Exhibit 99.2

Nasdaq : ONDS Fourth Quarter & Full Year 202 ʧ Earnings Release Copyright 2024. All rights reserved. NASDAQ: ONDS | April 1, 2024

2 Nasdaq: ONDS This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Holdings Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . Disclaimer

3 Nasdaq: ONDS Nasdaq : ONDS CHAIRMAN & CEO ERIC BROCK Eric is an entrepreneur with over 25 years of management and investing experience. CFO YISHAY CURELARU Yishay is an experienced financial executive with over 10 years experience with entrepreneurial growth companies. Leadership Team PRESIDENT MEIR KLINER Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing. PRESIDENT & COO GUY SIMPSON Guy joined Ondas Networks in 2010 bringing over 25 years of leadership, operations and engineering experience. CEO TIM TENNE Tim brings over 30 years of experience in military and commercial aerospace operations, regulatory, and leadership.

4 Nasdaq: ONDS Agenda Ondas on track to accelerate momentum in 2024 • Introduction • Financial Review & Outlook • Business Update • Ondas Networks • Ondas Autonomous Systems (OAS) • Closing Remarks • Q&A

5 Nasdaq: ONDS 5 Introduction Strengthening our business platform • Joe Popolo , CEO of Charles & Potomac Capital LLC joins Ondas Holdings Board of Directors • Largest single investor in the company • Experienced corporate executive; long history as operator and investor driving significant business growth and shareholder value creation • Incentives directly aligned with shareholders • Charles & Potomac led recently announced $8.6 million funding • In addition to leading $15 million funding at Ondas Networks in Q3 2023 • Established Ondas Autonomous Holdings Inc. (OAH) • Owns 100% of drone businesses (American Robotics & Airobotics) • Provides additional operational and financial flexibility supporting growth plan

6 Nasdaq: ONDS Overview 2023 was a breakout year for Ondas • Platform adoption drove significant revenue growth • Generated $15.7 million in revenue (more than 7 - fold growth YoY) • Ondas Networks generated $6.7 million of revenue • OAS generated $9.0 million of revenue • Ondas Networks growth driven by FCC 900 MHz mandate • Field activity with Class I rails advanced; ATCS and network integration advancing • Pipeline is growing with 900 MHz migration deadlines nearing • New Class I networks; new opportunities in passenger and transit emerging • OAS installing world's first autonomous drone fleets in cities • Groundbreaking Urban Drone Infrastructure fleet expansion begins in Dubai • Received FAA Type Certificate for our Optimus UAV; validates system quality and supports increased customer engagement • Built US leadership and launched expansion; MassDOT and others pending • Iron Drone Raider responding to urgent military and security needs

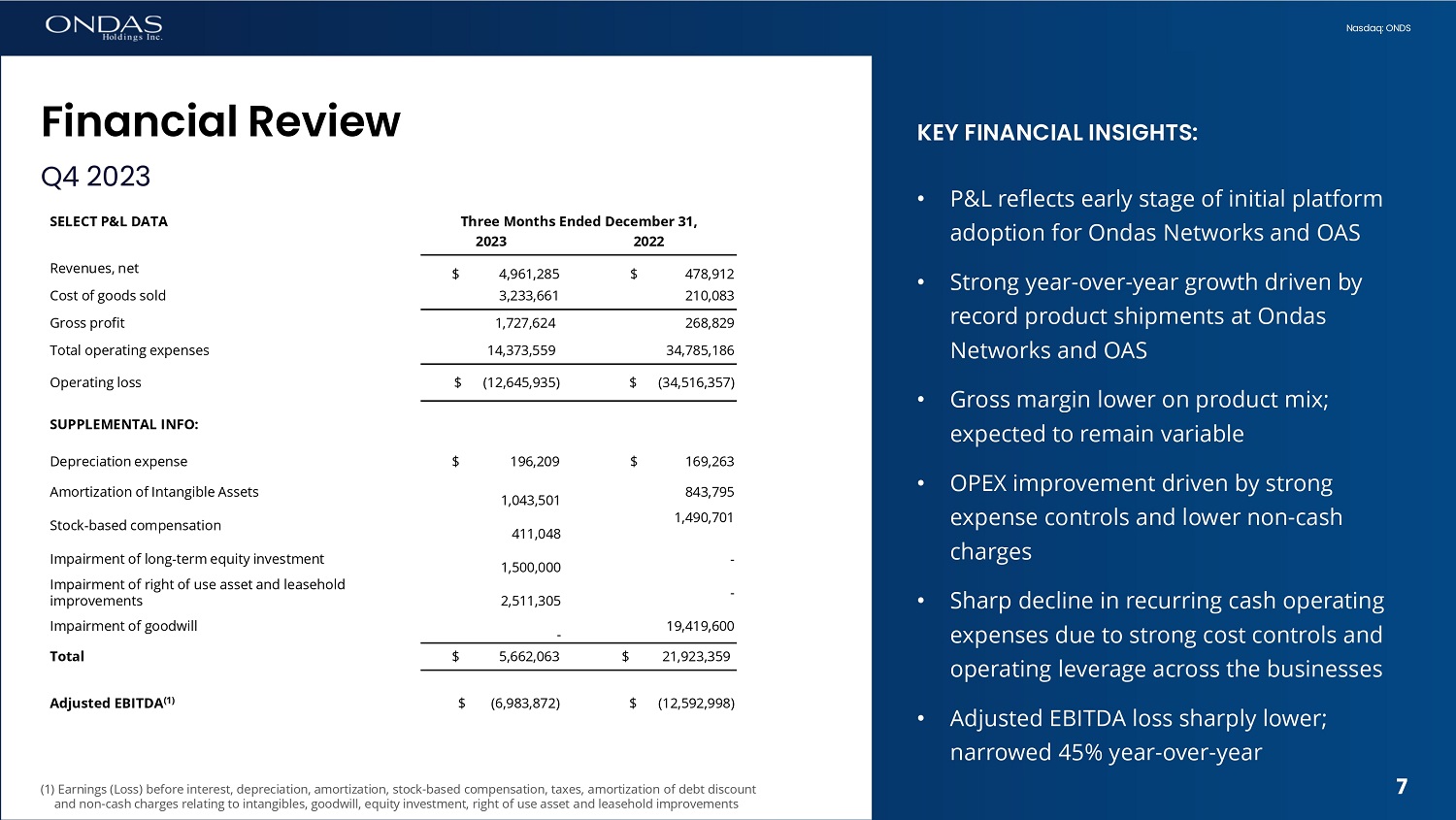

7 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • P&L reflects early stage of initial platform adoption for Ondas Networks and OAS • Strong year - over - year growth driven by record product shipments at Ondas Networks and OAS • Gross margin lower on product mix; expected to remain variable • OPEX improvement driven by strong expense controls and lower non - cash charges • Sharp decline in recurring cash operating expenses due to strong cost controls and operating leverage across the businesses • Adjusted EBITDA loss sharply lower; narrowed 45 % year - over - year (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, amortization of debt discount and non - cash charges relating to intangibles, goodwill, equity investment, right of use asset and leasehold improvements Financial Review Q4 2023 7 Three Months Ended December 31, SELECT P&L DATA 2022 2023 $ 478,912 $ 4,961,285 Revenues, net 210,08 3,233,661 Cost of goods sold 268,8 1,727,624 Gross profit 34,785,18 14,373,559 Total operating expenses $ (34,516,357) $ (12,645,935) Operating loss SUPPLEMENTAL INFO: $ 169,263 $ 196,209 Depreciation expense 843,795 1,043,501 Amortization of Intangible Assets 1,490,701 411,048 Stock - based compensation - 1,500,000 Impairment of long - term equity investment - 2,511,305 Impairment of right of use asset and leasehold improvements 19,419,600 - Impairment of goodwill $ 21,923,359 $ 5,662,063 Total $ (12,592,998) $ (6,983,872) Adjusted EBITDA (1)

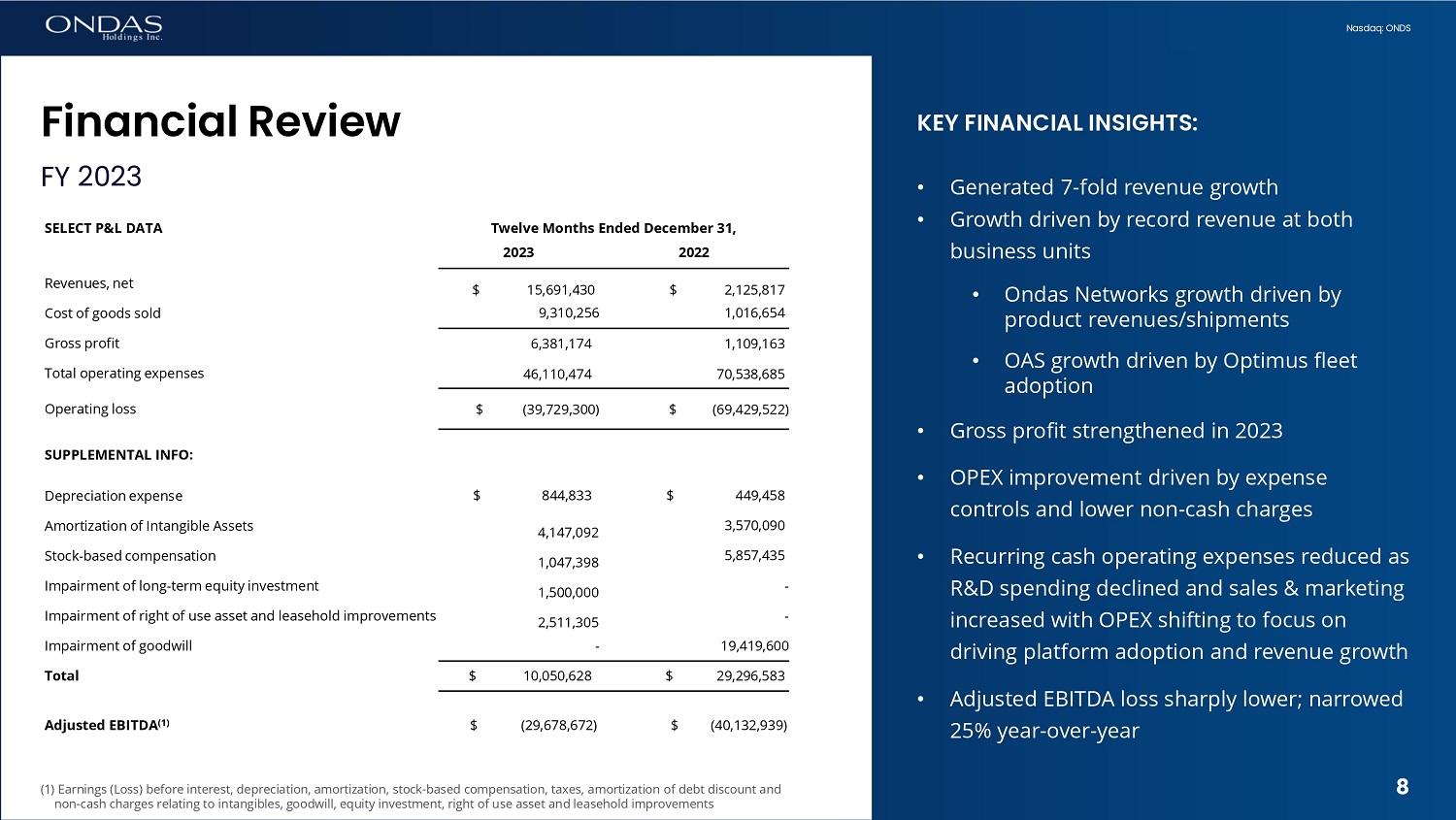

8 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Generated 7 - fold revenue growth • Growth driven by record revenue at both business units • Ondas Networks growth driven by product revenues/shipments • OAS growth driven by Optimus fleet adoption • Gross profit strengthened in 2023 • OPEX improvement driven by expense controls and lower non - cash charges • Recurring cash operating expenses reduced as R&D spending declined and sales & marketing increased with OPEX shifting to focus on driving platform adoption and revenue growth • Adjusted EBITDA loss sharply lower; narrowed 25% year - over - year (1) Earnings (Loss) before interest, depreciation, amortization, stock - based compensation, taxes, amortization of debt discount and non - cash charges relating to intangibles, goodwill, equity investment, right of use asset and leasehold improvements Financial Review FY 2023 8 Twelve Months Ended December 31, SELECT P&L DATA 2022 2023 $ 2,125,817 $ 15,691,430 Revenues, net 1,016,654 9,310,256 Cost of goods sold 1,109,163 6,381,174 Gross profit 70,538,685 46,110,474 Total operating expenses $ (69,429,522) $ (39,729,300) Operating loss SUPPLEMENTAL INFO: $ 449,458 $ 844,833 Depreciation expense 3,570,090 4,147,092 Amortization of Intangible Assets 5,857,435 1,047,398 Stock - based compensation - 1,500,000 Impairment of long - term equity investment - 2,511,305 Impairment of right of use asset and leasehold improvements 19,419,600 - Impairment of goodwill $ 29,296,583 $ 10,050,628 Total $ (40,132,939) $ (29,678,672) Adjusted EBITDA (1)

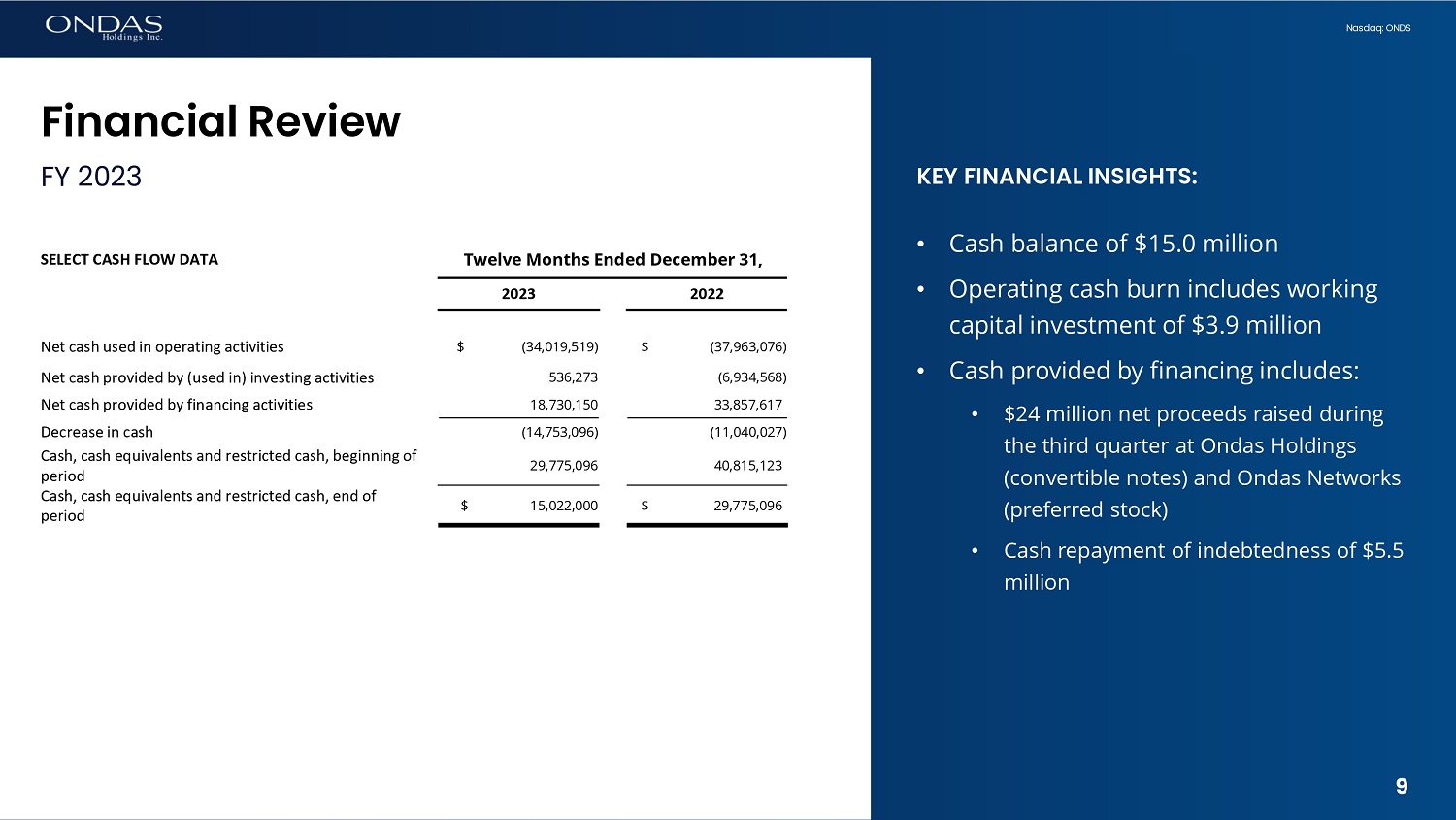

9 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • Cash balance of $15.0 million • Operating cash burn includes working capital investment of $3.9 million • Cash provided by financing includes: • $24 million net proceeds raised during the third quarter at Ondas Holdings (convertible notes) and Ondas Networks (preferred stock) • Cash repayment of indebtedness of $5.5 million Financial Review FY 2023 9 Twelve Months Ended December 31, SELECT CASH FLOW DATA 2022 2023 $ (37,963,076) $ (34,019,519) Net cash used in operating activities (6,934,568) 536,273 Net cash provided by (used in) investing activities 33,857,617 18,730,150 Net cash provided by financing activities (11,040,027) (14,753,096) Decrease in cash 40,815,123 29,775,096 Cash, cash equivalents and restricted cash, beginning of period $ 29,775,096 $ 15,022,000 Cash , cash equivalents and restricted cash , end of periodEB0

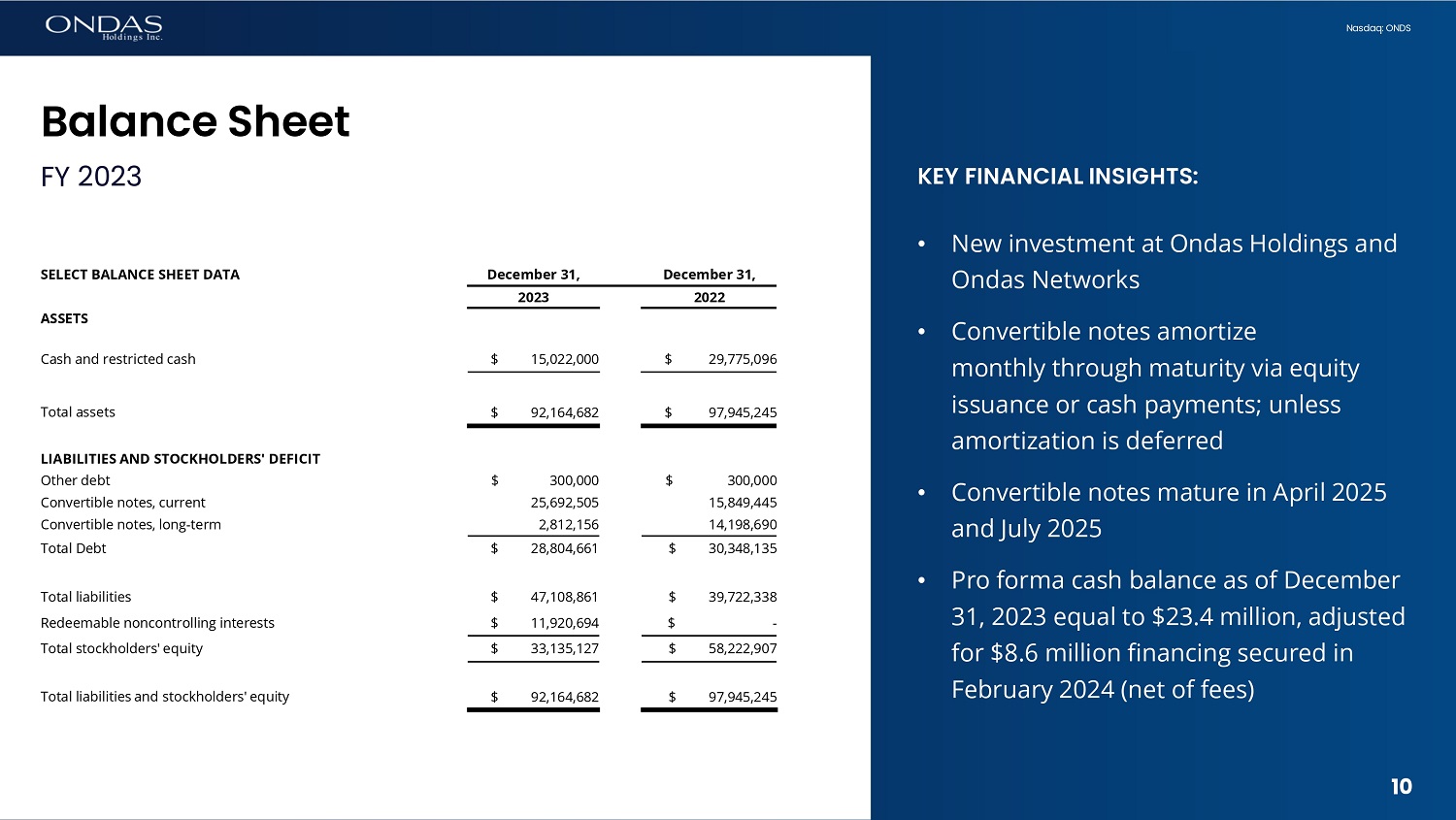

10 Nasdaq: ONDS KEY FINANCIAL INSIGHTS: • New investment at Ondas Holdings and Ondas Networks • Convertible notes amortize monthly through maturity via equity issuance or cash payments; unless amortization is deferred • Convertible notes mature in April 2025 and July 2025 • Pro forma cash balance as of December 31 , 2023 equal to $ million, adjusted for $ 8.6 million financing secured in February 2024 (net of fees) 10 Balance Sheet FY 2023 December 31, December 31, SELECT BALANCE SHEET DATA 2022 2023 ASSETS $ 29,775,096 $ 15,022,000 Cash and restricted cash $ 97,945,245 $ 92,164,682 Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT $ 300,000 $ 300,000 Other debt 15,849,445 25,692,505 Convertible notes, current 14,198,690 2,812,156 Convertible notes, long - term $ 30,348,135 $ 28,804,661 Total Debt $ 39,722,338 $ 47,108,861 Total liabilities $ - $ 11,920,694 Redeemable noncontrolling interests $ 58,222,907 $ 33,135,127 Total stockholders' equity $ 97,945,245 $ 92,164,682 Total liabilities and stockholders' equity

12 Nasdaq: ONDS • Appointed Guy Simpson President, in addition to his role as Chief Operating Officer • OPEX investments intently focused on driving our path to revenue growth and profitability • Greenfield 900 MHz network in late stages of ATCS and dot16 systems integration • Engaged with multiple rail customers on developing the final, scalable ATCS systems integration and network migration processes • Tracking commercial volume orders and deployments 12 Introduction Ondas Networks business focus moves squarely to platform adoption and service delivery

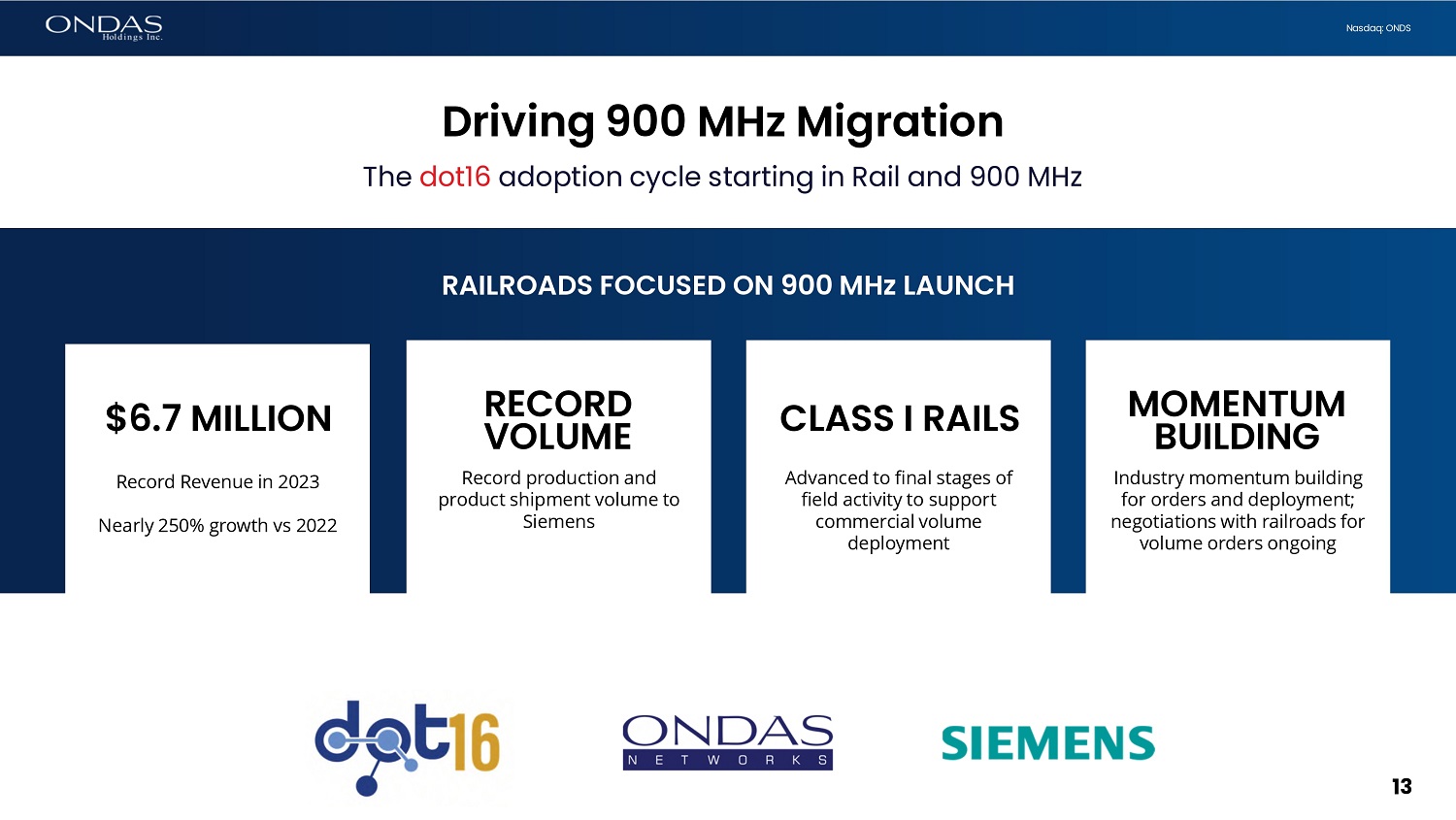

13 Nasdaq: ONDS Industry momentum building for orders and deployment; negotiations with railroads for volume orders ongoing Advanced to final stages of field activity to support commercial volume deployment Record production and product shipment volume to Siemens Record Revenue in 2023 Nearly 250 % growth vs 2022 RAILROADS FOCUSED ON 900 MHz LAUNCH $6.7 MILLION RECORD VOLUME CLASS I RAILS MOMENTUM BUILDING Driving 900 MHz Migration The dot16 adoption cycle starting in Rail and 900 MHz

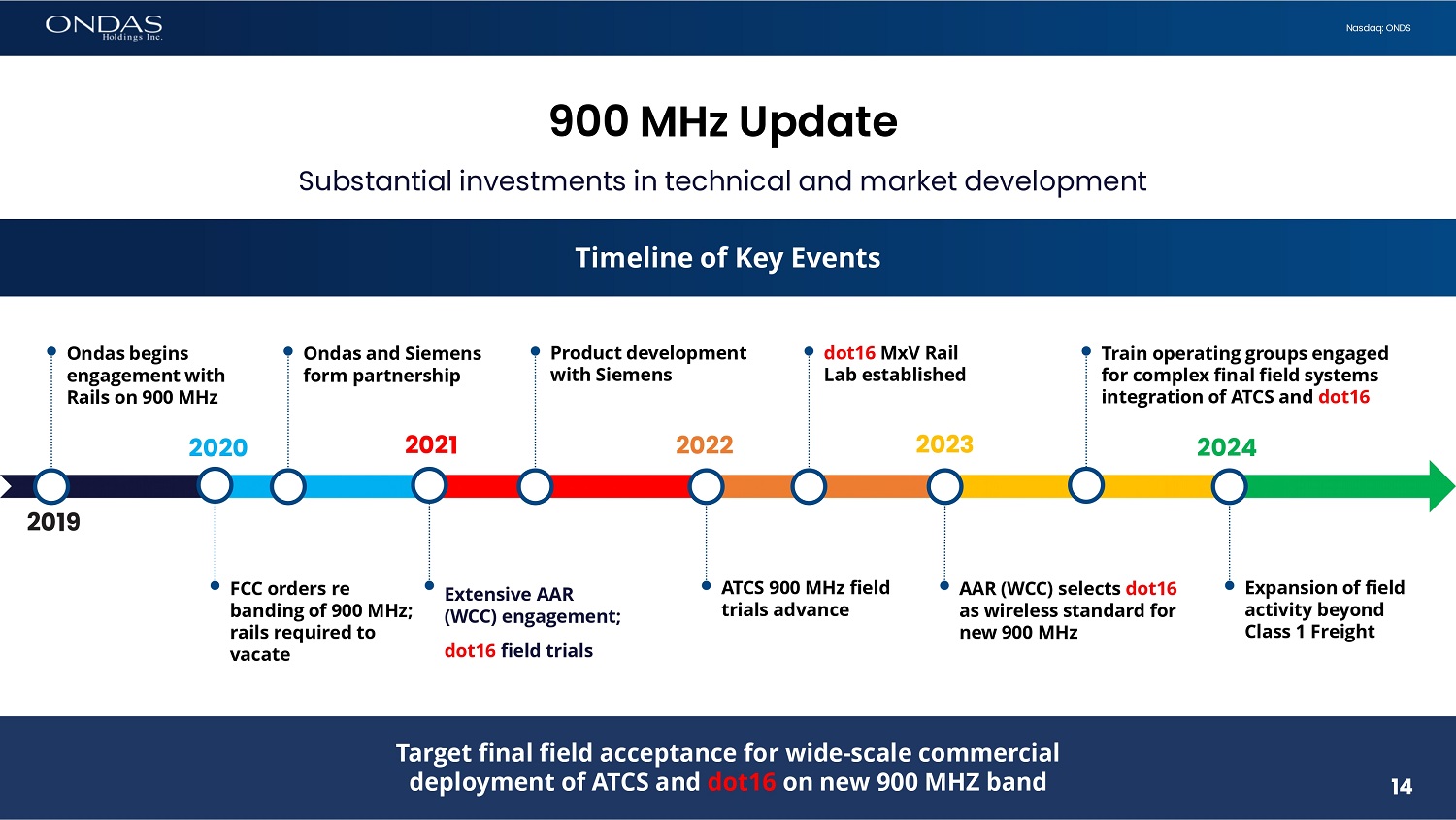

14 Nasdaq: ONDS 900 MHz Update Substantial investments in technical and market development Target final field acceptance for wide - scale commercial deployment of ATCS and dot16 on new 900 MHZ band 2020 2019 2023 2021 2024 2022 Ondas begins engagement with Rails on 900 MHz Ondas and Siemens form partnership FCC orders re banding of 900 MHz; rails required to vacate Train operating groups engaged for complex final field systems integration of ATCS and dot 16 Timeline of Key Events Extensive AAR (WCC) engagement; dot16 field trials AAR (WCC) selects dot16 as wireless standard for new 900 MHz Expansion of field activity beyond Class 1 Freight ATCS 900 MHz field trials advance Product development with Siemens 14 dot 16 MxV Rail Lab established

15 Nasdaq: ONDS 900 MHz – ATCS & dot16 2025 deadlines support expected order ramp • Ondas and Siemens engaged with final SYSTEM integration and migration activities • In late stages demonstrating the scalable processes related to ATCS systems integration and network migration to dot16 protocols • Addressing challenges to integrate applications with multiple legacy technologies in complex rail infrastructure systems all the way to back - office • Orders expected upon acceptance of ATCS and network integration • Initial orders for metropolitan rollout; broader system - wide to follow • Expect initial rail deployments are a catalyst for other Rails to engage on network planning and order • Commuter and transit customer are also engaged in field work/ order planning • Conversations with Railroads suggest FCC deadlines are in focus

16 Nasdaq: ONDS New photo Outlook for Ondas Networks Transition to orders, backlog and delivery for 900 MHz • Grow revenue and orders • Secure major volume orders in Q2 2024 • Grow order book and backlog through 2024 with more Rail customers • Drive broader adoption of dot16 platform / ecosystem • Accelerate field activity across Class I Rails with scalable ATCS and network migration processes • Expand training programs, field services and related revenue opportunities to support growth in orders and deployments • Continue wireless network leadership with AAR and partners • Siemens UK for on - locomotive • More MxV programs coming • Passenger and transit programs • Focus on cash efficiency; path to profitability 16

18 Nasdaq: ONDS Optimus Ascension Begins Record revenues during 2023 demonstrate strong product - market value for aerial security and data solutions • Strong market fit of Optimus Drone fleet is driving OAS growth • Optimus System fleet deployments, proof of value programs and system demonstrations continue to build awareness and: • Validate performance and reliability of smart drone network model • Prove use cases such as shortening of emergency response time for first responders • Demonstrate the disruptive potential to current security operations worldwide • Fleet expansion, led by UAE, is demonstrating global opportunity • Targeting huge global TAM for protection of critical infrastructure and services • Demand for smart drone network shared infrastructure driven via: • Public safety and DOTs • Ports and terminal operations, emergency response, reservoirs, large civil construction projects • Commercial and Industrial markets • DaaS business models are proven to be scalable; value of shared infrastructure demonstrated with customers 18

19 Nasdaq: ONDS Highlight: Dubai Emergency Response Optimus System highlighted in Dubai • Dubai governmental customer continues with fleet expansion • Ondas has delivered eight systems to customer through 2023 • Optimus System and its value in public safety highlighted at World Police Summit in March • Dubai governmental customer stated intention to deploy city - wide network • Customer highlighted that emergency responses time shortened to 70 seconds from 4 minutes pre - Optimus • Major public safety and security groups from the US and International markets received system demonstrations • Ondas targets expansion in UAE to civil and industrial infrastructure customers and use cases • Focus includes shared infrastructure deployment models with multiple customers • Leverage operations footprint for local and export opportunities from UAEEB0

20 Nasdaq: ONDS Iron Drone Raider Raider addresses urgent market need with high performance and unique capabilities • Accelerating commercialization of Iron - Drone Raider • Demand surging as defense and homeland security needs are transformed by the growing threat of hostile drones • Responding to urgent requirements of defense and security forces • Broadening Raider portfolio with new features • Leveraging work connected to Israeli Innovation Authority grant received in August 2023 • Developing global marketing plan • Initial market entry focused on defense and security markets in Israel • Exploring partnerships for distribution, systems integration • Developing plan for US defense and security market entry • Large TAM includes protection of critical industrial and civil infrastructure and sensitive public locations

21 Nasdaq: ONDS US Customer & Strategic Activity American Robotics – is built to scale in 2024 • Customer pipeline deepening and maturing • Focused on fleet opportunities and shared infrastructure models • Executed successful POV with MassDOT Aeronautical; included Optimus System demonstrations at multiple locations • Advanced marketing and negotiations with additional customers to launch programs for 2024; pipeline includes: • DOTs, Ports and Terminals, Public Safety • Rail, Utilities, O&G • Advancing operational capabilities • Expect inventory arrivals in Q2; supports increased installs • Plan to open a customer service center in Baltimore during Q2 • Developing Go - To - Market to introduce both Optimus and Iron Drone to US defense and security markets

22 Nasdaq: ONDS Highlight: MassDOT Aeronautics Successful proof of value program; exploring expansion opportunities • Completed successful MassDOT Aeronautics POV • Potential proven in multi - requirements domain • Maritime, Environmental, Safety, Security, Inspection • Advanced regulatory solutions for truly remote operations • Rapid autonomy enabled; AR received FAA BVLOS waiver • BVLOS waiver based on AR IP; USPTO patent submitted based on unique active/passive/data fusion for DAA (see - and - avoid) • Increased capabilities and solutions; Senhive partnership established; industry - leading passive C - UAS (Remote ID, ADS - B, AIS, Mode - S/C, and more) • Program validates large opportunity Departments of Transportation in US and worldwide • Established scalable aerial security and data solutions for protection of critical infrastructure and services • Supports expansion with other DOT agencies across the United States and globally • Developing maritime port autonomous framework

23 Nasdaq: ONDS Outlook for OAS Revenue ramp continues; on track to achieve 2024 objectives • Grow revenue and orders • Continue to deliver on fleet deployments in UAE • Secure additional fleet customers engagement in both US and international markets • Marketing team is now deployed in Europe • Accelerate U.S. business development • Leverage American Robotics U.S. footprint to penetrate DOTs, public safety, and critical industrial markets • Form strategic partnerships to provide full - spectrum drone capabilities and solution for defense, government, and commercial customers • Build and deliver inventory (supply will drive demand) • Production order expanded to 15 new Optimus Systems on order • Deliveries scheduled; inventory plan includes US demand • Preparing new production order for 2H 2024 to satisfy expected demand • Iron drone production capability being established in parallel

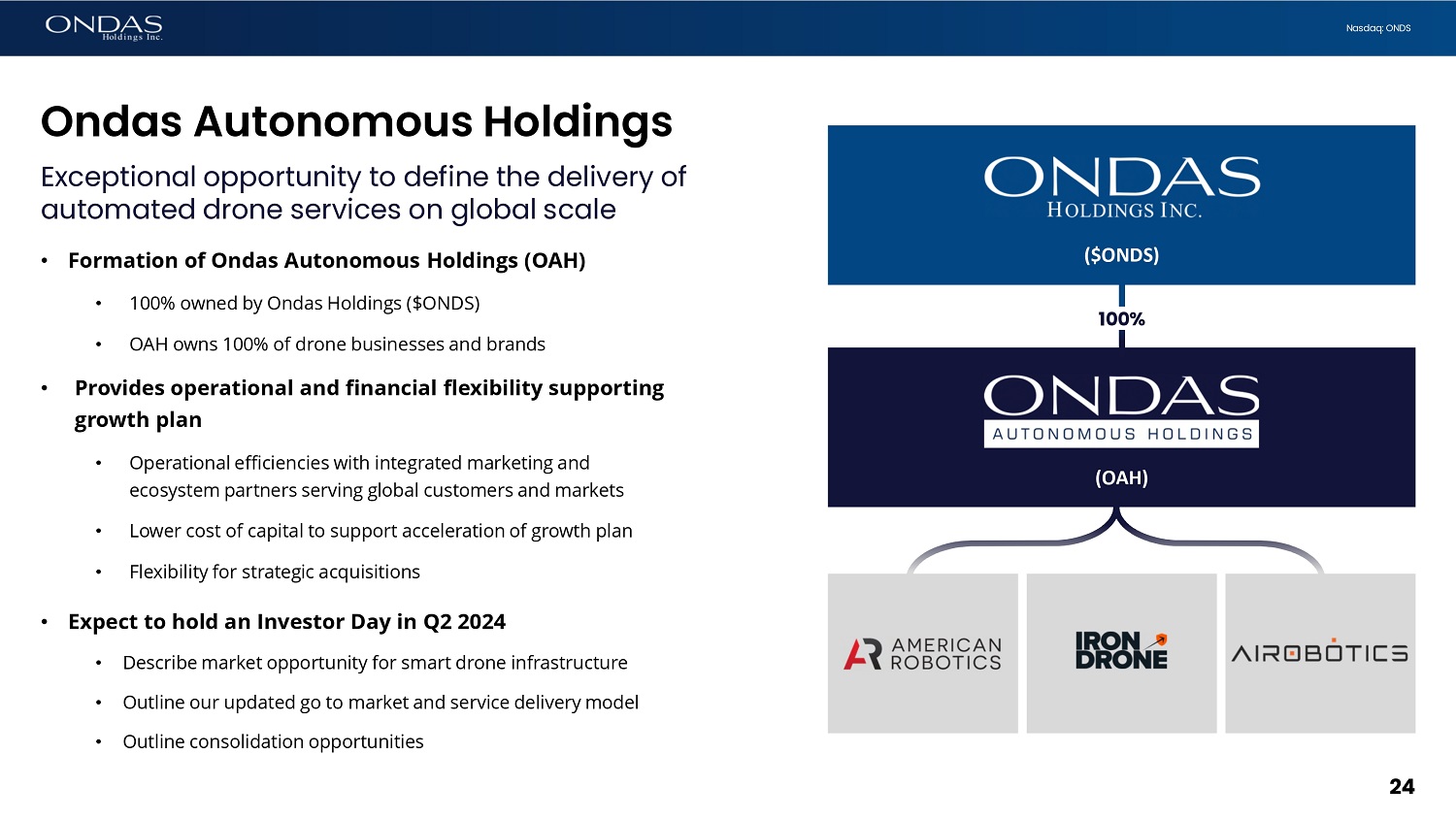

24 Nasdaq: ONDS Ondas Autonomous Holdings Exceptional opportunity to define the delivery of automated drone services on global scale • Formation of Ondas Autonomous Holdings (OAH) • 100% owned by Ondas Holdings ($ONDS) • OAH owns 100% of drone businesses and brands • Provides operational and financial flexibility supporting growth plan • Operational efficiencies with integrated marketing and ecosystem partners serving global customers and markets • Lower cost of capital to support acceleration of growth plan • Flexibility for strategic acquisitions • Expect to hold an Investor Day in Q2 2024 • Describe market opportunity for smart drone infrastructure • Outline our updated go to market and service delivery model • Outline consolidation opportunities (OAH) ($ONDS) 100%PG0

25 Nasdaq: ONDS • Expect significant revenue growth in both Ondas Networks and OAS • Targeting orders on 900 MHz with Class Is • Inventory delivery drives new customer announcements • Visibility limited in early 2024 • Focus on operation scale to drive cost efficiencies and path to improved cash flow and profitability • Upcoming milestones: • Ondas Networks • Initial commercial order on 900 MHz • New customer, network announcements • Ondas Autonomous Systems • Secure new strategic customer engagements • Update on Iron Drone commercialization activities Outlook 2024 Focus on deployments and operational scale DM0

Fourth Quarter & Full Year 2024 Earnings Release NASDAQ: ONDS | April 1, 2024 Q&A Copyright 2024. All rights reserved.

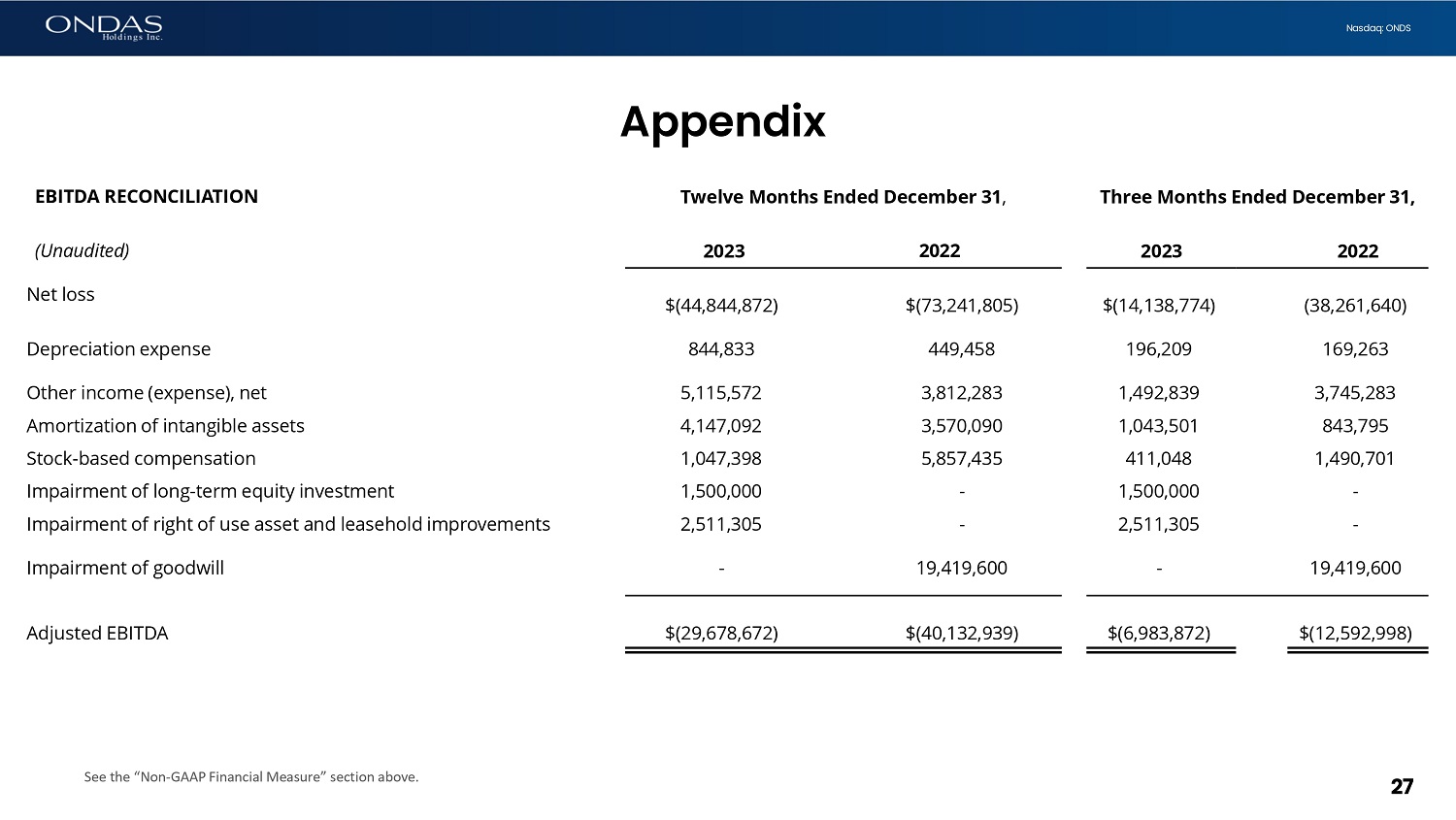

27 Nasdaq: ONDS Three Months Ended December 31, ௗ Twelve Months Ended December 31 , ௗ EBITDA RECONCILIATION 2022 ௗ 2023 ௗ 2022 2023 ௗ (Unaudited) (38,261,640) ௗ $(14,138,774) ௗ $(73,241,805) $(44,844,872) Net loss 169,263 ௗ 196,209 ௗ 449,458 ௗ 844,833 Depreciation expense 3,745,283 1,492,839 3,812,283 5,115,572 Other income (expense), net 843,795 1,043,501 3,570,090 4,147,092 Amortization of intangible assets 1,490,701 411,048 5,857,435 1,047,398 Stock - based compensation - 1,500,000 - 1,500,000 Impairment of long - term equity investment - 2,511,305 - 2,511,305 Impairment of right of use asset and leasehold improvements 19,419,600 ௗ - ௗ 19,419,600 ௗ - Impairment of goodwill $(12,592,998) ௗ $(6,983,872) ௗ $(40,132,939) $(29,678,672) Adjusted EBITDA See the “Non - GAAP Financial Measure” section above. Appendix

28 Nasdaq: ONDS As required by the rules of the Securities and Exchange Commission (“SEC”), we provide a reconciliation of EBITDA, the non - GAAP financial measure, contained in this presentation to the most directly comparable measure under GAAP, which reconciliation is set forth in the table included in the Appendix of this presentation . We believe that EBITDA facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses . Other companies may calculate EBITDA differently, and therefore our measures may not be comparable to similarly titled measures used by other companies . EBITDA should only be used as supplemental measures of our operating performance . We believe that EBITDA improves comparability from period to period by removing the impact of our asset base (depreciation and amortization) and other adjustments as set out in the table included in the Appendix of this presentation, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses . Management uses EBITDA in making financial, operating and planning decisions and evaluating the Company's ongoing performance . Non - GAAP Financial Measure

Nasdaq: ONDS 29 Nasdaq : ONDS Copyright 2024. All rights reserved. NASDAQ: ONDS | April 1, 2024 THANK YOU