Exhibit 99.2

Fourth Quarter and Full Year 2021 Earnings Release Ondas Holdings (NASDAQ: ONDS) March 22, 2022

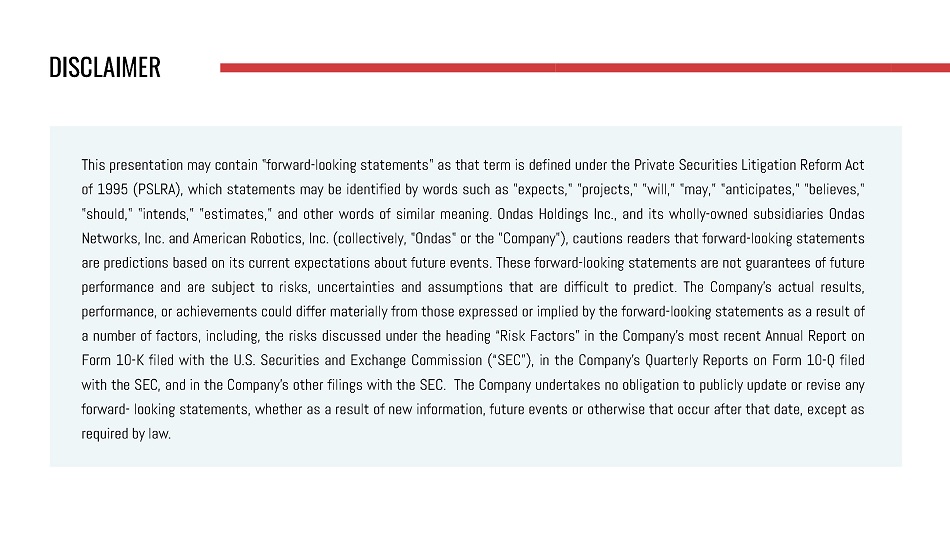

DISCLAIMER This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . , and its wholly - owned subsidiaries Ondas Networks, Inc . and American Robotics, Inc . (collectively, "Ondas" or the "Company"), cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law .

LEADERSHIP TEAM Derek Reisfield President and CFO Derek is an experienced executive with over 30 years experience with entrepreneurial growth companies, as well as executive roles with Fortune 500 companies. Eric Brock Chairman and CEO Eric is an entrepreneur with over 25 years of ma n a g e m ent a n d i n vesti n g experience. R ee se M o z e r CEO Reese is an entrepreneur and roboticist with over 10 years of experience developing and marketing autonomous drones. S t e w art K a nt or President Stewart brings 20 years of experience in the wireless industry to Ondas Networks .

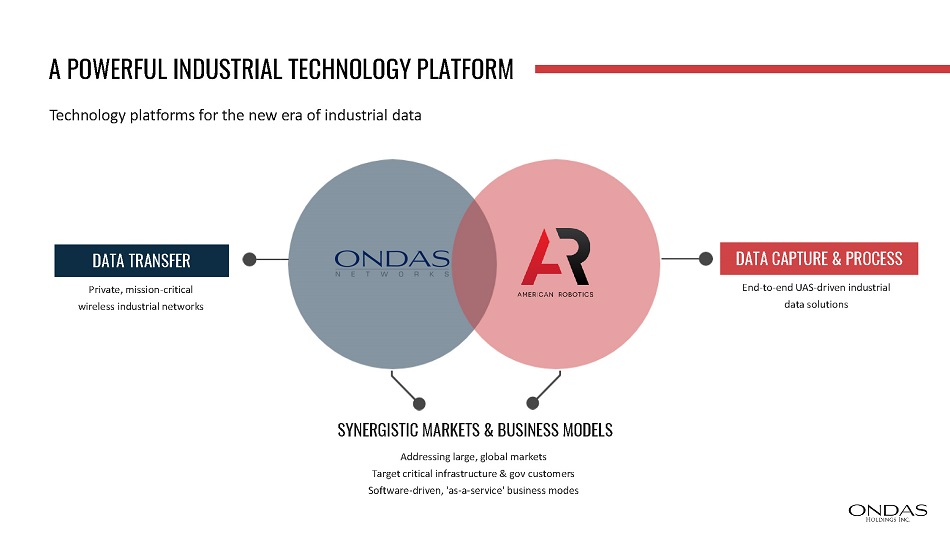

A POWERFUL INDUSTRIAL TECHNOLOGY PLATFORM Technology platforms for the new era of industrial data Private, mission - critical wireless industrial networks DATA TRANS F ER End - to - end UAS - driven industrial data solutions DATA CAPTURE & PROCESS SYNER G ISTIC MARKETS & BUSI N ESS MODELS Addressing large, global markets Target critical infrastructure & gov customers Software - driven, 'as - a - service' business modes

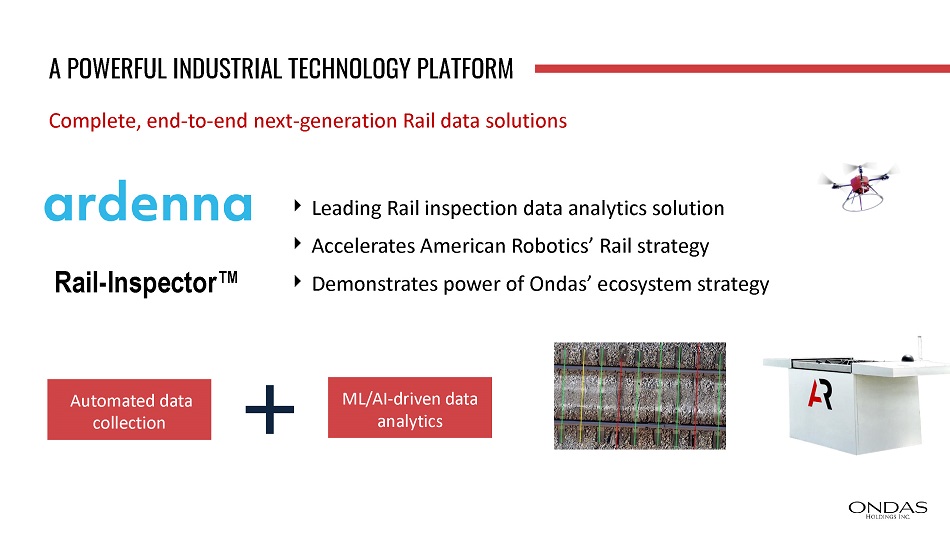

A POWERFUL INDUSTRIAL TECHNOLOGY PLATFORM Complete, end - to - end next - generation Rail data solutions Rail - Inspector Œ Leading Rail inspection data analytics solution Accelerates American Robotics’ Rail strategy Demonstrates power of Ondas’ ecosystem strategy Automated data collection ML/AI - driven data analytics

AGEND A 1 | Progress on Key Priorities 2 | Financial Review - 2021 3 | Update on Business Development & Growth Plan 4 | Outlook 5 | Investor Q&A

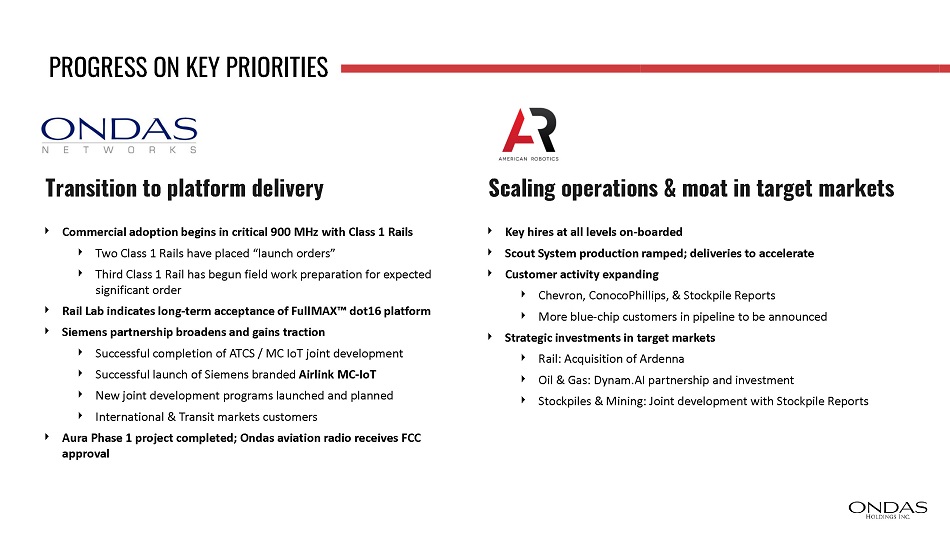

PROGRESS ON KEY PR I ORITI E S Commercial adoption begins in critical 900 MHz with Class 1 Rails Two Class 1 Rails have placed “launch orders” Third Class 1 Rail has begun field work preparation for expected significant order Rail Lab indicates long - term acceptance of FullMAX Ρ dot16 platform Siemens partnership broadens and gains traction Successful completion of ATCS / MC IoT joint development Successful launch of Siemens branded Airlink MC - IoT New joint development programs launched and planned International & Transit markets customers Aura Phase 1 project completed; Ondas aviation radio receives FCC approval Scaling operations & moat in target markets Transition to platform delivery Key hires at all levels on - boarded Scout System production ramped; deliveries to accelerate Customer activity expanding Chevron, ConocoPhillips, & Stockpile Reports More blue - chip customers in pipeline to be announced Strategic investments in target markets Rail: Acquisition of Ardenna Oil & Gas: Dynam.AI partnership and investment Stockpiles & Mining: Joint development with Stockpile Reports

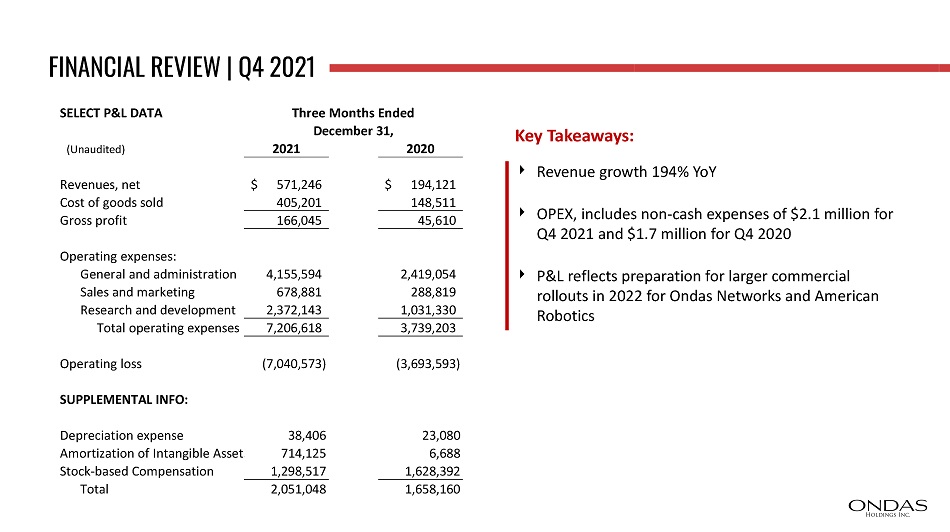

FIN A NCI A L RE V IEW | Q4 2021 SELECT P&L DATA Three Months Ended December 31, 2021 2020 (Unaudited) Revenues, net Cost of goods sold Gross profit $ 571,246 405,201 166,045 $ 194,121 148,511 45,610 Operating expenses: General and administration Sales and marketing Research and development 4,155,594 678,881 2,372,143 2,419,054 288,819 1,031,330 3,739,203 Total operating expenses 7,206,618 Operating loss SUPPLEMENTAL INFO: (7,040,573) (3,693,593) Depreciation expense 38,406 23,080 Amortization of Intangible Asset 714,125 6,688 Stock - based Compensation 1 , 298 , 51 7 1,628,392 Total 2,051,048 1,658,160 Revenue growth 194% YoY OPEX, includes non - cash expenses of $2.1 million for Q4 2021 and $1.7 million for Q4 2020 P&L reflects preparation for larger commercial rollouts in 2022 for Ondas Networks and American Robotics Key Takeaways:

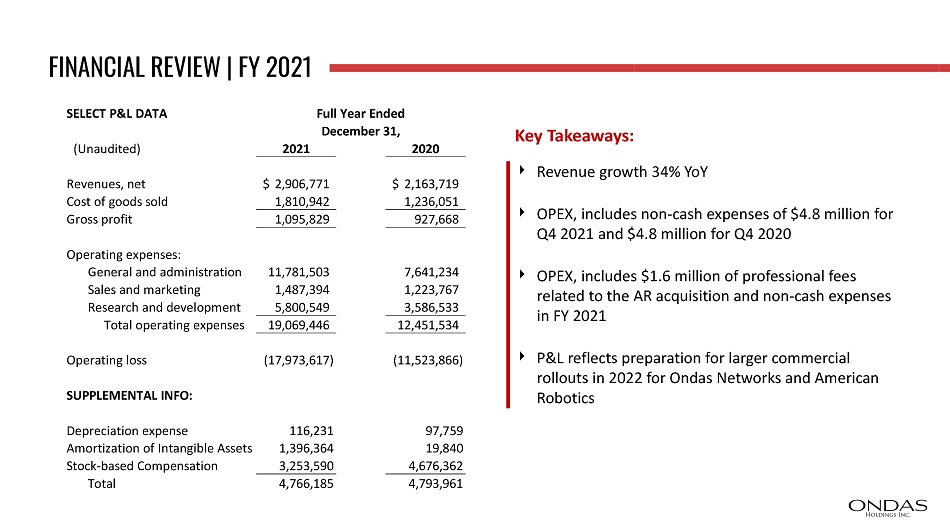

FIN A NCI A L RE V IEW | FY 2021 SELECT P&L DATA (Unaudited) 2021 2020 Full Year Ended December 31, Revenues, net Cost of goods sold Gross profit $ 2,906,771 1,810,942 1,095,829 $ 2,163,719 1,236,051 927,668 Operating expenses: General and administration Sales and marketing Research and development Total operating expenses 11,781,503 1,487,394 5,800,549 19,069,446 7,641,234 1,223,767 3,586,533 12,451,534 Operating loss (17,973,617) (11,523,866) SUPPLEMENTAL INFO: Depreciation expense Amortization of Intangible Assets Stock - based Compensation Total 116,231 1,396,364 3 , 253 , 59 0 4 , 766 , 18 5 97,759 19,840 4 , 676 , 36 2 4 , 793 , 96 1 Revenue growth 34% YoY OPEX, includes non - cash expenses of $4.8 million for Q4 2021 and $4.8 million for Q4 2020 OPEX, includes $1.6 million of professional fees related to the AR acquisition and non - cash expenses in FY 2021 P&L reflects preparation for larger commercial rollouts in 2022 for Ondas Networks and American Robotics Key Takeaways:

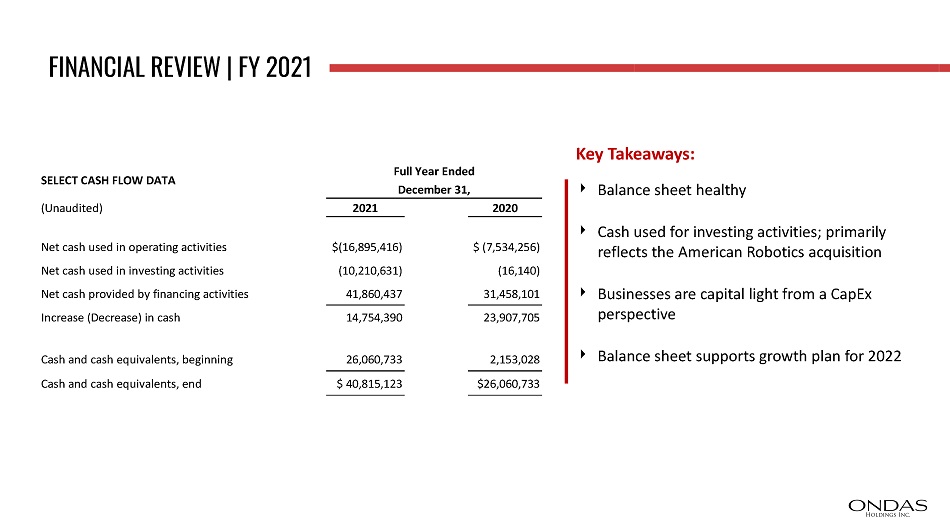

FIN A NCI A L RE V IEW | FY 2021 (Unaudited) Full Year Ended December 31, 2021 2020 Net cash used in operating activities $(16,895,416) $ (7,534,256) Net cash used in investing activities Net cash provided by financing activities (10,210,631) 41,860,437 (16,140) 31,458,101 Increase (Decrease) in cash 14 , 754 , 39 0 23 , 907 , 70 5 Cash and cash equivalents, beginning 26 , 060 , 73 3 2 , 153 , 02 8 Cash and cash equivalents, end $ 40,815,123 $26,060,733 SELECT CASH FLOW DATA Balance sheet healthy Cash used for investing activities; primarily reflects the American Robotics acquisition Businesses are capital light from a CapEx perspective Balance sheet supports growth plan for 2022 Key Takeaways:

STRATE G IC REVIEW Key Priorities and Accomplishments for Ondas Networks and American Robotics

STRATE G IC REVIEW Ondas Networks

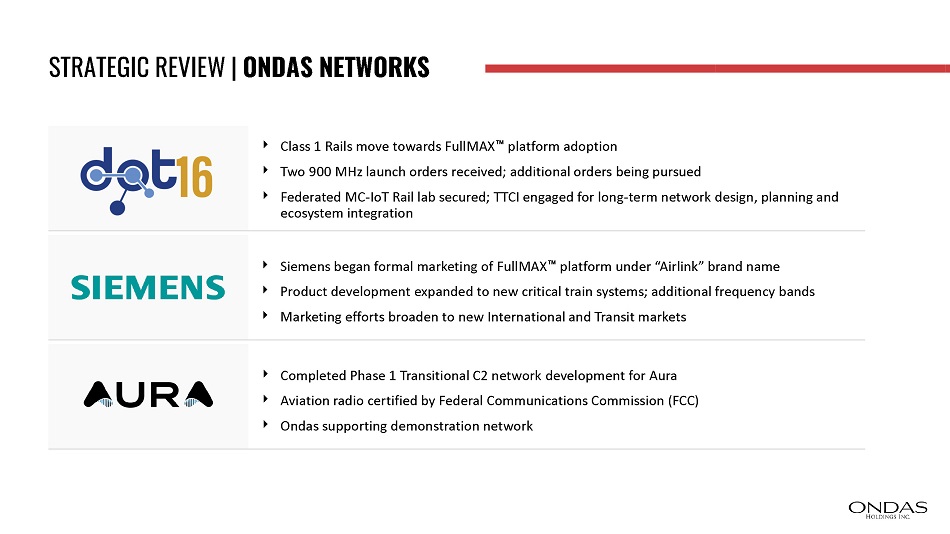

STRATE GIC RE V IEW | ONDAS NETWOR K S C lass 1 Rails m o v e t ow a r d s Fu llMA X Œ p l a t f o r m ado p ti on Two 900 MHz launch orders received; additional orders being pursued Federated MC - IoT Rail lab secured; TTCI engaged for long - term network design, planning and ecosystem integration Siemens began formal marketing of FullMAX Œ platform under “Airlink” brand name Product development expanded to new critical train systems; additional frequency bands Marketing efforts broaden to new International and Transit markets Completed Phase 1 Transitional C2 network development for Aura Aviation radio certified by Federal Communications Commission (FCC) Ondas supporting demonstration network

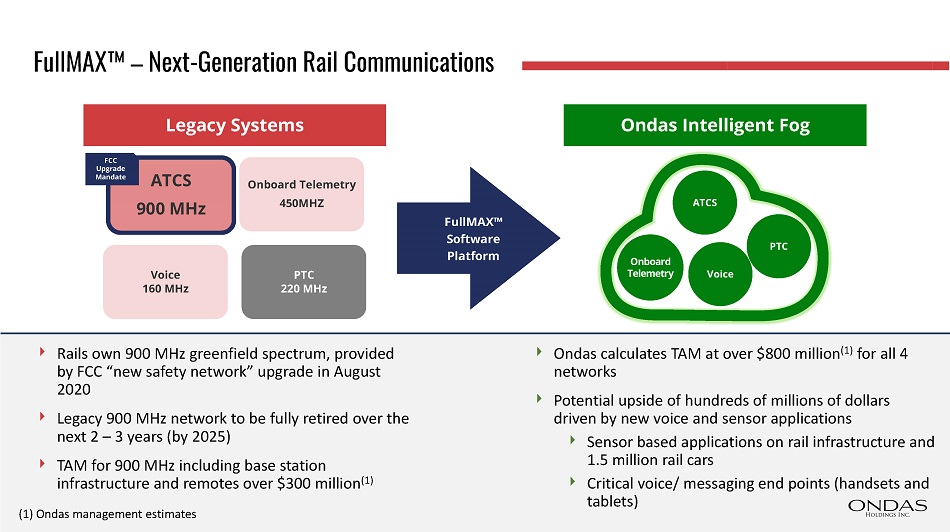

FullMAX Œ – Next - Generation Rail Communications Onboard Te le met r y A TCS Voice PTC FullMA X Ƞ Software Platform Onboard Telemetry 450MHZ ATCS 900 MHz Voice 160 M Hz PTC 220 M Hz Legacy Systems Ondas Intelligent Fog FCC Upgrade Ma n d a te Rails own 900 MHz greenfield spectrum, provided by FCC “new safety network” upgrade in August 2020 Legacy 900 MHz network to be fully retired over the next 2 – 3 years (by 2025) TAM for 900 MHz including base station infrastructure and remotes over $300 million (1) Ondas calculates TAM at over $800 million (1) for all 4 networks Potential upside of hundreds of millions of dollars driven by new voice and sensor applications Sensor based applications on rail infrastructure and 1.5 million rail cars Critical voice/ messaging end points (handsets and tablets) (1) Ondas management estimates

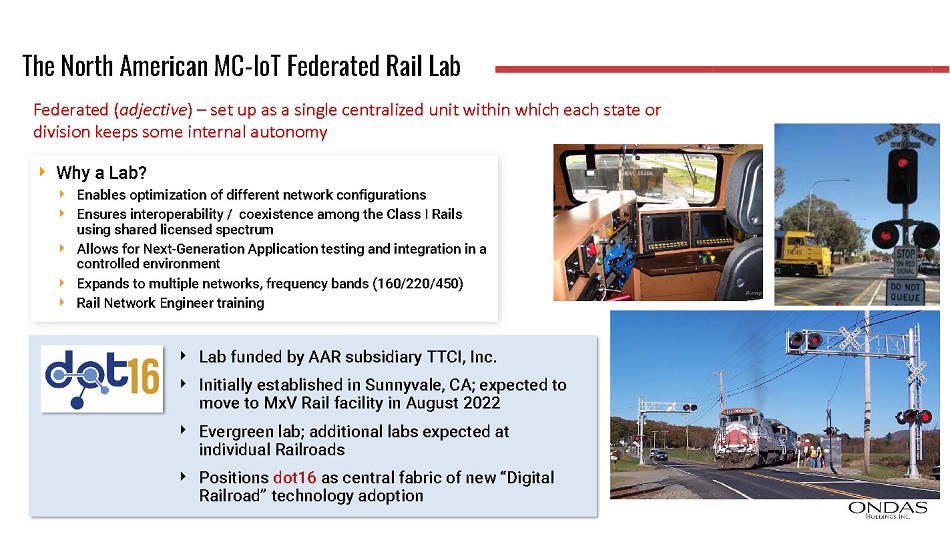

The North American MC - IoT Federated Rail Lab Federated ( adjective ) – set up as a single centralized unit within which each state or division keeps some internal autonomy Why a Lab? Enables optimization of different network configurations Ensures interoperability / coexistence among the Class I Rails using shared licensed spectrum Allows for Next - Generation Application testing and integration in a controlled environment Expands to multiple networks, frequency bands (160/220/450) Rail Network Engineer training Lab funded by AAR subsidiary TTCI, Inc. Initially established in Sunnyvale, CA; expected to move to MxV Rail facility in August 2022 Evergreen lab; additional labs expected at individual Railroads Positions dot16 as central fabric of new “Digital Railroad” technology adoption

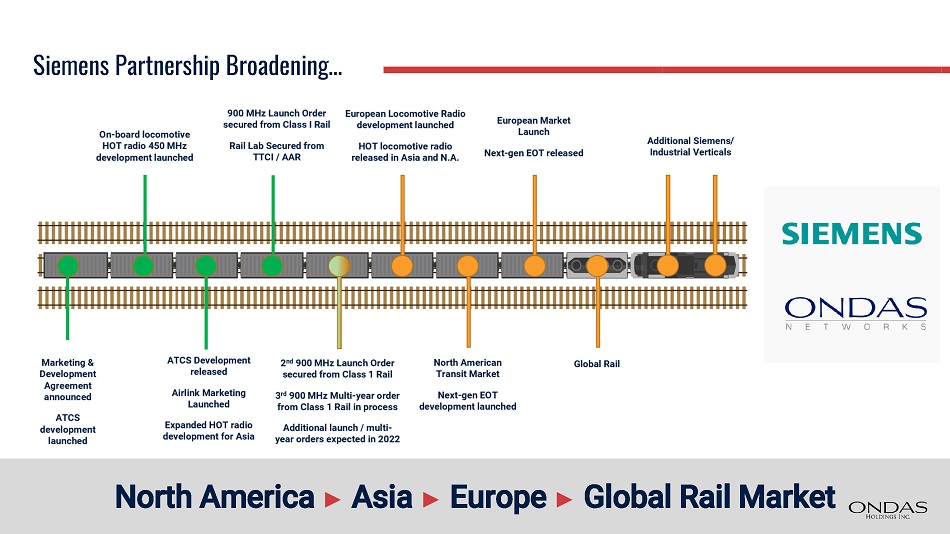

North America Ź Asia Ź Europe Ź Global Rail Market Siemens Par t nership Broadening…

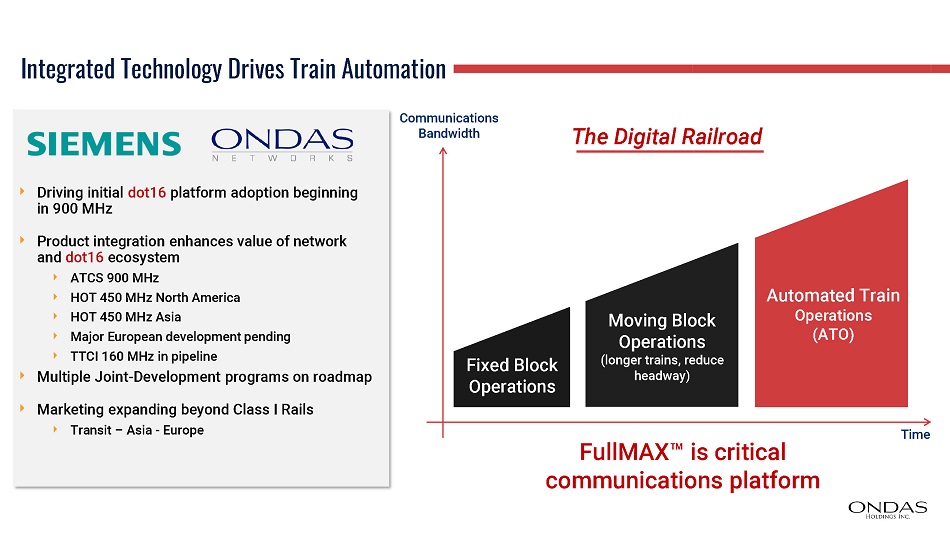

Integrated Technology Drives Train Automation FullMAX Πis critical communications platform Driving initial dot16 platform adoption beginning in 900 MHz Product integration enhances value of network and dot16 ecosystem ATCS 900 MHz HO T 45 0 M H z North Ame rica HO T 45 0 M H z Asia M a j o r E urope an dev e l o pm e n t pendi ng TTCI 160 MHz in pipeline Multiple Joint - Development programs on roadmap Marketing expanding beyond Class I Rails Transit РAsia - Europe The Digital Railroad Fixe d Bloc k Operations Movin g Bloc k Operations (longer trains, reduce headway) Automated Train Operat i ons (ATO) Tim e C o m m unic a ti o ns Bandwidth

CLASS 1 900 M Hz Launching Launch Orders Processes being established with Rails and Siemens for: Broader Deployments Applications expand beyond ATCS Centralized Train Control (CTC) Interlocking Vital Links Highway Crossings Voice Positive Train Control (PTC) Drone C2, Hi - Rail, Sensors Production Purchasing D eli very s c heduli n g Siemens packages Shipping Acceptance / Testing Engineer Training Installation Procedures System Maintenance Customer Support

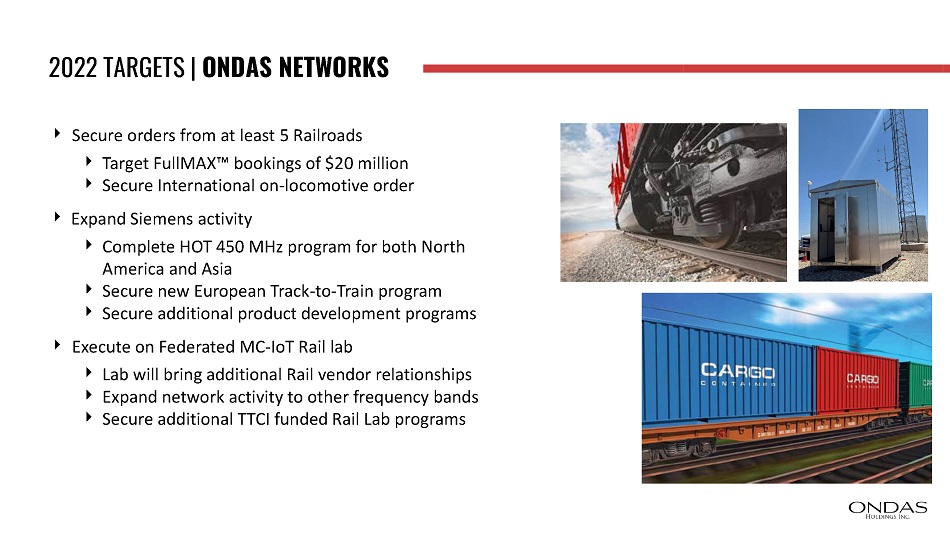

2022 TARGE T S | ONDAS NETWOR K S Secure orders from at least 5 Railroads Target FullMAX Ρ bookings of $20 million America and Asia Secure International on - locomotive order Expand Siemens activity Complete HOT 450 MHz program for both North Secure new European Track - to - Train program Secure additional product development programs Execute on Federated MC - IoT Rail lab Lab will bring additional Rail vendor relationships Expand network activity to other frequency bands Secure additional TTCI funded Rail Lab programs

STRATE G IC REVIEW American Robotics

STRATE GIC RE V IEW | AMERICA N ROBOTICS Hiring on target across all levels of organization; 450%+ YoY headcount growth Ramped up supply chain and manufacturing capabilities Begun maturing nationwide operations infrastructure & safety management system Granted two additional patents and five industry awards Secured first wave of blue - chip customer purchase orders Additional purchase orders in pipeline expected to be announced in coming quarters Establishing close relationships to ensure long - term growth and success Strategic investments to expand moat in our target markets Partnered with Dynam.AI to develop oil & gas analytics Acquired Ardenna assets and team to integrate rail analytics

EXPAN D ED TE A M & OPER A TIONS CAP A CITY Hiring on - target – Headcount expanded 450%+ YoY Onboarded key personnel and industry - leading talent at all levels: Experts in AI, ML, computer vision, robotics, electrical engineering, mechanical engineering, software development, manufacturing, and aviation. Education includes Carnegie Mellon, Stanford, MIT, Columbia, West Point, WPI, RIT, Tufts, Babson, and Bentley VP of Sales, VP of Operations, VP of Engineering, Director of Talent, Director of Flight Operations, and Director of Product Backgrounds include GE, Baker Hughes, iRobot, Amazon Robotics, Soft Robotics, BAE Systems, CyPhy Works, Textron, Kespry, AeroVironment, MIT Lincoln Labs, Ford, Facebook, IBM, US Army, US Air Force, and US Navy Expanded staff supports increased sales, manufacturing, and deployment of Scout Systems AR and Ondas Holdings signed lease on new joint HQ in Waltham, MA; expect to finalize move in April 2022

SUPP L Y CHAIN & M A NUFACTUR I NG American Robotics established critical relationships and partnerships with vendors and manufacturing partners to establish a reliable supply chain and manufacturing pipeline for 2022 and beyond. We are currently optimizing supply chain and manufacturing capacity to satisfy existing customer demand. Partnered with industry - leading contract manufacturers (CMs) in the Northeast; CMs positioned to increase Scout System Πproduction rate Initial Scout System Πunits have been delivered and installed at customer sites. Orders for 30+ systems are currently being placed. Focus now is building on this success by increasing manufacturing speed and decreasing bring - up time for each system

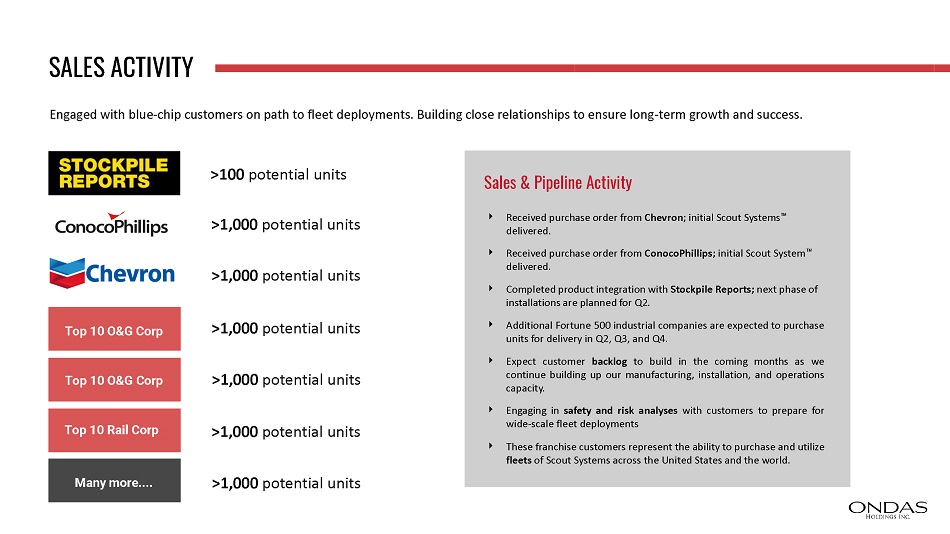

SALES ACT I VITY Engaged with blue - chip customers on path to fleet deployments. Building close relationships to ensure long - term growth and success. Received purchase order from Chevron ; initial Scout Systems Πdelivered. Received purchase order from ConocoPhillips; initial Scout System Πdelivered. Completed product integration with Stockpile Reports; next phase of installations are planned for Q2. Additional Fortune 500 industrial companies are expected to purchase units for delivery in Q2, Q3, and Q4. Expect customer backlog to build in the coming months as we continue building up our manufacturing, installation, and operations capacity . Engaging in safety and risk analyses with customers to prepare for wide - scale fleet deployments These franchise customers represent the ability to purchase and utilize fleets of Scout Systems across the United States and the world. Sales & Pipeline Activity Top 10 O& G Corp Top 10 O& G Corp Many mor e . . .. >100 potential units >1,000 potential units >1,000 potential units >1,000 potential units >1,000 potential units >1,000 potential units >1,000 potential units Top 10 Ra il Corp

DYN A M.AI INV E STME N T American Robotics entered into a joint development, services and marketing agreement with Dynam.AI Partnership supported by Ondas Holdings equity investment in Dynam.AI Funds used to support Dynam's proprietary Vizlab Ρ , an AI/ML platform - an advanced developer toolkit for data scientists Expand and enhance AR’s IP library and analytics capabilities with artificial intelligence based on physics - based algorithms American Robotics establishes partnership with dynam.AI, a software developer for complex artificial intelligence and machine learning projects.

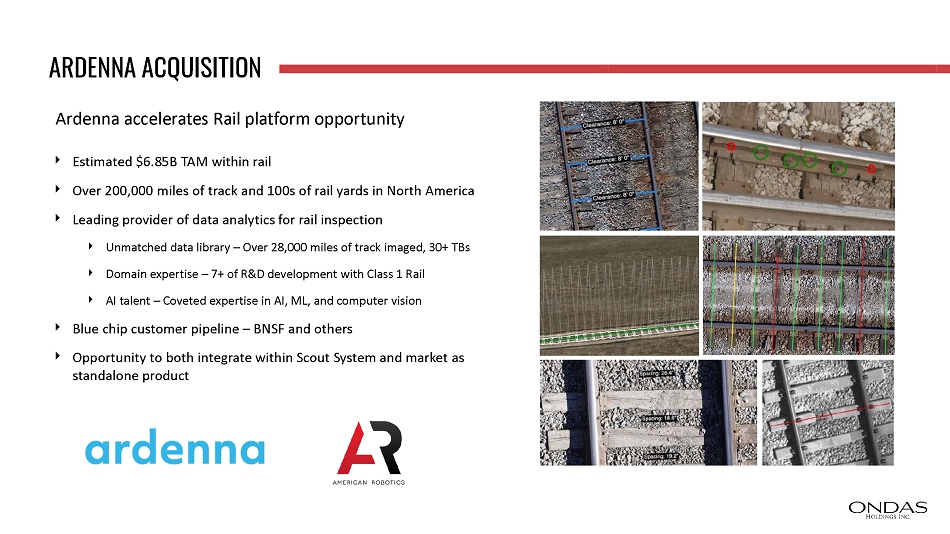

ARD EN N A AC Q UISITION Over 200,000 miles of track and 100s of rail yards in North America Estimated $6.85B TAM within rail Leading provider of data analytics for rail inspection Domain expertise – 7+ of R&D development with Class 1 Rail Unmatched data library – Over 28,000 miles of track imaged, 30+ TBs AI talent – Coveted expertise in AI, ML, and computer vision Blue chip customer pipeline – BNSF and others Opportunity to both integrate within Scout System and market as standalone product Ardenna accelerates Rail platform opportunity

2022 TARGE T S | AMERICA N ROBOTICS 30 Scout System Ρ installs by year - end Secure customer reorders for fleet sales Establish multi - year partnerships with top customers to tightly integrate our platform within their operations Work with our industrial customers to prove demonstrated safety in the field Continue executing operations growth plan, in terms of talent, supply chain, manufacturing, and operations processes Expand imaging payload and analytics capabilities for high - value use cases within our target markets

OUTLOOK SUMM A RY

G E N E R A T I O N A L O PP O R T U N I TY T O D E F I N E , S C A L E , LE A D , & C R E A TE M A S S I VE V A L U E F O R C U S T O M E R S A N D SHAREHOLDERS 29

SCA L ING IN D US TRIAL TECHNOL O GY PLATFORMS Balance sheet remains healthy Continue to invest in End - to - End solutions for customers Cash OPEX expected to be $6.5 - $7.0 million for Q1 2022 Funding product and business development Modest working capital requirements OPEX will trend higher during 2022; support higher levels of customer activity Expected growth in revenue and gross profits is expected to offset cash “burn” as we move through 2022 and 2023 ATM offering announced provides flexibility Provides potential to accelerate technology investments at Ondas Networks and American Robotics; based upon customer demands Offers ecosystem opportunities via partnerships, joint ventures, and acquisitions S T A Y O N O FF E N S E – CE M E N T A N D E X T E N D L E AD E R S H I P

2022 BUSINESS DRIVERS AND OUTLOOK Transitioning from investment mode to platform delivery Scaling operations & moat in target markets Critical 900 MHz adoption beginning Growing with Siemens in new markets Preparing production capacity and inventory for 2022 commercial sales Initial POCs with franchise customers to conclude and transition to fleet orders Continue to ramp operations and manufacturing capacity to support 100s of units Continue investing in technology moats valued by target markets

THAN K YOU FO R LISTENING ONDAS N E T W O R K S J - l AMERICAN ROBO TICS Please visit our websites and social media pages to stay updated with company progress. www.ondas.com www.linkedin.com/company/ondasnetworks/ www.twitter.com/OndasNetworks www.american - robotics.com www.linkedin.com/company/american - robotics - inc www.twitter.com/AmericanRobotic 0 ONDAS HOLDIN GS IN C.