Exhibit 99.2

Secofid Quarter 2022 Earfiifigs Release afid Busifiess Update NASDAQ: ONDS August 9, 2022

This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . , and its wholly - owned subsidiaries Ondas Networks, Inc . and American Robotics, Inc . (collectively, "Ondas" or the "Company"), cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . D I S C L A I M E R

LEADERSHIP TEAM E R I C B R O C K Chairman & CEO Eric is a n e ntr e pren e ur w i t h ov e r 25 y e ar s of m a nagement and i nv e st i ng e xp e ri e nc e . D E R E K R E I S F I E LD Chairman & CFO D e r e k is a n e xpe ri e nc e d e x e c u tive w ith ov e r 30 y e a r s e xpe ri e nce w i t h e ntr e pren eurial gro w t h com p ani e s , a s w e l l as e x e c u tive rol e s w ith F ortun e 50 0 com p ani e s. STEW A R T KANT O R President S t e w ar t brin g s ov e r 20 y e ar s of e xpe ri e nce in the w ir e l e s s i n dustry to O ndas N e t w or k s. REES E M O Z ER CEO R ee se is a n e ntr e pren e ur an d robot i cis t w i t h ov e r 1 0 y e ar s of e xpe ri e nce d e v e l op i ng and mark e ting auton o mo u s dron e s.

C l a ss I Ra i l s p r o g res s i ng; 90 0 MHz N e t w o r k l e a d i ng t o e x p a n de d o p p o rtun i tie s g l o b a l l y I N T R O D U C T I O N Business plans and product roadmaps on track at Ondas Networks and American Robotics A m eri c a n Ro b o ti c s e x tend s l e a d ers h i p p o s i ti o n with new c u s tomer s , p r o d u c t f eature s , a nd re g u l a tory mile s to n es O n d a s i s i n v est i ng i n tech n o l o g y, p e o p l e , a nd p a rtner s t o win g l o b a l i n d u str i a l d a ta mar k ets

In i ti a l V o l u m e O rde r R e c ei v e d f r o m S i em e ns M o b ili t y i n 90 0 MHz MAJOR DEVELOPMENTS Significant events signal business plan on track; creating value for shareholders Ag ree m en t t o Ac q u i r e Air o b o ti c s , a l e a d i ng a ut o mate d UAS p l a t f o r m p r o v i d er

MILESTONE ORDER SECURED • Marks beginning of commercial deployments • Mix of N G - A T CS , Mercury a nd V e n us b a se statio n s a nd remotes • Deliveries commencing in 2022 Ondas Networks receives initial 900 MHz volume order

INVESTING FOR SCALE Challenging economy and volatile markets create opportunity to accelerate timelines… + Strong balance sheet + Investing in MC - IoT platform technologies + ATM supports value - creating investments

AGENDA Overview of Airobotics Transaction Financial Review Strategic Update Outlook Investor Q&A

Leading Platforms Will Combine to Accelerate Next Generation of Commercial Drone Market

LANDMARK ACQUISITION Creating the global Commercial UAS leader… + Adding world - class technology and talent + Offers technical, regulatory and go - to - market synergy; extends competitive advantages + Significant financial benefits including new revenue opportunities with active customer pipeline and reduced redundant development costs Reached Definitive Merger Agreement to acquire Demonstrates Ondas’ unique ability to lead the scaling of automated Commercial UAS solutions

DEMO VIDEO

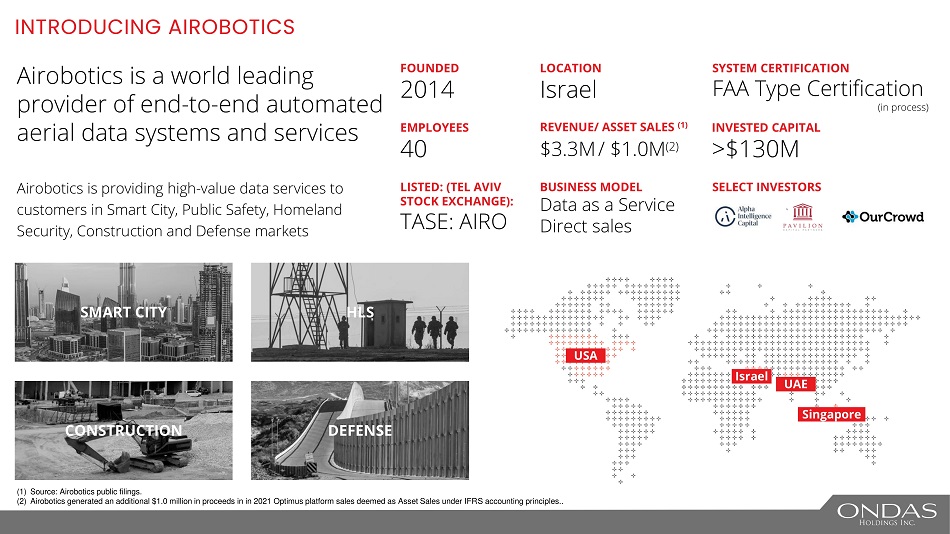

INTRODUCING AIROBOTICS Airobotics is a world leading provider of end - to - end automated aerial data systems and services Airobotics is providing high - value data services to customers in Smart City, Public Safety, Homeland Security, Construction and Defense markets FOUNDED 2014 EMPLOYEES 40 LISTED: (TEL AVIV ST O C K E X C H A N GE): TA S E: AIRO LOCATION Israel REVE N U E / ASSET SAL E S ( 1 ) $3.3M/ $1.0M (2) BUSINESS MODEL Data as a Service Direct sales SYSTEM CERTIFICATION FAA Type Cer t if i cat i on (in process) INVESTED CAPITAL >$130M SEL E C T I N VEST O RS SMART CITY CONSTRUCTION DEFENSE HLS USA Israel UAE Singapore (1) Source: Airobotics public filings. (2) Airobotics generated an additional $1.0 million in proceeds in in 2021 Optimus platform sales deemed as Asset Sales under IFRS accounting principles..

STRATEGIC RATIONALE — SCALE FOR CUSTOMERS Creation of a global UAS solutions provider to lead the consolidation of the commercial drone sector Extend Technology Leadership Leading UAS and Robotics Talent Global Regulatory Success Global Marketing & Services Platform Financial Benefits

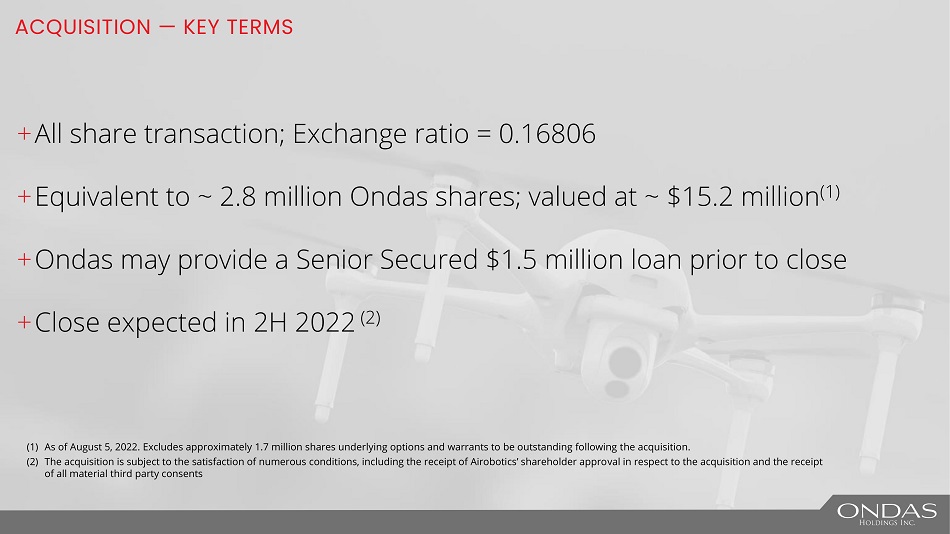

ACQUISITION — KEY TERMS + All share transaction; Exchange ratio = 0.16806 + Equivalent to ~ 2.8 million Ondas shares; valued at ~ $15.2 million (1) + Ondas may provide a Senior Secured $1.5 million loan prior to close + Clo s e exp e ct e d i n 2H 2 0 22 ( 2 ) (1) As of August 5, 2022. Excludes approximately 1.7 million shares underlying options and warrants to be outstanding following the acquisition. (2) The acquisition is subject to the satisfaction of numerous conditions, including the receipt of Airobotics’ shareholder approval in respect to the acquisition and the receipt of all material third party consents

Robo t ic Arm Da t a C a p t ure & De l ivery P ay l o a d s B at t ery Ca b in e t P ay l o a d Ca b in e t Rea l - T i m e U s er In t er f ace Data P latf o rm AIROBOTICS TECHNOLOGY PLATFORM Fully automated data capturing and analysis infrastructure for continues 24/7 drone operations without human intervention + ROBUSTNESS Rugged exterior and climate - controlled Drone shelter for harsh weather and industrial environments + FULL AUTOMATION 24/7 MULTIPLE DATA COLLECTION Allowing routine data capture without human intervention + C O VERA G E AREA 80 sq/km coverage area D o c k ing S t a t i o n & Air b a s e Aut o ma t ed Dr o ne

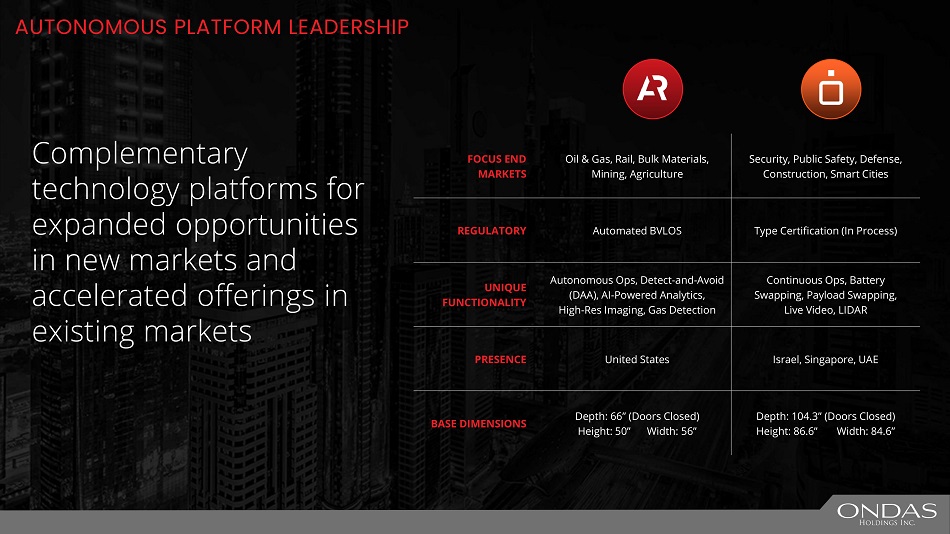

AUTONOMOUS PLATFORM LEADERSHIP Complementary technology platforms for expanded opportunities in new markets and accelerated offerings in existing markets F OC U S E N D MA R K E T S O il & Gas, R ai l , Bu l k M at e ria l s, M i n i n g, Agr i cult u re Se curit y , Publ i c S afet y , D e fens e , C onstruct i o n, S ma rt C i t i e s REGULATORY Automat e d B V LO S T y pe C e rtif i cati o n ( I n Proc e ss) UN IQ UE F UN CTIO N A L ITY Auto n om o us O ps, D e t e c t - an d - Av o id ( D A A ), A I - Po w e r e d Anal y t i cs, Hig h - Re s I magi n g, Ga s D e t e cti o n C ont i nuous O ps, Batt e ry S w app i n g , Pa yl oad S w app i n g , L i v e V id e o, LI DAR PRESENCE Un i t e d S tat e s I srae l , S i n gapor e , UAE BA S E DIM E N S IO NS D e pth: 66 ” (D o ors C l o s e d) H e i g ht: 50 ” W i dth: 5 6 ” D e pth: 104.3 ” (D o ors C l o s e d) H e i g ht: 86.6 ” W id t h: 84.6 ”

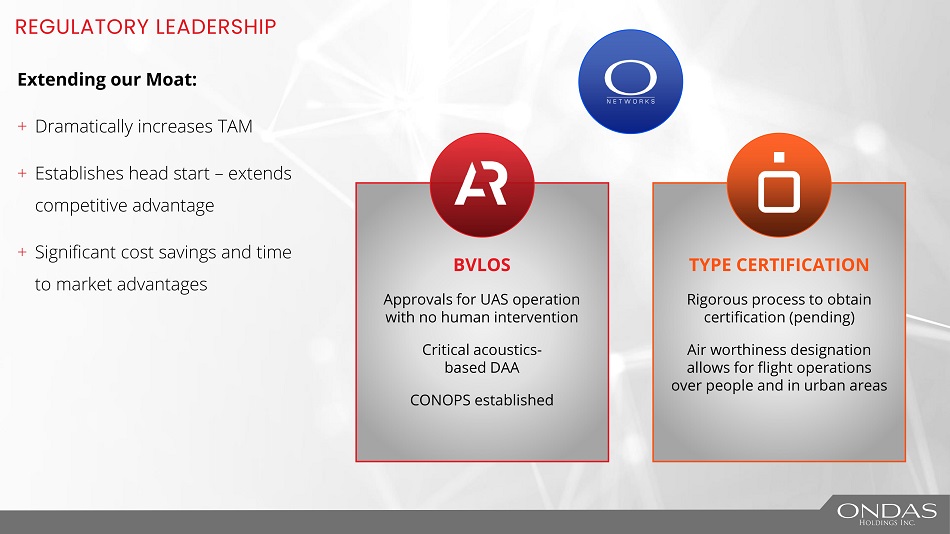

REGULATORY LEADERSHIP Extending our Moat: + Dramatically increases TAM + Establishes head start – extends competitive advantage + Significant cost savings and time to market advantages BVLOS Ap p r o v a l s for U AS o p er a ti o n with no human intervention Cr i ti c a l a c o u s ti c s - b a s e d DAA CONOPS established TYPE C ERTIFI C A TION Ri g or o us p r o c es s t o o b ta i n c ertifi c a ti o n ( p en d ing) Air w o rth ine s s d es i g n a ti o n a ll o ws for fli g ht o p er a ti o ns o v er p e o p l e a nd in ur b a n a reas

FINANCIAL REVIEW Q2 and 1H Financial Results

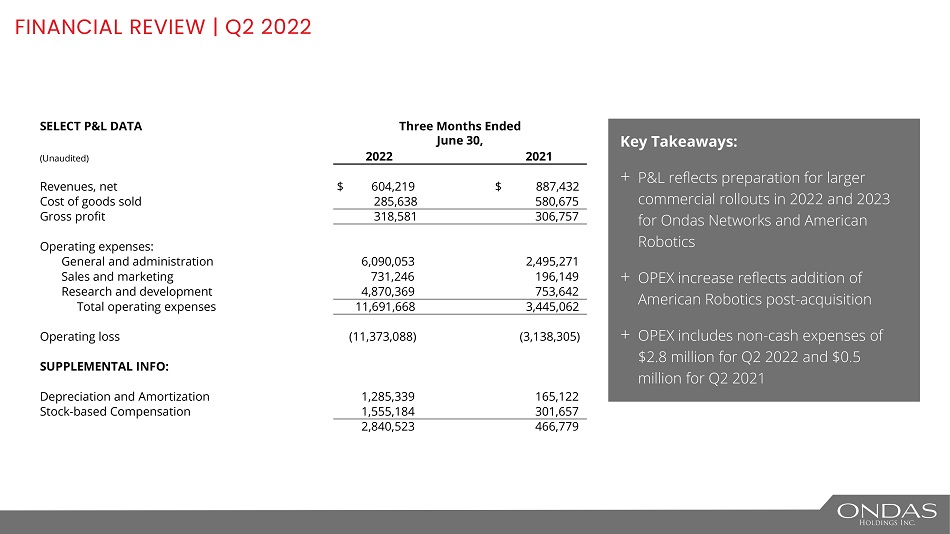

FINANCIAL REVIEW | Q2 2022 Key Takeaways: + P&L reflects preparation for larger commercial rollouts in 2022 and 2023 for Ondas Networks and American Robotics + O PEX inc r e as e r e f lect s a d d iti o n of American Robotics post - acquisition + O PEX inc lu d es no n - c a sh expe n ses of $2.8 million for Q2 2022 and $0.5 million for Q2 2021 SE L E CT P&L DATA Three Months Ended June 30, (Unaudited) 2022 2021 Revenues, net $ 604,219 $ 887,432 Cost of goods sold 285,638 580,675 Gross profit 318,581 306,757 Operating expenses: General and administration 6,090,053 2,495,271 Sales and marketing 731,246 196,149 Research and development 4,870,369 753,642 Total operating expenses 11,691,668 3,445,062 Operating loss (11,373,088) (3,138,305) SUPPLEMENTAL INFO: Depreciation and Amortization 1,285,339 165,122 Stock - based Compensation 1,555,184 301,657 2,840,523 466,779

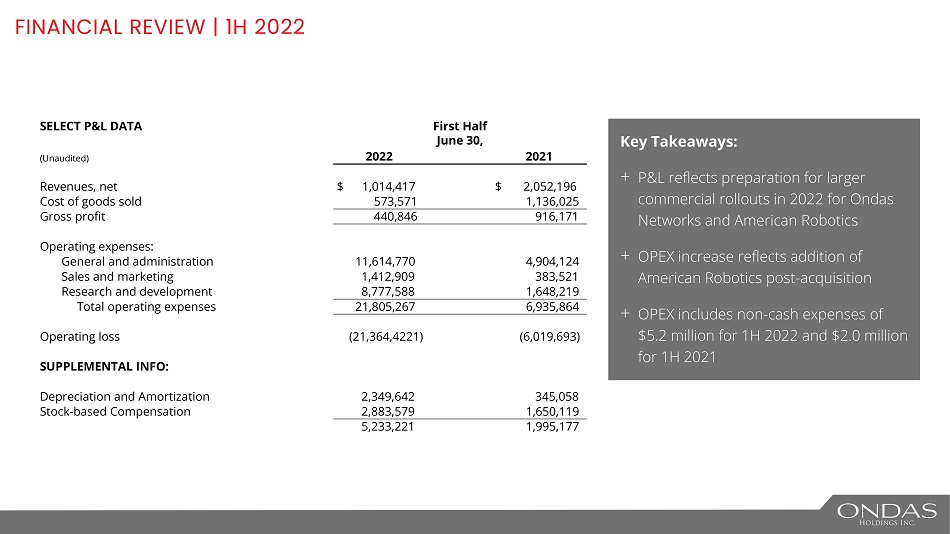

F I N A N C I A L RE V I E W | 1 H 2 0 2 2 Key Takeaways: + P&L reflects preparation for larger commercial rollouts in 2022 for Ondas Networks and American Robotics + O PEX inc r e as e r e f lect s a d d iti o n of American Robotics post - acquisition + O PEX inc lu d es no n - c a sh expe n ses of $5.2 million for 1H 2022 and $2.0 million for 1H 2021 SE L E CT P&L DATA F i r s t H a l f Ju n e 30, (Unaudited) 2022 2021 Revenues, net $ 1,014,417 $ 2,052,196 Cost of goods sold 573,571 1,136,025 Gross profit 440,846 916,171 Operating expenses: General and administration 11,614,770 4,904,124 Sales and marketing 1,412,909 383,521 Research and development 8,777,588 1,648,219 Total operating expenses 21,805,267 6,935,864 Operating loss (21,364,4221) (6,019,693) SUPPLEMENTAL INFO: Depreciation and Amortization 2,349,642 345,058 Stock - based Compensation 2,883,579 1,650,119 5,233,221 1,995,177

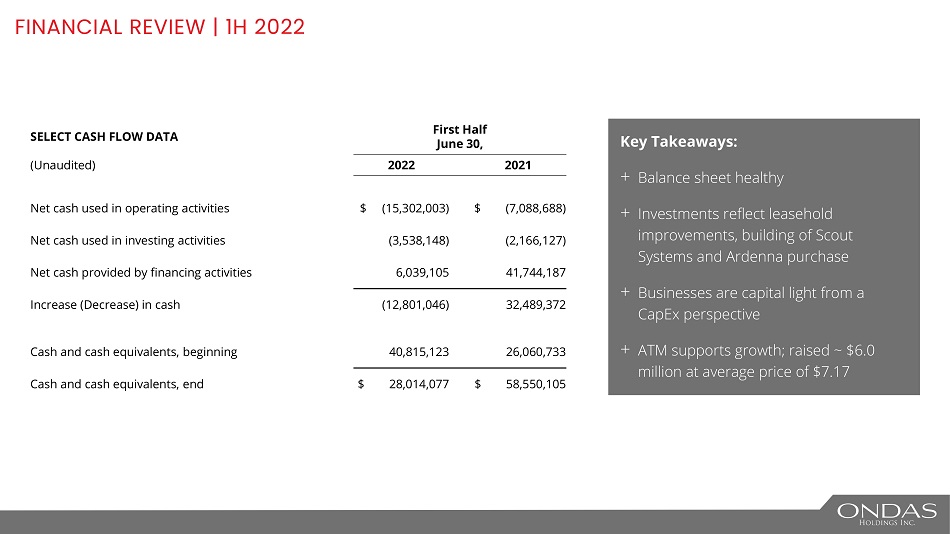

F I N A N C I A L RE V I E W | 1 H 2 0 2 2 Key Takeaways: + Balance sheet healthy + Investments reflect leasehold improvements, building of Scout Systems and Ardenna purchase + Businesses are capital light from a CapEx perspective + ATM supports growth; raised ~ $6.0 million at average price of $7.17 SE L E CT C ASH F L O W DATA F i r s t H a l f Ju n e 30, (Unaudited) 2022 2021 Net cash used in operating activities $ (15,302,003) $ (7,088,688) Net cash used in investing activities (3,538,148) (2,166,127) Net cash provided by financing activities 6,039,105 41,744,187 Increase (Decrease) in cash (12,801,046) 32,489,372 Cash and cash equivalents, beginning 40,815,123 26,060,733 Cash and cash equivalents, end $ 28,014,077 $ 58,550,105

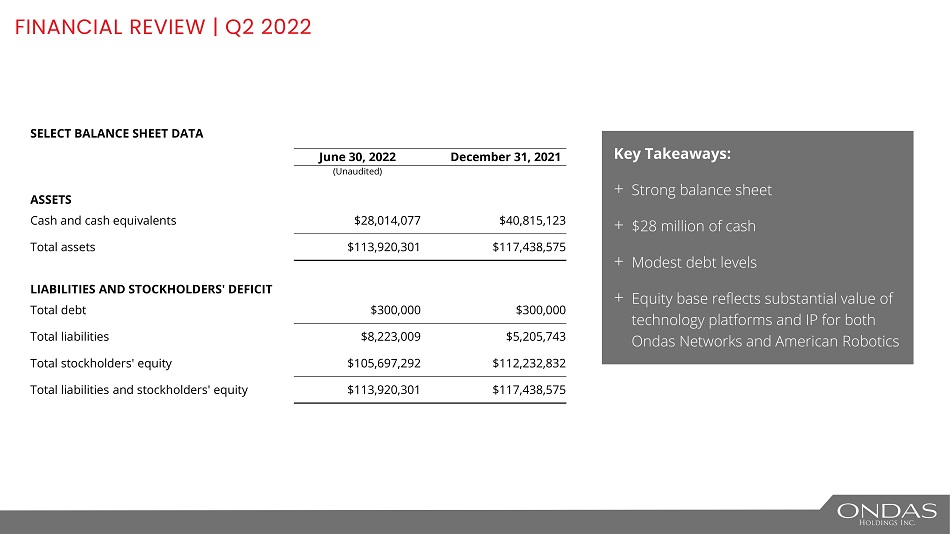

FINANCIAL REVIEW | Q2 2022 Key Takeaways: + Strong balance sheet + $28 million of cash + Modest debt levels + Equity base reflects substantial value of technology platforms and IP for both Ondas Networks and American Robotics SE L E CT BA L A N CE S H EE T DATA Ju n e 3 0 , 2022 De c e mb er 31, 2021 (Unaudited) ASSETS Cash and cash equivalents $28,014,077 $40,815,123 Total assets $113,920,301 $117,438,575 L IA B I L ITIE S A N D ST O C K HO L DERS ' DE F ICIT Total debt $300,000 $300,000 Total liabilities $8,223,009 $5,205,743 Total stockholders' equity $105,697,292 $112,232,832 Total liabilities and stockholders' equity $113,920,301 $117,438,575

Key Priorities and Accomplishments for Ondas Networks and American Robotics STRATEGIC REVIEW

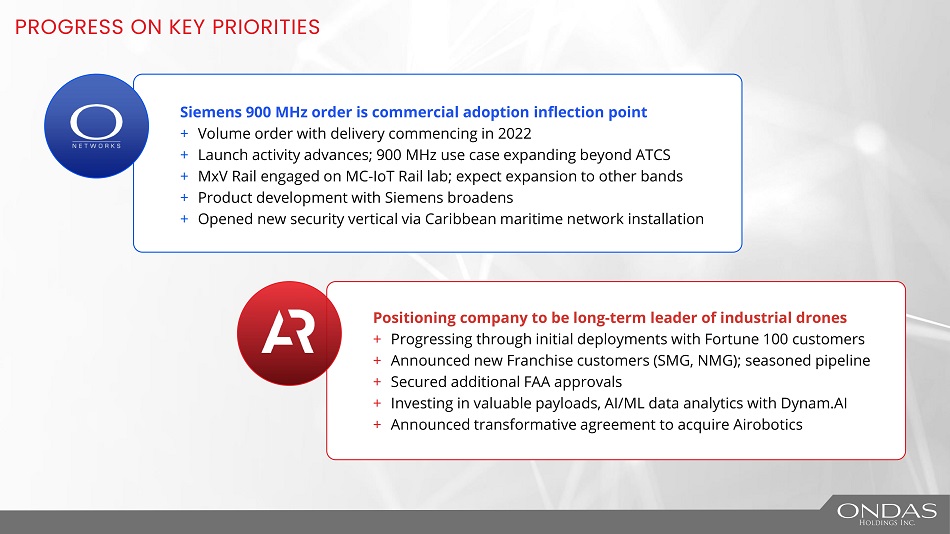

PROGRESS ON KEY PRIORITIES Siemens 900 MHz order is commercial adoption inflection point + V o l ume o rd er with del i v er y c o m m en c i ng i n 2 02 2 + Launch activity advances; 900 MHz use case expanding beyond ATCS + MxV Rail engaged on MC - IoT Rail lab; expect expansion to other bands + Product development with Siemens broadens + Opened new security vertical via Caribbean maritime network installation Positioning company to be long - term leader of industrial drones + Progressing through initial deployments with Fortune 100 customers + Announced new Franchise customers (SMG, NMG); seasoned pipeline + Se cured a dd i ti o n a l F AA a pp r o v a l s + In v est i ng i n v a l u a b l e p a y l o a d s , AI/ML d a ta a n a l yti c s with Dyn a m . AI + Announced transformative agreement to acquire Airobotics

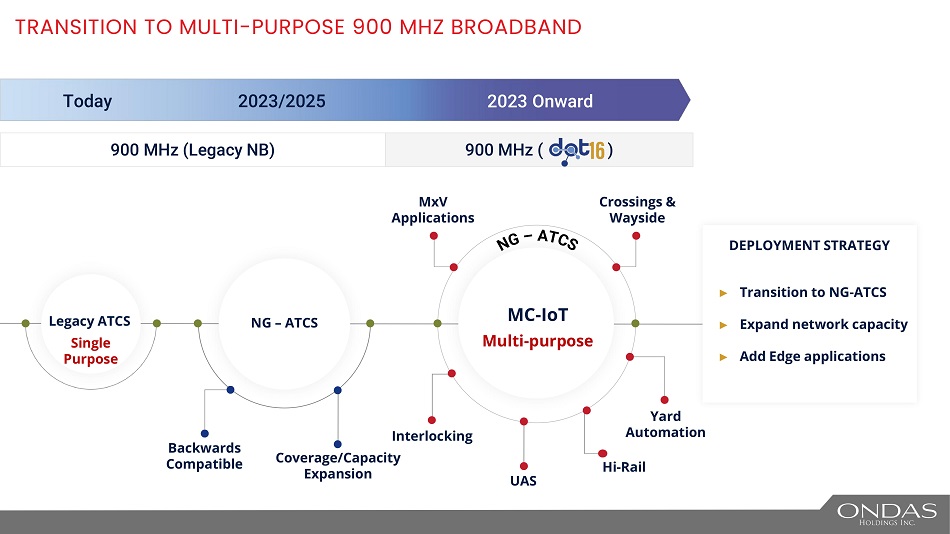

TRANSITION TO MULTI - PURPOSE 900 MHZ BROADBAND 900 MHz (Legacy NB) 900 MHz ( ) Today 2023/2025 2023 Onward Legacy ATCS Single Pu r p ose NG – AT CS M C - IoT Multi - purpose Backwards Com p at i b l e Coverage/Capacity Expansion Interlocking U AS Hi - R a i l Yard Autom a t i on D EPLO Y M EN T S T R AT EGY ► Transition to NG - ATCS ► Expand network capacity ► Add Edge applications Cro s s ing s & Wayside MxV Ap p li c a t i ons

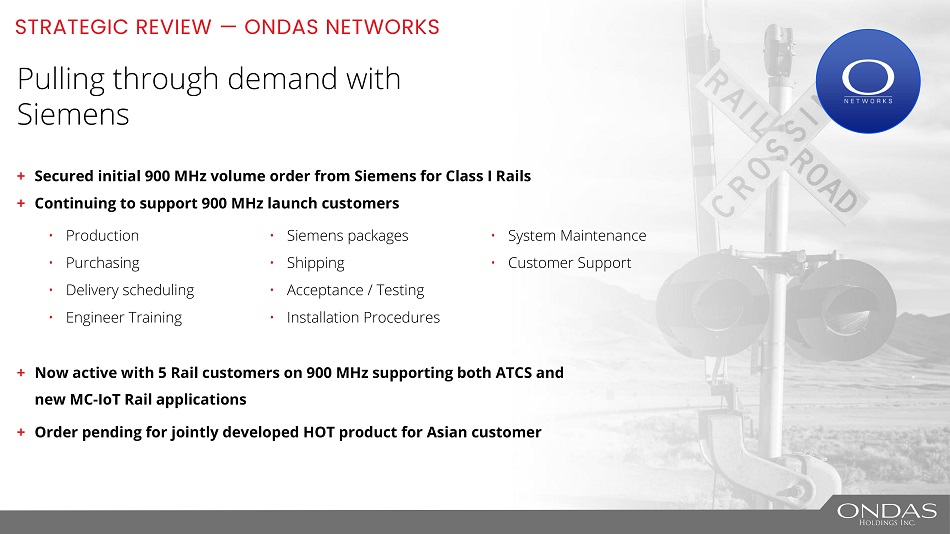

STRATEGIC REVIEW — ONDAS NETWORKS Pulling through demand with Siemens + Secured initial 900 MHz volume order from Siemens for Class I Rails + Continuing to support 900 MHz launch customers • System Maintenance • Customer Support + Now active with 5 Rail customers on 900 MHz supporting both ATCS and new MC - IoT Rail applications + Order pending for jointly developed HOT product for Asian customer • Siemens packages • Shipping • Acceptance / Testing • Installation Procedures • Production • Purchasing • Delivery scheduling • Engineer Training

STRATEGIC REVIEW — ONDAS NETWORKS New networks, New products, New markets + Joint - product development with Siemens expands • Head - of - Train 450 MHz (HOT) programs (N.A. and Asia near completion • Expect initial order from Siemens in Q3 2022 for major Asian Railroad; North America to follow • New European on - board locomotive radio program launched in June 2022 + MC - IoT Rail Lab delivery to MxV Rail in Pueblo, CO slated for August + Identified new network opportunities in North American Passenger & Transit market + Maritime security network deployment in Caribbean • Initial deployment with Israeli defense vendor • Expect additional orders for maritime perimeter security in 2022 Exhibiting with Siemens at InnoTrans 2022 global rail conference in Berlin in Q3

STRATEGIC REVIEW — AMERICAN ROBOTICS Recap of market opportunity we are pursuing + Global commercial drone market opportunity estimated to be $127B at scale + We estimate 90% of this market requires automated drone - in - a - box (DIB) tech to be practical and scalable + We estimate over 10 million assets sites around the world have need for autonomous DIB + Most of these are mission - critical and safety - critical operations with large customers who have the need for fleets of systems (100s or 1000s)

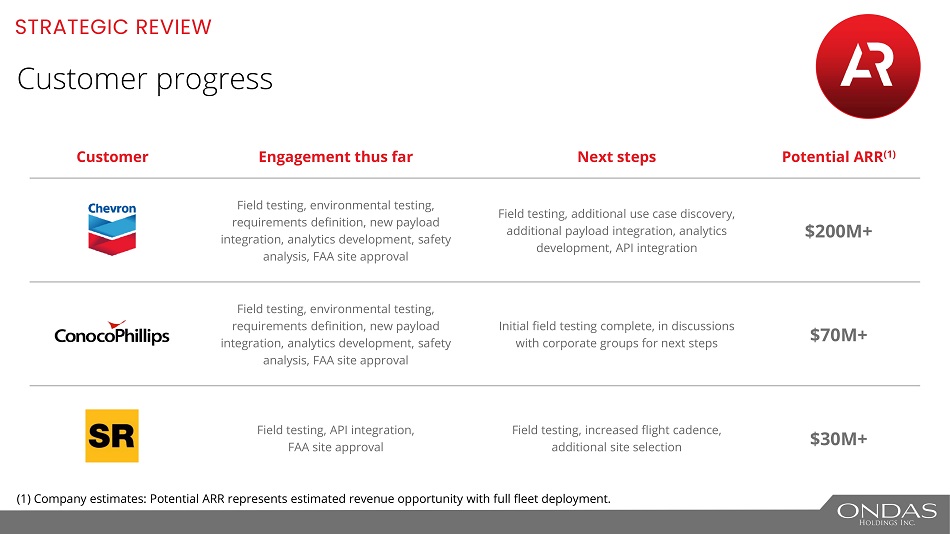

Customer Engagement thus far Next steps Potential ARR (1) Field testing, environmental testing, requirements definition, new payload integration, analytics development, safety a n a l y si s, F A A sit e a p p ro v a l Field testing, additional use case discovery, additional payload integration, analytics development, API integration $200M+ Field testing, environmental testing, requirements definition, new payload integration, analytics development, safety a n a l y si s, F A A sit e a p p ro v a l Initial field testing complete, in discussions with corporate groups for next steps $70M+ Field testing, API integration, F A A si t e a pp r o val Field testing, increased flight cadence, additional site selection $30M+ STRATEGIC REVIEW Customer progress (1) Company estimates: Potential ARR represents estimated revenue opportunity with full fleet deployment.

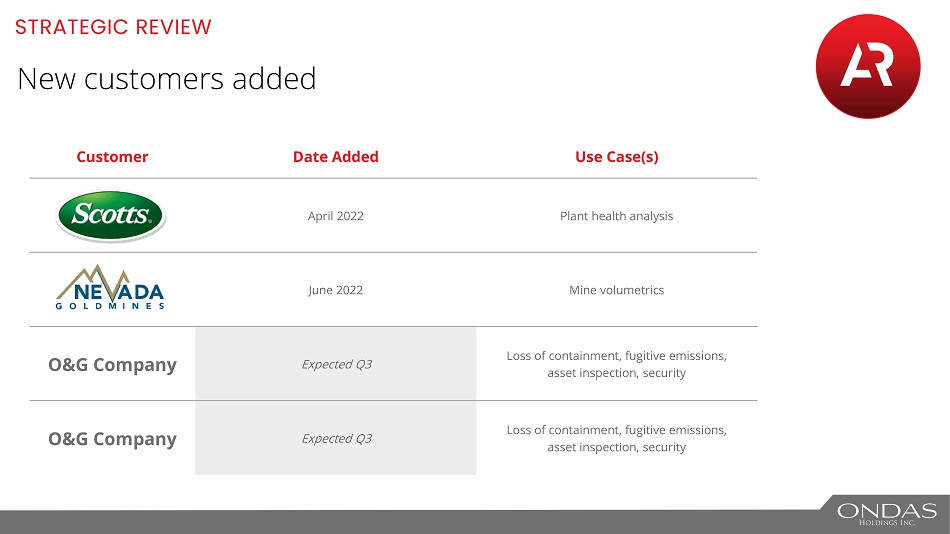

Customer Date Added Use Case(s) A pr i l 2 0 22 Plant health analysis June 2022 Mine volumetrics O&G Company Expected Q3 Loss of containment, fugitive emissions, asset inspection, security O&G Company Expected Q3 Loss of containment, fugitive emissions, asset inspection, security STRATEGIC REVIEW New customers added

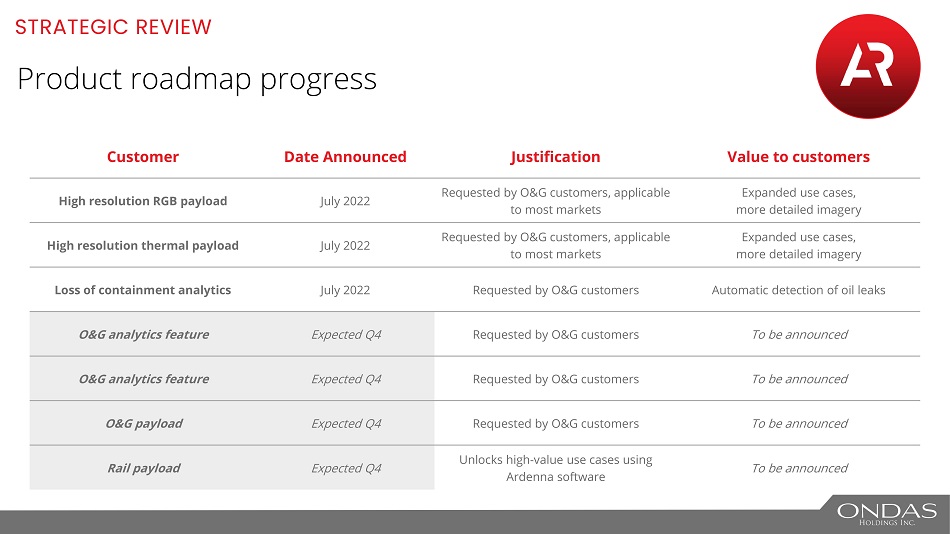

Customer Date Announced Justification Value to customers High resolution RGB payload J u ly 2 0 22 Requested by O&G customers, applicable to most markets Expanded use cases, more detailed imagery High resolution thermal payload J u ly 2 0 22 Requested by O&G customers, applicable to most markets Expanded use cases, more detailed imagery Loss of containment analytics J u ly 2 0 22 Requested by O&G customers Automatic detection of oil leaks O&G a nalyt i c s f e a t ure Expected Q4 Requested by O&G customers To be announced O&G analytics feature Expected Q4 Requested by O&G customers To be announced O &G pa y l o a d Expected Q4 Requested by O&G customers To be announced Rail payload Expected Q4 Unlocks high - value use cases using Ardenna software To be announced STRATEGIC REVIEW Product roadmap progress

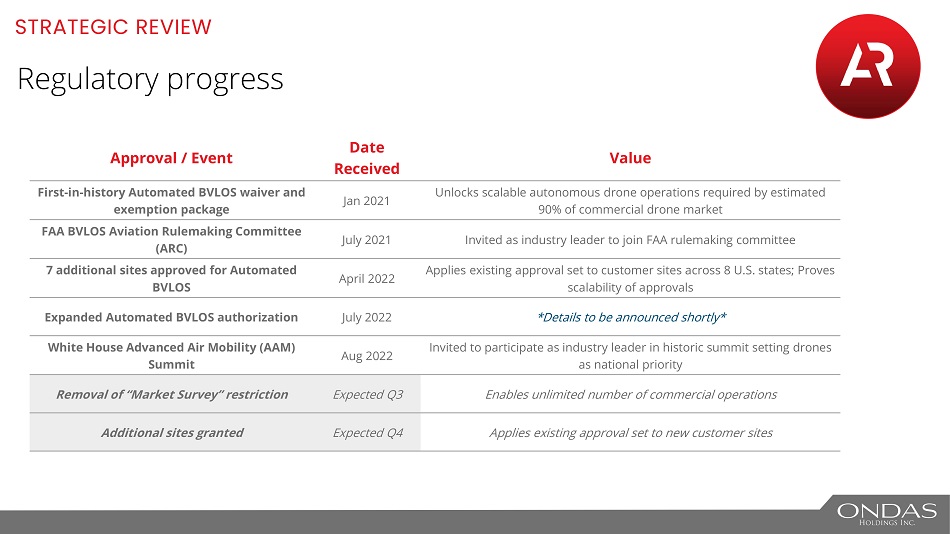

Approval / Event Date Received Value First - in - history Automated BVLOS waiver and exemption package J a n 2 0 21 Unlocks scalable autonomous drone operations required by estimated 90% of commercial drone market FAA BVLOS Aviation Rulemaking Committee (ARC) J u ly 2 0 21 Invited as industry leader to join FAA rulemaking committee 7 additional sites approved for Automated BVLOS Ap ri l 2 0 22 Applies existing approval set to customer sites across 8 U.S. states; Proves scalability of approvals Expanded Automated BVLOS authorization J u ly 2 0 22 *Details to be announced shortly* White House Advanced Air Mobility (AAM) Summit Au g 2 0 22 Invited to participate as industry leader in historic summit setting drones as national priority Removal of “Market Survey” restriction Expected Q3 Enables unlimited number of commercial operations Additional sites granted Expected Q4 Applies existing approval set to new customer sites STRATEGIC REVIEW Regulatory progress

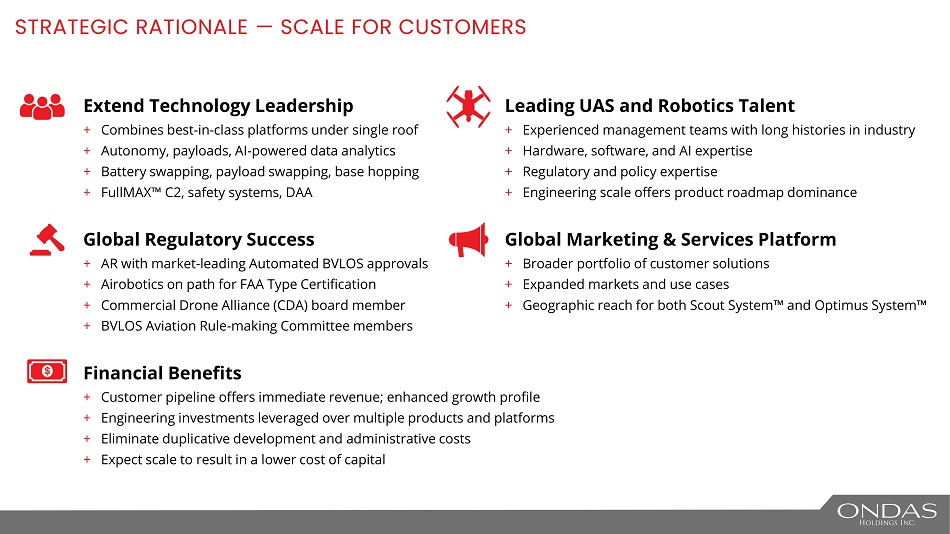

STRATEGIC RATIONALE — SCALE FOR CUSTOMERS Extend Technology Leadership + C o m b i n e s b e s t - i n - c l as s pla t f o rm s un d e r s i n g l e ro of + A u to n o m y, payl oa d s , A I - p o we r e d data ana l yt i cs + Battery sw a p p i n g, payl oad sw a p p i n g, base h o p ping + F u ll MA X Œ C2, saf e t y sys t e ms , D A A Leading UAS and Robotics Talent + Experienced management teams with long histories in industry + H ardwar e , so f tw are , an d A I e x p e rt ise + Reg u l ator y an d p o li c y e x p e rt ise + Engineering scale offers product roadmap dominance Global Regulatory Success + A R w i t h mar k e t - l e ading A utomat e d B V L OS ap p ro v a l s + Airobotics on path for FAA Type Certification + C o mm e rc i a l D ron e A lli anc e (C D A ) b o ar d m e m b e r + B V L OS A v i at i on Rul e - making C o mm i tte e m e mb e rs Global Marketing & Services Platform + Bro ad e r p ortf o li o of cus t om e r so l ut i o n s + Ex p an d e d mar k e t s an d u s e cases + Geographic reach for both Scout System Œ and Optimus System Œ Financial Benefits + Customer pipeline offers immediate revenue; enhanced growth profile + Engineering investments leveraged over multiple products and platforms + Eliminate duplicative development and administrative costs + Expect scale to result in a lower cost of capital

Outlook Summary

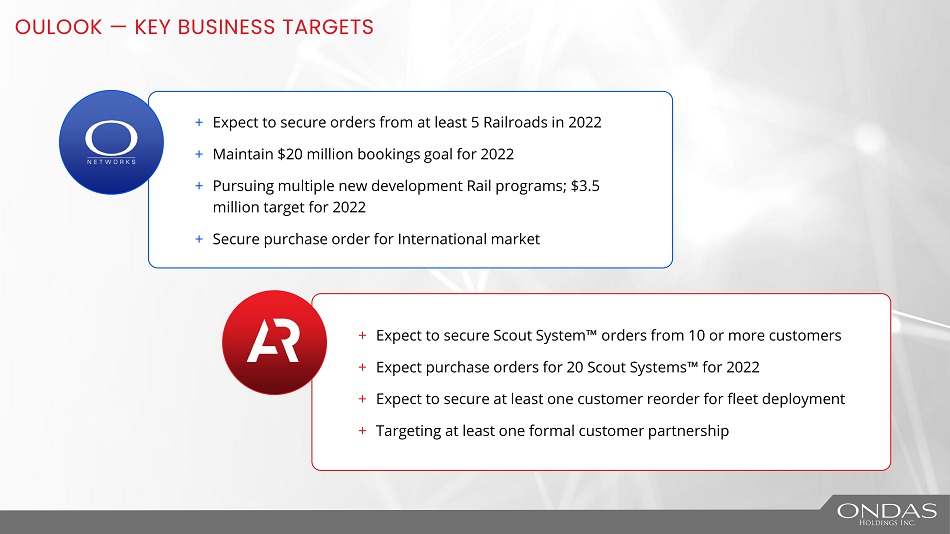

OULOOK — KEY BUSINESS TARGETS + E x p e c t t o se c ure o rd er s f r o m a t l e a s t 5 Ra i l r o a d s i n 2 02 2 + Maintain $20 million bookings goal for 2022 + Pursuing multiple new development Rail programs; $3.5 mi l li o n ta r g e t for 2 02 2 + Secure purchase order for International market + Expect to secure Scout System Œ orders from 10 or more customers + E x p e c t pur c h a s e o rd er s for 2 0 S c o ut S y s te m s Œ for 2 02 2 + Expect to secure at least one customer reorder for fleet deployment + Targeting at least one formal customer partnership

SCALING INDUSTRIAL TECHNOLOGY PLATFORMS + Balance sheet remains healthy + Cash OPEX expected to be approximately $8.0 – $8.5 million for Q3 2022 + ATM is an efficient mechanism to fund growth Continue to cement and extend leadership

AIROBOTICS ACQUISITION ACCELERATES GROWTH PLAN Creation of a global UAS solutions provider to lead the consolidation of the commercial drone sector + Leading technology platforms and management teams emerging + Sophisticated customers driving market adoption need a scaled player • Automated systems are complex to adopt and deploy • Must lead the development of payloads and data analytics • Require support across large operation footprints and regions + Platforms must meet rigorous performance and regulatory standards Customers, Talent and Capital will migrate to the leaders in a winner take most market

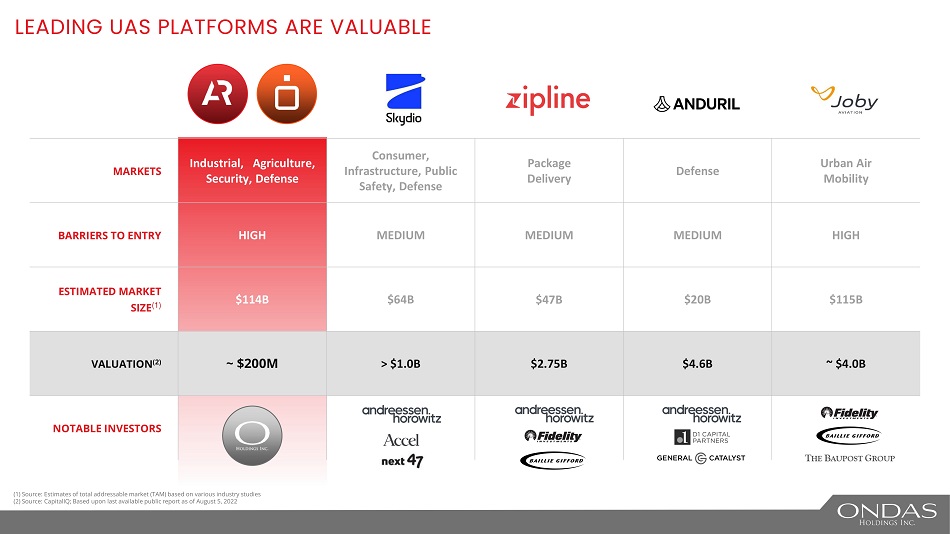

LEADING UAS PLATFORMS ARE VALUABLE MARKETS Indus tr i a l , A g r i cultu r e , Security, Defense Consumer, Infrastructure, Public Safety, Defense Pa ck a ge D e li v e r y Defense Urban Air Mobility BARRI E R S TO E N TRY HIGH MEDIUM MEDIUM MEDIUM HIGH E S TIMA T E D MA R K E T SIZE (1) $114B $64B $47B $20B $115B VALUATION (2) ~ $200M > $1.0B $2.75B $4.6B ~ $4.0B N OTABLE I N V E S TORS (1) Source: Estimates of total addressable market (TAM) based on various industry studies (2) Source: CapitalIQ; Based upon last available public report as of August 5, 2022

CLOSING REMARKS Business development on track at Ondas Networks and American Robotics Delivering on 900 MHz Network and expanded platform opportunities American Robotics demonstrating industry leadership for customers Ondas is investing to win with its partners and ecosystem

Investor Q&A

No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Important Additional Information Will be Filed with the SEC Ondas will file with the SEC a registration statement on Form S - 4 , which will include a prospectus of Ondas . INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONDAS, AIROBOTICS, THE PROPOSED ACQUISITION AND RELATED MATTERS . Investors will be able to obtain free copies of the registration statement and other documents filed with the SEC through the website maintained by the SEC at www . sec . gov and on Ondas’ website at https : //ir . ondas . com . IMPPORTANT DISCLOSURES

Thafik You for Listefiifig www.ondas.com www.linkedin.com/company/ondasnetworks/ www.twitter.com/OndasNetworks www.american - robotics.com www.twitter.com/AmericanRobotic