broker non-votes” occur when shares held by a brokerage firm are not voted with respect to a proposal because the firm has not received voting instructions from the stockholder and the firm does not have the authority to vote the shares in its discretion. Under New York Stock Exchange rules, the Director Election Proposal, 2021 Incentive Plan Proposal, Say on Pay Proposal, and Frequency of Say on Pay Proposal are non-routine proposals, and as such a broker does not have the discretion to vote on such proposals if such broker has not received instructions from the beneficial owner of the shares represented. The Auditor Ratification Proposal is a routine proposal, and as such a broker does have discretion to vote on the Auditor Ratification Proposal.

Will my shares be voted if I do not provide my proxy?

If your shares are held by a brokerage firm and you do not provide the firm specific voting instructions, such firm will not have the authority to vote your shares for the Director Election Proposal, 2021 Incentive Plan Proposal, Say on Pay Proposal, and Frequency of Say on Pay Proposal, and your shares will not be voted, and will be considered “broker non-votes,” with respect to these proposals to be presented at the Annual Meeting. Therefore, we urge you to provide voting instructions so that your shares will be voted. If you hold your shares directly in your own name, your shares will not be voted unless you provide a proxy or fill out a written ballot in person at the Annual Meeting.

How do I vote?

Ondas stockholders of record on September 27, 2021 may submit their proxies as follows:

• Through the Internet, by visiting the website established for that purpose at www.FCRvote.com/ONDS by 11:59 p.m. Eastern Time on November 4, 2021 and following the instructions;

• By telephone, by calling the toll-free number 1 (866) 402-3905 in the United States, Canada, or Puerto Rico on a touch-tone phone by 11:59 p.m. Eastern Time on November 4, 2021 and following the recorded instructions; or

• By mail, by marking, signing, and dating the enclosed proxy card and returning it in the postage-paid envelope provided or returning it pursuant to the instructions provided in the proxy card.

If you are a beneficial owner, please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you.

To vote in person:

• If you are a registered holder, attend our Annual Meeting, bring valid photo identification, and deliver your completed proxy card or ballot in person; or

• If you hold your shares in “street name,” attend our Annual Meeting, bring valid photo identification, and obtain a legal proxy from your bank or broker to vote the shares that are held for your benefit, attach it to your completed proxy card and deliver it in person.

2

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet, by telephone, by signing and mailing a new proxy card with a later date, or by attending the Annual Meeting and voting in person (only your latest proxy submitted prior to the Annual Meeting will be counted). However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

What vote is required to approve each proposal at the Annual Meeting?

Proposal 1 — Director Election Proposal.

The vote required to elect our eight directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote for the Director Election Proposal.

Proposal 2 — Auditor Ratification Proposal.

The vote required to approve the Auditor Ratification Proposal is a majority of the votes cast at the Annual Meeting. Abstentions will have no effect on the outcome of the vote for the Auditor Ratification Proposal.

Proposal 3 — 2021 Incentive Plan Proposal.

The vote required to approve the 2021 Incentive Plan Proposal is a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote for the 2021 Incentive Plan Proposal.

Proposal 4 — Say on Pay Proposal.

The vote required to approve the Say on Pay Proposal is a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the Say on Pay Proposal.

Proposal 5 — Frequency of Say on Pay Proposal.

Stockholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation every one, two, or three years, and the Board and the Compensation Committee will take into account the outcome of the vote when considering how frequently to seek an advisory vote on Say on Pay in future years. Stockholders may, if they wish, abstain from casting a vote on this proposal. The option receiving the highest number of votes will be deemed to be the preferred frequency of our stockholders. Abstentions and broker non-votes will have no effect on the outcome of the Frequency of the Say on Pay Proposal.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

• FOR Proposal 1: the Director Election Proposal;

• FOR Proposal 2: the Auditor Ratification Proposal;

• FOR Proposal 3: the 2021 Incentive Plan Proposal;

• FOR Proposal 4: the Say on Pay Proposal; and

• ONE YEAR on Proposal 5: the Frequency of Say on Pay Proposal.

3

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your voting instructions. If you submit a proxy but do not provide instructions or if your instructions are unclear, the persons named as proxies will vote your shares in accordance with the recommendations of the Board, as set forth above.

With respect to any other proposal that properly comes before the Annual Meeting, the persons named as proxies will vote as recommended by our Board or, if no recommendation is given, in their own discretion.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers, and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. Ondas has engaged Alliance Advisors, LLC to assist it in the distribution and solicitation of proxies at a fee of $12,500, plus expenses. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of common stock held of record by them.

Whom should I call with questions?

If you have additional questions about the Annual Meeting, you should contact:

Ondas Holdings Inc.

61 Old South Road, #495

Nantucket, Massachusetts 02554

Attention: Investor Relations

Phone Number: (888) 350-9994

E-mail Address: inquiries@ondas.com

If you would like additional copies of this proxy statement or you need assistance voting your shares, you should contact:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, New Jersey 07003

Phone: (855) 325-6668 (Toll Free in U.S.)

Website: www.allianceadvisors.com

4

PROPOSAL 1: DIRECTOR ELECTION PROPOSAL

Our Board currently consists of eight members. Eric Brock, Chairman and Chief Executive Officer of the Company, and Stewart W. Kantor, President, Chief Financial Officer, Treasurer and Secretary of the Company, identified Messrs. Bushey and Seidl and Ms. Sood as director nominees and presented such nominations to the Nominating and Corporate Governance (“N&CG”) Committee as highly qualified candidates who bring relevant experience to our Board. Mr. Bushey was appointed to the Board on June 3, 2020. Mr. Seidl was appointed to the Board on November 16, 2020. Ms. Sood was appointed to the Board on January 19, 2021. Messrs. Cohen, Reisfield and Silverman previously served as directors of Ondas Networks Inc. and were appointed directors of Ondas on September 28, 2018 following the completion of the Acquisition (as defined below). Upon the recommendation of our N&CG Committee, our Board has nominated the eight persons listed below to stand for a term expiring at the next Annual Meeting of Stockholders or until their successors are duly elected and qualified. Each nominee listed below is currently serving as a director and is willing and able to serve as a director of Ondas.

Directors and Executive Officers

Below are the names of and certain information regarding our executive officers and directors:

|

Name |

Age |

Position |

||

|

Eric A. Brock |

51 |

Chairman and Chief Executive Officer |

||

|

Stewart W. Kantor |

59 |

Director, President, Chief Financial Officer, Treasurer, and Secretary |

||

|

Thomas V. Bushey |

41 |

Director |

||

|

Richard M. Cohen |

70 |

Director |

||

|

Derek Reisfield |

58 |

Director |

||

|

Randall P. Seidl |

58 |

Director |

||

|

Richard H. Silverman |

81 |

Director |

||

|

Jaspreet Sood |

48 |

Director |

Eric A. Brock — Chairman of the Board and Chief Executive Officer

Mr. Brock was appointed as one of our directors and as our President, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer on June 28, 2018. On September 28, 2018, following the completion of the reverse acquisition transaction to acquire Ondas Networks Inc. (the “Acquisition”), he was appointed Chairman of the Board and resigned from the positions of Chief Financial Officer, Secretary and Treasurer. Mr. Brock also serves as Chairman of the Board and Chief Executive Officer of Ondas Networks Inc. since September 28, 2018. Mr. Brock is an entrepreneur with over 20 years of global banking and investing experience. He served as a founding Partner and Portfolio Manager with Clough Capital Partners, a Boston-based investment firm from 2000 to 2017. Prior to Clough, Mr. Brock was an investment banker at Bear, Stearns & Co. and an accountant at Ernst & Young, LLP. Mr. Brock holds an MBA from the University of Chicago and a BS from Boston College. Our Board believes that Mr. Brock’s experience in the public markets makes him well qualified to serve on our Board.

Stewart W. Kantor — Director, President, Chief Financial Officer, Treasurer and Secretary

Mr. Kantor was appointed as one of our directors and as our President, Chief Financial Officer, Treasurer and Secretary on September 28, 2018 following the completion of the Acquisition. Mr. Kantor served as our President from September 28, 2018 to June 2, 2020, and re-appointed as our President on January 19, 2021, and continues to serve as our Chief Financial Officer, President, Treasurer and Secretary. Mr. Kantor is a co-founder of Ondas Networks Inc. and served as its Chief Executive Officer since its inception on February 16, 2006 until the completion of the Acquisition. He now serves as Chief Financial Officer, Treasurer and Secretary of Ondas Networks Inc. Mr. Kantor brings 30 years of experience in the wireless industry including senior level positions in business and product development, and marketing and finance at AT&T Wireless, BellSouth International and Nokia Networks. Since 2004, Mr. Kantor has focused exclusively on the development of private wireless data network technology for mission critical industries including electric utilities, oil and gas companies and the transportation industries. Mr. Kantor obtained his B.A. in Political Science from Columbia University in 1984 and an MBA in Finance from the Wharton School in 1991. We believe Mr. Kantor’s industry background and experience makes him well qualified to serve on our Board.

5

Thomas V. Bushey — Director

Mr. Bushey was appointed as one of our directors effective June 3, 2020. Mr. Bushey served as our President from June 2, 2020 to January 19, 2021. Mr. Bushey has served as our consultant since January 19, 2021. Mr. Bushey has been Chief Executive Officer of Sunderland Capital, an investment management firm, since 2015. Prior to founding Sunderland Capital in 2015, Mr. Bushey was a portfolio manager at Blackrock. Previously he worked as an investment banker at Credit Suisse, as a private equity professional at Thayer Capital, and as a hedge fund analyst at Millennium Partners. Mr. Bushey earned a B.S. in Economics from the Wharton School of the University of Pennsylvania. We believe that Mr. Bushey’s investment banking and private equity background and experience make him well qualified to serve on our Board.

Richard M. Cohen — Director

Mr. Cohen was appointed as one of our directors on September 28, 2018. Previously, he had served as a member of the Board of Ondas Networks Inc. since April 2016. He has been the President of Richard M Cohen Consultants since 1995, a company providing financial consulting services to both public and private companies. From March 2012 to July 2015, he was the Founder and Managing Partner of Chord Advisors, a firm providing outsourced CFO services to both public and private companies. From May 2012 to August 2013, he was the Interim CEO and member of the Board of Directors of CorMedix Inc. (NYSE: CRMD). From July 2008 to August 2012, Mr. Cohen was a member of the Audit Committee of Rodman and Renshaw, an investment banking firm. From July 2001 to August 2012, he was a partner with Novation Capital until its sale to a private equity firm. Mr. Cohen holds a BS with honors from the University of Pennsylvania (Wharton), an MBA from Stanford University and a CPA from New York State. He is considered an expert to Chair the Audit Committee of a publicly traded company. We believe that Mr. Cohen’s educational background and financial experience supporting publicly traded companies including as a CEO and Board member of a public traded company on the New York Stock Exchange makes him well qualified to serve on our Board.

Derek Reisfield — Director

Derek Reisfield was appointed as one of our directors on September 28, 2018. Previously, he had served as a member of the Board of Ondas Networks Inc. since April 2016. From December 2020 to the present, he has served as the President and CEO of Thetis Business Solutions, LLC. From 2018 to 2020, he served as an independent business consultant. From 2015 to December 2018, Mr. Reisfield served as Vice President, Strategy and Business Development of MetaRail, Inc. (formerly, Wayfare Interactive Technologies, Inc.), a company that provides commerce search capabilities to digital publishers and marketers. In 2008, Mr. Reisfield co-founded BBN Networks, LLC, formerly known as BBN Networks, Inc., a digital advertising and marketing solutions company focused on the B2B sector, where he served as Chief Executive Officer until 2014 and as Chairman until 2015. Mr. Reisfield was Executive Vice President and CFO of Fliptrack, Inc., a social mobile gaming company, from 2007 to 2008. He was an independent consultant from 2002 to 2007 working with digital startups and large consumer-oriented companies facing digital threats and opportunities. He was Co-Founder and Managing Principal of i-Hatch Ventures, LLC from 1999-2001, Co-Founder, Vice Chairman and Executive Vice President of Luminant, Inc., a digital consulting firm, from 1999-2000, Co-Founder and Chairman of Marketwatch, a financial and business news and information company, from 1997-1998, President CBS New Media from 1997-1998, Vice President, Business Development of CBS, 1996-97, Director of Strategic Management CBS and its predecessor Westinghouse Electric Corporation, Inc. 1996-1997. Prior to that, Mr. Reisfield was the Co-Founder of the Media and Telecommunications Practice of Mitchell Madison Group, LLC, a management consultancy and a leader of the Media and Telecommunications practice of McKinsey & Company, Inc. a management consultancy. He has served on several public corporation boards. Mr. Reisfield is a director emeritus of the San Francisco Zoological Society. Mr. Reisfield holds a BA from Wesleyan University, and an AM in Communications Management from the Annenberg School of Communications of USC in 1986. We believe Mr. Reisfield’s experience in senior leadership positions at both privately held and publicly traded technology companies, including holding board positions in corporate governance, make him a well-qualified candidate to serve on our Board.

Randall P. Seidl — Director

Randall P. Seidl was appointed as one of our directors on November 16, 2020. In September 2020, he founded and continues to serve as CEO of Sales Community, a sales social network with a mission to add value to technology sales professionals. In 2016, he founded and continues to serve as CEO of Top Talent Recruiting, a boutique contingency-based recruiting business. In 2013, he founded and continues to serve as CEO of

6

Revenue Acceleration to help tech companies accelerate revenue growth. From 2009 to 2013, Mr. Seidl served as Sr. Vice President/General Manager of Hewlett Packard’s Americas and U.S. Enterprise Group. From 2006 to 2009, he served as Sr. Vice President/General Manager of Sun Microsystems’ North America business and as Vice President/General Manager for its Financial Services Area. From 2004 to 2006, he served as Vice President/General Manager of East Region at StorageTek. From 2003 to 2004, he served as CEO and director at Permabit, from 2000 to 2003 was co-founder and Executive Vice President of GiantLoop, and from 1996 to 1999 was Chairman and CEO of Workgroup Solutions. He began his career at EMC Corporation, holding various positions including Vice President of Open Systems Sales for North America from 1985 to 1996. Since 2015, Mr. Seidl has served as director of Data Dynamics, a privately-held company, a leader in intelligent file management solutions. Since 2014, he has served as director of Cloudgenera, a privately-held company, a leading supplier of vendor agnostic IT analytics that arm organizations with the business cases needed to optimize technology spend. He previously served as director of Datawatch Corporation (2015-2018, Nasdaq: DWCH, acquired by Altair). He continues to serve on the advisory boards or consults with DataRobot, Trilio, WekalO, ISG, CXO Nexus, Corent, DecisionLink, Dooly, Sendoso, Emissary, and CaptivateIQ. Mr. Seidl is a graduate of Boston College’s Carroll School of Management. Mr. Seidl serves as a trustee on Boston College’s Board of Trustees, on the Board of Trustees of St. Sebastian’s School, and is active with other charities. We believe Mr. Seidl’s experience in senior leadership positions at private/public technology companies and his private/public board experience makes him well-qualified to serve on our board of directors.

Richard H. Silverman — Director

Mr. Silverman was appointed as one of our directors on September 28, 2018. Previously, he had served as a member of the Board of Ondas Networks Inc. since April 2016. Mr. Silverman is a well-recognized and respected professional in the energy industry in Arizona and on a national level. He is past Chair of the board of directors for the Electric Power Research Institute; past Chair and former steering committee member of the Large Public Power Council; and former executive committee member of the board of directors for the American Public Power Association. Since August 2011, Mr. Silverman has been Of Counsel at Jennings, Strouss & Salmon, PLC, where he focuses his practice on energy law. Prior to joining the firm, he served as General Manager of Salt River Project from 1994 to 2011. Mr. Silverman holds a Juris Doctor from the University of Arizona and B.A. in Business from the University of Arizona. We believe Mr. Silverman’s prior experience as general manager of Salt River Project, one of the nation’s largest public power utilities serving approximately one million customers in the Phoenix metropolitan area, will help the Company navigate strategic issues in the rapidly changing electric utility industry with specific knowledge of the impact of renewables like solar energy on the electric grid and makes him well qualified to serve on our Board.

Jaspreet (Jas) Sood — Director

Ms. Sood was appointed as one of our directors on January 19, 2021. Ms. Sood is a seasoned executive who has strategic expertise in the areas of sales, product management, P&L management, operational transformation and go to market strategies. Since August 2021, Ms. Sood serves as Senior Vice President of Sales — US Enterprise for Palo Alto Networks (NYSE: PANW). Prior to joining Palo Alto Networks, Ms. Sood held a variety of executive level positions with Hewlett Packard Enterprise (NYSE: HPE) and its predecessor companies in the areas of business operations, strategy, product management, and finance. Ms. Sood was employed by Hewlett Packard Enterprise and its predecessor companies for twenty-five years. Ms. Sood holds an MBA with an emphasis in Technology Management from Pepperdine University and a bachelor’s degree in Economics from the University of California, Irvine. In 2018, 2019, 2020, and 2021, she was honored as a “CRN Power 100 Woman of the Channel” and is routinely featured as a guest speaker at various technology industry events. We believe Ms. Sood’s business experience makes her well qualified to serve on our board of directors.

Vote Required and Board Recommendation

The vote required to elect our eight directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes cast. The Board recommends that you vote “FOR” the election of each of the director nominees.

7

Board of Directors

The business and affairs of our company are managed by or under the direction of the Board. The Board is currently composed of eight members. The Board has not appointed a lead independent director; instead the presiding director for each executive session is rotated among the Chairs of the committees of our Board.

The Board held two meetings and took 12 actions by unanimous written consent during the year ended December 31, 2020. In 2020, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he served.

Our directors are expected to attend our Annual Meeting of Stockholders. Any director who is unable to attend our Annual Meeting is expected to notify the Chairman of the Board in advance of the Annual Meeting. The Company did not hold an Annual Meeting during the year ended December 31, 2020.

Committees of the Board

Audit Committee

Our Audit Committee reviews our internal accounting procedures and consults with and reviews the services provided by our independent registered public accountants. Our Audit Committee consists of three directors, Messrs. Cohen, Silverman and Reisfield, and our Board has determined that each of them is independent within the meaning of listing requirements of The Nasdaq Stock Market (“Nasdaq”) and the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). Mr. Cohen is the chairman of the Audit Committee and our Board has determined that Mr. Cohen is an “audit committee financial expert” as defined by SEC rules and regulations implementing Section 407 of the Sarbanes-Oxley Act. Our Board has determined that the composition of our Audit Committee meets the criteria for independence under, and the functioning of our Audit Committee complies with, the applicable requirements of the Sarbanes-Oxley Act, Nasdaq listing requirements and SEC rules and regulations. We intend to continue to evaluate the requirements applicable to us and to comply with the future requirements to the extent that they become applicable to our Audit Committee. The principal duties and responsibilities of our Audit Committee include:

• overseeing the accounting and financial reporting processes of the Company, internal systems of control of the Company and audits of the Company’s consolidated financial statements;

• overseeing the Company’s relationship with its independent auditors, including appointing or changing the Company’s auditors and ensuring their independence;

• providing oversight regarding significant financial matters, including the Company’s tax planning, treasury policies, dividends and share issuance and repurchases;

• overseeing the Code of Business Conduct and Ethics; and

• reviewing and approving all transactions with related persons for potential conflict of interest situations on an ongoing basis.

The Audit Committees held five meetings and took no actions by unanimous written consent during the year ended December 31, 2020.

Compensation Committee

Our Compensation Committee reviews and determines the compensation of all our executive officers. Our Compensation Committee consists of three directors, Messrs. Cohen, Silverman and Reisfield, each of whom is a non-employee member of our Board as defined in Rule 16b-3 under the Exchange Act and independent within the meaning of listing requirements of Nasdaq. Mr. Reisfield is the chairman of the Compensation Committee. Our Board has determined that the composition of our Compensation Committee satisfies the applicable independence requirements under, and the functioning of our Compensation Committee complies with the applicable listing

8

requirements of Nasdaq and SEC rules and regulations. We intend to continue to evaluate and intend to comply with all future requirements applicable to our Compensation Committee. The principal duties and responsibilities of our Compensation Committee include:

• establishing, overseeing and administering the Company’s employee compensation policies and programs;

• reviewing and approving compensation and incentive programs and awards for the Company’s Chief Executive Officer, all other executive officers of the Company and the non-employee members of the Company’s Board; and

• administering the Company’s equity compensation plans.

The Compensation Committee held two meetings and took two actions by unanimous written consent during the year ended December 31, 2020.

Nominating and Corporate Governance Committee

The N&CG Committee consists of three independent directors, Messrs. Cohen, Silverman and Reisfield. Mr. Cohen is the chairman of the N&CG Committee.

Our Board has determined that the composition of our N&CG Committee satisfies the applicable independence requirements under, and the functioning of our N&CG Committee complies with the applicable listing requirements of Nasdaq and SEC rules and regulations. We will continue to evaluate and will comply with all future requirements applicable to our N&CG Committee. The N&CG Committee’s responsibilities include:

• assisting the Board in identifying individuals qualified to become Board members, consistent with criteria approved by the Board;

• recommending for the Board’s approval the slate of nominees to be proposed by the Board to stockholders for election to the Board;

• developing, updating and recommending to the Board the governance principles applicable to the Company;

• overseeing the evaluation of the Board and management;

• recommending to the Board the directors who will serve on each committee of the Board; and

• addressing any related matters required by the federal securities laws.

The N&CG Committee held no meetings and took 2 action by unanimous written consent during the year ended December 31, 2020.

Code of Business Conduct and Ethics and Committee Charters

We have adopted a Code of Business Conduct and Ethics, or the Code of Conduct, applicable to all of our employees, executive officers and directors. The Audit Committee of our Board is responsible for overseeing the Code of Conduct and our Board must approve any waivers of the Code of Conduct for employees, executive officers and directors. All of our directors, executive officers and employees are required to certify in writing their understanding of and intent to comply with the Code.

We post on our website www.ondas.com the charters of each of our board committees and our Code of Business Conduct, and any amendments or waivers thereto applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions; and any other corporate governance materials contemplated by the Nasdaq listing requirements and SEC regulations. These documents are also available in print, without charge, to any stockholder requesting a copy in writing from our Secretary at our executive offices set forth in this proxy statement.

9

Board Leadership

The Board has no policy regarding the need to separate or combine the offices of Chairman of the Board (“Chairman”) and Chief Executive Officer and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for the Company. The positions of Chairman and Chief Executive Officer are currently held by Eric Brock. The Board believes the Chief Executive Officer is in the best position to direct the independent directors’ attention on the issues of greatest importance to the Company and its stockholders. As a result, the Company does not have a lead independent director. Our overall corporate governance policies and practices combined with the strength of our independent directors and our internal controls minimize any potential conflicts that may result from combining the roles of Chairman and Chief Executive Officer.

Board Oversight of Enterprise Risk

The Board is actively involved in the oversight and management of risks that could affect the Company. This oversight and management is conducted primarily through the committees of the Board identified above but the full Board has retained responsibility for general oversight of risks. The Audit Committee is primarily responsible for overseeing the risk management function, specifically with respect to management’s assessment of risk exposures (including risks related to liquidity, credit, operations and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The other committees of the Board consider the risks within their areas of responsibility. The Board satisfies its oversight responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Independence

A majority of our Board is independent under the rules of Nasdaq. Our Board has undertaken a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise his ability to exercise independent judgment in carrying out his responsibilities. As a result of this review, our Board has determined that Messrs. Cohen, Reisfield, Seidl, Silverman and Ms. Sood are “independent directors” as defined under the rules of Nasdaq.

Communications with the Company and the Board

Stockholders may communicate with the Company through its Investor Relations Department by writing to Investor Relations, Ondas Holdings Inc., 61 Old South Road, #495, Nantucket, Massachusetts 02554.

Stockholders interested in communicating with our Board, any Board committee, any individual director, or any group of directors (such as our independent directors) should send written correspondence to Ondas Holdings Inc. Board of Directors, Attn: Secretary, 61 Old South Road, #495, Nantucket, Massachusetts 02554.

Stockholder Proposals for Next Year’s Annual Meeting

Any stockholder proposal to be considered at the 2022 Annual Meeting of Stockholders, including nominations of persons for election to our Board, must be properly submitted to us by June 9, 2022. Detailed information for submitting stockholder proposals or nominations of director candidates will be provided upon written request to the Secretary of Ondas Holdings Inc., 61 Old South Road, #495, Nantucket, Massachusetts 02554.

10

Stockholder Director Nominations

The N&CG Committee has established a policy pursuant to which it considers director candidates recommended by our stockholders. All director candidates recommended by our stockholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other persons. To recommend a director candidate for consideration by our N&CG Committee, a stockholder must submit the recommendation in writing to our Secretary not later than 120 calendar days prior to the anniversary date of our proxy statement distributed to our stockholders in connection with our previous year’s annual meeting of stockholders, and the recommendation shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Corporation which are beneficially owned by the person and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and (b) as to the stockholder giving the notice, (i) the name and record address of such stockholder and (ii) the class and number of shares of capital stock of the Corporation which are beneficially owned by such stockholder. The Corporation may require any proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as a director of the Corporation.

11

Executive and Director Compensation

Summary Compensation Table

The table below sets forth compensation information for services rendered in all capacities for the last two fiscal years ended December 31, 2020 and 2019. The information includes the dollar value of base salaries, bonus awards, stock awards, stock options grants and certain other compensation, if any, whether paid or deferred.

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock |

Option |

Non-Equity |

Non-qualified |

All Other |

Total |

|||||||||||||||||

|

Eric A. Brock(1) |

2020 |

$ |

131,494 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

47,284 |

$ |

178,778 |

|||||||||

|

2019 |

$ |

200,000 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

27,819 |

$ |

227,819 |

||||||||||

|

Stewart W. Kantor(2) |

2020 |

$ |

131,494 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

7,176 |

$ |

138,670 |

|||||||||

|

2019 |

$ |

200,000 |

$ |

50,000 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

12,500 |

$ |

262,500 |

||||||||||

|

Thomas V. Bushey(3) |

2020 |

$ |

115,385 |

$ |

— |

$ |

3,150,000 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

3,265,385 |

|||||||||

____________

(1) In 2020, Mr. Brock’s salary of $131,494 was accrued. On January 29, 2021, Mr. Brock was paid $64,344 of the accrued amount. In 2019, Mr. Brock’s salary of $200,000 includes $58,333 paid between January 1 and April 15, 2019 and $141,667 accrued between April 16 and December 31, 2019. On March 12, 2020, Mr. Brock waived accrued payroll amounts in the amount of $141,667. All Other Compensation for 2020 and 2019 includes health insurance premiums paid on Mr. Brock’s behalf.

(2) In 2020, Mr. Kantor’s salary of $131,494 includes $128,644 paid between January 1 and March 15, 2020 and May 13 and December 31, 2020, and $2,850 accrued between March 16 and May 12, 2020. On March 12, 2020, Mr. Kantor waived $8,334 of salary accrued in 2018 in the amount of $8,334. All Other Compensation for 2020 includes health insurance premiums paid on Mr. Kantor’s behalf totaling $744 and employer matching of 401(k) totaling $6,432. All Other Compensation for 2019 represents employer matching of 401(k).

(3) In 2020, Mr. Bushey’s salary of $115,385 was accrued. On January 19, 2021, Mr. Bushey waived the accrued payroll in the amount of $115,385. In June 2020, Mr. Bushey was granted the right to receive 1,000,000 restricted stock units (the “RSU Shares”). At the time of Mr. Bushey’s resignation as President in January 2021, Mr. Bushey had the right to receive 500,000 RSU Shares (375,000 vested as of December 31, 2020 and 125,000 of which the Compensation Committee accelerated vesting), which will be issued on June 3, 2022 pursuant to Mr. Bushey’s deferral election. The remaining 500,000 RSU shares were canceled in January 2021.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth certain information regarding equity-based awards held by the named executive officer as of December 31, 2020.

|

Stock awards |

|||||

|

Number of |

Market |

||||

|

Eric A. Brock |

— |

|

— |

||

|

Stewart W. Kantor |

— |

|

— |

||

|

Thomas V. Bushey(2) |

625,000 |

$ |

5,831,250 |

||

____________

(1) Determined by multiplying the closing price of the Company’s Common Stock on December 31, 2020, $9.33, by the number of shares of Common Stock underlying the RSUs.

(2) In June 2020, Mr. Bushey was granted the right to receive 1,000,000 restricted stock units (the “RSU shares”).

12

At the time of Mr. Bushey’s resignation as President in January 2021, Mr. Bushey had the right to receive 500,000 RSU shares (375,000 vested as of December 31, 2020 and 125,000 of which the Compensation Committee accelerated vesting), which will be issued on June 3, 2022 pursuant to Mr. Bushey’s deferral election. The remaining 500,000 RSU shares were canceled in January 2021.

Employment Agreements with Executive Officers

Eric Brock serves as our Chief Executive Officer pursuant to an employment agreement entered into on September 28, 2018, as amended and restated on June 3, 2020, (the “Brock Agreement”). The Brock Agreement provides for a continuous term and may be terminated by either party at any time. Pursuant to the Brock Agreement, Mr. Brock will receive an initial salary of $200,000 per annum, subject to annual review by our Board. Mr. Brock is eligible to participate in benefit plans generally available to our employees. During 2020, in response to COVID-19 employee furloughs, Mr. Brock accepted a pay reduction of 90% for the period from March 21 to May 19, 2020 and a 35% pay reduction from May 20 to December 15, 2020. Mr. Brock’s salary was returned to 100% effective December 16, 2020.

Stewart Kantor serves as our President, Chief Financial Officer, Secretary and Treasurer pursuant to an employment agreement entered into on September 28, 2018, as amended and restated on June 3, 2020, (the “Kantor Agreement”), which replaces the prior employment agreement he had with Ondas Networks Inc. (“Ondas Networks”). The Kantor Agreement provides for a continuous term and may be terminated by either party at any time. Pursuant to the Kantor Agreement, Mr. Kantor will receive an initial salary of $200,000 per annum, subject to annual review by our Board. Mr. Kantor is eligible to participate in benefit plans generally available to our employees. During 2020, in response to COVID-19 employee furloughs, Mr. Kantor accepted a pay reduction of 90% for the period from March 21 to May 19, 2020 and a 35% pay reduction from May 20 to December 15, 2020. Mr. Kantor’s salary was returned to 100% effective December 16, 2020.

As part of the terms of the Brock Agreement and Kantor Agreement, each of Messrs. Brock and Kantor entered into a Non-Competition, Confidential Information and Intellectual Property Assignment Agreement (the “Supplemental Agreements”). As part of the Supplemental Agreements, each of Messrs. Brock and Kantor agreed (i) not to engage in Competitive Business (as defined in the Supplemental Agreements) during his term of employment with us and for a period of 12 months following termination; (ii) not to disclose Confidential Information (as defined in the Supplemental Agreements), subject to certain customary carve-outs; and (iii) to assign to the Company any Intellectual Property (as defined in the Supplemental Agreements) developed using the Company’s resources or related to the Company’s business within the scope of and during the period of employment.

Mr. Brock is entitled to severance compensation from the Company if his employment is terminated (i) without cause or (ii) due to “constructive termination” or (iii) due to disability, with these causes of termination being defined in the Brock Agreement. The severance compensation would consist of (i) accrued and vested benefits, and (ii) continued payment of Mr. Brock’s base salary and benefits for a period of six (6) months following separation.

Mr. Kantor is entitled to severance compensation from the Company if his employment is terminated (i) without cause or (ii) due to “constructive termination” or (iii) due to disability, with these causes of termination being defined in the Kantor Agreement. The severance compensation would consist of (i) accrued and vested benefits, and (ii) continued payment of Mr. Kantor’s base salary and benefits for a period of twelve (12) months following separation.

On June 3, 2020, the Company entered into an employment agreement with Thomas V. Bushey to serve as President of the Company. Pursuant to the employment agreement, Mr. Bushey will be paid an annual salary of $200,000 and will be eligible to participate in the benefits plans established for Company employees. Also, on June 3, 2020, Mr. Bushey was granted restricted stock units (“RSUs”) for 1,000,000 shares of the Company’s Common Stock pursuant to the Company’s 2018 Incentive Stock Plan, which shares will vest quarterly in equal amounts over a period of two years from the date of grant (with 125,000 shares vesting on the last day of each calendar quarter beginning on June 30, 2020), and which shares will not be issued and delivered to Mr. Bushey until June 3, 2022, at the request of Mr. Bushey.

13

Pursuant to the employment agreement, Mr. Bushey will be an at will employee of the Company. If (i) Mr. Bushey is terminated by the Company without Cause (as defined in the employment agreement), (ii) Mr. Bushey terminates his employment due to Constructive Termination (as defined in the employment agreement), or (iii) Mr. Bushey’s employment terminates as a result of his disability, the Company will provide Mr. Bushey the following compensation: (a) benefits accrued and vested through the date of termination pursuant to the Company’s plan benefits and (b) continued base salary and plan benefits on a monthly basis for a period of twelve (12) months following the date of termination. If terminated without cause, the Company will accelerate the vesting of all unvested restricted stock units. The payment of the severance payments described above are conditioned on Mr. Bushey’s continued compliance with the terms of the employment agreement and Mr. Bushey executing, delivering to the Company and not revoking a general release and non-disparagement agreement. The employment agreement contains standard non-compete and non-solicitation provisions.

On January 19, 2021, Mr. Bushey resigned as the Company’s President. Mr. Bushey will continue to serve on the Company’s Board, and as a consultant to the Company. Pursuant to the terms of a Separation Agreement and General Release (the “Separation Agreement”) dated January 19, 2021 (the “Effective Date”), between Mr. Bushey and the Company, Mr. Bushey agreed to waive his entitlement to accrued salary in the amount of $125,256 and accrued vacation in the amount of $9,846 as of the Effective Date. At the time of Mr. Bushey’s resignation as President in January 2021, Mr. Bushey had the right to receive 500,000 RSU Shares (375,000 vested as of December 31, 2020 and 125,000 of which the Compensation Committee accelerated vesting), which will be issued on June 3, 2022 pursuant to Mr. Bushey’s deferral election. The remaining 500,000 RSU Shares were canceled. As part of the Separation Agreement, Mr. Bushey and the Company entered into a Consulting Agreement dated January 19, 2021 (the “Consulting Agreement”). Pursuant to the Consulting Agreement, Mr. Bushey will provide services to the Company at the direction of the Company’s Chief Executive Officer. The Consulting Agreement terminated on July 19, 2021. Mr. Bushey was paid $7,500 per month for these services.

Director Compensation

Our directors received no compensation during the year ended December 31, 2020.

On January 25, 2021, the Compensation Committee of the Board of the Company approved the 2021 Director Compensation Policy (the “Policy”). The Policy is applicable to all directors that are not employees or compensated consultants of the Company. Pursuant to the Policy, the cash compensation to non-employee directors will be the following: (i) quarterly board retainer – $2,500; (ii) additional Board Chair retainer – $2,000; (iii) additional Audit Committee Chair retainer – $2,000; (iv) additional Compensation Committee Chair retainer – $2,000; and (v) additional Nominating Committee Chair retainer – $1,000. Also, pursuant to the Policy, the annual equity award to non-employee directors will be RSUs representing $60,000. Also, pursuant to the Policy, non-employee directors will be reimbursed for reasonable out-of-pocket business expenses incurred in connection with business related to the Board of Directors.

In addition, on January 25, 2021, the Compensation Committee approved the following grants: (a) for Messrs. Cohen, Reisfield and Silverman (i) 5,000 RSUs pursuant to the 2018 Incentive Stock Plan, and (ii) 30,000 stock options, which are immediately exercisable, pursuant to the 2018 Incentive Stock Plan, at an exercise price of $12.72 per share with a ten year term, and (b) for Mr. Seidl and Ms. Sood (i) 5,000 RSUs pursuant to the 2018 Incentive Stock Plan, and (ii) 10,000 RSUs pursuant to the 2018 Incentive Stock Plan. Each restricted stock unit represents a contingent right to receive one share of common stock of the Company. The 5,000 RSUs granted to each of Messrs. Cohen, Reisfield, Silverman and Seidl and Ms. Sood vest in four successive equal quarterly installments with the first vesting date commencing on the first day of the next calendar quarter, provided that such director is a director of the Company on the applicable vesting dates. The 10,000 restricted stock units granted to Mr. Seidl and Ms. Sood vest in eight successive equal quarterly installments with the first vesting date commencing on the first day of the next calendar quarter, provided that such director is a director of the Company on the applicable vesting dates. All restricted stock units granted to these directors shall vest in full immediately upon a change in control.

14

Equity Compensation Plan Information

The following table reflects the number of securities to be issued upon the exercise or vesting of outstanding options and restricted stock units as of December 31, 2020 under the 2018 Equity Incentive Plan.

|

Plan Category |

Number of |

Weighted- |

Number of |

|||

|

Equity compensation plans approved by stockholders |

568,006 |

7.39 |

3,333,334 |

|||

|

Equity compensation plans not approved by stockholders |

— |

— |

— |

|||

|

Total |

568,006 |

7.39 |

3,333,334 |

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of September 27, 2021, the following table sets forth certain information with respect to the beneficial ownership of our common stock by (i) each stockholder known by us to be the beneficial owner of more than five percent (5%) of our common stock, (ii) by each of our current directors and executive officers as identified herein, and (iii) all of our directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock, stock options (“Options”), and common stock purchase warrants (“Warrants”) that are currently exercisable or convertible into shares of our common stock within sixty (60) days of the Record Date, are deemed to be outstanding and to be beneficially owned by the person holding the Options or Warrants for the purpose of computing the percentage ownership of the person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise noted, the address for all officers and directors listed below is 61 Old South Road, #495, Nantucket, MA 02554.

|

Name and Address of Officer and Directors |

Amount and |

Percentage of |

|||

|

Eric A. Brock (Chairman of the Board and Chief Executive Officer)(2) |

1,957,873 |

4.81 |

% |

||

|

Stewart W. Kantor (Director, President, Chief Financial Officer, Treasurer, |

863,445 |

2.13 |

% |

||

|

Thomas V. Bushey (Director)(4) |

500,000 |

1.22 |

% |

||

|

Richard M. Cohen (Director)(5) |

58,064 |

* |

|

||

|

Derek Reisfield (Director)(6) |

63,064 |

* |

|

||

|

Randall P. Seidl (Director)(7) |

7,500 |

* |

|

||

|

Richard H. Silverman (Director)(8) |

58,064 |

* |

|

||

|

Jaspreet Sood (Director)(9) |

7,500 |

* |

|

||

|

All Officers & Directors as a Group (8 persons)(10) |

3,515,510 |

8.51 |

% |

||

|

Name and Address of Stockholders |

|

||||

|

Energy Capital, LLC(11) |

5,796,455 |

14.03 |

% |

||

____________

* Represents beneficial ownership of less than 1%.

(1) Unless otherwise noted, we believe that all shares are beneficially owned and that all persons named in the table have sole voting and investment power with respect to all shares of common stock owned by them. Applicable percentage of ownership is based on 40,607,723 shares of common stock currently outstanding, as adjusted for each stockholder.

(2) Mr. Brock exercises sole voting and dispositive power over the 1,891,206 shares of common stock and 66,667 shares of common stock issuable upon exercise of Warrants. The percentage beneficially owned is based on 40,674,390 shares which would be outstanding if Mr. Brock exercised the Warrants within sixty days of September 27, 2021.

(3) Mr. Kantor exercises sole voting and dispositive over the 863,445 shares of common stock. The percentage beneficially owned is based on 40,607,723 shares.

(4) Mr. Bushey was granted the right to receive 1,000,000 RSUs. At the time of Mr. Bushey’s resignation as President, Mr. Bushey had the right to receive 500,000 RSUs (375,000 vested as of December 31, 2020 and 125,000 of which the Compensation Committee accelerated vesting), which will be issued on June 3, 2022 pursuant to Mr. Bushey’s deferral election, subject to early delivery if Mr. Bushey’s service with the Company is terminated before June 3, 2022. The percentage beneficially owned is based on 41,107,723 shares if the vested RSUs were issued within sixty days of September 27, 2021.

(5) Mr. Cohen exercises sole voting and dispositive power over 24,314 shares of common stock, 30,000 shares of common stock issuable upon exercise of an option, 1,250 shares of common stock issuable upon the vesting of RSUs, and 2,500 shares of common stock underlying RSUs that have vested and are pending delivery. The percentage beneficially owned is based on 40,641,473 shares which would be outstanding if Mr. Cohen exercised the option and RSUs were issued within sixty days of September 27, 2021.

(6) Mr. Reisfield exercises sole voting and dispositive power over 29,314 shares of common stock, 30,000 shares of common stock issuable upon exercise of an option, 1,250 shares of common stock issuable upon the vesting of RSUs, and 2,500 shares of common stock underlying RSUs that have vested and are pending delivery. The percentage beneficially owned is based on 40,641,473 shares which would be outstanding if Mr. Reisfield exercised the option and the vested RSUs were issued within sixty days of September 27, 2021.

16

(7) Mr. Seidl exercises sole voting and dispositive power over 2,500 shares of common stock issuable upon the vesting of RSUs and 5,000 shares of common stock underlying RSUs that have vested and are pending delivery. The percentage beneficially owned is based on 40,615,223 shares which would be outstanding if the vested RSUs were issued within sixty days of September 27, 2021.

(8) Mr. Silverman exercises sole voting and dispositive power over 24,314 shares of common stock, 30,000 shares of common stock issuable upon exercise of an option, 1,250 shares of common stock issuable upon the vesting of RSUs, and 2,500 shares of common stock underlying RSUs that have vested and are pending delivery. The percentage beneficially owned is based on 40,641,743 shares which would be outstanding if Mr. Silverman exercised the option and the vested RSUs were issued within sixty days of September 27, 2021.

(9) Ms. Sood exercises sole voting and dispositive power over 2,500 shares of common stock issuable upon the vesting of RSUs and 5,000 shares of common stock underlying RSUs that have vested and are pending delivery. The percentage beneficially owned is based on 40,615,223 shares which would be outstanding if the vested RSUs were issued within sixty days of September 27, 2021.

(10) The percentage beneficially owned is based on 41,290,640 shares which would be outstanding if all of the above described options and warrants were exercised and the vested RSUs were issued within sixty days of September 27, 2021.

(11) The address for Energy Capital is 13650 Fiddlesticks Blvd., Suite 202-324, Ft. Myers, FL 33912. Robert J. Smith is the sole owner of Energy Capital and exercises sole voting and dispositive power over the 5,092,248 shares of common stock and 704,207 shares of common stock issuable upon exercise of Warrants. The percentage beneficially owned is based on 41,311,930 shares which would be outstanding if Mr. Smith exercised the Warrants owned by Energy Capital within sixty days of September 27, 2021.

17

PROPOSAL 2: AUDITOR RATIFICATION PROPOSAL

We are asking our stockholders to ratify the Audit Committee’s selection of Rosenberg Rich Baker Berman, P.A. (“RRBB”) as our independent certified public accountants for the year ending December 31, 2021. If the stockholders do not ratify the appointment of RRBB, the selection of our independent certified public accountants may be reconsidered by our Audit Committee.

On June 28, 2018, the Audit Committee of the Board of Company engaged RRBB as the Company’s independent registered public accounting firm.

RRBB audited the Company’s financial statements as of and for the years ended December 31, 2019 and December 31, 2020. RRBB’s reports on the Company’s financial statements as of and for the years ended December 31, 2019 and December 31, 2020 did not contain any adverse opinion or disclaimer of opinion, nor was either report qualified or modified as to uncertainty, audit scope, or accounting principles.

Representatives of RRBB are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

Aggregate fees billed to the Company for the years ended December 31, 2020 and 2019 by RRBB were as follows:

|

For the years ended |

||||||

|

2020 |

2019 |

|||||

|

Audit Fees(1) |

$ |

124,915 |

$ |

90,000 |

||

|

Audit-Related Fees(1) |

$ |

6,558 |

$ |

— |

||

|

Tax Fees(2) |

$ |

10,000 |

$ |

10,000 |

||

|

All Other Fees(3) |

$ |

50,000 |

$ |

47,240 |

||

|

Total |

$ |

191,473 |

$ |

147,200 |

||

____________

(1) Audit fees and audit-related fees consist of fees associated with the annual audit, including the reviews of our quarterly reports.

(2) Tax fees included the preparation on our tax returns.

(3) All other fees consist of fees associated with services provided related to all other filings with the SEC as well as consents.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

On September 28, 2018, the Audit Committee of our Board adopted a policy and related procedures requiring its pre-approval of all audit and non-audit services to be rendered by its independent registered public accounting firm. These policies and procedures are intended to ensure that the provision of such services do not impair the independent registered public accounting firm’s independence. These services may include audit services, audit related services, tax services and other services. All services provided by RRBB during the years ended December 31, 2020 and 2019 were approved by the Audit Committee.

Vote Required and Board Recommendation

The vote required for the Auditor Ratification Proposal is a majority of the votes cast at the Annual Meeting. The Board recommends a vote “FOR” the Auditor Ratification Proposal.

18

PROPOSAL 3: 2021 STOCK INCENTIVE PLAN PROPOSAL

On September 30, 2021, the Compensation Committee approved the Ondas Holdings Inc. 2021 Stock Incentive Plan (the “2021 Incentive Plan”), subject to approval by our stockholders. We believe the 2021 Incentive Plan will advance the interests of our Company and our stockholders.

We are asking our stockholders to approve the 2021 Incentive Plan as we currently have approximately 380,000 shares of common stock available under the 2018 Equity Incentive Plan. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the 2021 Incentive Plan. Our executive officers and directors have an interest in this proposal by virtue of their being eligible to receive awards under the 2021 Plan.

The full text of the 2021 Incentive Plan, is set forth in Appendix A to this proxy statement.

Description of the 2021 Incentive Plan

The text of the 2021 Incentive Plan is attached hereto as Appendix A and is hereby incorporated by reference. The following summary of key provisions of the 2021 Incentive Plan is qualified in its entirety by reference to the attached 2021 Incentive Plan document.

Purpose of the 2021 Incentive Plan

The purpose of the 2021 Incentive Plan is to enable Ondas to attract, retain, reward and motivate eligible individuals by providing them with an opportunity to acquire or increase a proprietary interest in Ondas and to incentivize them to expend maximum effort for the growth and success of the Company, so as to strengthen the mutuality of the interests between the eligible individuals and the stockholders of Ondas.

Eligibility and Participation

Officers, directors, employees (including prospective employees) and consultants of our company, its subsidiaries and affiliates will be eligible to participate in the 2021 Incentive Plan, as determined by the Compensation Committee. As of the Record Date, there were approximately 42 employees, of which two were executive officers, and six non-employee directors that are eligible to participate in the 2021 Incentive Plan.

Administration of the 2021 Incentive Plan

The 2021 Incentive Plan will be administered by the Compensation Committee, composed exclusively of independent non-employee directors in accordance with Rule 16b-3 under the Exchange Act. The Compensation Committee will have full authority to administer the 2021 Incentive Plan, including, without limitation, the authority to determine who will receive awards, to establish the specific terms that will govern awards as will be set forth in individual award agreements, to interpret awards and 2021 Incentive Plan provisions and to amend the 2021 Incentive Plan and outstanding awards subject to certain limitations set forth in the 2021 Incentive Plan document.

Shares Reserved for Plan Awards

The 2021 Incentive Plan provides for a reserve of 6,000,000 shares of common stock. If any award under the 2021 Incentive Plan is cancelled, forfeited or terminated for any reason or is settled in cash, the shares of common stock that were subject to such award shall become available for future awards under the 2021 Incentive Plan unless such shares were cancelled, forfeited, withheld or terminated in order to pay the exercise price, purchase price or any taxes or tax withholdings on an award.

Shares tendered to pay the exercise price or tax withholding obligation for stock options will be treated as delivered for purposes of calculating the share reserve limit and will not be added back to the share reserve for additional grants.

19

Stock Appreciation Rights and Stock Options

The 2021 Incentive Plan provides for awards of stock appreciation rights, non-qualified stock options and incentive stock options intended to comply with Section 422 of the Code. With respect to the shares of common stock reserved under the 2021 Incentive Plan, a maximum of 6,000,000 of such shares may be subject to grants of incentive stock options. The 2021 Incentive Plan specifically prohibits the following:

• The granting of stock options with an exercise price less than the fair market value of our common stock on the date of grant (or, in the case of an incentive stock option granted to a 10% stockholder, 110% of fair market value); and

• Without stockholder approval (except in the event of a stock split, certain other recapitalizations and a change in control):

• Lowering the exercise price of stock options and stock appreciation rights to provide an exercise price that is lower than the then current fair market value of Ondas’s common stock;

• The cancellation of such awards when the exercise price is equal to or greater than the then current fair market value of Ondas’s common stock in exchange for new awards; or

• The repurchase of such awards which have an exercise price that is higher than the then current fair market value of Ondas’s common stock.

As of Record Date, the closing price of our common stock was $8.19 per share, as reported on NASDAQ.

A stock appreciation right entitles the holder to receive shares of our common stock or cash equal in value to the difference between the fair market value of our common stock on the exercise date and the value of our common stock on the grant date. Stock appreciation rights and stock options will have a maximum term of ten years.

The Compensation Committee determines the vesting of stock options and stock appreciation rights at the time of grant.

Awards of Restricted Stock, Restricted Stock Units, Performance Shares, Performance Share Units and Performance Units

An award of restricted stock is an award of shares of our common stock subject to risk of forfeiture and a restriction on transferability. An award of restricted stock units is an award of the right to receive a fixed number of shares of common stock upon vesting or at the end of a specified deferral period subject to the risk of forfeiture and a restriction on transferability. The risk of forfeiture and restriction on transferability will lapse following a stated period of time, upon attainment of specified performance targets or some combination thereof. An award of performance shares is an award of restricted stock that vest solely upon the achievement of certain performance goals being attained during a performance period. An award of performance share units is an award of the right to receive a fixed number of shares of common stock, or the cash equivalent, which is contingent on the achievement of certain performance goals being attained during a performance period. An award of performance units is an award of the right to receive a designated dollar value, or shares of common stock of the equivalent value, which is contingent on the achievement of certain performance goals being attained during a performance period. The Compensation Committee determines the vesting and restrictions on grants of restricted stock, restricted stock units, performance shares and performance units at the time of grant. Unless the Compensation Committee provides otherwise in an award agreement, a recipient of a restricted stock or performance share award will have all of the rights of a holder of our common stock with respect to the underlying shares except for the restriction on transferability, including the right to vote the shares. With certain exceptions, restricted stock units carry no voting or dividend or other rights associated with respect to such underlying commons stock prior to the issuance of such shares.

Change in Control and Other Events

The 2021 Incentive Plan provides the Compensation Committee with discretion to take certain actions with respect to outstanding awards in the event of a change in control or certain other material events that affect our capital structure or the number of shares of our common stock outstanding. In the event of a recapitalization, reclassification, reorganization, stock split, reverse stock split, share combination, exchange of shares, stock

20