Exhibit 99.2

Copyright 2022. All rights reserved. MISSION - CRITICAL INDUSTRIAL DATA Third Quarter 2022 Earnings Release and Update November 14, 2022 Nasdaq : ONDS

Disclaimer This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . , and wholly - owned subsidiaries Ondas Networks, Inc . and American Robotics, Inc . (collectively, "Ondas" or the "Company"), cautions readers that forward - looking statements are predictions based on its current expectations about future events . forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Nasdaq : ONDS 2

Leadership Team Nasdaq : ONDS Chairman & CEO ERIC BROCK Eric is an entrepreneur with over 25 years of management and investing experience. President & CFO DEREK REISFIELD Derek is an experienced executive with over 30 years experience with entrepreneurial growth companies, as well as executive roles with Fortune 500 companies. President STEWART KANTOR Stewart brings over 20 years of experience in the wireless industry to Ondas Networks. CEO REESE MOZER Reese is an entrepreneur and roboticist with over 10 years of experience in developing and marketing autonomous drones. 3

Business plans and product roadmaps on track at Ondas Networks and American Robotics Introduction Nasdaq : ONDS Airobotics acquisition progressing; customer are supportive and fleet deployments begin Class I Rails progressing; 900MHz Network leading to expand opportunities globally American Robotics extends leadership position with new customers, product features, and regulatory milestones 4

Nasdaq : ONDS Funding & Airobotics Update Financial Review Strategic Update Outlook Investor Q&A Agenda 5

Balance Sheet Supports Growth Plan 2 - Year Maturity (1) (October 2024) 3% interest rate $4.25 conversion price Monthly amortization (3) (payable in cash or shares) Funding removes overhang and provides growth capital • $34.5 million Convertible Note (unsecured) • $30 million gross proceeds • Investor option for additional investment • ATM remains in place • Pro forma cash balance of $43.0 million (2) • $90 million of potential incremental liquidity via convertible notes and ATM KEY TERMS: (1) Assumes shareholder approval; otherwise notes mature in February 2023 (2) Includes cash on September 30, 2022, adjusted for net proceeds of convertible note offering on October 28, 2022 (3) Amortization payment subject to the terms of the convertible note. Nasdaq : ONDS 6

• Acquisition expected to close in Q1 2023 • Integration planning advanced • Positive customer response KEY EVENT: Airobotics shareholder vote on December 18 th Nasdaq : ONDS Deal and Airobotics business development progressing Airobotics Update 7

Nasdaq : ONDS Optimus platform is ready to scale; customer pipeline is seasoned Airobotics Update • Dubai begins first urban deployment of fully autonomous drones • High value applications: Homeland security, public safety; smart cities • Airobotics targets additional urban fleet deployments in the UAE UAE government entity plans city - wide fleet deployment of autonomous Optimus drone platform by 2025 8

Q3 And YTD Financial Review Financial Review Nasdaq : ONDS 9

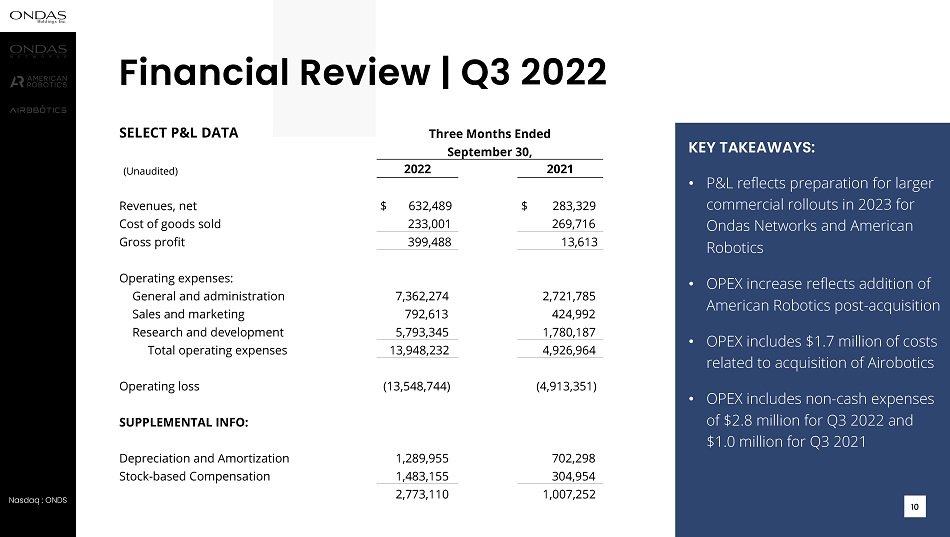

SELECT P&L DATA Three Months Ended September 30, (Unaudited) 2022 2021 Revenues, net $ 632,489 $ 283,329 Cost of goods sold 233,001 269,716 Gross profit 399,488 13,613 Operating expenses: General and administration 7,362,274 2,721,785 Sales and marketing 792,613 424,992 Research and development 5,793,345 1,780,187 Total operating expenses 13,948,232 4,926,964 Operating loss (13,548,744) (4,913,351) SUPPLEMENTAL INFO: Depreciation and Amortization 1,289,955 702,298 Stock - based Compensation 1,483,155 304,954 2,773,110 1,007,252 Financial Review | Q3 2022 Nasdaq : ONDS KEY TAKEAWAYS : • P&L reflects preparation for larger commercial rollouts in 2023 for Ondas Networks and American Robotics • OPEX increase reflects addition of American Robotics post - acquisition • OPEX includes $1.7 million of costs related to acquisition of Airobotics • OPEX includes non - cash expenses of $2.8 million for Q3 2022 and $1.0 million for Q3 2021 10

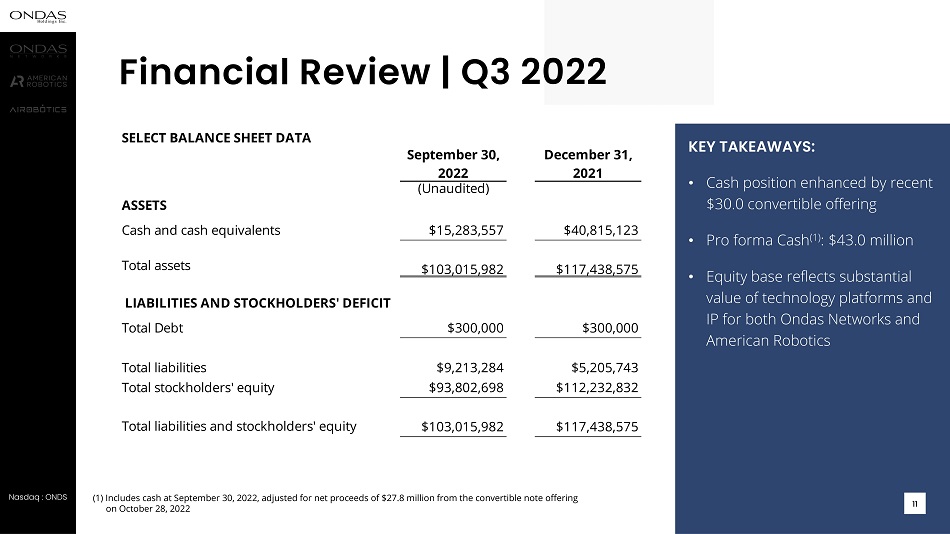

SELECT BALANCE SHEET DATA September 30, December 31, 2022 2021 (Unaudited) ASSETS Cash and cash equivalents $15,283,557 $40,815,123 Total assets $103,015,982 $117,438,575 LIABILITIES AND STOCKHOLDERS' DEFICIT Total Debt $300,000 $300,000 Total liabilities $9,213,284 $5,205,743 Total stockholders' equity $93,802,698 $112,232,832 Total liabilities and stockholders' equity $103,015,982 $117,438,575 Financial Review | Q3 2022 Nasdaq : ONDS KEY TAKEAWAYS : • Cash position enhanced by recent $30.0 convertible offering • Pro forma Cash (1) : $43.0 million • Equity base reflects substantial value of technology platforms and IP for both Ondas Networks and American Robotics (1) Includes cash at September 30, 2022, adjusted for net proceeds of $27.8 million from the convertible note offering on October 28, 2022 11

Key Priorities and Accomplishments for Ondas Networks and American Robotics Strategic Review Nasdaq : ONDS 12

(1) ICSS: Integrated Coastal Surveillance Systems Nasdaq : ONDS Progress On Key Priorities Siemens 900 MHz order is commercial adoption inflection point • Volume order for 900 MHz with delivery commencing in Q4 • Received initial volume HOT order from Siemens for a major Asian railway network • Expanded into homeland security market with ICSS (1) network in Asia • Two major railroads have completed field launch preparation activities • Transferred MxV Rail MC - IoT Rail lab; formal rail standard being established Positioning company to be long - term leader of industrial drones • Progressing through POC phase with customers towards fleet orders • Announced new customers (Nevada Gold, O&G company) • Secured additional milestone FAA approvals • Investing in valuable payloads, AI/ML data analytics with Dynam.AI • Announced transformative agreement to acquire Airobotics 13

Nasdaq : ONDS 14

Nasdaq : ONDS Pulling Through Demand With Siemens Strategic Review — Ondas Networks Scaling production for volume order in 900 MHz for Class I Rails in North America • Siemens to build inventory for customer backlog • Obtained Canadian government approval for 900 MHz ATCS • Class 1’s pursuing variety of new use cases for 900 MHz • 5 railroads active with FullMAX equipment Transferred the Rail Lab to MxV new headquarters in Pueblo, Colorado • Expect formalization of AAR standard based on dot16 standard • Expect new use case development funded by MxV rail this year • Vendor eco - system will create more value around dot16 platform Two rails have completed internal launch activities • Class 1’s pursuing variety of new use cases for 900 MHz • Typical launch preparation activity for a Class I Rail • Production • Purchasing • Delivery scheduling • Engineer Training • Siemens packages 15

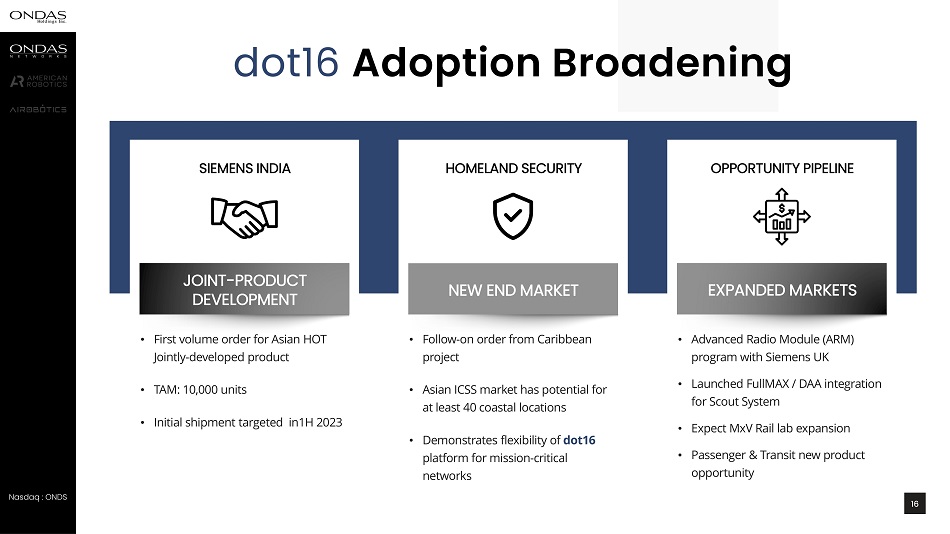

dot16 Adoption Broadening SIEMENS INDIA HOMELAND SECURITY OPPORTUNITY PIPELINE JOINT - PRODUCT DEVELOPMENT NEW END MARKET EXPANDED MARKETS • First volume order for Asian HOT Jointly - developed product • TAM: 10,000 units • Initial shipment targeted in1H 2023 • Advanced Radio Module (ARM) program with Siemens UK • Launched FullMAX / DAA integration for Scout System • Expect MxV Rail lab expansion • Passenger & Transit new product opportunity • Follow - on order from Caribbean project • Asian ICSS market has potential for at least 40 coastal locations • Demonstrates flexibility of dot16 platform for mission - critical networks Nasdaq : ONDS Nasdaq : ONDS 16

Nasdaq : ONDS 17

Q3 and Recent Highlights • Signed definitive agreement to acquire Airobotics, a leading Israeli developer of autonomous unmanned aircraft systems. • Acquired the assets of Field of View LLC enhancing our capabilities to integrate new, industrial payloads with the Scout System to meet product development requirements for customers. • Announced strategic technology partnership with Infrared Cameras Inc. (ICI). This partnership will enhance American Robotics’ autonomous drone platform with sensors to detect methane leaks. M&A & Partnership Activity Regulatory Activity Received FAA Exemption permitting wide - scale commercial operations of our autonomous Scout Systems without limitations on use. Received FAA Waiver for expanded automated BVLOS operations, unlocking inspection opportunities over large industrial sites and linear assets. Received FAA Waiver permitting automated BVLOS operations at two new customer sites located in Texas. Received purchase order from new leading oil & gas company to deploy Scout Systems in the Permian Basin. Airobotics received first - in - history order for commercial fleet deployment in urban environment with UAE city. Expected plans to cover entire city over next few years. Delivered new high - resolution RGB, thermal payloads and analytics features to Oil & Gas customers to further enable efficiencies in inspection processes. Manufactured 6 Scout System units in Q3 2022, with plans to have a total of 35 systems manufactured by the end of Q2 2023. Commercial Activity Nasdaq : ONDS 18

Laying foundation for exponential growth via early adopter partnerships. Focus on increasing product stickiness through co - design, workflow integration, and customer service. What is Happening Behind the Scenes? • New payload integration • New analytics development • UI / UX optimization • Safety evaluations • Cyber security evaluations • Legal evaluations • Data collection • API integration • Workflow integration • Customer training Nasdaq : ONDS 19

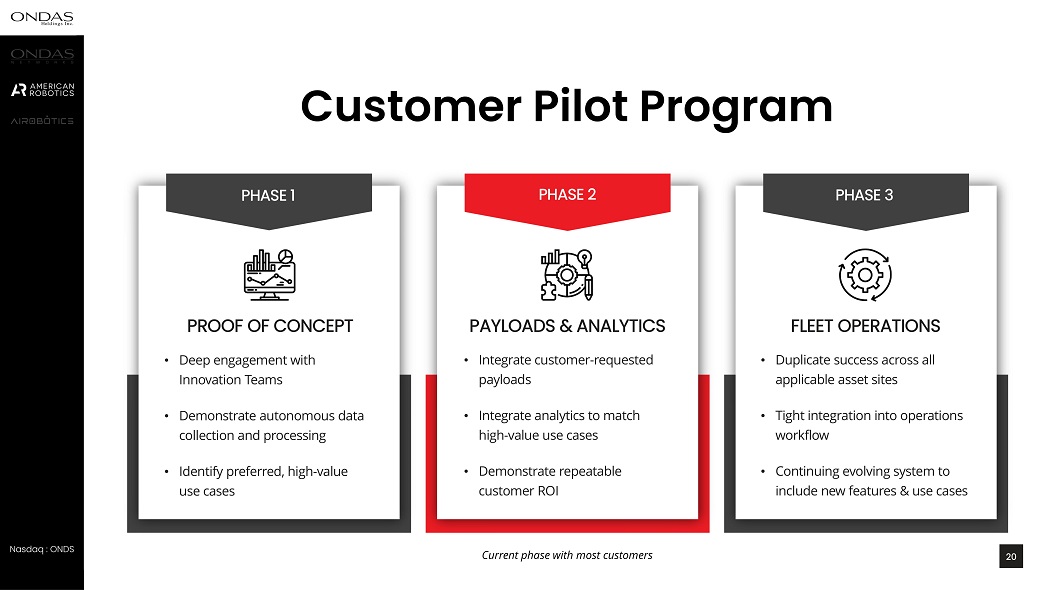

Nasdaq : ONDS PHASE 3 • Duplicate success across all applicable asset sites • Tight integration into operations workflow • Continuing evolving system to include new features & use cases FLEET OPERATIONS PROOF OF CONCEPT PHASE 1 • Deep engagement with Innovation Teams • Demonstrate autonomous data collection and processing • Identify preferred, high - value use cases PHASE 1 PAYLOADS & ANALYTICS PHASE 2 • Integrate customer - requested payloads • Integrate analytics to match high - value use cases • Demonstrate repeatable customer ROI Customer Pilot Program Current phase with most customers 20

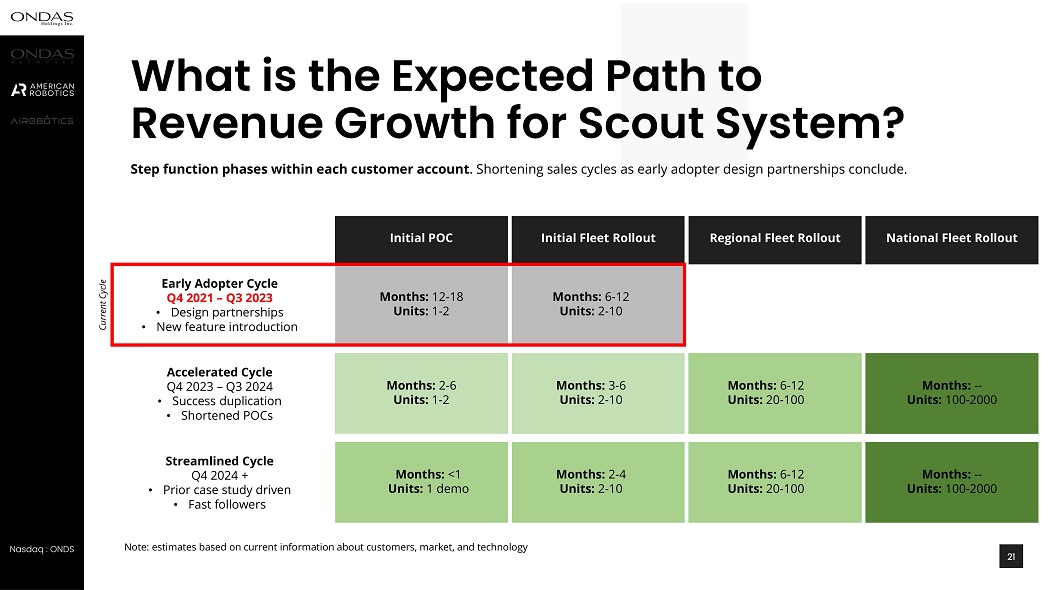

Months: 12 - 18 Units: 1 - 2 Streamlined Cycle Q4 2024 + • Prior case study driven • Fast followers Early Adopter Cycle Q4 2021 – Q3 2023 • Design partnerships • New feature introduction Accelerated Cycle Q4 2023 – Q3 2024 • Success duplication • Shortened POCs Months: 2 - 6 Units: 1 - 2 Months: <1 Units: 1 demo Initial POC Months: 6 - 12 Units: 2 - 10 Months: 3 - 6 Units: 2 - 10 Months: 2 - 4 Units: 2 - 10 Initial Fleet Rollout Months: 6 - 12 Units: 20 - 100 Months: 6 - 12 Units: 20 - 100 Regional Fleet Rollout Months: -- Units: 100 - 2000 Months: -- Units: 100 - 2000 National Fleet Rollout What is the Expected Path to Revenue Growth for Scout System? Step function phases within each customer account . Shortening sales cycles as early adopter design partnerships conclude. Note: estimates based on current information about customers, market, and technology Current Cycle Nasdaq : ONDS 21

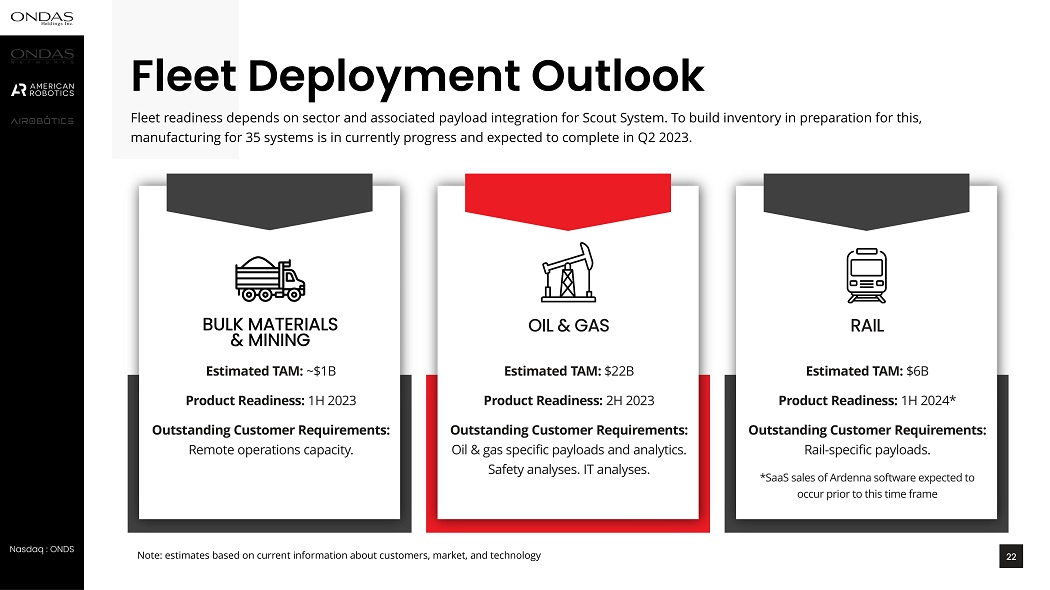

Fleet Deployment Outlook Fleet readiness depends on sector and associated payload integration for Scout System. To build inventory in preparation for thi s, manufacturing for 35 systems is in currently progress and expected to complete in Q2 2023. Note: estimates based on current information about customers, market, and technology Nasdaq : ONDS OIL & GAS Estimated TAM: $22B Product Readiness: 2H 2023 Outstanding Customer Requirements: Oil & gas specific payloads and analytics. Safety analyses. IT analyses. Estimated TAM: ~$1B Product Readiness: 1H 2023 Outstanding Customer Requirements: Remote operations capacity. BULK MATERIALS & MINING Estimated TAM: $6B Product Readiness: 1H 2024* Outstanding Customer Requirements: Rail - specific payloads. *SaaS sales of Ardenna software expected to occur prior to this time frame RAIL 22

Recap of rationale, and updates on progress and outlook The Airobotics Acquisition Nasdaq : ONDS 23

Fully automated data capturing and analysis infrastructure for continues 24/7 drone operations without human intervention Airobotics Technology Platform Rugged exterior and climate - controlled Drone shelter for harsh weather and industrial environments ROBUSTNESS Allowing routine data capture without human intervention FULL AUTOMATION 24/7 MULTIPLE DATA COLLECTION 80 sq/km coverage area (31 square miles) COVERAGE AREA Data Capture & Delivery Payloads Robotic Arm Battery Cabinet Real - Time User Interface Payload Cabinet Data Platform 24 Nasdaq : ONDS

Smart city infrastructure is first big win for Optimus System. Fleet Deployments Have Started • Other similar customers in the pipeline • More announcements anticipated soon • Announced on November 9, 2022: The first - in - history commercial fleet deployment of autonomous drone systems in a city • Initial order for 4 Optimus Systems, with plans to cover entire city over next few years SMART CITY APPLICATION • Plans to increase inventory have begun • Sales to this market will contribute to high - margin material revenue growth in short and long term UAE CITY MORE RELATED DEPLOYMENTS EXPECTED Nasdaq : ONDS 25

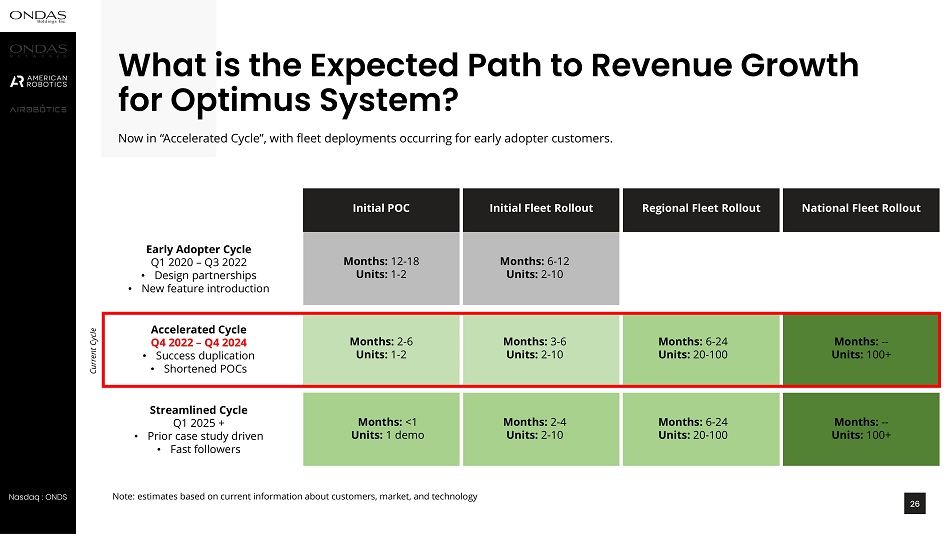

Months: 12 - 18 Units: 1 - 2 Streamlined Cycle Q1 2025 + • Prior case study driven • Fast followers Early Adopter Cycle Q1 2020 – Q3 2022 • Design partnerships • New feature introduction Accelerated Cycle Q4 2022 – Q4 2024 • Success duplication • Shortened POCs Months: 2 - 6 Units: 1 - 2 Months: <1 Units: 1 demo Initial POC Months: 6 - 12 Units: 2 - 10 Months: 3 - 6 Units: 2 - 10 Months: 2 - 4 Units: 2 - 10 Initial Fleet Rollout Months: 6 - 24 Units: 20 - 100 Months: 6 - 24 Units: 20 - 100 Regional Fleet Rollout Months: -- Units: 100+ Months: -- Units: 100+ National Fleet Rollout What is the Expected Path to Revenue Growth for Optimus System? Now in “Accelerated Cycle”, with fleet deployments occurring for early adopter customers. Note: estimates based on current information about customers, market, and technology Current Cycle Nasdaq : ONDS 26

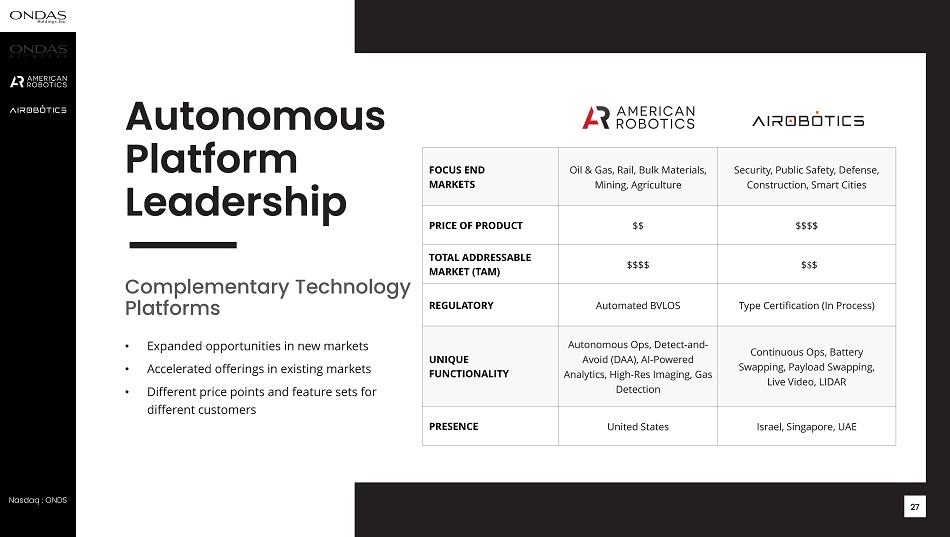

• Expanded opportunities in new markets • Accelerated offerings in existing markets • Different price points and feature sets for different customers Complementary Technology Platforms Autonomous Platform Leadership FOCUS END MARKETS Oil & Gas, Rail, Bulk Materials, Mining, Agriculture Security, Public Safety, Defense, Construction, Smart Cities PRICE OF PRODUCT $$ $$$$ TOTAL ADDRESSABLE MARKET (TAM) $$$$ $$ REGULATORY Automated BVLOS Type Certification (In Process) UNIQUE FUNCTIONALI T Y Autonomous Ops, Detect - and - Avoid (DAA), AI - Powered Analytics , High - Res Imaging, Gas Detection Continuous Ops, Battery Swapping, Payload Swapping, Live Video, LIDAR PRESENCE United States Israel, Singapore, UAE Nasdaq : ONDS 27

Nasdaq : ONDS Outlook Summary 28

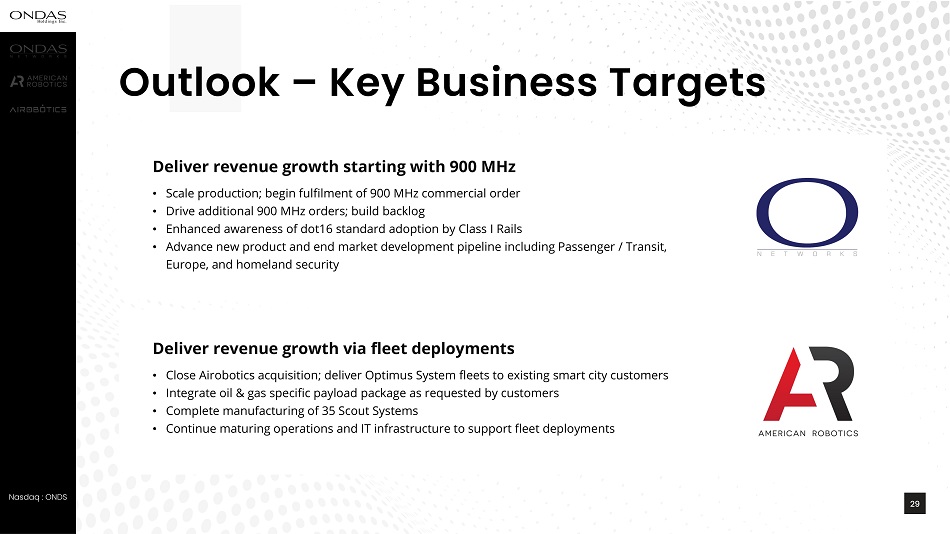

Nasdaq : ONDS Outlook – Key Business Targets Deliver revenue growth starting with 900 MHz • Scale production; begin fulfilment of 900 MHz commercial order • Drive additional 900 MHz orders; build backlog • Enhanced awareness of dot16 standard adoption by Class I Rails • Advance new product and end market development pipeline including Passenger / Transit, Europe, and homeland security Deliver revenue growth via fleet deployments • Close Airobotics acquisition; deliver Optimus System fleets to existing smart city customers • Integrate oil & gas specific payload package as requested by customers • Complete manufacturing of 35 Scout Systems • Continue maturing operations and IT infrastructure to support fleet deployments 29

• Balance sheet healthy ; addressed funding overhang • Cash OPEX expected to be approximately $9.5 millio n (1) for Q 4 2022 • Prioritize delivering revenue growth with wireless and drone platforms (1) Excludes professional and advisory fees related to the Airobotics transaction. Nasdaq : ONDS Continue to Cement and Extend Leadership Outlook 30

• Fragmented; subscale solutions • Confused customers • Investor capital spread thinly Source: Drone Insight Market requires scaled end - to - end solutions providers Nasdaq : ONDS Opportunity Lead Vendor Map Highlights Opportunity to Define Market Solutions 31

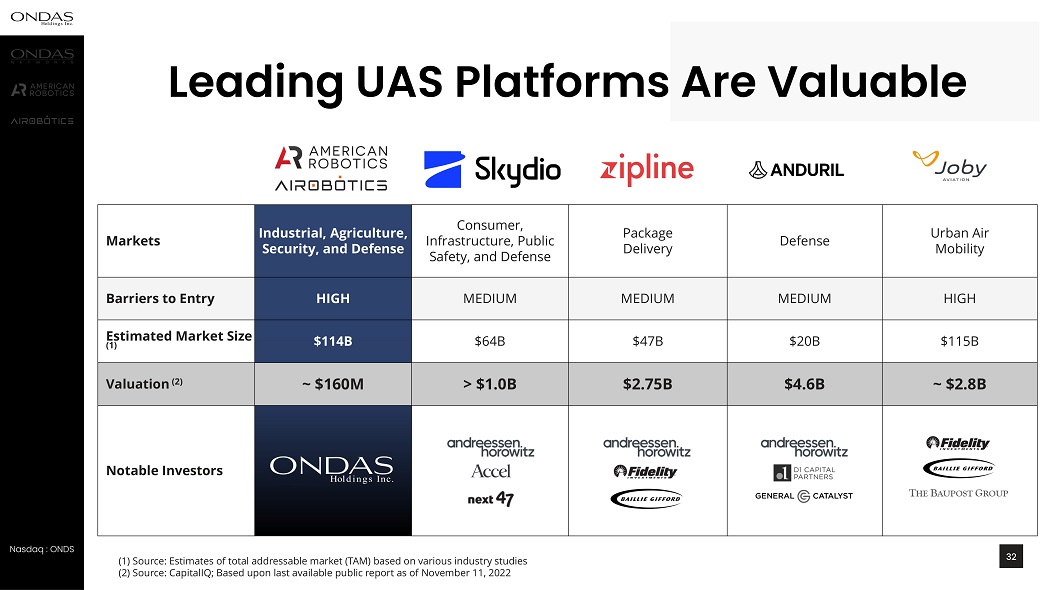

Leading UAS Platforms Are Valuable (1) Source: Estimates of total addressable market (TAM) based on various industry studies (2) Source: CapitalIQ; Based upon last available public report as of November 11 , 2022 Nasdaq : ONDS Markets Industrial , Agriculture, Security , and Defense Consumer, Infrastructure, Public Safety, and Defense Package Delivery Defense Urban Air Mobility Barriers to Entry HIGH MEDIUM MEDIUM MEDIUM HIGH Estimated Market Size (1) $ 114B $ 64B $ 47B $20B $115B Valuation (2) ~ $160M > $1.0B $2.75B $ 4.6B ~ $ 2.8 B Notable Investors 32

Nasdaq : ONDS Business development on track at Ondas Networks and American Robotics Delivering on 900 MHz Network and expanded platform opportunities American Robotics demonstrating industry leadership for customers Ondas is investing to win with its partners and ecosystem Closing Remarks 33

Nasdaq : ONDS Investor Q&A 34

No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended . Important Additional Information Will be Filed with the SEC On September 22 , 2022 , Ondas filed with the Securities and Exchange Commission (the "SEC") a Registration Statement on Form S - 4 , as amended on November 3 , 2022 , which includes a prospectus of Ondas, and is subject to review by the SEC . INVESTORS ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONDAS, AIROBOTICS, THE PROPOSED ACQUISITION AND RELATED MATTERS . Investors will be able to obtain free copies of the registration statement and other documents filed with the SEC through the website maintained by the SEC at www . sec . gov and on Ondas’ website at https : //ir . ondas . com . Important Disclosures Nasdaq : ONDS 35

Thank You for Listening www.ondas.com www.linkedin.com /company/ ondasnetworks / www.twitter.com / o ndas n etworks www.american - robotics.com www.twitter.com / a merican r obotic www.linkedin.com /company/ american - robotics - inc / NASDAQ: ONDS