Exhibit 99.2

Second Quarter 2023 Earnings Release Copyright 2023. All rights reserved. NASDAQ: ONDS | August 2023

Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . 2 Disclaimer

Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of EBITDA, the non - GAAP financial measure, contained in this presentation to the most directly comparable measure under GAAP, which reconciliation is set forth in the table included in the Appendix of this presentation . We believe that EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . EBITDA should only be used as supplemental measures of our operating performance . We believe that EBITDA improves comparability from period to period by removing the impact of our asset base (depreciation and amortization) and other adjustments as set out in the table included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . Management uses EBITDA in making financial, operating and planning decisions and evaluating the Company's ongoing performance . 3 Non - GAAP Financial Measure

Nasdaq: ONDS Leadership Team DEREK REISFIELD CFO Derek is an experienced executive with over 30 years experience with entrepreneurial growth companies, as well as executive roles with Fortune 500 companies. ERIC BROCK CHAIRMAN & CEO Eric is an entrepreneur with over 25 years of management and investing experience. MEIR KLINER PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. STEWART KANTOR PRESIDENT & CFO Stewart brings over 20 years of experience in the wireless industry to Ondas Networks. 4

Nasdaq: ONDS Agenda 5 Ondas on track for a breakout 2023 • Introduction • Financial Review & Outlook • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A

Nasdaq: ONDS Introduction 6 6 Record revenue signals strong start to 2023 • $5.5M revenue delivered in Q2; $8.1M revenue year - to - date • Strengthened balance sheet with $25M in growth capital raised from private and institutional investors • Field activity with Class I rails advanced ; pipeline is growing with 900 MHz migration deadlines coming closer • Urban autonomous drone fleet installations progressed with SkyGo POC completion; new partners announced in India and Saudi Arabia • US industrial and government customers and ecosystem partners are emerging starting with MassDOT Aeronautical and Skyfire • Increased scale, revenue growth, and disciplined OPEX management, leading to significantly lower quarterly cash burn

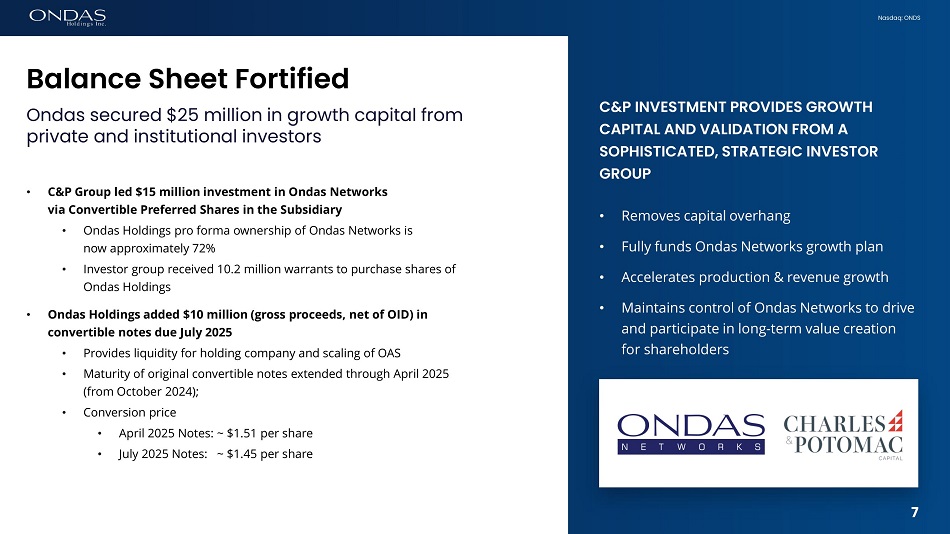

Nasdaq: ONDS Balance Sheet Fortified Ondas secured $25 million in growth capital from private and institutional investors • C&P Group led $15 million investment in Ondas Networks via Convertible Preferred Shares in the Subsidiary • Ondas Holdings pro forma ownership of Ondas Networks is now approximately 72% • Investor group received 10.2 million warrants to purchase shares of Ondas Holdings • Ondas Holdings added $10 million (gross proceeds, net of OID) in convertible notes due July 2025 • Provides liquidity for holding company and scaling of OAS • Maturity of original convertible notes extended through April 2025 (from October 2024); • Conversion price • April 2025 Notes: ~ $1.51 per share • July 2025 Notes: ~ $1.45 per share C&P INVESTMENT PROVIDES GROWTH CAPITAL AND VALIDATION FROM A SOPHISTICATED, STRATEGIC INVESTOR GROUP • Removes capital overhang • Fully funds Ondas Networks growth plan • Accelerates production & revenue growth • Maintains control of Ondas Networks to drive and participate in long - term value creation for shareholders 6 7

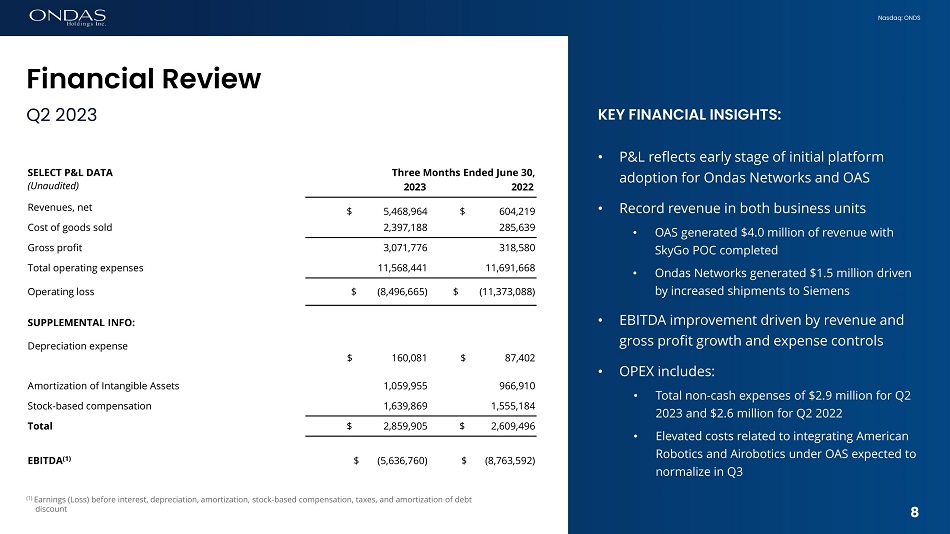

8 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • P&L reflects early stage of initial platform adoption for Ondas Networks and OAS • Record revenue in both business units • OAS generated $4.0 million of revenue with SkyGo POC completed • Ondas Networks generated $1.5 million driven by increased shipments to Siemens • EBITDA improvement driven by revenue and gross profit growth and expense controls • OPEX includes: • Total non - cash expenses of $2.9 million for Q2 2023 and $2.6 million for Q2 2022 • Elevated costs related to integrating American Robotics and Airobotics under OAS expected to normalize in Q3 SELECT P&L DATA Three Months Ended June 30, (Unaudited) 2023 2022 Revenues, net $ 5,468,964 $ 604,219 Cost of goods sold 2,397,188 285,639 Gross profit 3,071,776 318,580 Total operating expenses 11,568,441 11,691,668 Operating loss $ (8,496,665) $ (11,373,088) SUPPLEMENTAL INFO: Depreciation expense $ 160,081 $ 87,402 Amortization of Intangible Assets 1,059,955 966,910 Stock - based compensation 1,639,869 1,555,184 Total $ 2,859,905 $ 2,609,496 EBITDA (1) $ (5,636,760) $ (8,763,592) (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, and amortization of debt discount Financial Review Q2 2023 8

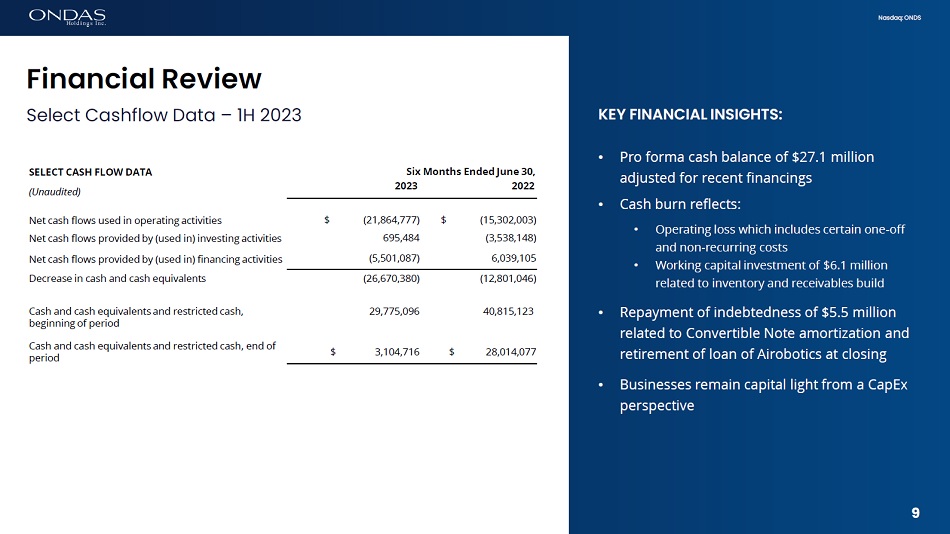

Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Pro forma cash balance of $27.1 million adjusted for recent financings • Cash burn reflects: • Operating loss which includes certain one - off and non - recurring costs • Working capital investment of $6.0 million related to inventory and receivables build • Repayment of indebtedness of $5.5 million related to Convertible Note amortization and retirement of loan of Airobotics at closing • Businesses remain capital light from a CapEx perspective SELECT CASH FLOW DATA Six Months Ended June 30, (Unaudited) 2023 2022 Net cash flows used in operating activities $ (21,864,777) $ (15,302,003) Net cash flows provided by (used in) investing activities 695,484 (3,538,148) Net cash flows provided by (used in) financing activities (5,501,087) 6,039,105 Decrease in cash and cash equivalents (26,670,380) (12,801,046) Cash and cash equivalents and restricted cash, beginning of period 29,775,096 40,815,123 Cash and cash equivalents and restricted cash, end of period $ 3,104,716 $ 28,014,077 9 9 Financial Review Select Cashflow Data – 1H 2023

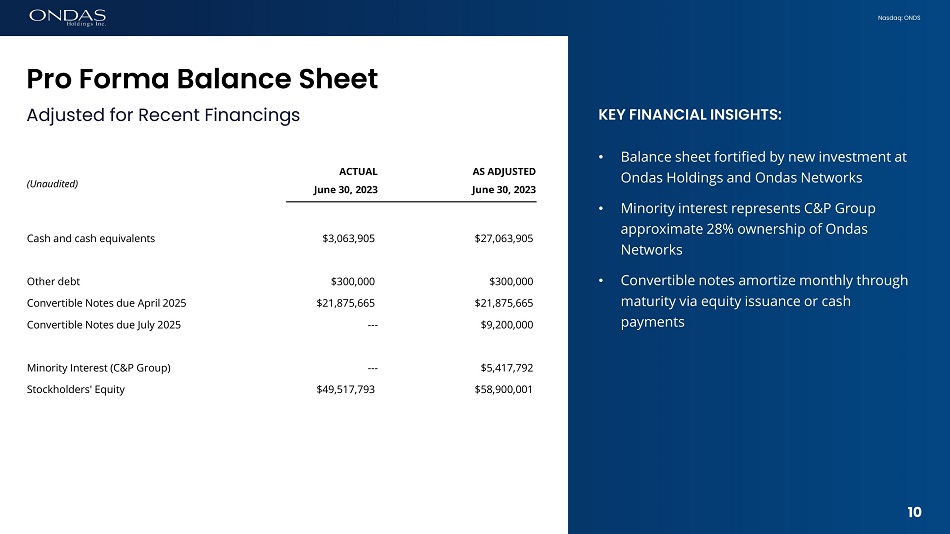

Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Balance sheet fortified by new investment at Ondas Holdings and Ondas Networks • Minority interest represents C&P Group approximate 28% ownership of Ondas Networks • Convertible notes amortize monthly through maturity via equity issuance or cash payments 9 10 Pro Forma Balance Sheet Adjusted for Recent Financings ACTUAL AS ADJUSTED (Unaudited) June 30, 2023 June 30, 2023 Cash and cash equivalents $3,063,905 $27,063,905 Other debt $300,000 $300,000 Convertible Notes due April 2025 $21,875,665 $21,875,665 Convertible Notes due July 2025 -- - $9,200,000 Minority Interest (C&P Group) -- - $5,417,792 Stockholders' Equity $49,517,793 $58,900,001

Nasdaq: ONDS LIQUIDITY OUTLOOK: • Strong multi - year growth expected as platform adoption curves inflect higher • $25 million raised in July supports growth outlook • Cash OPEX expected to be $9.0 million in Q3 • Continue to maintain tight cost controls with focus on driving profitability 9 11 Financial Outlook Continue to see significant growth in 2023 and beyond • Slower production ramp at Ondas Networks will result in shortfall relative to earlier targets, due to: • Component availability • Working capital tightness • Production has re - accelerated in Q3 at Ondas Networks • Support from recent capital raise; scaling with contract manufacturer • Lead times dictate shipment capability and revenue recognition • OAS is on path to achieve previous expectations • Target $7.0 million of revenue in 2H 2023; $15 million for full year 2023 • Expect Ondas Networks volume orders in second half 2023; significant revenue ramp still expected in 2024 and beyond for both business units

BUSINESS UNIT REVIEW

Nasdaq: ONDS RAILROADS BEGIN 900 MHz LAUNCH 14 $1.5 MILLION Generated record revenue $1.5 million RECORD VOLUME Record volume shipments to Siemens CLASS I RAILS Engaged in field activity to support commercial deployment planning activities and negotiations for volume orders MOMENTUM BUILDING Industry momentum building for orders and deployment planning 900 MHz Migration in Motion The dot16 adoption cycle starting in Rail and 900 MHz

Nasdaq: ONDS Preparing for 900 MHz upgrade 15 2025 deadlines support expected order ramp • Ondas and Siemens engaged in field and purchasing groups • Rail operations teams (e.g., C&S groups) with budgets and responsibility for network operations • Initial deployments focused on critical network and high traffic locations, as well as new “vital communications” end points such as railroad crossings • Siemens negotiating orders; pricing and deployment plans being outlined • MxV Rail continues to advance dot16 integration • Network controller development • Expect engagement on other frequency bands • Scaling production; overcoming initial challenges • Component tightness due to phase 1 production startup is alleviating • Recent financing provides working capital for inventory build • Transitioned to contract manufacturer to increase production capacity

Nasdaq: ONDS New photo Outlook for Ondas Networks Production ramp accelerates; tracking major orders for 900 MHz • Grow revenue and orders • Production will accelerate again with working capital and supply chain improvements • Contract manufacturer partner now engaged to scale • Plan to secure major volume orders in 2H 2023; build inventory in front of 900 MHz migration • Continue product and network development • Siemens and Ondas field activity intensifying with increasing number of Class I Rails • Advancing product development programs; new opportunities emerge • Siemens UK for on - locomotive • Passenger and transit programs • Focus on cash efficiency; path to profitability • Revenue and gross profit to scale and increasingly offset OPEX 16 • Maintain culture of strong cost controls 16

Nasdaq: ONDS Customer & Financial Activity 18 Significant revenue ramp demonstrates 2023 projected growth • Revenue growth commences • Delivered $4.0M revenue in Q2 • Expect growth through 2023 and into 2024 via continued fleet expansion and addition of new customers • Fleet strategy scaling in The Gulf • Successful completion of SkyGo POC in Abu Dhabi • Secured a renewed and expanded service agreement for ongoing support and system maintenance for installed Optimus fleet in Dubai • Strategic alliance in Saudi Arabia to establish drone infrastructure • Customer pipeline grows • Marketing and customer qualification in U.S. progressing • Announced MassDOT and Skyfire established as early go - to - market customer and partner in US • Increased interest demonstrated from other regions as well

Nasdaq: ONDS GAINING TRACTION IN UNITED STATES • MassDOT POC expected to lead to permanent installations • Marketing to critical infrastructure operators across Massachusetts • Showcase for other state DOTs • Skyfire partnership for fast growing Drone First Responder markets • Accelerates Public Safety drone infrastructure opportunity • Targeting police, fire with state, local and federal organizations Strategic Activity Advancing Product & Ecosystem • FAA Type Certification advancing; supports scaling with customers globally • Received noise certification approval for Airobotics Optimus - 1EX drone system; marking the final major step towards completing Type Certification • Allows for complex aerial missions over people, roads and critical infrastructure accelerating and broadening market entry into the US • International expansion beyond UAE and Israel • Announced partnership and initial marketing activity in India with Aero A2Z • Announced entry into Kingdom of Saudi Arabia via strategic alliance with Saudi Excellence • Driving public policy initiatives • Appointed to Board of Directors of Commercial Drone Alliance (CDA); CDA, collaborates closely with key policymakers at FAA, DOT, White House, and Congress to educate and champion the future of the drone industry More customers in pipeline… 19

Nasdaq: ONDS Outlook for OAS 20 Revenue ramp continues; on track to achieve 2023 objectives • Grow revenue and orders • Continue to deliver on fleet deployments in UAE; expect to announce additional orders in 2023 • Expect to announce additional milestones relating to U.S. expansion of Optimus and Iron Drone Raider • Advance new market expansion with local partners in Saudi Arabia and India • Accelerate US business development • Leverage American Robotics US footprint to penetrate public safety, smart city and O&G and other industrial markets • Expand sales teams and pre - sales activities with larger number of customers and ecosystem partners • Build inventory • Expect 10 new Optimus Systems to be manufactured and delivered by Q4 2023 • 15 systems are on order; additional inventory build expected for 2024

Nasdaq: ONDS • Ondas is beginning to monetize the significant investments in FullMAX (TM) and Optimus platforms • Activity with Siemens and Class I Rails highlights improved visibility around customer adoption and deployment timelines • Fleet deployments of Optimus demonstrate long - term leadership in massive markets; U.S. expansion opens huge market • Revenue growth and cost controls drive path to profitability • Continue to advance and define the solutions in the large markets we target Closing – Record Year Ahead 21 Leverage winner - take - most platforms

Q&A Second Quarter 2023 Earnings Release | August 2023 Copyright 2023. All rights reserved. Nasdaq : ONDS

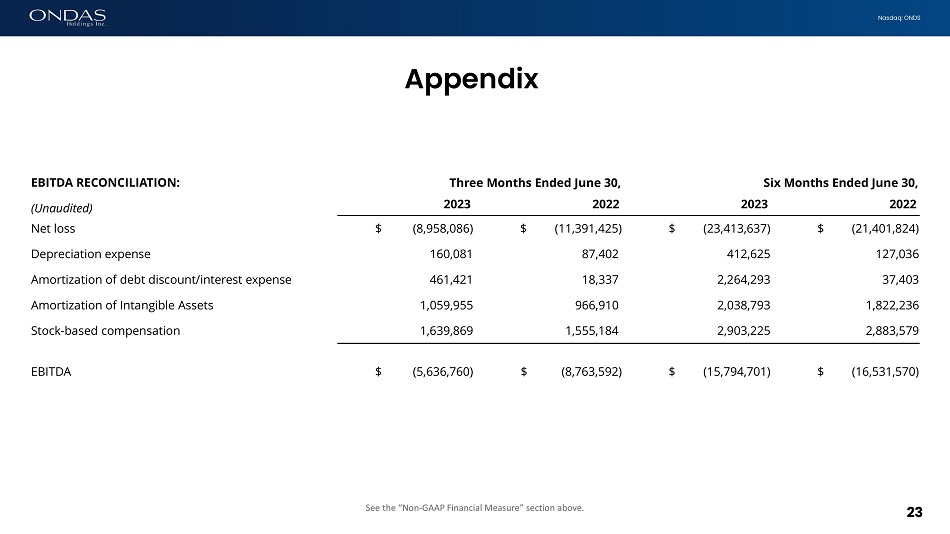

Nasdaq: ONDS Appendix 23 See the “Non - GAAP Financial Measure” section above. EBITDA RECONCILIATION: Three Months Ended June 30, Six Months Ended June 30, (Unaudited) 2023 2022 2023 2022 Net loss $ (8,958,086) $ (11,391,425) $ (23,413,637) $ (21,401,824) Depreciation expense 160,081 87,402 412,625 127,036 Amortization of debt discount/interest expense 461,421 18,337 2,264,293 37,403 Amortization of Intangible Assets 1,059,955 966,910 2,038,793 1,822,236 Stock - based compensation 1,639,869 1,555,184 2,903,225 2,883,579 EBITDA $ (5,636,760) $ (8,763,592) $ (15,794,701) $ (16,531,570)

Nasdaq: ONDS 24 Copyright 2023. All rights reserved. NASDAQ: ONDS | August 2023 THANK YOU