Exhibit 99.2

Fourth Quarter and Full Year 2022 Earnings Release Copyright 2023. All rights reserved. NASDAQ: ONDS | March 2023

Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . 2 Disclaimer

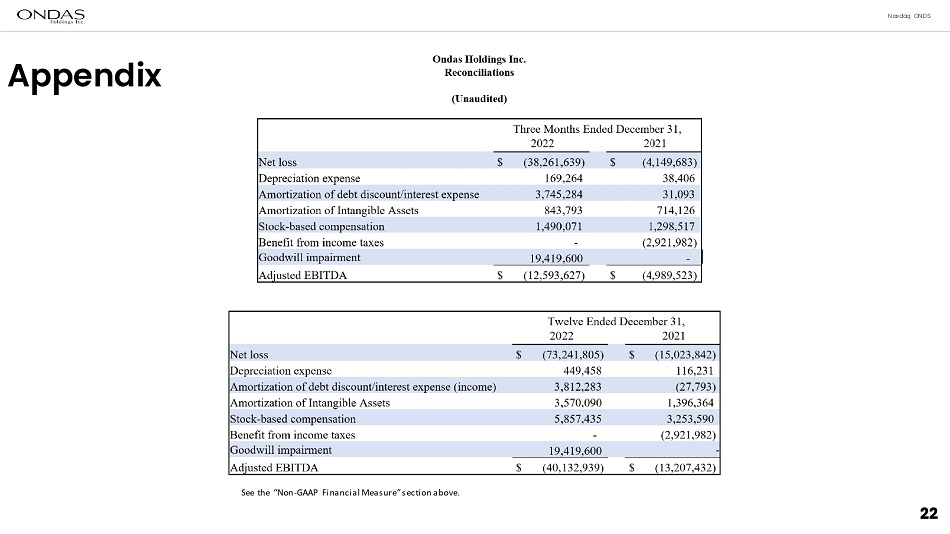

Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of Adjusted EBITDA, the non - GAAP financial measure, contained in this presentation to the most directly comparable measure under GAAP, which reconciliation is set forth in the table included in the Appendix of this presentation . We believe that Adjusted EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate Adjusted EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA should only be used as supplemental measures of our operating performance . We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the table included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . Management uses Adjusted EBITDA in making financial, operating and planning decisions and evaluating the Company's ongoing performance . With respect to our financial target for 2023 for Adjusted EBITDA a reconciliation of this non - GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non - GAAP target measure . The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income prepared in accordance with GAAP, that would be required to produce such a reconciliation . 3 Non - GAAP Financial Measure

Nasdaq: ONDS Leading technology developer and service provider for commercial drone markets Global leader in hyper - growth commercial drone market Provider of next - generation private industrial wireless networking technologies for critical industrial markets Next - gen data platform upgrade cycle starting with Class I Railroads Autonomous Drones, Data, & AI • Leading Technology • World - Class Talent • Blue Chip Customers • Dominant IP position Ondas positioned for a breakout 2023 4

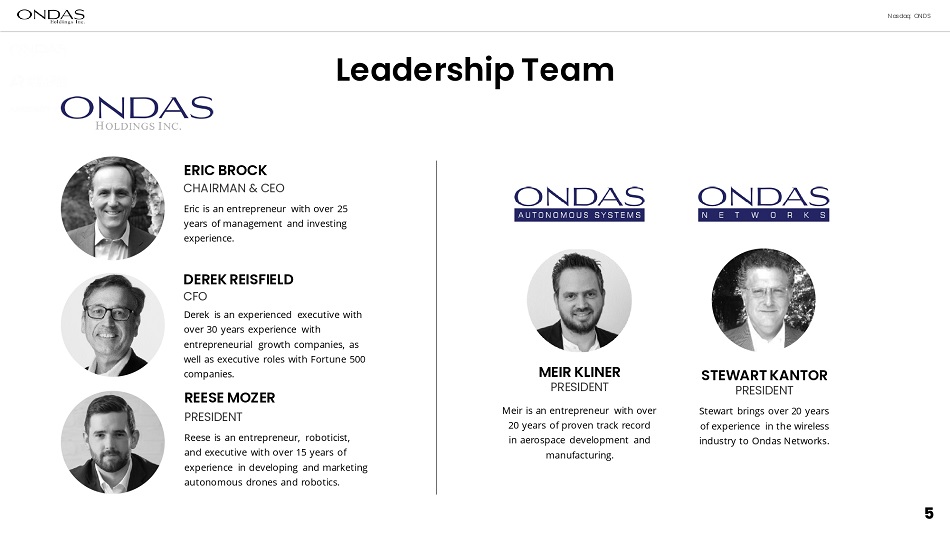

Nasdaq: ONDS STEWART KANTOR PRESIDENT Stewart brings over 20 years of experience in the wireless industry to Ondas Networks . ERIC BROCK CHAIRMAN & CEO Eric is an entrepreneur with over 25 years of management and investing experience . DEREK REISFIELD CFO Derek is an experienced executive with over 30 years experience with entrepreneurial growth companies, as well as executive roles with Fortune 500 companies. REESE MOZER PRESIDENT Reese is an entrepreneur, roboticist, and executive with over 15 years of experience in developing and marketing autonomous drones and robotics. MEIR KLINER PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. Leadership Team 5

Nasdaq: ONDS Ondas positioned for a breakout 2023 Agenda • Introduction • Financial Review & Outlook • Business Update • Ondas Networks • Ondas Autonomous Systems • Closing Remarks • Q&A 6

Nasdaq: ONDS Ondas transitioning to broad platform adoption; Revenue ramp in 2023 7 Introduction • Secured largest commercial orders to - date • Ondas Networks dot16 platform supports important Rail safety and efficiency applications • Ondas Autonomous Systems installing world’s first autonomous drone fleets in cities • Advanced business development to create an expected path to significant revenue growth, scale, and profitability

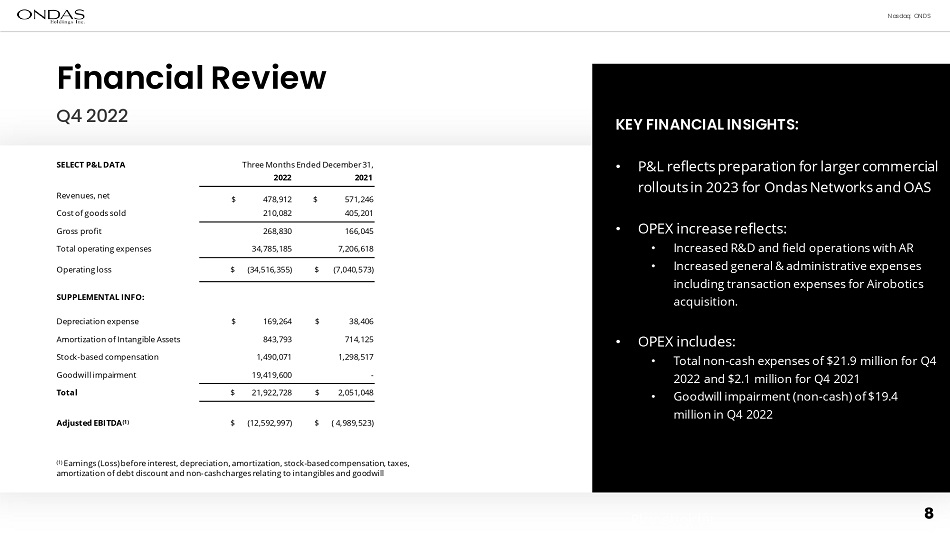

Nasdaq: ONDS Q4 2022 Financial Review KEY FINANCIAL INSIGHTS: • P&L reflects preparation for larger commercial rollouts in 2023 for Ondas Networks and OAS • OPEX increase reflects : • Increased R&D and field operations with AR • Increased general & administrative expenses including transaction expenses for Airobotics acquisition . • OPEX includes: • Total non - cash expenses of $21.9 million for Q4 2022 and $2.1 million for Q4 2021 • Goodwill impairment (non - cash) of $19.4 million in Q4 2022 8 Placeholder SELECT P&L DATA Three Months Ended December 31, 2022 2021 Revenues, net $ 478,912 $ 571,246 Cost of goods sold 210,082 405,201 Gross profit 268,830 166,045 Total operating expenses 34,785,185 7,206,618 Operating loss $ (34,516,355) $ (7,040,573) SUPPLEMENTAL INFO: Depreciation expense $ 169,264 $ 38,406 Amortization of Intangible Assets 843,793 714,125 Stock - based compensation 1,490,071 1,298,517 Goodwill impairment 19,419,600 - Total $ 21,922,728 $ 2,051,048 Adjusted EBITDA (1) $ (12,592,997) $ ( 4,989,523) (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, amortization of debt discount and non - cash charges relating to intangibles and goodwill

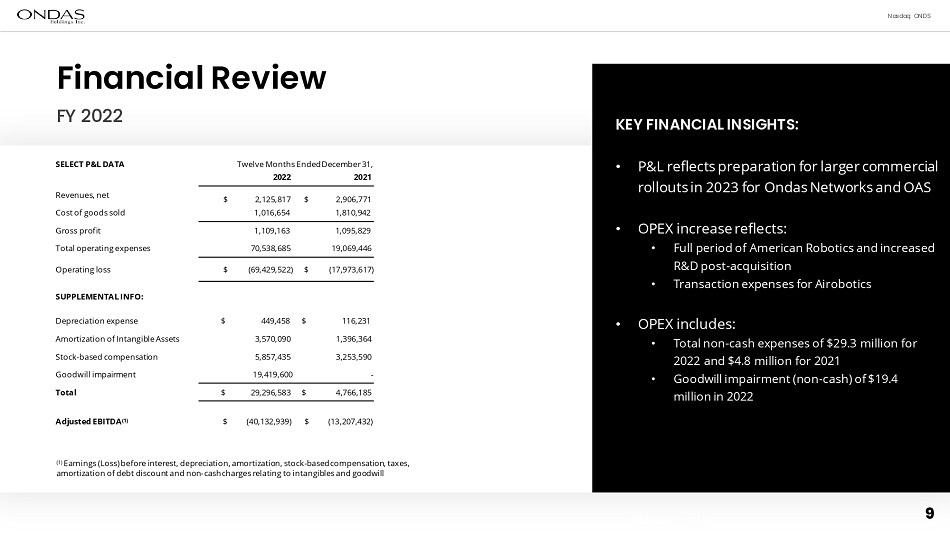

Nasdaq: ONDS FY 2022 Financial Review KEY FINANCIAL INSIGHTS: • P&L reflects preparation for larger commercial rollouts in 2023 for Ondas Networks and OAS • OPEX increase reflects: • Full period of American Robotics and increased R&D post - acquisition • Transaction expenses for Airobotics • OPEX includes: • Total non - cash expenses of $29.3 million for 2022 and $4.8 million for 2021 • Goodwill impairment (non - cash) of $19.4 million in 2022 9 Placeholder SELECT P&L DATA Twelve Months Ended December 31, 2022 2021 Revenues, net $ 2,125,817 $ 2,906,771 Cost of goods sold 1,016,654 1,810,942 Gross profit 1,109,163 1,095,829 Total operating expenses 70,538,685 19,069,446 Operating loss $ (69,429,522) $ (17,973,617) SUPPLEMENTAL INFO: Depreciation expense $ 449,458 $ 116,231 Amortization of Intangible Assets 3,570,090 1,396,364 Stock - based compensation 5,857,435 3,253,590 Goodwill impairment 19,419,600 - Total $ 29,296,583 $ 4,766,185 Adjusted EBITDA (1) $ (40,132,939) $ (13,207,432) (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, amortization of debt discount and non - cash charges relating to intangibles and goodwill

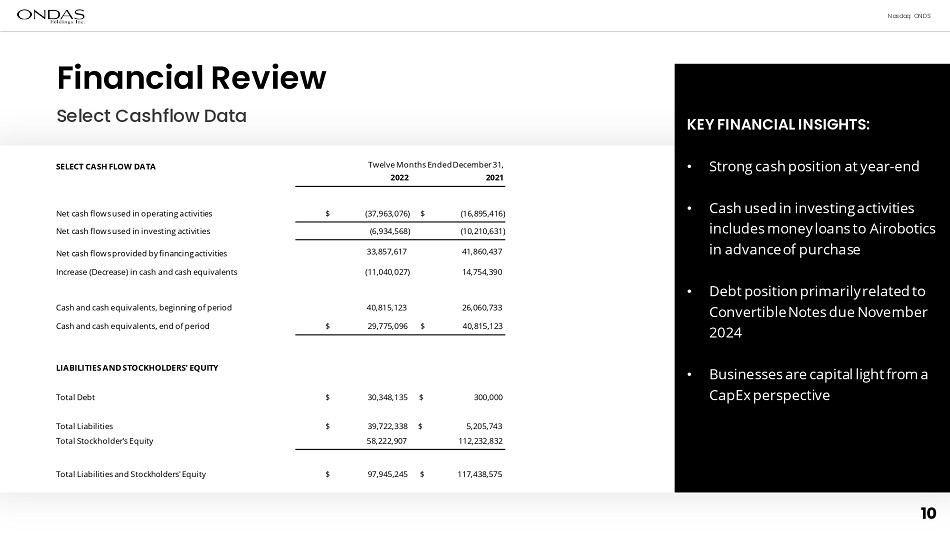

Nasdaq: ONDS Select Cashflow Data 10 Financial Review KEY FINANCIAL INSIGHTS: • Strong cash position at year - end • Cash used in investing activities includes money loans to Airobotics in advance of purchase • Debt position primarily related to Convertible Notes due November 2024 • Businesses are capital light from a CapEx perspective SELECT CASH FLOW DATA Twelve Months Ended December 31, 2022 2021 Net cash flows used in operating activities $ (37,963,076) $ (16,895,416) Net cash flows used in investing activities (6,934,568) (10,210,631) Net cash flows provided by financingactivities 33,857,617 41,860,437 Increase (Decrease) in cash and cash equivalents (11,040,027) 14,754,390 Cash and cash equivalents, beginning of period 40,815,123 26,060,733 Cash and cash equivalents, end of period $ 29,775,096 $ 40,815,123 LIABILITIES AND STOCKHOLDERS' EQUITY Total Debt $ 30,348,135 $ 300,000 Total Liabilities $ 39,722,338 $ 5,205,743 Total Stockholder's Equity 58,222,907 112,232,832 Total Liabilities and Stockholders' Equity $ 97,945,245 $ 117,438,575

Nasdaq: ONDS Ondas positioned for a breakout 2023 Financial Outlook • Significant revenue growth expected in 2023 and beyond • Reaffirming outlook: • $26 – $30 million 2023 revenue target • $19 – $24 million Adjusted EBITDA • Cash utilization improves: • Ondas Networks operating leverage • Integration of American Robotics and Airobotics • Financial targets for the year are based on: • Existing $13.1 million backlog • Visibility into expected demand from existing customers 11

Nasdaq: ONDS Business Unit Review 12

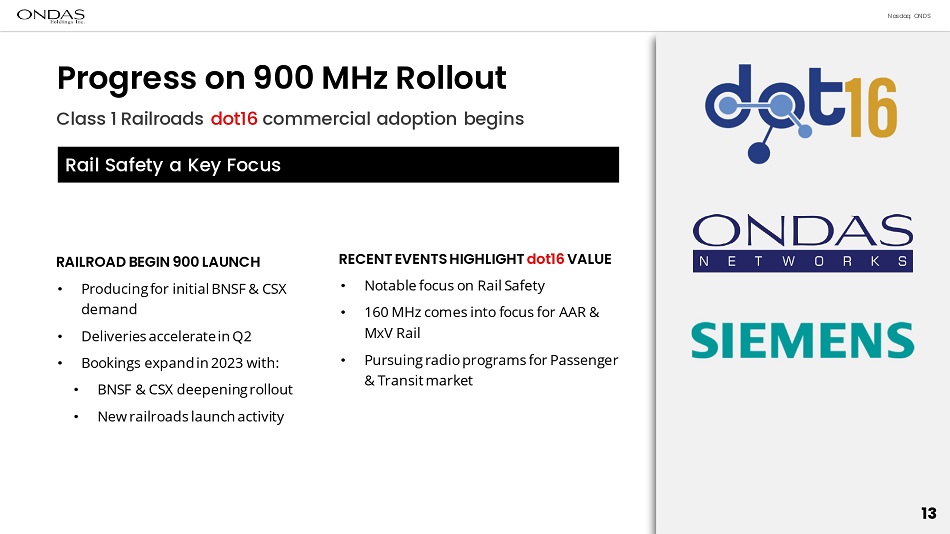

Nasdaq: ONDS Class 1 Railroads dot16 commercial adoption begins 13 Progress on 900 MHz Rollout Rail Safety a Key Focus RAILROAD BEGIN 900 LAUNCH • Producing for initial BNSF & CSX demand • Deliveries accelerate in Q2 • Bookings expand in 2023 with: • BNSF & CSX deepening rollout • New railroads launch activity RECENT EVENTS HIGHLIGHT dot16 VALUE • Notable focus on Rail Safety • 160 MHz comes into focus for AAR & MxV Rail • Pursuing radio programs for Passenger & Transit market

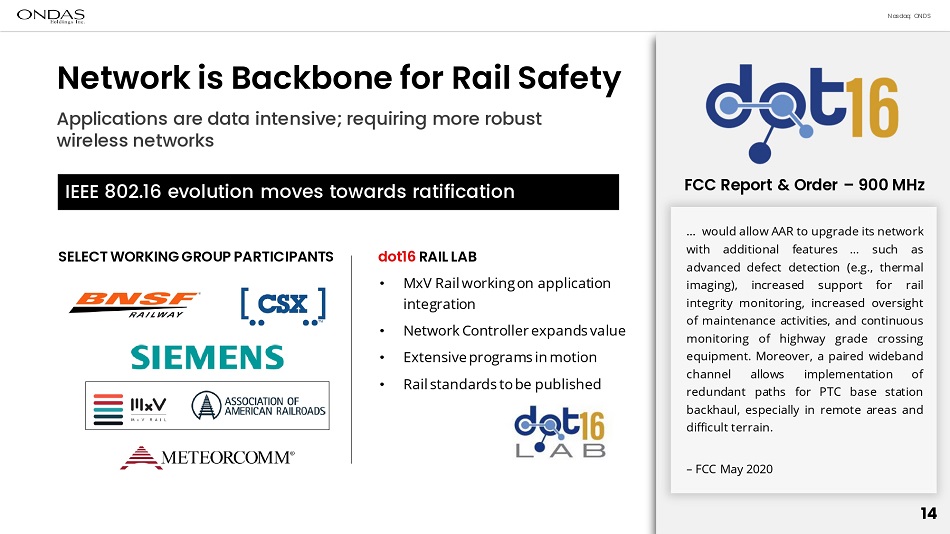

Nasdaq: ONDS Applications are data intensive; requiring more robust wireless networks Network is Backbone for Rail Safety IEEE 802.16 evolution moves towards ratification FCC Report & Order – 900 MHz SELECT WORKING GROUP PARTICIPANTS dot16 RAIL LAB • MxV Rail working on application integration • Network Controller expands value • Extensive programs in motion • Rail standards to be published … would allow AAR to upgrade its network with additional features … such as advanced defect detection (e . g . , thermal imaging), increased support for rail integrity monitoring, increased oversight of maintenance activities, and continuous monitoring of highway grade crossing equipment . Moreover, a paired wideband channel allows implementation of redundant paths for PTC base station backhaul, especially in remote areas and difficult terrain . – FCC May 2020 14

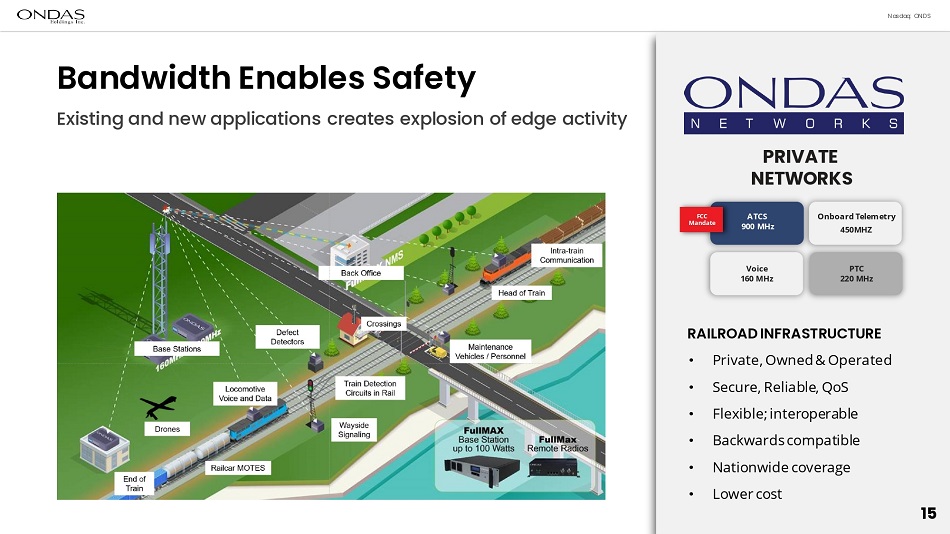

Nasdaq: ONDS Bandwidth Enables Safety Existing and new applications creates explosion of edge activity RAILROAD INFRASTRUCTURE • Private, Owned& Operated • Secure, Reliable, QoS • Flexible; interoperable • Backwards compatible • Nationwide coverage • Lower cost PRIVATE NETWORKS Onboard Telemetry 450MHZ ATCS 900 MHz Voice 160 MHz PTC 220 MHz FCC Mandate 15

Nasdaq: ONDS STRONG FOUNDATION FOR 2023 • UAE fleet launches proceeding • Semi fab customer validates platform • Closed Iron Drone; c - UAS system launched • Marketing efforts expanding T H I S I S RAIDER T H I S I S OPTIMUS 16

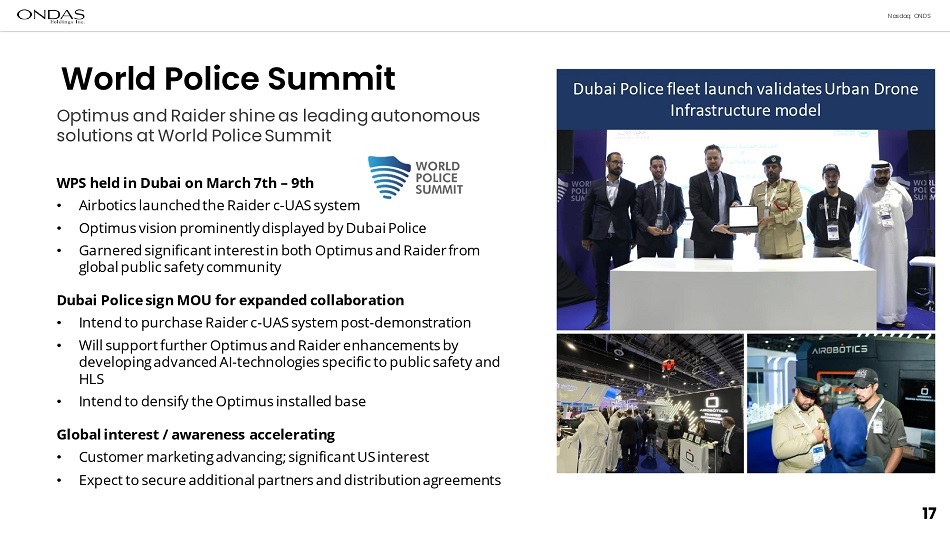

Nasdaq: ONDS Optimus and Raider shine as leading autonomous solutions at World Police Summit World Police Summit WPS held in Dubai on March 7th – 9th • Airbotics launched the Raider c - UAS system • Optimus vision prominently displayed by Dubai Police • Garnered significant interest in both Optimus and Raider from global public safety community Dubai Police sign MOU for expanded collaboration • Intend to purchase Raider c - UAS system post - demonstration • Will support further Optimus and Raider enhancements by developing advanced AI - technologies specific to public safety and HLS • Intend to densify the Optimus installed base Global interest / awareness accelerating • Customer marketing advancing; significant US interest • Expect to secure additional partners and distribution agreements Dubai Police fleet launch validates Urban Drone Infrastructure model 17

Nasdaq: ONDS Customer validation with fleet adoption highlights massive growth opportunity Dubai setting pace for Urban Public Safety / HLS • Installed units under full operation • Max utilization of the Optimus system capacity • Discussions about new Optimus deployment for 2024 SkyGo JV to define Smart City shared services model • Target customers for both security and inspection services • Public safety, O&G, ports, rail & municipal agencies • JV Model may be pursued in other countries Drone Infrastructure for major semiconductor fab construction project • Renewed long - term relationship • Multiple customers / revenue streams for installed Optimus infrastructure • Global market potential with infrastructure and on - shoring construction booms Urban Infrastructure Ramping 18

Nasdaq: ONDS Iron Drone Launched 19 Irone Drone acquisition closed | c - UAS system launched amidst significant customer interest Key system features • Fully automated pod and high - speed autonomous racer drones • Physical kinetic drone capture with designated net; designated parachute to reduce collateral damage of interception • Escort mode to avoid unnecessary interception • System robustness and easy integration to any detection system Physical capture preferred to frequency jamming • In civil installations, a net capture system is safer • Jamming impacts local private communications; introduces risk to on - ground assets and people Well - suited from critical & highly - trafficked locations • Sensitive government facilities: White House • Critical infrastructure: Power plants, bridges • High traffic locations: Stadiums, marathons, parades, public events • Product attractive to Defense & HLS markets as well

Nasdaq: ONDS Leverage winner - take - most platforms Strong year ahead • Plan to monetize the significant investments in FullMAX and Optimus platforms o Expect safety upgrades to accelerate Rail adoption o Fleet deployments of Optimus will demonstrate long - term leadership in huge market • Revenue growth and cost controls drive path to profitability • Continue to advance and define the solutions in the large markets we target 20

21 Nasdaq: ONDS Q&A Investor Presentation | March 2023 Copyright 2023. All rights reserved. Nasdaq : ONDS

Nasdaq: ONDS 22 Appendix See the “Non - GAAP Financial Measure” section above.

Thank you Copyright 2023. All rights reserved. NASDAQ: ONDS | March 2023