Exhibit 99.2

Third Quarter 2023 Earnings Release Copyright 2023. All rights reserved. NASDAQ: ONDS | November 2023

2 Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Disclaimer

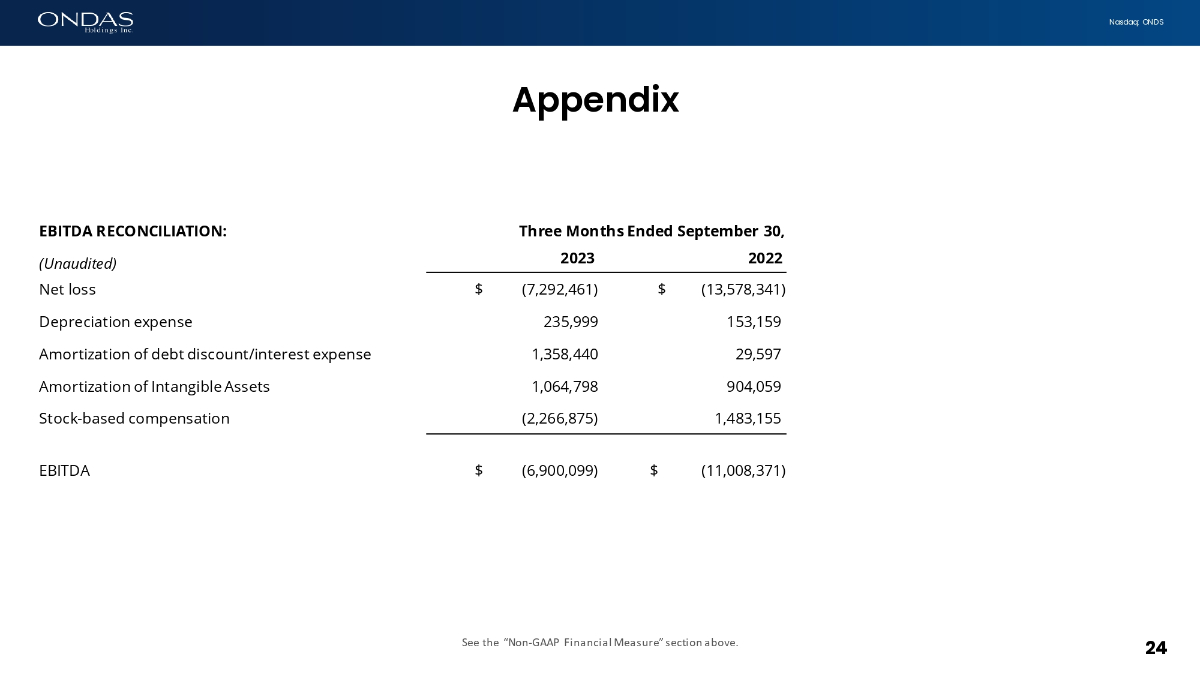

3 Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of EBITDA, the non - GAAP financial measure, contained in this presentation to the most directly comparable measure under GAAP, which reconciliation is set forth in the table included in the Appendix of this presentation . We believe that EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . EBITDA should only be used as supplemental measures of our operating performance . We believe that EBITDA improves comparability from period to period by removing the impact of our asset base (depreciation and amortization) and other adjustments as set out in the table included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . Management uses EBITDA in making financial, operating and planning decisions and evaluating the Company's ongoing performance . Non - GAAP Financial Measure

4 Nasdaq: ONDS Opening Remarks Tailwinds strengthening; value increasing

5 Nasdaq: ONDS Leadership Team MEIR KLINER PRESIDENT Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. STEWART KANTOR PRESIDENT & CFO Stewart brings over 20 years of experience in the wireless industry to Ondas Networks. TIM TENNE CEO Tim brings over 30 years of experience in military and commercial aerospace operations, regulatory, and leadership. ERIC BROCK CHAIRMAN, CEO & INTERIM CFO Eric is an entrepreneur with over 25 years of management and investing experience.

6 Nasdaq: ONDS Agenda Ondas on track for a breakout 2023 • Introduction • Financial Review & Outlook • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A

7 Nasdaq: ONDS Introduction Strong 2023 marks transition to platform adoption • $2.7M revenue delivered in Q3; $10.7M revenue year - to - date • Ondas Networks generated record $2.4 million revenue in Q3 • Strengthened balance sheet with $25M in growth capital raised from private and institutional investors • Field activity with Class I rails advanced ; pipeline is growing with 900 MHz migration deadlines nearing • Received Type Certificate from the FAA for our Optimus UAV; validates system quality and supports increased customer engagement • Iron Drone Raider development accelerated to meet IDF requirements • Appointed Tim Tenne new CEO of American Robotics to lead U.S. expansion • UAE governmental entity continues fleet expansion across Dubai for public safety operations 7

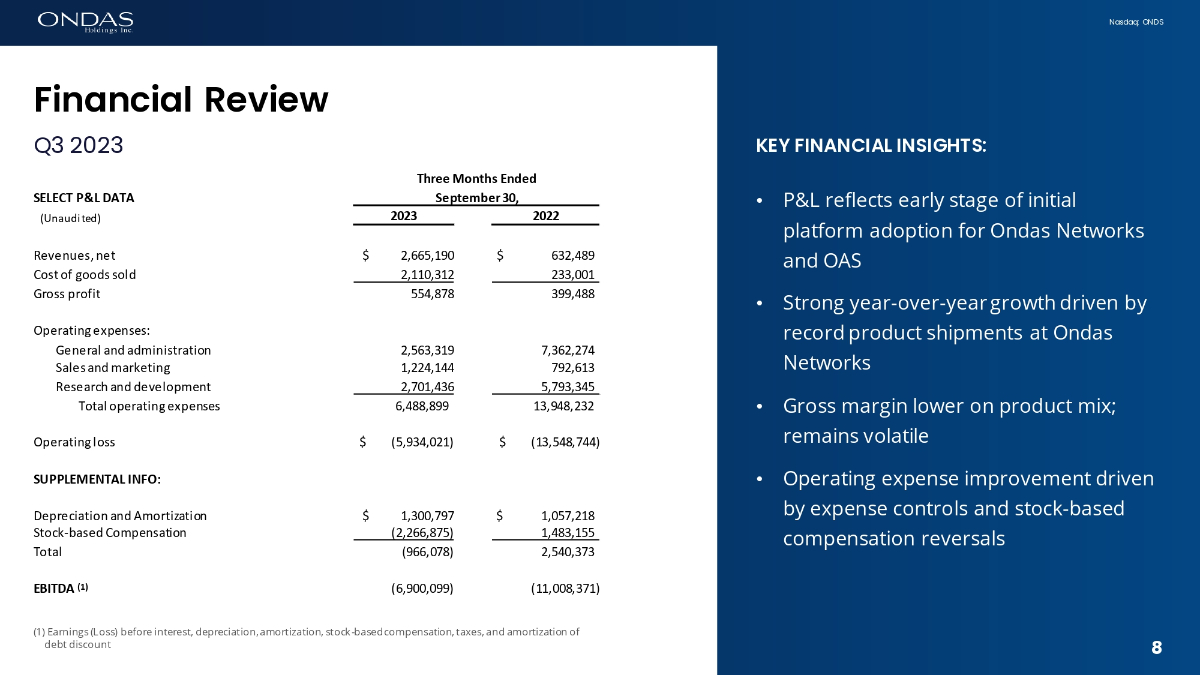

8 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • P&L reflects early stage of initial platform adoption for Ondas Networks and OAS • Strong year - over - year growth driven by record product shipments at Ondas Networks • Gross margin lower on product mix; remains volatile • Operating expense improvement driven by expense controls and stock - based compensation reversals (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, and amortization of debt discount Financial Review Q3 2023 8 Three Months Ended September 30, SELECT P&L DATA 2022 2023 (Unaudited) $ 632,489 $ 2,665,190 Revenues, net 233,001 2,110,312 Cost of goods sold 399,488 554,878 Gross profit Operating expenses: 7,362,274 2,563,319 General and administration 792,613 1,224,144 Sales and marketing 5,793,345 2,701,436 Research and development 13,948,232 6,488,899 Total operating expenses $ (13,548,744) $ (5,934,021) Operating loss SUPPLEMENTAL INFO: $ 1,057,218 $ 1,300,797 Depreciation and Amortization 1,483,155 (2,266,875) Stock - based Compensation 2,540,373 (966,078) Total (11,008,371) (6,900,099) EBITDA (1)

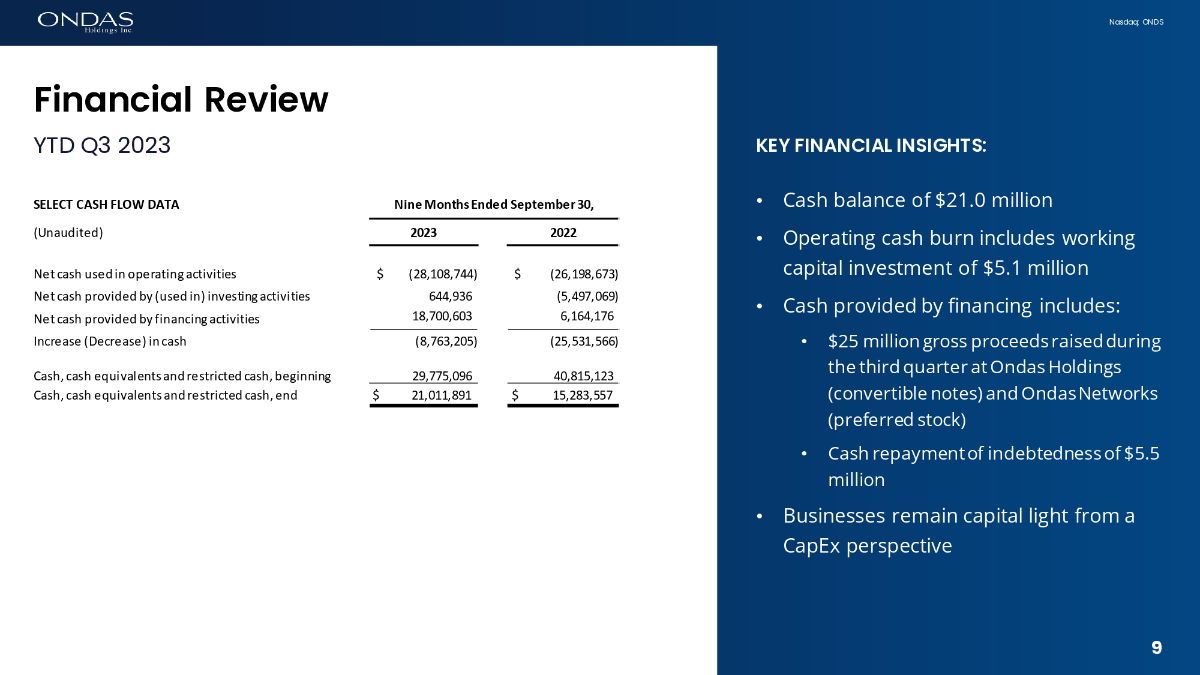

9 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Cash balance of $21.0 million • Operating cash burn includes working capital investment of $5.1 million • Cash provided by financing includes: • $25 million gross proceeds raised during the third quarter at Ondas Holdings (convertible notes) and Ondas Networks (preferred stock) • Cash repayment of indebtedness of $5.5 million • Businesses remain capital light from a CapEx perspective Financial Review YTD Q3 2023 9 Nine Months Ended September 30, SELECT CASH FLOW DATA 2022 2023 (Unaudited) $ (26,198,673) $ (28,108,744) Net cash used in operating activities (5,497,069) 644,936 Net cash provided by (used in) investing activities 6,164,176 18,700,603 Net cash provided by financing activities (25,531,566) (8,763,205) Increase (Decrease) in cash 40,815,123 29,775,096 Cash, cash equivalents and restricted cash, beginning $ 15,283,557 $ 21,011,891 Cash, cash equivalents and restricted cash, end

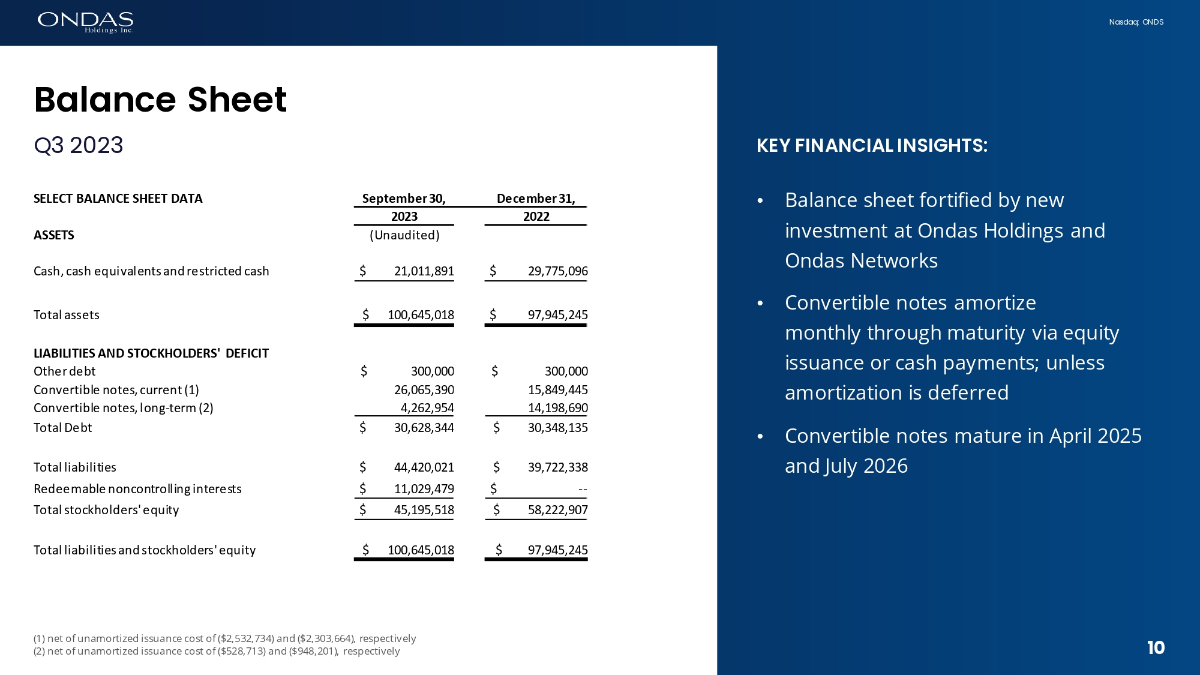

10 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Balance sheet fortified by new investment at Ondas Holdings and Ondas Networks • Convertible notes amortize monthly through maturity via equity issuance or cash payments; unless amortization is deferred • Convertible notes mature in April 2025 and July 2026 10 Balance Sheet Q3 2023 December 31, September 30, SELECT BALANCE SHEET DATA 2022 2023 (Unaudited) ASSETS $ 29,775,096 $ 21,011,891 Cash, cash equivalents and restricted cash $ 97,945,245 $ 100,645,018 Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT $ 300,000 $ 300,000 Other debt 15,849,445 26,065,390 Convertible notes, current (1) 14,198,690 4,262,954 Convertible notes, long - term (2) $ 30,348,135 $ 30,628,344 Total Debt $ 39,722,338 $ 44,420,021 Total liabilities $ - - $ 11,029,479 Redeemable noncontrolling interests $ 58,222,907 $ 45,195,518 Total stockholders' equity $ 97,945,245 $ 100,645,018 Total liabilities and stockholders' equity (1) net of unamortized issuance cost of ($2,532,734) and ($2,303,664), respectively (2) net of unamortized issuance cost of ($528,713) and ($948,201), respectively

Nasdaq: ONDS Financial Outlook Continue to see significant growth in 2024 and beyond • Maintain $15 million revenue target for full year 2023 • Expect ~ $4.2 – $4.4 million in revenue for Q4 2023 • OAS is on path to achieve original targets set at close of Airobotics acquisition in January • Continue to track volume orders at Ondas Networks; tracking new customer orders in OAS, both in the U.S. and in ROW • Continue to maintain tight cost controls with a focus on driving a path to profitability; expect cash operating expenses of $7.0 million in Q4 2023 • Significant revenue ramp still expected in 2024 and beyond for both business units 11

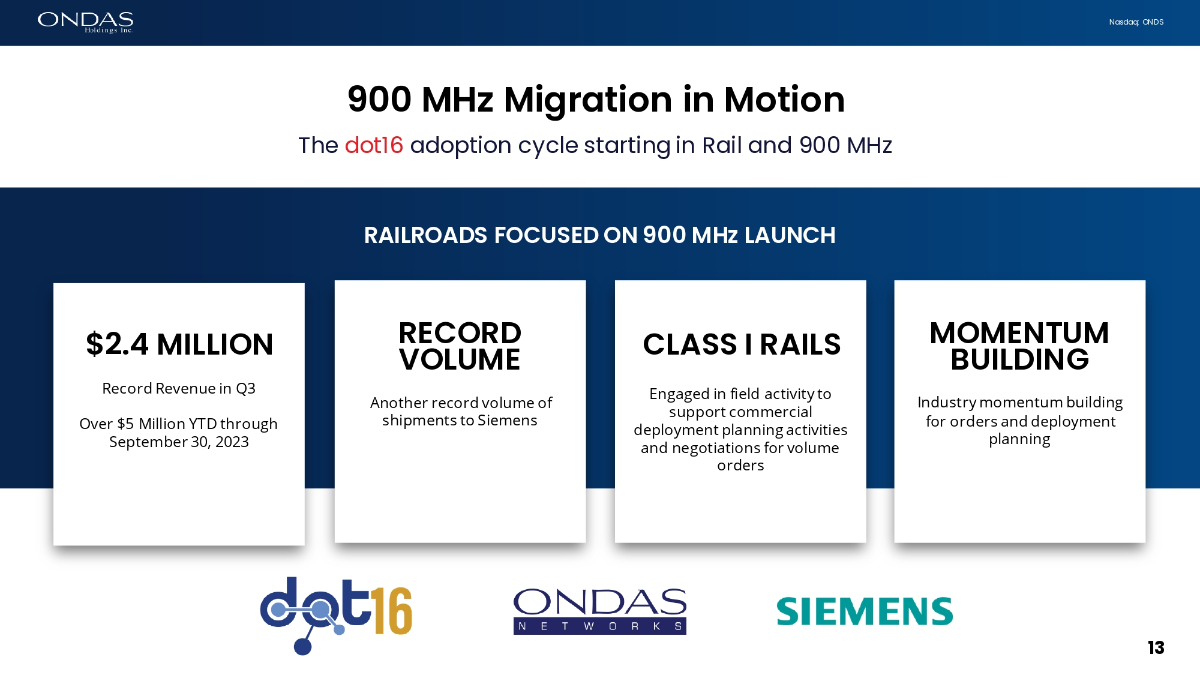

13 Nasdaq: ONDS RAILROADS FOCUSED ON 900 MHz LAUNCH $2.4 MILLION Record Revenue in Q3 Over $5 Million YTD through September 30, 2023 RECORD VOLUME Another record volume of shipments to Siemens CLASS I RAILS Engaged in field activity to support commercial deployment planning activities and negotiations for volume orders MOMENTUM BUILDING Industry momentum building for orders and deployment planning 900 MHz Migration in Motion The dot16 adoption cycle starting in Rail and 900 MHz

14 Nasdaq: ONDS Preparing for 900 MHz Upgrade 2025 deadlines support expected order ramp • Ondas and Siemens engaged in field and purchasing groups • Rail operations teams (e.g., C&S groups) with budgets and responsibility for network operations • Initial deployments focused on critical network and high traffic locations, as well as new “vital communications” end points such as railroad crossings • Siemens negotiating orders; pricing and deployment plans being outlined • MxV Rail continues to advance dot16 integration • Network controller development • Preparing new work on 160 MHz • Production capacity scaling • Recent financing provides working capital for inventory build • Transitioned to contract manufacturer to increase production capacity • Strong customer activity at RSSI show in Indianapolis in early October with new Transit engagement

15 Nasdaq: ONDS New photo Outlook for Ondas Networks Production ramp accelerates; tracking major orders for 900 MHz • Grow revenue and orders • Continue production capacity expansion in advance of expected volume orders • Secure major volume orders in Q4 2023; build inventory in front of 900 MHz migration • Continue product and network development • Siemens and Ondas field activity intensifying with increasing number of Class I Rails • Advancing product development programs; new opportunities emerge • Siemens UK for on - locomotive • Passenger and transit programs • Focus on cash efficiency; path to profitability • Revenue and gross profit to scale and increasingly offset OPEX • Maintain culture of strong cost controls 15

17 Nasdaq: ONDS Customer & Strategic Activity Laying foundation for global platform adoption and scaled operations • Business scaling globally on multiple continents • Fleet expansion in Dubai continues with $2.6 million order for immediate delivery of additional Optimus Drone Systems from a local governmental entity • Successfully completed landmark maritime safety proof - of - concept (PoC) of Optimus Infrastructure in Haifa port area in Israel • Announced Maghrebnet partnership in Morocco; continuation of partnership strategy enacted in Kingdom of Saudi Arabia & India • Continuing UAS and C - UAS Innovation • Received a grant of approximately $ 540 , 000 from the Israel Innovation Authority (IIA) to advance the Iron Drone Raider, an AI - driven counter - drone system

18 Nasdaq: ONDS Advancing Iron Drone Raider Demand for Counter - UAS solutions is accelerating • Advancing development of Iron Drone Raider for Israeli Defense Force (IDF) • Engaged with Israeli defense contractors to support integrated solution • Leveraging work connected to Israeli Innovation Authority grant received in August 2023 • Unique and proprietary C - UAS solution to neutralize hostile drone threats • Fully autonomous platform • Innovative, AI - driven capture capabilities • Large, growing market for Counter - UAS solutions • TAM estimated at $4.7 billion by 2030 (24.7% CAGR) by Market Future Research

19 Nasdaq: ONDS Customer & Strategic Activity Advancing Product & Customer Pipeline • Airobotics Optimus - 1EX drone FAA Type Certification secured; supports scaling with customers globally • Second sUAS to receive Type Certification for system; only certified drone platform designed for security and data collection use • Enables complex aerial missions over people, vehicles, and critical infrastructure accelerating and broadening market entry into the U.S. • Gaining traction in United States • Tim Tenne named American Robotics CEO to lead expansion plan • Commencing POC with MassDOT Aeronautical which includes Optimus System demonstrations at multiple locations • Advanced marketing and negotiations with additional customers to launch POCs for 2024 in industrial and government markets, including Rail, Utilities, O&G, and DOTs

20 Nasdaq: ONDS TIM TENNE – AMERICAN ROBOTICS CEO • Retired military officer, pilot, and commander • Led development of world's first FAA UAS/drone regulations • Experienced executive in multi - mode transportation (aviation, rail and transit) • Leadership positions at multiple commercial UAS companies • Over 15,000 flight hours; certified in multiple aircraft • Licensed attorney in multiple jurisdictions American Robotics Autonomous platforms drive growth opportunity • Best - in - class automated security and data solutions • Accurate, reliable, real - time security and data • Automation required to scale • Drive adoption of Optimus platform • Marketing and customer qualification in U.S. progressing • Leverage growing partnerships and technology ecosystem • Evolve into broader automated security and data solutions provider • Focus on broad UAS solutions for Industrial, public safety, and security use cases • Establish scalable operations and services division

21 Nasdaq: ONDS Outlook for OAS Revenue ramp continues; on track to achieve 2023 objectives • Grow revenue and orders • Continue to deliver on fleet deployments in UAE; expect to announce additional customer engagements in 2024 • Expect to announce additional milestones relating to U.S. expansion of Optimus • Accelerate U.S. business development • Leverage American Robotics U.S. footprint to penetrate public safety, smart city and O&G and other industrial markets • Expand sales teams and pre - sales activities with larger number of customers and ecosystem partners • Form strategic partnerships to provide full - spectrum drone hardware, services, and data integration • Build inventory • Expect 10 new Optimus Systems to be manufactured and delivered starting Q4 2023 into Q1 2024

22 Nasdaq: ONDS • Ondas is monetizing the significant investments in our FullMAX (TM) and Optimus platforms • Activity with Siemens and Class I Rails highlights improved visibility around customer adoption and deployment timelines • Fleet deployments of Optimus demonstrate long - term leadership in massive markets; U.S. expansion opens huge market • Revenue growth and cost controls drive path to profitability • Continue to advance and define the solutions in the large markets we target Wrapping up a Record Year Leverage winner - take - most platforms

Second Quarter 2023 Earnings Release | November 2023 Nasdaq : ONDS Q&A Copyright 2023. All rights reserved.

24 Nasdaq: ONDS See the “Non - GAAP Financial Measure” section above. Appendix Three Months Ended September 30, EBITDA RECONCILIATION: 2022 2023 (Unaudited) $ (13,578,341) $ (7,292,461) Net loss 153,159 235,999 Depreciation expense 29,597 1,358,440 Amortization of debt discount/interest expense 904,059 1,064,798 Amortization of Intangible Assets 1,483,155 (2,266,875) Stock - based compensation $ (11,008,371) $ (6,900,099) EBITDA

Nasdaq: ONDS 25 Copyright 2023. All rights reserved. NASDAQ: ONDS | November 2023 THANK YOU