UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

Ondas Holdings Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

Ondas Holdings Inc.

411 Waverley Oaks Road, Suite 114

Waltham, Massachusetts 02452

November [●], 2022

Dear Fellow Ondas Stockholder:

We are pleased to invite you to join us at the 2022 Annual Meeting of Stockholders of Ondas Holdings Inc. (“Ondas”) to be held on [●], December [●], 2022 at [●] a.m. Eastern Time, at [●].

The accompanying Notice of Annual Meeting and Proxy Statement describes the specific matters to be voted upon at the Annual Meeting. Whether you own a few or many shares of Ondas stock and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented at the Annual Meeting. Your vote is important and we ask that you please cast your vote as soon as possible.

The Board of Directors recommends that you vote FOR the election of all the director nominees; FOR the ratification of the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2022; FOR the advisory approval of the Company’s executive compensation (“Say on Pay”); and FOR the approval, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of common stock issuable by the Company pursuant to the Notes (as defined in the Proxy Statement). Please refer to the accompanying Proxy Statement for detailed information on each of the proposals and the Annual Meeting.

Sincerely,

Eric A. Brock

Chairman and Chief Executive Officer

Ondas Holdings Inc.

Ondas Holdings Inc.

411 Waverley Oaks Road, Suite 114

Waltham, Massachusetts 02452

NOTICE OF THE 2022 ANNUAL MEETING OF STOCKHOLDERS

To Stockholders of Ondas Holdings Inc.:

The 2022 Annual Meeting of Stockholders of Ondas Holdings Inc. will be held on [●], December [●], 2022 at [●] a.m. Eastern Time, at [●]. The purpose of the Annual Meeting is to consider and vote upon the following proposals:

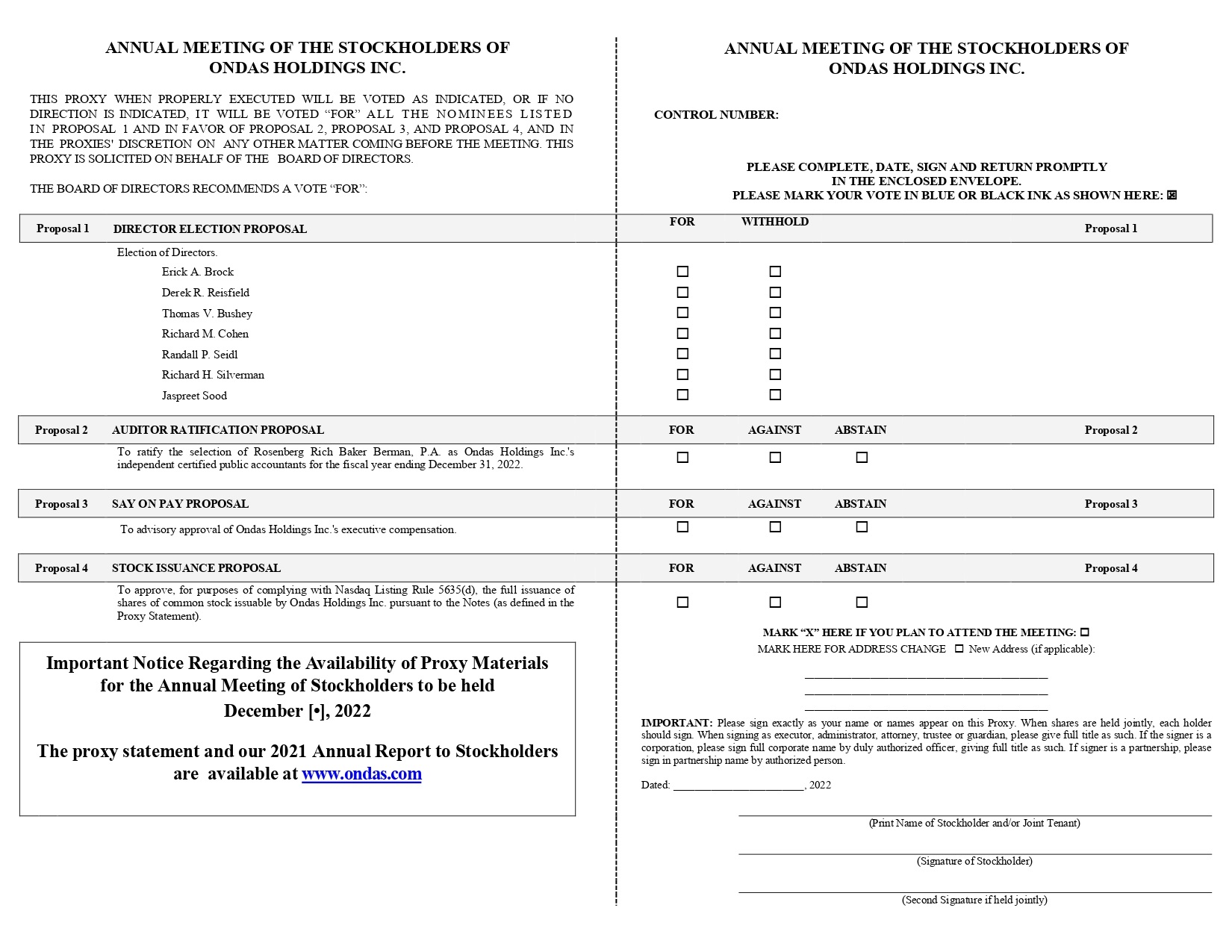

| 1. | Director Election Proposal — a proposal to elect seven directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified; |

| 2. | Auditor Ratification Proposal — a proposal to ratify the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2022; |

| 3. | Say on Pay Proposal — a proposal to obtain advisory approval of the Company’s executive compensation; |

| 4. | Stock Issuance Proposal — a proposal to approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of common stock issuable by the Company pursuant to the Notes (as defined in the Proxy Statement), and |

| 5. | To transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

The close of business on November [●], 2022 has been fixed as the record date for the Annual Meeting (the “Record Date”). Only holders of record of Ondas Holdings Inc. common stock on the Record Date are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We cordially invite you to attend the Annual Meeting in person. Even if you plan to attend the Annual Meeting, we ask that you please cast your vote as soon as possible. As more fully described in the accompanying proxy statement, you may revoke your proxy and reclaim your right to vote at any time prior to its use.

Sincerely,

Derek R. Reisfield

President, Chief Financial Officer,

Treasurer, and Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER [●], 2022

The accompanying proxy statement and the

2021 Annual Report on Form 10-K are available at

[●].

PROXY STATEMENT

TABLE OF CONTENTS

i

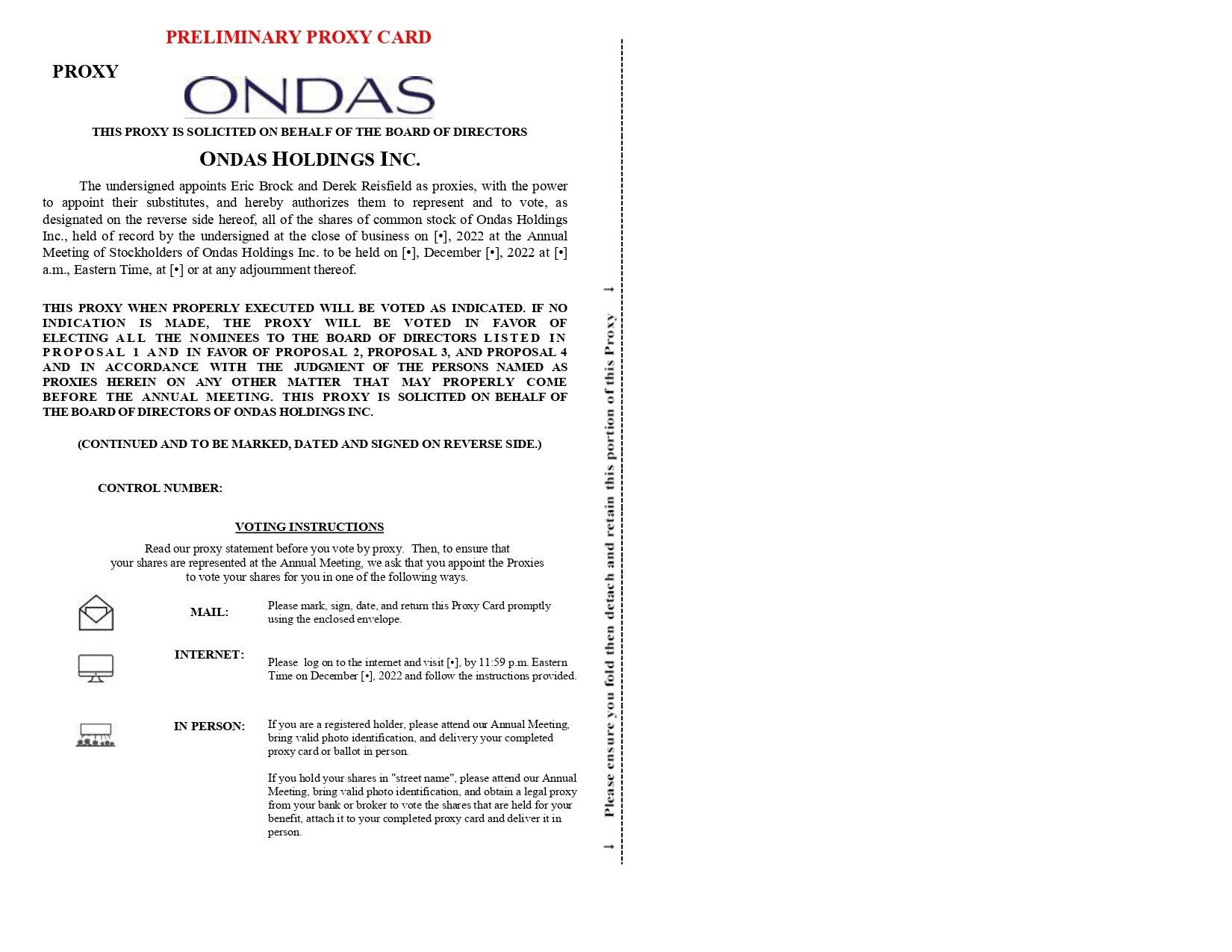

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of Ondas Holdings Inc. (“Ondas” or the “Company,” or “we,” “us,” and “our”) for use at our 2022 Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held on [●], December [●], 2022 at [●] a.m. Eastern Time, at [●]. If you will need directions to the Annual Meeting, or if you require special assistance at the Annual Meeting because of a disability, please contact Derek Reisfield at (888) 350-9994.

The close of business on November [●], 2022 has been fixed as the record date for the Annual Meeting (the “Record Date”). Only holders of record of Ondas common stock on the Record Date are entitled to notice of, and to vote at, the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the Record Date, there were [●] shares of common stock issued and outstanding and entitled to vote at the Annual Meeting. This proxy statement and form of proxy are first being mailed to stockholders on or about November [●], 2022.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of our 2022 Annual Meeting?

Our 2022 Annual Meeting will be held to consider and vote upon the following proposals:

| 1. | Director Election Proposal — a proposal to elect seven directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified; |

| 2. | Auditor Ratification Proposal — a proposal to ratify the selection of Rosenberg Rich Baker Berman, P.A. as the Company’s independent certified public accountants for the fiscal year ending December 31, 2022; |

| 3. | Say on Pay Proposal — a proposal to obtain advisory approval of the Company’s executive compensation; |

| 4. | Stock Issuance Proposal — a proposal to approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of common stock issuable by the Company pursuant to the Notes (as defined in the Proxy Statement), and |

| 5. | To transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting only if you were an Ondas stockholder as of the Record Date or you hold a valid proxy for the Annual Meeting. You should be prepared to present photo identification for admittance. If your shares are held by a brokerage firm, bank, or a trustee, you should provide proof of beneficial ownership as of the Record Date, such as a bank or brokerage account statement or other similar evidence of ownership. Even if you plan to attend the Annual Meeting, please cast your vote as soon as possible.

What are the voting rights of Ondas stockholders?

Each stockholder of common stock is entitled to one vote per share on each of the seven director nominees and one vote per share on each other matter properly presented at the Annual Meeting for each share of common stock owned by that stockholder on the Record Date.

What constitutes a quorum?

The holders of a majority of the shares of stock, issued and outstanding and entitled to vote, shall be present in person or represented by proxy in order to constitute a quorum for the Annual Meeting. If you submit a properly executed proxy or voting instruction card or properly cast your vote via the Internet or telephone, your shares will be considered part of the quorum, even if you abstain from voting or withhold authority to vote as to a particular proposal. Under Nevada law, we also will consider as present for purposes of determining whether a quorum exists any shares represented by “broker non-votes.”

1

What are “broker non-votes?”

“Broker non-votes” occur when shares held by a brokerage firm are not voted with respect to a proposal because the firm has not received voting instructions from the stockholder and the firm does not have the authority to vote the shares in its discretion. Under applicable exchange rules, the Director Election Proposal, Say on Pay Proposal, and Stock Issuance Proposal are non-routine proposals, and as such a broker does not have the discretion to vote on such proposals if such broker has not received instructions from the beneficial owner of the shares represented. The Auditor Ratification Proposal is a routine proposal, and as such a broker does have discretion to vote on the Auditor Ratification Proposal.

Will my shares be voted if I do not provide my proxy?

If your shares are held by a brokerage firm and you do not provide the firm specific voting instructions, such firm will not have the authority to vote your shares for the Director Election Proposal, Say on Pay Proposal, and Stock Issuance Proposal, and your shares will not be voted, and will be considered “broker non-votes,” with respect to these proposals to be presented at the Annual Meeting. Therefore, we urge you to provide voting instructions so that your shares will be voted. If you hold your shares directly in your own name, your shares will not be voted unless you provide a proxy or fill out a written ballot in person at the Annual Meeting.

How do I vote?

Ondas stockholders of record on November [●], 2021 may submit their proxies as follows:

| ● | Through the Internet, by visiting the website established for that purpose at [●] by 11:59 p.m. Eastern Time on December [●], 2022 and following the instructions; |

| ● | By telephone, by calling the toll-free number [●] in the United States, Canada, or Puerto Rico on a touch-tone phone by 11:59 p.m. Eastern Time on December [●], 2022 and following the recorded instructions; or |

| ● | By mail, by marking, signing, and dating the enclosed proxy card and returning it in the postage-paid envelope provided or returning it pursuant to the instructions provided in the proxy card. |

If you are a beneficial owner, please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you.

To vote in person:

| ● | If you are a registered holder, attend our Annual Meeting, bring valid photo identification, and deliver your completed proxy card or ballot in person; or |

| ● | If you hold your shares in “street name,” attend our Annual Meeting, bring valid photo identification, and obtain a legal proxy from your bank or broker to vote the shares that are held for your benefit, attach it to your completed proxy card and deliver it in person. |

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet, by telephone, by signing and mailing a new proxy card with a later date, or by attending the Annual Meeting and voting in person (only your latest proxy submitted prior to the Annual Meeting will be counted). However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

2

What vote is required to approve each proposal at the Annual Meeting?

Proposal 1 — Director Election Proposal.

The vote required to elect our seven directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes cast at the Annual Meeting. A withhold vote, abstentions and broker non-votes will have no effect on the outcome of the vote for the Director Election Proposal.

Proposal 2 — Auditor Ratification Proposal.

The vote required to approve the Auditor Ratification Proposal is a majority of the votes cast at the Annual Meeting. Abstentions will have no effect on the outcome of the vote for the Auditor Ratification Proposal.

Proposal 3 — Say on Pay Proposal.

The vote required to approve the Say on Pay Proposal is a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the Say on Pay Proposal.

Proposal 4 — Stock Issuance Proposal.

The vote required to approve the Stock Issuance Proposal is a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the Stock Issuance Proposal.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

| ● | FOR Proposal 1: the Director Election Proposal; |

| ● | FOR Proposal 2: the Auditor Ratification Proposal; |

| ● | FOR Proposal 3: the Say on Pay Proposal; and |

| ● | FOR Proposal 4: the Stock Issuance Proposal. |

3

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your voting instructions. If you submit a proxy but do not provide instructions or if your instructions are unclear, the persons named as proxies will vote your shares in accordance with the recommendations of the Board, as set forth above.

With respect to any other proposal that properly comes before the Annual Meeting, the persons named as proxies will vote as recommended by our Board or, if no recommendation is given, in their own discretion.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers, and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. Ondas has engaged [●] to assist it in the distribution and solicitation of proxies at a fee of $[●], plus expenses. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of common stock held of record by them.

Whom should I call with questions?

If you have additional questions about the Annual Meeting, you should contact:

Ondas Holdings Inc.

411 Waverley Oaks Road, Suite 114

Waltham, Massachusetts 02452

Attention: Investor Relations

Phone Number: (888) 350-9994

E-mail Address: inquiries@ondas.com

If you would like additional copies of this proxy statement or you need assistance voting your shares, you should contact:

[●]

4

PROPOSAL 1: DIRECTOR ELECTION PROPOSAL

Our Board currently consists of seven members. All of the director nominees listed below were elected by our stockholders at our 2021 Annual Meeting of Stockholders. Upon the recommendation of our Nominating and Corporate Governance (“N&CG”) Committee, our Board has nominated the seven persons listed below to stand for a term expiring at the next Annual Meeting of Stockholders or until their successors are duly elected and qualified. Each nominee listed below is currently serving as a director and is willing and able to serve as a director of Ondas.

Directors and Executive Officers

Below are the names of and certain information regarding our executive officers and directors:

| Name | Age | Position | ||

| Eric A. Brock | 52 | Chairman and Chief Executive Officer | ||

| Derek R. Reisfield | 59 | Director, President, Chief Financial Officer, Treasurer, and Secretary | ||

| Thomas V. Bushey | 42 | Director | ||

| Richard M. Cohen | 71 | Director | ||

| Randall P. Seidl | 59 | Director | ||

| Richard H. Silverman | 82 | Director | ||

| Jaspreet Sood | 49 | Director |

Eric A. Brock - Chairman of the Board and Chief Executive Officer

Mr. Brock was appointed as one of our directors and as our President, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer on June 28, 2018. On September 28, 2018, following the completion of the reverse acquisition transaction to acquire Ondas Networks Inc. (the “Acquisition”), he was appointed Chairman of the Board and resigned from the positions of Chief Financial Officer, Secretary and Treasurer. Mr. Brock also serves as Chairman of the Board and Chief Executive Officer of Ondas Networks Inc. since September 28, 2018. Since October 2021, Mr. Brock has served as a member of the Board of Directors of Dynam.AI. Mr. Brock is an entrepreneur with over 20 years of global banking and investing experience. He served as a founding Partner and Portfolio Manager with Clough Capital Partners, a Boston-based investment firm from 2000 to 2017. Prior to Clough, Mr. Brock was an investment banker at Bear, Stearns & Co. and an accountant at Ernst & Young, LLP. Mr. Brock holds an MBA from the University of Chicago and a BS from Boston College. Our Board believes that Mr. Brock’s experience in the public markets makes him well qualified to serve on our Board.

Derek Reisfield - Director, President, Chief Financial Officer, Treasurer and Secretary

Mr. Reisfield was appointed as one of our directors on September 28, 2018, and as our President, Chief Financial Officer, Treasurer and Secretary on December 9, 2021. Mr. Reisfield also serves as Chief Financial Officer, Treasurer and Secretary of Ondas Networks Inc. since December 9, 2021. Previously, he had served as a member of the Board of Ondas Networks Inc. from April 2016 to September 2018. From December 2020 to the present, he has served as the President and Chief Executive Officer of Thetis Business Solutions, LLC. From 2018 to 2020, he served as an independent business consultant. From 2015 to December 2018, Mr. Reisfield served as Vice President, Strategy and Business Development of MetaRail, Inc. (formerly, Wayfare Interactive Technologies, Inc.), a company that provides commerce search capabilities to digital publishers and marketers. In 2008, Mr. Reisfield co-founded BBN Networks, LLC, formerly known as BBN Networks, Inc., a digital advertising and marketing solutions company focused on the B2B sector, where he served as Chief Executive Officer until 2014 and as Chairman until 2015. Mr. Reisfield was Executive Vice President and Chief Financial Officer of Fliptrack, Inc., a social mobile gaming company, from 2007 to 2008. He was an independent consultant from 2002 to 2007 working with digital startups and large consumer-oriented companies facing digital threats and opportunities. He was Co-Founder and Managing Principal of i-Hatch Ventures, LLC from 1999-2001, Co-Founder, Vice Chairman and Executive Vice President of Luminant, Inc., a digital consulting firm, from 1999-2000, Co-Founder and Chairman of Marketwatch, a financial and business news and information company, from 1997-1998, President CBS New Media from 1997-1998, Vice President, Business Development of CBS from 1996-1997, Director of Strategic Management CBS and its predecessor Westinghouse Electric Corporation, Inc. from 1996-1997. Prior to that, Mr. Reisfield was the Co-Founder of the Media and Telecommunications Practice of Mitchell Madison Group, LLC, a management consultancy and a leader of the Media and Telecommunications practice of McKinsey & Company, Inc., a management consultancy. He has served on several public corporation boards. Mr. Reisfield is a director emeritus of the San Francisco Zoological Society. Mr. Reisfield holds a BA from Wesleyan University, and an AM in Communications Management from the Annenberg School of Communications of USC in 1986. We believe Mr. Reisfield’s experience in senior leadership positions at both privately held and publicly traded technology companies, including holding board positions in corporate governance, make him a well-qualified candidate to serve on our Board.

5

Non-Management Directors

Thomas V. Bushey - Director

Mr. Bushey was appointed as one of our directors effective June 3, 2020. Mr. Bushey served as our President from June 2, 2020 to January 19, 2021. Mr. Bushey served as our consultant from January 19, 2021 to July 19, 2021. Mr. Bushey has served as a director and Chief Executive Officer of Newbury Street Acquisition Corporation (NASDAQ: NBST) since November 2020. Mr. Bushey has been Chief Executive Officer of Sunderland Capital, an investment management firm, since 2015. Prior to founding Sunderland Capital in 2015, Mr. Bushey was a portfolio manager at Blackrock. Previously he worked as an investment banker at Credit Suisse, as a private equity professional at Thayer Capital, and as a hedge fund analyst at Millennium Partners. Mr. Bushey earned a B.S. in Economics from the Wharton School of the University of Pennsylvania. We believe that Mr. Bushey’s investment banking and private equity background and experience make him well qualified to serve on our Board.

Richard M. Cohen - Director

Mr. Cohen was appointed as one of our directors on September 28, 2018. Previously, he had served as a member of the Board of Ondas Networks Inc. from April 2016 to September 2018. He has been the President of Richard M Cohen Consultants since 1995, a company providing financial consulting services to both public and private companies. He has served as a director of Great Elm Capital Corp. (NASDAQ: GECC) since March 2022, Smart For Life, Inc. (NASDAQ: SMFL) since February 2022, and Direct Digital Holdings, Inc. (NASDAQ: DRCT) since November 2021. From March 2012 to July 2015, he was the Founder and Managing Partner of Chord Advisors, a firm providing outsourced CFO services to both public and private companies. From May 2012 to August 2013, he was the Interim CEO and member of the Board of Directors of CorMedix Inc. (NYSE: CRMD). From July 2008 to August 2012, Mr. Cohen was a member of the Audit Committee of Rodman and Renshaw, an investment banking firm. From July 2001 to August 2012, he was a partner with Novation Capital until its sale to a private equity firm. Mr. Cohen holds a BS with honors from the University of Pennsylvania (Wharton), an MBA from Stanford University and a CPA from New York State. He is considered an expert to Chair the Audit Committee of a publicly traded company. We believe that Mr. Cohen’s educational background and financial experience supporting publicly traded companies including as a CEO and Board member of a public traded company on the New York Stock Exchange makes him well qualified to serve on our Board.

Randall P. Seidl - Director

Mr. Seidl was appointed as one of our directors on November 16, 2020. In September 2020, he founded and continues to serve as Chief Executive Officer of Sales Community, a sales social network with a mission to add value to technology sales professionals. In 2016, he founded and continues to serve as Chief Executive Officer of Top Talent Recruiting, a boutique contingency-based recruiting business. In 2013, he founded and continues to serve as Chief Executive Officer of Revenue Acceleration to help tech companies accelerate revenue growth. From 2009 to 2013, Mr. Seidl served as Sr. Vice President/General Manager of Hewlett Packard’s Americas and U.S. Enterprise Group. From 2006 to 2009, he served as Sr. Vice President/General Manager of Sun Microsystems’ North America business and as Vice President/General Manager for its Financial Services Area. From 2004 to 2006, he served as Vice President/General Manager of East Region at StorageTek. From 2003 to 2004, he served as Chief Executive Officer and director at Permabit, from 2000 to 2003 was co-founder and Executive Vice President of GiantLoop, and from 1996 to 1999 was Chairman and Chief Executive Officer of Workgroup Solutions. He began his career at EMC Corporation, holding various positions including Vice President of Open Systems Sales for North America from 1985 to 1996. Since 2015, Mr. Seidl has served as director of Data Dynamics, a privately held company, a leader in intelligent file management solutions. Since 2014, he has served as director of Cloudgenera, a privately held company, a leading supplier of vendor agnostic IT analytics that arm organizations with the business cases needed to optimize technology spend. He previously served as director of Datawatch Corporation (2015-2018, Nasdaq: DWCH, acquired by Altair). He continues to serve on the advisory boards or consults with DataRobot, Trilio, WekalO, ISG, CXO Nexus, Corent, DecisionLink, Dooly, Sendoso, Emissary, and CaptivateIQ. Mr. Seidl is a graduate of Boston College’s Carroll School of Management. Mr. Seidl serves as a trustee on Boston College’s Board of Trustees, on the Board of Trustees of St. Sebastian’s School, and is active with other charities. We believe Mr. Seidl’s experience in senior leadership positions at private/public technology companies and his private/public board experience makes him well-qualified to serve on our board of directors.

Richard H. Silverman – Director

Mr. Silverman was appointed as one of our directors on September 28, 2018. Previously, he had served as a member of the Board of Ondas Networks Inc. from April 2016 to September 2018. Mr. Silverman is a well-recognized and respected professional in the energy industry in Arizona and on a national level. He is past Chair of the board of directors for the Electric Power Research Institute; past Chair and former steering committee member of the Large Public Power Council; and former executive committee member of the board of directors for the American Public Power Association. Since August 2011, Mr. Silverman has been Of Counsel at Jennings, Strouss & Salmon, PLC, where he focuses his practice on energy law. Prior to joining the firm, he served as General Manager of Salt River Project from 1994 to 2011. Mr. Silverman holds a Juris Doctor from the University of Arizona and B.A. in Business from the University of Arizona. We believe Mr. Silverman’s prior experience as general manager of Salt River Project, one of the nation’s largest public power utilities serving approximately one million customers in the Phoenix metropolitan area, will help the Company navigate strategic issues in the rapidly changing electric utility industry with specific knowledge of the impact of renewables like solar energy on the electric grid and makes him well qualified to serve on our Board.

6

Jaspreet (Jas) Sood – Director

Ms. Sood was appointed as one of our directors on January 19, 2021. Ms. Sood is a seasoned executive who has strategic expertise in the areas of sales, product management, P&L management, operational transformation and go to market strategies. Since August 2021, Ms. Sood serves as Senior Vice President of Sales — US Enterprise for Palo Alto Networks (NYSE: PANW). Prior to joining Palo Alto Networks, Ms. Sood held a variety of executive level positions with Hewlett Packard Enterprise (NYSE: HPE) and its predecessor companies in the areas of business operations, strategy, product management, and finance. Ms. Sood was employed by Hewlett Packard Enterprise and its predecessor companies for twenty-five years. Ms. Sood holds an MBA with an emphasis in Technology Management from Pepperdine University and a bachelor’s degree in Economics from the University of California, Irvine. In 2018, 2019, 2020, and 2021, she was honored as a “CRN Power 100 Woman of the Channel” and is routinely featured as a guest speaker at various technology industry events. We believe Ms. Sood’s business experience makes her well qualified to serve on our board of directors.

Board Matrix

The matrix below summarizes certain of the key experiences, qualifications, skills, and attributes that our director nominees bring to the Board to enable effective oversight. This matrix is intended to provide a summary of our director nominees’ qualifications and is not a complete list of each director nominee’s strengths or contributions to the Board. Additional details on each director nominee’s experiences, qualifications, skills, and attributes are set forth in their biographies:

| (As of November 9, 2022) | ||||||||||||||

| Eric Brock | Derek Reisfield | Thomas Bushey | Richard Cohen | Randall Seidl | Richard Silverman | Jaspreet Sood | ||||||||

| Skills and Experience | ||||||||||||||

| Executive Leadership | ● | ● | ● | ● | ● | ● | ● | |||||||

| Industry Experience | ● | ● | ||||||||||||

| Financial and Accounting | ● | ● | ● | ● | ● | ● | ● | |||||||

| Strategy and Innovation | ● | ● | ● | ● | ● | ● | ● | |||||||

| Cybersecurity | ● | |||||||||||||

| Risk Management | ● | ● | ● | ● | ● | ● | ● | |||||||

| Law | ● | |||||||||||||

| Tenure and Independence | ||||||||||||||

| Tenure (years) | 4 | 4 | 2 | 4 | 1 | 4 | 1 | |||||||

| Independence | ● | ● | ● | ● | ||||||||||

| Demographics | ||||||||||||||

| Age | 52 | 59 | 42 | 71 | 59 | 82 | 49 | |||||||

| Gender Identity | M | M | M | M | M | M | F | |||||||

| African American or Black | ||||||||||||||

| Alaskan Native or Native American | ||||||||||||||

| Asian | ● | |||||||||||||

| Hispanic or Latinx | ||||||||||||||

| Native Hawaiian or Pacific Islander | ||||||||||||||

| White | ● | ● | ● | ● | ● | ● | ||||||||

| LGBTQ+ | ||||||||||||||

Vote Required and Board Recommendation

The vote required to elect our seven directors, each for a term expiring at the next Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes cast. The Board recommends that you vote “FOR” the election of each of the director nominees.

7

Board of Directors

The business and affairs of our company are managed by or under the direction of the Board. The Board is currently composed of seven members. The Board has not appointed a lead independent director; instead the presiding director for each executive session is rotated among the Chairs of the committees of our Board.

The Board held nine meetings and took four actions by unanimous written consent during the year ended December 31, 2021. In 2021, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he or she served.

Our directors are expected to attend our Annual Meeting of Stockholders. Any director who is unable to attend our Annual Meeting is expected to notify the Chairman of the Board in advance of the Annual Meeting. All of our directors attended the 2021 annual meeting of stockholders.

Committees of the Board

Audit Committee

Our audit committee reviews our internal accounting procedures and consults with and reviews the services provided by our independent registered public accountants. Our audit committee consists of three directors, Messrs. Cohen and Silverman and Ms. Sood, and our Board has determined that each of them is independent within the meaning of listing requirements of The Nasdaq Stock Market (“Nasdaq”) and the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Mr. Cohen is the chairman of the audit committee, and our Board has determined that Mr. Cohen is an “audit committee financial expert” as defined by SEC rules and regulations implementing Section 407 of the Sarbanes-Oxley Act. Our Board has determined that the composition of our audit committee meets the criteria for independence under, and the functioning of our audit committee complies with, the applicable requirements of the Sarbanes-Oxley Act, Nasdaq listing requirements and SEC rules and regulations. We intend to continue to evaluate the requirements applicable to us and to comply with the future requirements to the extent that they become applicable to our audit committee. The principal duties and responsibilities of our audit committee include:

| ● | overseeing the accounting and financial reporting processes of the Company, internal systems of control of the Company and audits of the Company’s consolidated financial statements; |

| ● | overseeing the Company’s relationship with its independent auditors, including appointing or changing the Company’s auditors and ensuring their independence; |

| ● | providing oversight regarding significant financial matters, including the Company’s tax planning, treasury policies, dividends and share issuance and repurchases; |

| ● | overseeing the Code of Conduct; and |

| ● | reviewing and approving all transactions with related persons for potential conflict of interest situations on an ongoing basis. |

The Audit Committees held six meetings and took one actions by unanimous written consent during the year ended December 31, 2021.

8

Compensation Committee

Our compensation committee reviews and determines the compensation of all our executive officers. Our compensation committee consists of three directors, Messrs. Cohen, Seidl, and Silverman, each of whom is a non-employee member of our Board as defined in Rule 16b-3 under the Exchange Act and independent within the meaning of listing requirements of Nasdaq. Mr. Seidl is the chairman of the compensation committee. Our Board has determined that the composition of our compensation committee satisfies the applicable independence requirements under, and the functioning of our compensation committee complies with the applicable listing requirements of Nasdaq and SEC rules and regulations. We intend to continue to evaluate and intend to comply with all future requirements applicable to our compensation committee. The principal duties and responsibilities of our compensation committee include:

| ● | establishing, overseeing and administering the Company’s employee compensation policies and programs; |

| ● | reviewing and approving compensation and incentive programs and awards for the Company’s CEO, all other executive officers of the Company and the non-employee members of the Company’s Board; and |

| ● | administering the Company’s equity compensation plans. |

The Compensation Committee held four meetings and took six actions by unanimous written consent during the year ended December 31, 2021.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee consists of three independent directors, Messrs. Cohen, Seidl, and Silverman. Mr. Cohen is the chairman of the nominating and corporate governance committee.

Our Board has determined that the composition of our nominating and corporate governance committee satisfies the applicable independence requirements under, and the functioning of our nominating and corporate governance committee complies with the applicable listing requirements of Nasdaq and SEC rules and regulations. We will continue to evaluate and will comply with all future requirements applicable to our nominating and corporate governance committee. The nominating and corporate governance committee’s responsibilities include:

| ● | assisting the Board in identifying individuals qualified to become Board members, consistent with criteria approved by the Board; |

| ● | recommending for the Board’s approval the slate of nominees to be proposed by the Board to stockholders for election to the Board; |

| ● | developing, updating and recommending to the Board the governance principles applicable to the Company; |

| ● | overseeing the evaluation of the Board and management; |

| ● | recommending to the Board the directors who will serve on each committee of the Board; and |

| ● | addressing any related matters required by the federal securities laws. |

The N&CG Committee held two meetings and took one action by unanimous written consent during the year ended December 31, 2021.

Code of Business Conduct and Ethics and Committee Charters

We have adopted a Code of Business Conduct and Ethics (the “Code of Conduct”), applicable to all of our employees, executive officers and directors. The audit committee of our Board is responsible for overseeing the Code of Conduct and our Board must approve any waivers of the Code of Conduct for employees, executive officers and directors. All of our directors, executive officers and employees are required to certify in writing their understanding of and intent to comply with the Code of Conduct.

Our Board adopted charters for the Audit Committee, Compensation Committee, and N&CG Committee of the Board describing the authority and responsibilities delegated to each committee.

We post on our website www.ondas.com the charters of each of our Board committees and our Code of Conduct, and all disclosures that are required by law concerning any amendments or waivers thereto applicable to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions; and any other corporate governance materials contemplated by the Nasdaq listing requirements and SEC regulations. These documents are also available in print, without charge, to any stockholder requesting a copy in writing from our Secretary at our executive offices set forth in this proxy statement.

9

Board Leadership

The Board has no policy regarding the need to separate or combine the offices of Chairman of the Board (“Chairman”) and Chief Executive Officer and instead the Board remains free to make this determination from time to time in a manner that seems most appropriate for the Company. The positions of Chairman and Chief Executive Officer are currently held by Eric Brock. The Board believes the Chief Executive Officer is in the best position to direct the independent directors’ attention on the issues of greatest importance to the Company and its stockholders. As a result, the Company does not have a lead independent director. Our overall corporate governance policies and practices combined with the strength of our independent directors and our internal controls minimize any potential conflicts that may result from combining the roles of Chairman and Chief Executive Officer.

Board Oversight of Enterprise Risk

The Board is actively involved in the oversight and management of risks that could affect the Company. This oversight and management is conducted primarily through the committees of the Board identified above but the full Board has retained responsibility for general oversight of risks. The Audit Committee is primarily responsible for overseeing the risk management function, specifically with respect to management’s assessment of risk exposures (including risks related to liquidity, credit, operations and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The other committees of the Board consider the risks within their areas of responsibility. The Board satisfies its oversight responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Independence

A majority of our Board is independent under the rules of Nasdaq. Our Board has undertaken a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Board has determined that Messrs. Cohen, Seidl, Silverman and Ms. Sood are “independent directors” as defined under the rules of Nasdaq.

Communications with the Company and the Board

Stockholders may communicate with the Company through its Investor Relations Department by writing to Investor Relations, Ondas Holdings Inc., 411 Waverley Oaks Road, Suite 114, Waltham, Massachusetts 02452.

Stockholders interested in communicating with our Board, any Board committee, any individual director, or any group of directors (such as our independent directors) should send written correspondence to Ondas Holdings Inc. Board of Directors, Attn: Secretary, 411 Waverley Oaks Road, Suite 114, Waltham, Massachusetts 02452.

Stockholder Proposals for Next Year’s Annual Meeting

Any stockholder proposal to be considered at the 2023 Annual Meeting of Stockholders, including nominations of persons for election to our Board, must be properly submitted to us by [●], 2023. Detailed information for submitting stockholder proposals or nominations of director candidates will be provided upon written request to the Secretary of Ondas Holdings Inc., 411 Waverley Oaks Road, Suite 114, Waltham, Massachusetts 02452.

Stockholder Director Nominations

The N&CG Committee has established a policy pursuant to which it considers director candidates recommended by our stockholders. All director candidates recommended by our stockholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other persons. To recommend a director candidate for consideration by our N&CG Committee, a stockholder must submit the recommendation in writing to our Secretary not later than 120 calendar days prior to the anniversary date of our proxy statement distributed to our stockholders in connection with our previous year’s annual meeting of stockholders, and the recommendation shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company which are beneficially owned by the person and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and (b) as to the stockholder giving the notice, (i) the name and record address of such stockholder and (ii) the class and number of shares of capital stock of the Company which are beneficially owned by such stockholder. Additionally, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company.

10

Executive and Director Compensation

Summary Compensation Table

The table below sets forth compensation information for services rendered in all capacities for the last two fiscal years ended December 31, 2021 and 2020. The information includes the dollar value of base salaries, bonus awards, stock awards, stock options grants and certain other compensation, if any, whether paid or deferred.

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||

| Eric A. Brock (2) | 2021 | $ | 200,000 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 30,661 | $ | 230,661 | |||||||||||||||||||

| (CEO) | 2020 | $ | 131,494 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 47,284 | $ | 178,778 | |||||||||||||||||||

| Stewart W. Kantor (3) | 2021 | $ | 200,000 | $ | 125,000 | $ | - | $ | - | $ | - | $ | - | $ | 11,643 | $ | 336,643 | |||||||||||||||||||

| (former President, CFO, Treasurer and Secretary) | 2020 | $ | 131,494 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 7,176 | $ | 138,670 | |||||||||||||||||||

| (1) | On November 23, 2021, Messrs. Brock and Kantor were granted cash bonuses of $125,000. Mr. Brock informed the Compensation Committee that he would forego his bonus. | |

| (2) | In 2020, Mr. Brock’s salary of $131,494 was accrued. On January 29, 2021, Mr. Brock was paid $64,344 of the accrued amount and the remaining $67,150 was paid on April 15, 2021. All Other Compensation for 2021 and 2020 includes health insurance premiums paid on Mr. Brock’s behalf. | |

| (3) | Mr. Kantor resigned as a director and President, Chief Financial Officer, Treasurer and Secretary of the Company on December 7, 2021. Mr. Kantor currently serves as President of Ondas Networks Inc. In 2020, Mr. Kantor’s salary of $131,494 includes $128,644 paid between January 1 and March 15, 2020 and May 13 and December 31, 2020, and $2,850 accrued between March 16 and May 12, 2020, which was paid on April 15, 2021. All Other Compensation for 2021 includes health insurance premiums paid on Mr. Kantor’s behalf totaling $636 and employer matching of 401(k) totaling $11,007. All Other Compensation for 2020 includes health insurance premiums paid on Mr. Kantor’s behalf totaling $744 and employer matching of 401(k) totaling $6,432. |

Outstanding Equity Awards at Fiscal Year End

As of December 31, 2021, our named executive officers had no outstanding equity awards.

Employment Agreements with Executive Officers

Eric Brock serves as our Chief Executive Officer pursuant to an employment agreement entered into on September 28, 2018 (the “Brock Agreement”). The Brock Agreement provides for a continuous term and may be terminated by either party at any time. Pursuant to the Brock agreement, Mr. Brock will receive an initial salary of $200,000 per annum, subject to annual review by our Board. Mr. Brock is eligible to participate in benefit plans generally available to our employees. During 2020, in response to COVID-19 employee furloughs, Mr. Brock accepted a pay reduction of 90% for the period from March 21 to May 19, 2020 and a 35% pay reduction from May 20 to December 15, 2020. Mr. Brock’s salary was returned to 100% effective December 16, 2020.

Derek Reisfield serves as our President, Chief Financial Officer, Secretary and Treasurer pursuant to an employment agreement entered into on December 10, 2021 (the “Reisfield Agreement”). The Reisfield Agreement provides for a continuous term and may be terminated by either party at any time. Pursuant to the Reisfield Agreement, Mr. Reisfield will receive an initial salary of $200,000 per annum, subject to annual review by our Board. Mr. Reisfield is eligible to participate in benefit plans generally available to our employees.

Stewart Kantor previously served as our President, Chief Financial Officer, Treasurer and Secretary and currently serves as President of Ondas Networks, pursuant to an employment agreement entered into on September 28, 2018, as amended (the “Kantor Agreement”). The Kantor Agreement provides for a continuous term and may be terminated by either party at any time. Pursuant to the Kantor Agreement, Mr. Kantor will receive an initial salary of $200,000 per annum, subject to annual review by our Board. Mr. Kantor is eligible to participate in benefit plans generally available to our employees. During 2020, in response to COVID-19 employee furloughs, Mr. Kantor accepted a pay reduction of 90% for the period from March 21 to May 19, 2020 and a 35% pay reduction from May 20 to December 15, 2020. Mr. Kantor’s salary was returned to 100% effective December 16, 2020.

11

As part of the terms of the Brock, Reisfield, and Kantor Agreements, each of Messrs. Brock, Reisfield and Kantor entered into an Employment, Non-Competition, Confidential Information and Intellectual Property Assignment Agreement (the “Supplemental Agreements”). As part of the Supplemental Agreements, each of Messrs. Brock, Reisfield, and Kantor agreed (i) not to engage in Competitive Business (as defined in the Supplemental Agreements) during his term of employment with us and for a period of 12 months following termination; (ii) not to disclose Confidential Information (as defined in the Supplemental Agreements), subject to certain customary carve-outs; and (iii) to assign to the Company any Intellectual Property (as defined in the Supplemental Agreements) developed using the Company’s resources or related to the Company’s business within the scope of and during the period of employment.

Messrs. Brock, Reisfield and Kantor are entitled to severance compensation from the Company if his employment is terminated (i) without cause or (ii) due to “constructive termination” or (iii) due to disability, with these causes of termination being defined in the Brock Agreement. The severance compensation would consist of (i) accrued and vested benefits, and (ii) continued payment of the executive base salary and benefits as follows: (i) for a period of six (6) months following Messrs. Brock’s and Reisfield’s separation and (ii) for a period of twelve months following Mr. Kantor’s separation.

Director Compensation

On January 25, 2021, the Compensation Committee (the “Compensation Committee”) of the Board of Directors of Ondas Holdings Inc. (the “Company”) approved the Director Compensation Policy (the “Policy”). The Policy is applicable to all directors that are not employees or compensated consultants of the Company. Pursuant to the Policy, the cash compensation to non-employee directors will be the following: (i) quarterly board retainer - $2,500; (ii) additional Board Chair retainer - $2,000; (iii) additional Audit Committee Chair retainer - $2,000; (iv) additional Compensation Committee Chair retainer - $3,000; and (v) additional Nominating Committee Chair retainer - $1,000. Also, pursuant to the Policy, the annual equity award to non-employee directors will be restricted stock units representing $60,000. Also, pursuant to the Policy, non-employee directors will be reimbursed for reasonable out-of-pocket business expenses incurred in connection with business related to the Board of Directors.

In addition, on January 25, 2021, the Compensation Committee approved the following grants: (a) for Messrs. Cohen, Reisfield and Silverman (i) 5,000 restricted stock units pursuant to the 2018 Incentive Stock Plan, and (ii) 30,000 stock options, which are immediately exercisable, pursuant to the 2018 Incentive Stock Plan, at an exercise price of $12.72 per share with a ten year term, and (b) for Mr. Seidl and Ms. Sood (i) 5,000 restricted stock units pursuant to the 2018 Incentive Stock Plan, and (ii) 10,000 restricted stock units pursuant to the 2018 Incentive Stock Plan. Each restricted stock unit represents a contingent right to receive one share of common stock of the Company. The 5,000 restricted stock units granted to each of Messrs. Cohen, Reisfield, Silverman and Seidl and Ms. Sood vest in four successive equal quarterly installments with the first vesting date commencing on the first day of the next calendar quarter, provided that such director is a director of the Company on the applicable vesting dates. The 10,000 restricted stock units granted to Mr. Seidl and Ms. Sood vest in eight successive equal quarterly installments with the first vesting date commencing on the first day of the next calendar quarter, provided that such director is a director of the Company on the applicable vesting dates. All restricted stock units granted to these directors shall vest in full immediately upon a change in control.

| Name | Fees Earned or Paid in Cash ($) | Stock awards ($)(1) | Option awards ($)(1) | Non-equity incentive plan compensation ($) | Nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) | |||||||||||||||||||||

| Thomas V. Bushey | 10,000 | 60,375 | - | - | - | - | 70,375 | |||||||||||||||||||||

| Richard M. Cohen | 22,000 | 123,975 | 171,622 | - | - | - | 317,597 | |||||||||||||||||||||

| Derek Reisfield | 18,000 | 123,975 | 171,622 | - | - | 8,333 (2) | 321,930 | |||||||||||||||||||||

| Randall P. Seidl | 10,000 | 251,175 | - | - | - | - | 261,175 | |||||||||||||||||||||

| Richard H. Silverman | 10,000 | 123,975 | 171,622 | - | - | - | 305,597 | |||||||||||||||||||||

| Jaspreet Sood | 10,000 | 251,175 | - | - | - | - | 261,175 | |||||||||||||||||||||

| (1) | The amounts reflected in this column represent the aggregate grant date fair value of the awards made during each respective year, as computed in accordance with FASB ASC Topic 718. For additional information related to the measurement of stock-based compensation awards, see Note 11 to the accompanying financial statements. | |

| (2) | Mr. Reisfield was appointed President, Chief Financial Officer, Treasurer and Secretary as of December 9, 2021. All other compensation for Mr. Reisfield reflects his salary from December 9, 2021 to December 31, 2021. |

12

Equity Compensation Plan Information

The following table summarizes the equity compensation plans under which our securities may be issued as of December 31, 2021.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted- average exercise price per share of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans |

|||||||||

| Equity compensation plans approved by security holders: | ||||||||||||

| 2018 Incentive Stock Plan (1) | 2,819,566 | $ | 6.49 | 513,768 | ||||||||

| 2021 Incentive Stock Plan (2) | - | $ | - | 6,000,000 | ||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| (1) | The 2018 Incentive Stock Plan was approved by stockholders in September 2018. The number of securities to be issued upon exercise of outstanding options, warrants and rights consist of 735,294 shares underlying outstanding options and 2,084,272 shares underlying outstanding restricted stock units granted pursuant to the 2018 Incentive Stock Plan. | |

| (2) | The 2021 Incentive Stock Plan was approved by stockholders in November 2021. |

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of November 9, 2022, the following table sets forth certain information with respect to the beneficial ownership of Ondas common stock by (i) each stockholder known by Ondas to be the beneficial owner of more than five percent (5%) of Ondas common stock, (ii) by each of Ondas’ current executive officers, named executive officers, and directors as identified herein, and (iii) all of Ondas’ directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock, options, restricted stock units, and common stock purchase warrants (“Warrants”) that are currently exercisable or convertible into shares of our common stock within sixty (60) days of the date of this document, are deemed to be outstanding and to be beneficially owned by the person holding such securities for the purpose of computing the percentage ownership of the person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise noted, the address for all officers and directors listed below is 411 Waverley Oaks Road, Suite 114 Waltham, MA 02452.

| Name | Amount

and Nature of Beneficial Ownership(1) | Percent of Class | ||||||

| Directors and Executive Officers | ||||||||

| Eric A. Brock (Chairman of the Board and Chief Executive Officer)(2) | 1,891,206 | 4.4 | % | |||||

| Derek Reisfield (Director, President, Chief Financial Officer, Treas. and Sec.)(3) | 72,926 | * | ||||||

| Thomas V. Bushey (Director)(4) | 506,362 | 1.2 | % | |||||

| Richard M. Cohen (Director)(5) | 65,676 | * | ||||||

| Randall P. Seidl (Director)(6) | 21,263 | * | ||||||

| Richard H. Silverman (Director)(7) | 65,676 | * | ||||||

| Jaspreet Sood (Director)(8) | 21,263 | * | ||||||

| All Executive Officers & Directors as a Group (7 persons)(9) | 2,644,372 | 6.1 | % | |||||

| 5% or Greater Stockholders | ||||||||

| Energy Capital, LLC(10) | 5,092,248 | 11.9 | % | |||||

| * | Represents beneficial ownership of less than 1%. |

| (1) | Unless otherwise noted, we believe that all shares are beneficially owned and that all persons named in the table have sole voting and investment power with respect to all shares of common stock owned by them. Applicable percentage of ownership is based on 42,885,046 shares of common stock currently outstanding, as adjusted for each stockholder. |

| (2) | Mr. Brock exercises sole voting and dispositive power over the 1,891,206 shares of common stock. |

| (3) | Mr. Reisfield exercises sole voting and dispositive power over 35,314 shares of common stock (including 2,250 shares held by his son), 30,000 shares of common stock issuable upon exercise of an option, and 7,612 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (4) | Mr. Bushey exercises sole voting and dispositive power over 506,362 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (5) | Mr. Cohen exercises sole voting and dispositive power over 28,064 shares of common stock, 30,000 shares of common stock issuable upon exercise of an option, and 7,612 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (6) | Mr. Seidl exercises sole voting and dispositive power over 7,500 shares of common stock, 1,250 shares of common stock issuable upon the vesting of RSUs, and 12,513 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (7) | Mr. Silverman exercises sole voting and dispositive power over 28,064 shares of common stock, 30,000 shares of common stock issuable upon exercise of an option, and 7,612 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (8) | Ms. Sood exercises sole voting and dispositive power over 7,500 shares of common stock, 1,250 shares of common stock issuable upon the vesting of RSUs, and 12,513 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (9) | Includes 90,000 shares of common stock issuable upon exercise of options, 2,500 shares of common stock issuable upon vesting of RSUs, and 554,224 shares of common stock underlying RSUs that have vested and are pending delivery. |

| (10) | Based on Amendment No. 1 to Schedule 13D filed on January 27, 2020, the address for Energy Capital, LLC (“Energy Capital”) is 13650 Fiddlesticks Blvd., Suite 202-324, Ft. Myers, FL 33912. Robert J. Smith is the sole owner of Energy Capital and exercises sole voting and dispositive power over the 5,092,248 shares of common stock. |

14

PROPOSAL 2: AUDITOR RATIFICATION PROPOSAL

We are asking our stockholders to ratify the Audit Committee’s selection of Rosenberg Rich Baker Berman, P.A. (“RRBB”) as our independent certified public accountants for the year ending December 31, 2022. If the stockholders do not ratify the appointment of RRBB, the selection of our independent certified public accountants may be reconsidered by our Audit Committee.

On June 28, 2018, the Audit Committee of the Board of Company engaged RRBB as the Company’s independent registered public accounting firm.

RRBB audited the Company’s financial statements as of and for the years ended December 31, 2020 and December 31, 2021. RRBB’s reports on the Company’s financial statements as of and for the years ended December 31, 2020 and December 31, 2021 did not contain any adverse opinion or disclaimer of opinion, nor was either report qualified or modified as to uncertainty, audit scope, or accounting principles.

Representatives of RRBB are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. It is also expected that they will be available to respond to appropriate questions.

Aggregate fees billed to the Company for the years ended December 31, 2021 and 2020 by RRBB were as follows:

| For the years ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Audit Fees | $ | 192,400 | $ | 124,915 | ||||

| Audit-Related Fees | 0 | 6,558 | ||||||

| Tax Fees | 12,500 | 10,000 | ||||||

| All Other Fees | 16,098 | 50,000 | ||||||

| $ | 220,998 | $ | 191,473 | |||||

Audit fees consist of fees associated with the annual audit, including the reviews of our quarterly reports. Audit-related fees consist of travel costs. Tax fees include the preparation on our tax returns. All other fees consist of fees associated with services provided related to all other filings with the SEC as well as consents.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

On September 28, 2018, the Audit Committee of our Board adopted a policy and related procedures requiring its pre-approval of all audit and non-audit services to be rendered by its independent registered public accounting firm. These policies and procedures are intended to ensure that the provision of such services do not impair the independent registered public accounting firm’s independence. These services may include audit services, audit related services, tax services and other services. All services provided by RRBB during the years ended December 31, 2021 and 2020 were approved by the Audit Committee.

Vote Required and Board Recommendation

The vote required for the Auditor Ratification Proposal is a majority of the votes cast at the Annual Meeting. The Board recommends a vote “FOR” the Auditor Ratification Proposal.

15

PROPOSAL 3: SAY ON PAY PROPOSAL

Background of the Proposal

The Dodd-Frank Act requires all public companies to hold a separate non-binding advisory shareholder vote to approve the compensation of executive officers as described in the executive compensation tables and any related information in each such company’s proxy statement (commonly known as a “Say on Pay” proposal). Pursuant to Section 14A of the Exchange Act, we are holding a separate non-binding advisory vote on Say on Pay at the Annual Meeting.

Say on Pay Resolution

This Say on Pay proposal is set forth in the following resolution:

RESOLVED, that the stockholders of Ondas Holdings Inc. approve, on an advisory basis, the compensation of its named executive officers, as disclosed in the Ondas Holdings Inc.’s Proxy Statement for the 2022 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables, and any related information found in the proxy statement of Ondas Holdings Inc.

Because your vote on this proposal is advisory, it will not be binding on the Board, the Compensation Committee or the Company. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Vote Required and Board Recommendation

The vote required for the Say on Pay Proposal is a majority of the votes cast at the Annual Meeting. The Board recommends a vote “FOR” the Say on Pay Proposal.

16

PROPOSAL 4: STOCK ISSUANCE PROPOSAL

Notes

On October 26, 2022, the Company entered into a Securities Purchase Agreement (the “SPA”) with an institutional investor (the “Investor” or “Holder”) for an aggregate financing of up to $69.0 million. At the initial closing under the SPA, which occurred on October 28, 2022, the Company issued to the Investor in a registered direct offering 3% senior convertible notes due 2023 of the Company (the “Initial Notes”), in an aggregate principal amount of $34.5 million, which Notes are convertible into shares of the Company’s common stock under certain conditions.

If we obtain stockholder approval of the issuances of common stock in excess of the 19.9% Exchange Cap under the terms of the SPA, subject to the satisfaction of certain additional conditions, we may elect to exchange the Initial Notes, on a dollar-for-dollar basis, into new 3% senior convertible notes, which we refer to herein as the Exchange Notes. The Exchange Notes will be identical in all material respects to the Initial Notes, except that they will be issued pursuant to an indenture and a supplemental indenture in exchange for the Initial Notes then outstanding and will have a maturity date of the second anniversary of the date of such exchange.

Upon certain conditions being satisfied, including the Company obtaining stockholder approval of the Stock Issuance Proposal, and filing an additional prospectus supplement, indenture and supplemental indenture, if elected by the Investor, the Company will issue to the Investor additional Notes in an aggregate principal amount of up to $34.5 million (the “Additional Notes,” and together with the Initial Notes and the Exchange Notes, the “Notes”). The Additional Notes will be identical in all material respect to the Exchange Notes, except that they will be issued pursuant to an additional prospectus supplement and a separate supplemental indenture and will have a maturity date of the second anniversary of the date of such issuance thereof.

The Notes have an original issue discount of approximately 13% and, as a result, the Company received gross proceeds of approximately $30.0 million at the initial closing. The Company expects to receive gross proceeds of an additional $30.0 million assuming that the Investor elects for the Company to issue the maximum number of Additional Notes contemplated by the SPA.

The securities issued pursuant to the initial closing, including 16,235,294 shares of the Company’s common stock issuable upon conversion of the Initial Notes at the initial conversion price of $4.25, were offered by the Company pursuant to an effective shelf registration statement on Form S-3 (File No. 333- 252571) filed with the Securities and Exchange Commission (the “SEC”), on January 29, 2021 (as such registration statement became effective on February 5, 2021, and was expanded to cover additional securities pursuant to a Registration Statement on Form S-3MEF (No. 333-268014), dated October 26, 2022, filed with the SEC pursuant to Rule 462(b) of the Securities Act of 1933, as amended(the “Securities Act”)), and a prospectus supplement to the base prospectus contained therein, filed by the Company with the SEC on October 28, 2022 pursuant to Rule 424(b) under the Securities Act.

The information set forth in this Proposal 4 is qualified in its entirety by reference to the full text of the Form of Securities Purchase Agreement and the Form of Initial Notes, Form of Exchange Notes and Form of Additional Notes attached as Exhibits 10.1, 4.1, 4.2 and 4.3 to our Current Report on Form 8-K filed with the SEC on October 26, 2022.

Why We are Seeking Stockholder Approval of the Stock Issuance Proposal

Our common stock is listed on The Nasdaq Capital Market and, as such, we are subject to the Nasdaq Stock Market Rules. Pursuant to Nasdaq Rule 5635(d), stockholder approval is required prior to the issuance of securities in a transaction, other than a public offering, involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance, at a price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement, or (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement for the transaction.

In light of this rule, the SPA provides that, unless the Company obtains the approval of its stockholders as required by Nasdaq, the Company is prohibited from issuing any shares of common stock pursuant to the terms of the Notes if the issuance of such shares of common stock would exceed 19.99% of the Company’s outstanding shares of common stock as of October 28, 2022, or if such issuance would otherwise exceed the aggregate number of shares of common stock which the Company may issue without breaching its obligations under the rules and regulations of Nasdaq. Further, pursuant to the SPA, the Company agreed to obtain stockholder approval of the Stock Issuance Proposal by filing a proxy statement and soliciting votes from the Company’s stockholders at a stockholder meeting to be held no later than 45 days after the date of the initial closing under the SPA (or, if such filing is delayed by a court or regulatory agency, in no event later than 90 calendar days after the Closing), an information statement with respect thereto or (y) provide each stockholder entitled to vote at a special meeting of stockholders of the Company (the “Stockholder Meeting”), which shall be promptly called and held not later than December 31, 2022, in each case, on the terms specified in the SPA. If the Company does not obtain stockholder approval of the Stock Issuance Proposal on or prior to the Stockholder Meeting Deadline, the Company will be obligated to continue to seek stockholder approval of the Stock Issuance Proposal on or prior to March 31, 2023 and semi-annually after that until the stockholder approval is obtained.

Because the conversion price of the Notes is adjustable and monthly installment payments due on the notes, including interest, may be paid in the form of converting such installment payments into shares of common stock at the election of the Company, the Company cannot guaranty the number of shares that it may issue to the Investor pursuant to the SPA. The securities issued pursuant to the initial closing included 16,235,294 shares of the Company’s common stock issuable upon conversion of the Initial Notes at the initial conversion price of $4.25. Unless we obtain the approval of our stockholders in accordance with the rules and regulations of the Nasdaq Capital Market, a maximum of 8,532,198 shares of our common stock (19.99% of the outstanding shares of our common stock on October 28, 2022) shall be issuable upon conversion or otherwise pursuant to the terms of the Notes.

To meet the NASDAQ 20% rule, we need stockholder approval under the listing rules of Nasdaq to remove the Exchange Cap provisions in the SPA to permit the potential issuance of more than 20% of our outstanding common stock in accordance with the terms of the SPA and Notes.

17

The Notes may not be converted and shares of common stock may not be issued under Notes if, after giving effect to the conversion or issuance, the Investor (together with its affiliates, if any) would beneficially own in excess of 4.99% of our outstanding shares of common stock, which we refer to herein as the “Note Blocker”. The Note Blocker may be raised or lowered to any other percentage not in excess of 9.99% at the option of the applicable holder of Notes, except that any raise will only be effective upon 61-days’ prior notice to us.

Subject to the satisfaction of certain conditions set forth in the SPA, the Company may deliver a written notice, at any time after the approval of the Stock Issuance Proposal (each, an “Exchange Notice”, and the date of such applicable Exchange Notice, each, an “Exchange Notice Date”) to the Investor, executed by the chief executive officer or chief financial officer of the Company, electing to exchange (collectively, the “Exchange”) all outstanding amounts under the Initial Notes of each such Buyer (each, an “Exchange Amount”) for Exchange Notes with identical outstanding amounts to such Initial Notes exchanged. The proposed date of the closing of the Exchange (the “Exchange Closing Date”), which shall be the second (2nd) Trading Day after such Exchange Notice (or such other date as is mutually agreed to by the Company and each Investor). In addition, pursuant to the SPA and upon obtaining stockholder approval of the Stock Issuance Proposal, the Investor has the right, but not the obligation, to require the Company to sell to the Investor up to the maximum amount of Additional Notes purchased by the Investor in the initial closing under the SPA (each such additional closing, an “Additional Optional Closing”). If an Investor has not elected to effect an Additional Closing on or prior to the first anniversary of the later of (I) the first anniversary of the SPA and (II) the earlier to occur of (A) the date no Initial Notes remain outstanding and (B) the date that Exchange Closing Date, such Investor shall have no further right to effect an Additional Closing under the SPA.

Description of Notes

Initial Closing; Exchange; Additional Closings

At the initial closing of this offering, we issued $34,500,000 in aggregate principal amount of Initial Notes to certain institutional investors.

If we obtain stockholder approval of the issuances of common stock in excess of the 19.99% Exchange Cap, subject to the satisfaction of certain additional conditions, we may elect to exchange the Notes, on a dollar-for-dollar basis, into new 3% Senior Convertible Notes, which we refer to herein as the Exchange Notes. The Exchange Notes will be identical in all material respects to the Initial Notes, except that they will be issued pursuant to an indenture and a supplemental indenture in exchange for the Initial Notes then outstanding and will have a maturity date of the second anniversary of the date of such exchange.

Upon our filing of an additional prospectus supplement, indenture and supplemental indenture, if elected by the initial purchasers of Initial Notes, we may consummate additional closings of up to $34,500,000 in aggregate principal amount of new 3% Senior Convertible Notes at additional closings pursuant to the SPA. The Additional Notes will be identical in all material respect to the Exchange Notes, except that they will be issued pursuant to an additional prospectus supplement and a separate supplemental indenture and will have a maturity date of the second anniversary of the date of such issuance thereof.

Ranking

The Notes will be the senior unsecured obligations of the Company and not the financial obligations of our subsidiaries. Until such date no Notes remain outstanding, all payments due under the Notes will be senior to all other indebtedness of the Company and/or any of our subsidiaries.

Maturity Date

Unless earlier converted, or redeemed, the Initial Notes will mature on February 28, 2023, which we refer to herein as the “Maturity Date”, subject to the right of the investors to extend the date:

| (i) | at the investor’s option to any date (but in no event later than October 28, 2024 without our prior consent); |

| (ii) | if an event of default under the Notes has occurred and is continuing (or any event shall have occurred and be continuing that with the passage of time and the failure to cure would result in an event of default under the Notes); and/or |

| (iii) | for a period of 20 business days after the consummation of a fundamental transaction if certain events occur. |

We are required to pay, on the Maturity Date, all outstanding principal, accrued and unpaid interest and accrued and unpaid late charges on such principal and interest, if any.

Interest

The Notes bear interest at the rate of 3% per annum (a) shall commence accruing on the date of issuance, (b) shall be computed on the basis of a 360-day year and twelve 30-day months and (c) shall be payable in cash monthly in arrears on (x) if prior to the initial Installment Date (as defined below) or after the Maturity Date, the first trading day of each calendar month, or (y) if on or after the initial Installment Date, but on or prior to the Maturity Date, such Installment Date, if any, in such calendar month (each an “Interest Date”) and if unpaid on an Interest Date, shall compound on such Interest Date. If a holder elects to convert or redeem all or any portion of a Note prior to the Maturity Date, all accrued and unpaid interest on the amount being converted or redeemed will also be payable.

The interest rate of the Notes will automatically increase to 15% per annum (the “Default Rate”) upon the occurrence and continuance of an event of default (See “—Events of Default” below).

18

Late Charges

The Company is required to pay a late charge of 15% on any amount of principal or other amounts that are not paid when due (solely to the extent such amounts are not then accruing interest at the Default Rate).

Conversion

Fixed Conversions at Option of Holder

Each holder of Notes may convert all, or any part, of the outstanding principal and interest of the Notes, at any time at such holder’s option, into shares of the Company’s common stock at the initial fixed conversion price of $4.25, which is subject to:

| ● | proportional adjustment upon the occurrence of any stock split, stock dividend, stock combination and/or similar transactions; and |

| ● | adjustment in connection with a subsequent offering at a per share price less than 120% of the fixed conversion price then in effect to 120% of such per share price. |

Voluntary Adjustment Right

Subject to the rules and regulations of the Nasdaq Capital Market, we have the right, at any time, with the written consent of the holders, to lower the fixed conversion price to any amount and for any period of time deemed appropriate by our Board.

Alternate Event of Default Optional Conversion

If an event of default has occurred under the Notes, the holder may alternatively elect to convert the Note (subject to an additional 25% redemption premium) at the Alternate Event of Default Conversion Price.

Limitations on Conversion

Beneficial Ownership Limitation