Exhibit 99.2

First Quarter 2023 Earnings Release Copyright 2023. All rights reserved. NASDAQ: ONDS | May 2023

Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . 2 Disclaimer

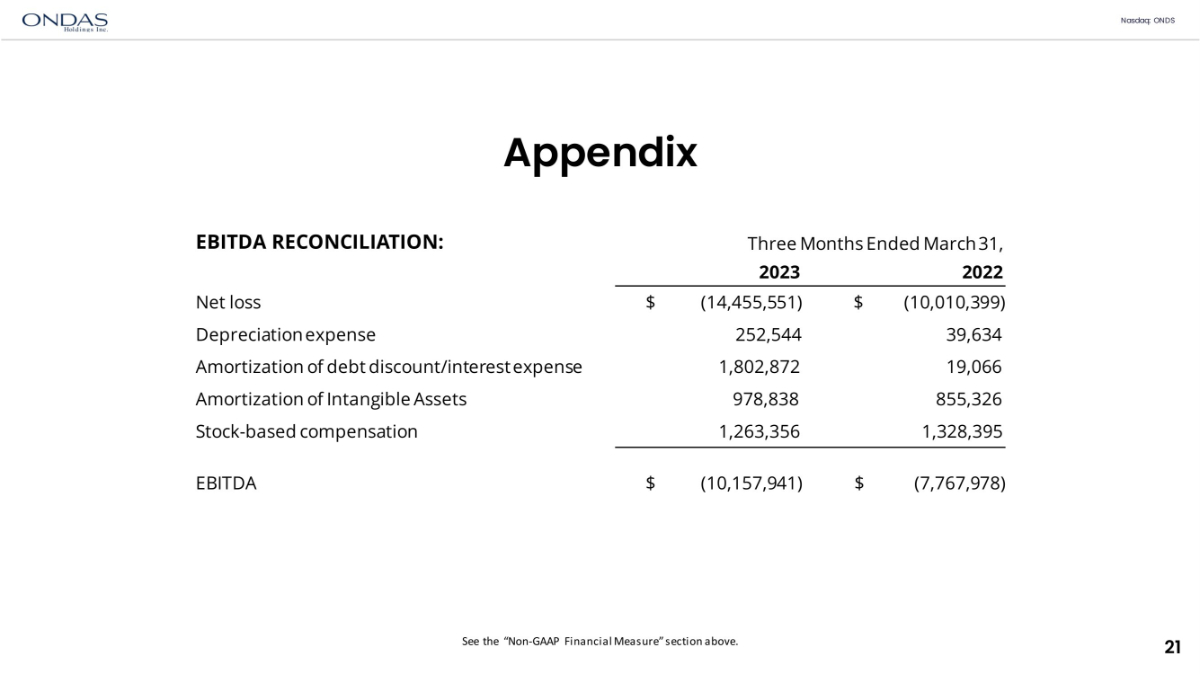

Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of EBITDA, the non - GAAP financial measure, contained in this presentation to the most directly comparable measure under GAAP, which reconciliation is set forth in the table included in the Appendix of this presentation . We believe that EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . EBITDA should only be used as supplemental measures of our operating performance . We believe that EBITDA improves comparability from period to period by removing the impact of our asset base (depreciation and amortization) and other adjustments as set out in the table included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . Management uses EBITDA in making financial, operating and planning decisions and evaluating the Company's ongoing performance . With respect to our financial target for 2023 for EBITDA a reconciliation of this non - GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non - GAAP target measure . The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income prepared in accordance with GAAP, that would be required to produce such a reconciliation . 3 Non - GAAP Financial Measure

Nasdaq: ONDS STEWART KANTOR PRESIDENT Stewart brings over 20 years of experience in the wireless industry to Ondas Networks . ERIC BROCK CHAIRMAN & CEO Eric is an entrepreneur with over 25 years of management and investing experience . DEREK REISFIELD CFO Derek is an experienced executive with over 30 years experience with entrepreneurial growth companies, as well as executive roles with Fortune 500 companies. REESE MOZER PRESIDENT Reese is an entrepreneur, roboticist, and executive with over 15 years of experience in developing and marketing autonomous drones and robotics. MEIR KLINER PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. Leadership Team 4

Nasdaq: ONDS Ondas on track for breakout 2023 Agenda • Introduction • Financial Review & Outlook • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A 5

Nasdaq: ONDS Introduction Record revenue signals strong start to 2023 • $2.6M revenue delivered in Q1; exceeding all of 2022 • AAR formalized IEEE 802.16 technology as the greenfield 900 MHz wireless platform; 900 MHz timelines likely to accelerate rail customer order activity • OAS urban autonomous drone fleet installations progressing in Dubai and Abu Dhabi; marketing of Optimus to US industrial and government market off to a good start • Poised for dramatic revenue growth in 2023; expected to drive scale, improved profitability, and significantly lower quarterly cash burn 6 6

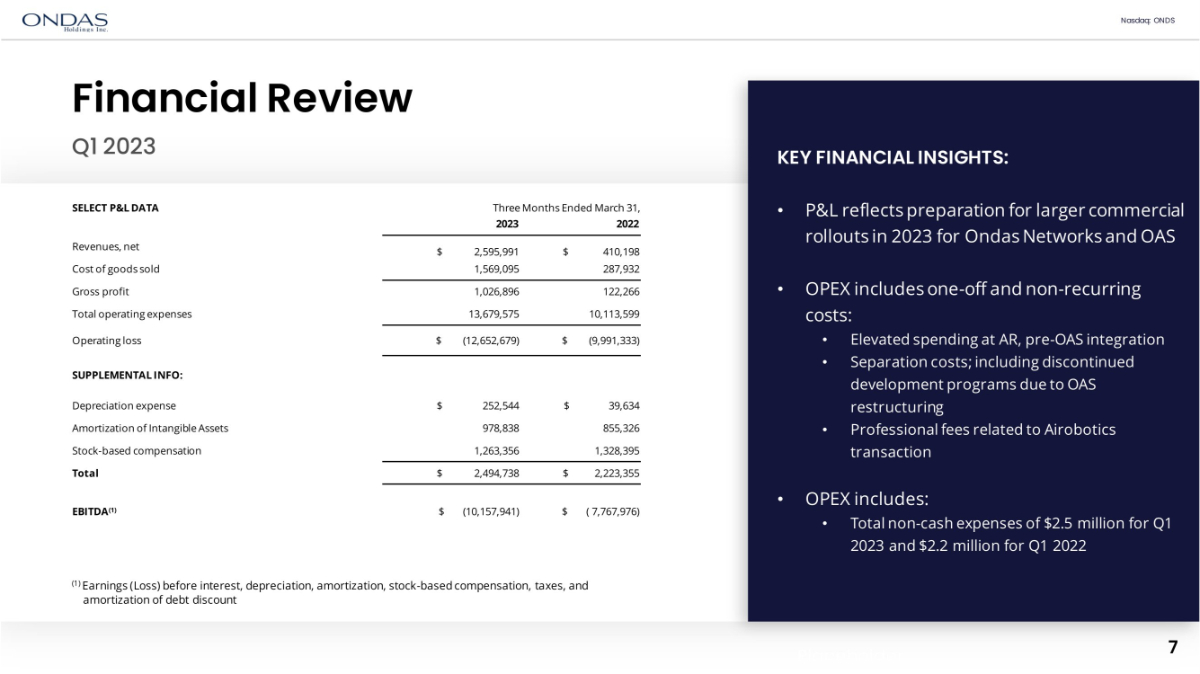

Nasdaq: ONDS 7 Q1 2023 Financial Review Placeholder KEY FINANCIAL INSIGHTS: • P&L reflects preparation for larger commercial rollouts in 2023 for Ondas Networks and OAS • OPEX includes one - off and non - recurring costs: • Elevated spending at AR, pre - OAS integration • Separation costs; including discontinued development programs due to OAS restructuring • Professional fees related to Airobotics transaction • OPEX includes: • Total non - cash expenses of $2.5 million for Q1 2023 and $2.2 million for Q1 2022 Three Months Ended March 31, SELECT P&L DATA 2022 2023 $ 410,198 $ 2,595,991 Revenues, net 287,932 1,569,095 Cost of goods sold 122,266 1,026,896 Gross profit 10,113,599 13,679,575 Total operating expenses $ (9,991,333) $ (12,652,679) Operating loss SUPPLEMENTAL INFO: $ 39,634 $ 252,544 Depreciation expense 855,326 978,838 Amortization of Intangible Assets 1,328,395 1,263,356 Stock - based compensation $ 2,223,355 $ 2,494,738 Total $ ( 7,767,976) $ (10,157,941) EBITDA (1) (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, and amortization of debt discount

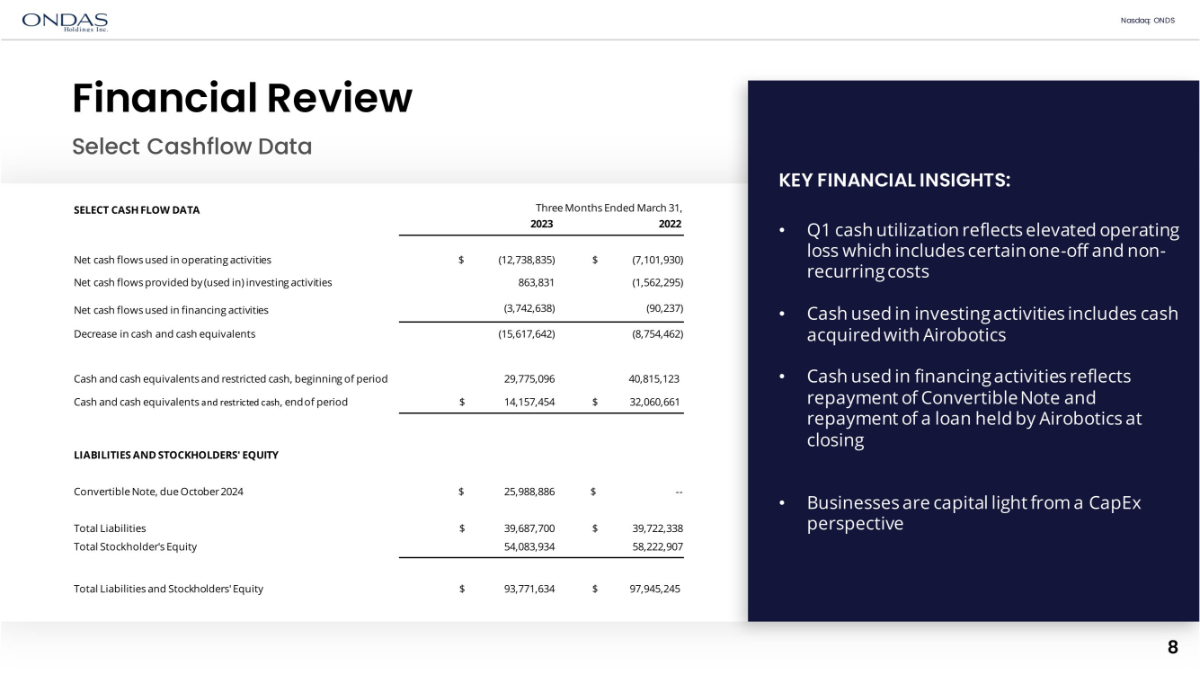

Nasdaq: ONDS Select Cashflow Data 8 Financial Review KEY FINANCIAL INSIGHTS: • Q1 cash utilization reflects elevated operating loss which includes certain one - off and non - recurring costs • Cash used in investing activities includes cash acquired with Airobotics • Cash used in financing activities reflects repayment of Convertible Note and repayment of a loan held by Airobotics at closing • Businesses are capital light from a CapEx perspective Three Months Ended March 31, SELECT CASH FLOW DATA 2022 2023 $ (7,101,930) $ (12,738,835) Net cash flows used in operating activities (1,562,295) 863,831 Net cash flows provided by (used in) investing activities (90,237) (3,742,638) Net cash flows used in financing activities (8,754,462) (15,617,642) Decrease in cash and cash equivalents 40,815,123 29,775,096 Cash and cash equivalents and restricted cash, beginning of period $ 32,060,661 $ 14,157,454 Cash and cash equivalents and restricted cash , end of period LIABILITIES AND STOCKHOLDERS' EQUITY $ - - $ 25,988,886 Convertible Note, due October 2024 $ 39,722,338 $ 39,687,700 Total Liabilities 58,222,907 54,083,934 Total Stockholder's Equity $ 97,945,245 $ 93,771,634 Total Liabilities and Stockholders' Equity

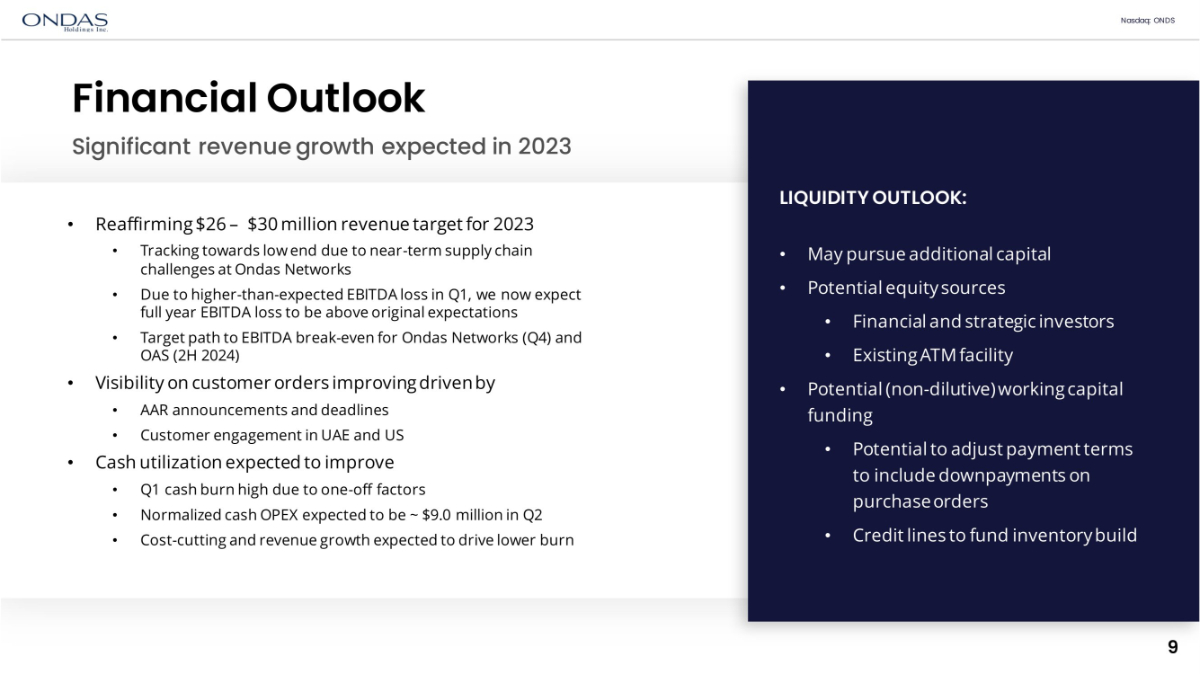

Nasdaq: ONDS Financial Outlook Significant revenue growth expected in 2023 • Reaffirming $26 – $30 million revenue target for 2023 • Tracking towards low end due to near - term supply chain challenges at Ondas Networks • Due to higher - than - expected EBITDA loss in Q1, we now expect full year EBITDA loss to be above original expectations • Target path to EBITDA break - even for Ondas Networks (Q4) and OAS (2H 2024) • Visibility on customer orders improving driven by • AAR announcements and deadlines • Customer engagement in UAE and US • Cash utilization expected to improve • Q1 cash burn high due to one - off factors • Normalized cash OPEX expected to be ~ $9.0 million in Q2 • Cost - cutting and revenue growth expected to drive lower burn LIQUIDITY OUTLOOK: • May pursue additional capital • Potential equity sources • Financial and strategic investors • Existing ATM facility • Potential (non - dilutive) working capital funding • Potential to adjust payment terms to include downpayments on purchase orders • Credit lines to fund inventory build 9

Nasdaq: ONDS Business Unit Review 10 10

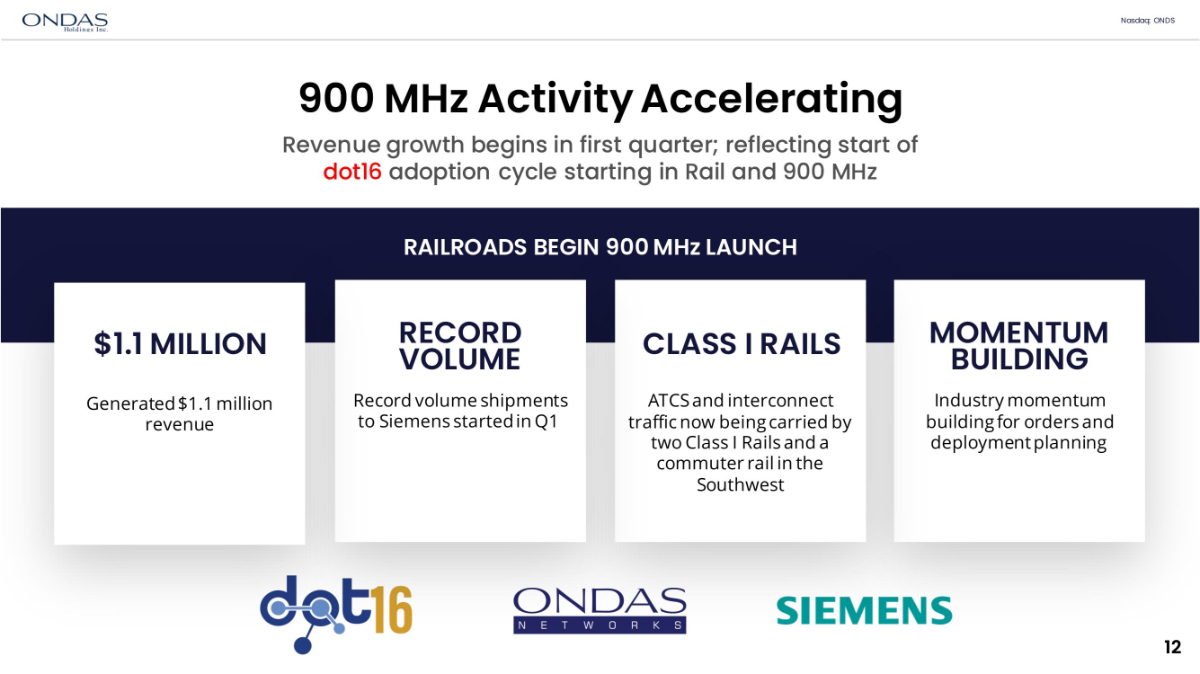

Nasdaq: ONDS 900 MHz Activity Accelerating Revenue growth begins in first quarter; reflecting start of dot16 adoption cycle starting in Rail and 900 MHz ATCS and interconnect traffic now being carried by two Class I Rails and a commuter rail in the Southwest Generated $1.1 million revenue 12 RAILROADS BEGIN 900 MHz LAUNCH $1.1 MILLION RECORD VOLUME Record volume shipments to Siemens started in Q1 CLASS I RAILS MOMENTUM BUILDING Industry momentum building for orders and deployment planning

Nasdaq: ONDS AAR Announces dot16 Selection 13 13 RECENT EVENTS ENERGIZE INDUSTRY AROUND dot16 • American Railway Engineering & Maintenance - of - Way Association (AREMA) subsequently ratified dot16 as specification for 900 MHz network • Key deadlines confirmed and shared publicly with the industry by AAR • Legacy 900 MHz network must be vacated by September 2025 • FCC substantial buildout must be complete by April 2026 • Ondas & Siemens have seen significant recent increase in customer activity in preparation for deployments to meet deadlines • Expect order activity to increase dramatically • Ondas will be building inventory in front of this demand AAR formalizes dot16 as the wireless technology platform for the new 900 MHz network

Nasdaq: ONDS Ondas and Siemens are preparing to meet rising demand in front of Rail deployment deadlines Legacy narrowband networks are poised for upgrade; high capacity 900 MHz network is increasingly attractive • Deadlines to vacate legacy 900 MHz band is rapidly approaching • Other rail suppliers are facing significant supply chain and legacy technology issues • Other legacy (unlicensed) radio technologies are no longer effective for interlocking • Recent derailment in Midwest is fueling need for expanded defect detectors deployments; 900 MHz is an optimal band • Capacity concerns in the 200 MHz band for non - PTC applications (e.g., Remote Control Locomotives) increasingly problematic • Transit agencies in US and Internationally facing significant end of life legacy radio issues dot16 Adoption Drivers 14

Nasdaq: ONDS Significant revenue ramp demonstrates 2023 projected growth Revenue growth commences • Delivered $1.5M revenue in Q1 • Expect growth through 2023 via backlog and new customer orders Fleet installations continue • Additional Optimus systems installed for Dubai Police • Installed first Optimus systems in Abu Dhabi • Received repeat purchase order from major semiconductor chip manufacturer Customer pipeline grows • Marketing and customer qualification in U.S. progresses • Increased interest demonstrated from other regions as well • Launch of Iron Drone platform generates additional interest from existing and new customers Customer & Financial Activity 16

Nasdaq: ONDS M&A, Cost - Cutting, Joint Venture and MOUs M&A • Completed acquisition of Airobotics, developer of Optimus • Acquired assets of Iron Drone, a leading counter - drone solution Focused on Operational Efficiency • Integrated American Robotics and Airobotics to establish Ondas Autonomous Systems business unit • Streamlined R&D and operations, significantly reducing OPEX • Leveraging shared technologies, government approvals, and customer pipelines Partnerships Creating Value • Announced Joint Venture plans with UAE - based SkyGo • Signed MOU for expanded collaboration with Dubai Police • Announced collaboration with Rafael Advanced Defense Systems to further develop Autonomous Drone Infrastructure Strategic Activity 17

Nasdaq: ONDS Revenue ramp continues; on track to achieve 2023 objectives Grow revenue and orders • Continue to deliver on fleet deployments in UAE • Expect to announce additional orders in 2023 • Expect to announce milestones relating to U.S. expansion of Optimus and Iron Drone, with focus on industrial, public safety, and government markets Execute product development • Complete integration of fugitive emissions payloads for O&G • Complete integration of TASA for BVLOS operations • Implemented 5G wireless connectivity • Advancing the Optimus System FAA’s Type Certification process Build inventory • Expect 10 new Optimus Systems to be manufactured and delivered by Q4 2023 • 15 systems are on order; additional inventory build expected for 2024 Outlook for OAS 18

Nasdaq: ONDS Leverage winner - take - most platforms Closing – Record Year Ahead • On path to monetize the significant investments in FullMAX and Optimus platforms o AAR announcements improve visibility around customer demand and timelines o Fleet deployments of Optimus will demonstrate long - term leadership in massive markets ; U . S . expansion opens huge market • Revenue growth and cost controls drive path to profitability • Continue to advance and define the solutions in the large markets we target 19

Nasdaq: ONDS 20 Q&A First Quarter 2023 Earnings Release | May 2023 Copyright 2023. All rights reserved. Nasdaq : ONDS

Nasdaq: ONDS Appendix 21 See the “Non - GAAP Financial Measure” section above. Three Months Ended March 31, EBITDA RECONCILIATION: 2022 2023 $ (10,010,399) $ (14,455,551) Net loss 39,634 252,544 Depreciation expense 19,066 1,802,872 Amortization of debt discount/interest expense 855,326 978,838 Amortization of Intangible Assets 1,328,395 1,263,356 Stock - based compensation $ (7,767,978) $ (10,157,941) EBITDA

Thank you Copyright 2023. All rights reserved. NASDAQ: ONDS | May 2023