Exhibit 99.1

Copyright 2026. All rights reserved. NASDAQ: ONDS | January 2026 OAS INVESTOR DAY 2026

Nasdaq: ONDS 2 This presentation may contain "forward - looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning . Ondas Inc . (“Ondas” or the “Company”) cautions readers that forward - looking statements are predictions based on its current expectations about future events . These forward - looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict . The Company’s actual results, performance, or achievements could differ materially from those expressed or implied by the forward - looking statements as a result of a number of factors, including, the risks discussed under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10 - K filed with the U . S . Securities and Exchange Commission (“SEC”), in the Company’s Quarterly Reports on Form 10 - Q filed with the SEC, and in the Company’s other filings with the SEC . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law . This presentation also contains estimates and other information concerning our industry that are based on industry publications, surveys and forecasts . This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information . Information in this presentation is not an offer to sell securities or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction . Non - GAAP Financial Measures We believe that earnings before interest, taxes, depreciation and amortization (“EBITDA”) and EBITDA margin, the non - GAAP financial measures contained in this presentation, facilitate analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, the Company’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may these non - GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies EBITDA and EBITDA margin should only be used as supplemental measures of our operating performance. We believe that EBITDA and EBITDA margin improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. Management uses EBITDA and EBITDA margin in making financial, operating and planning decisions and evaluating the Company's ongoing performance. With respect to our financial target for 2030 EBITDA margin a reconciliation of this non - GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non - GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward - looking statement of income prepared in accordance with GAAP, that would be required to produce such a reconciliation. Discl6imer

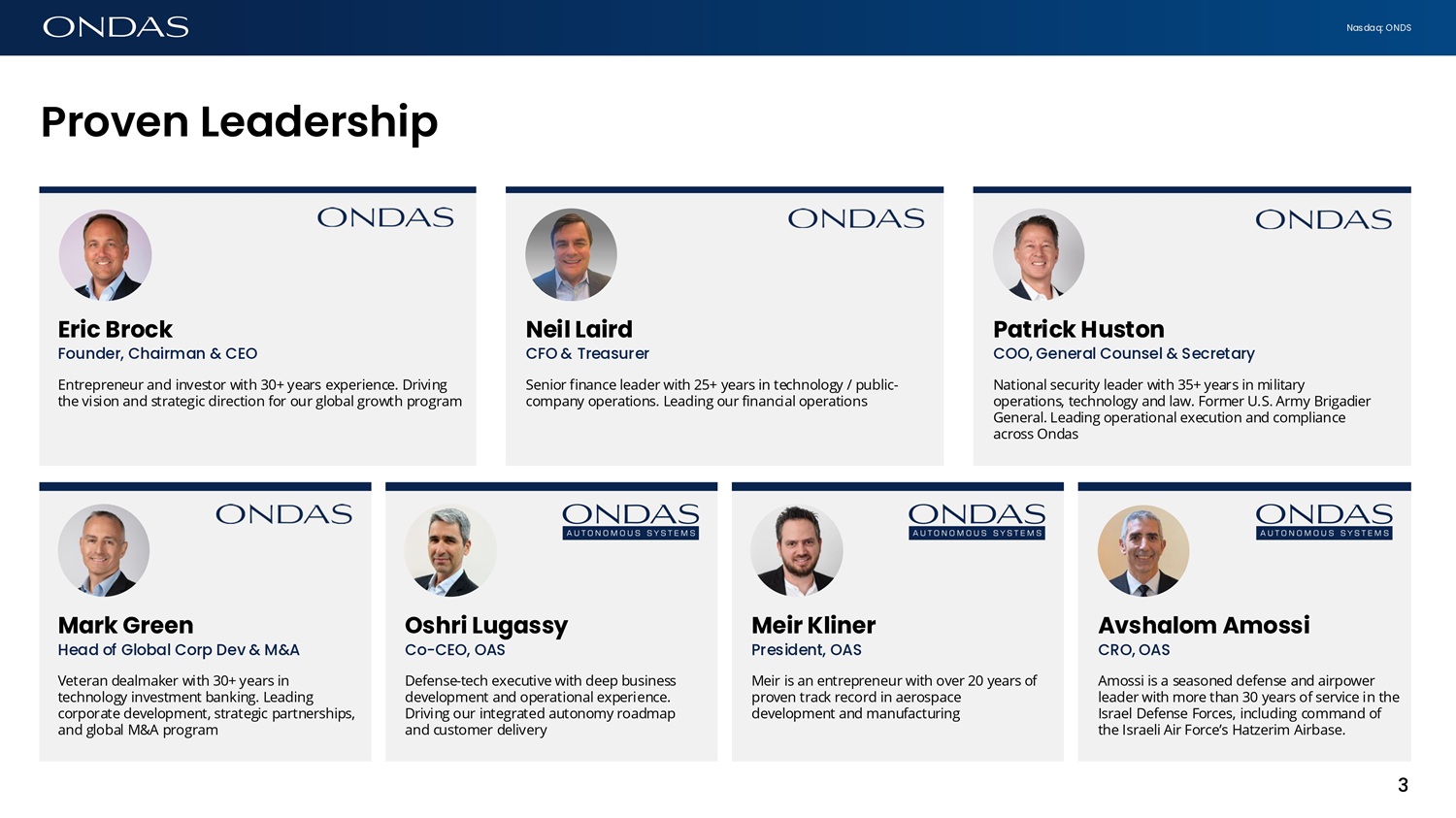

Nasdaq: ONDS Provefi Le6dership Mark Green Head of Global Corp Dev & M&A Veteran dealmaker with 30+ years in technology investment banking. Leading corporate development, strategic partnerships, and global M&A program Patrick Huston COO, General Counsel & Secretary National security leader with 35+ years in military operations, technology and law. Former U.S. Army Brigadier General. Leading operational execution and compliance across Ondas Eric Brock Founder, Chairman & CEO Entrepreneur and investor with 30+ years experience. Driving the vision and strategic direction for our global growth program Neil Laird CFO & Treasurer Senior finance leader with 25+ years in technology / public - company operations. Leading our financial operations Oshri Lugassy Co - CEO, OAS Defense - tech executive with deep business development and operational experience. Driving our integrated autonomy roadmap and customer delivery Meir Kliner President, OAS Meir is an entrepreneur with over 20 years of proven track record in aerospace development and manufacturing Avshalom Amossi CRO, OAS Amossi is a seasoned defense and airpower leader with more than 30 years of service in the Israel Defense Forces, including command of the Israeli Air Force’s Hatzerim Airbase. 3

Nasdaq: ONDS INTEGRATED AUTONOMY D E F E N S E . S E C U R I T Y . I N T E L L I G E N C E . 4 4

Nasdaq: ONDS • Introduction • Technology & Capabilities • Go to Market / Operating Platform • Business Development Update • Strategic Growth Program • Ondas Capital • Financial Outlook • Investor Q&A 5 Agefid6

Nasdaq: ONDS 6 Tr6fisform6tiofi L6ufiched ifi 2025 Advanced our Core + Strategic growth plan DELIVERED ON OUR CORE + STRATEGIC GROWTH PLAN • Evolved OAS into multi - domain autonomy platform • Delivered record revenue growth exceeding targets and business development objectives • Invested ahead of long - term growth to build operating leverage • Launched and executed accretive investment and acquisition program • Strengthened competitive position via balance sheet strength Leading security, data and information services solution for military and commercial security markets Glob6l le6der ifi hyper - growth robotics 6fid 6utofiomous systems m6rket 6

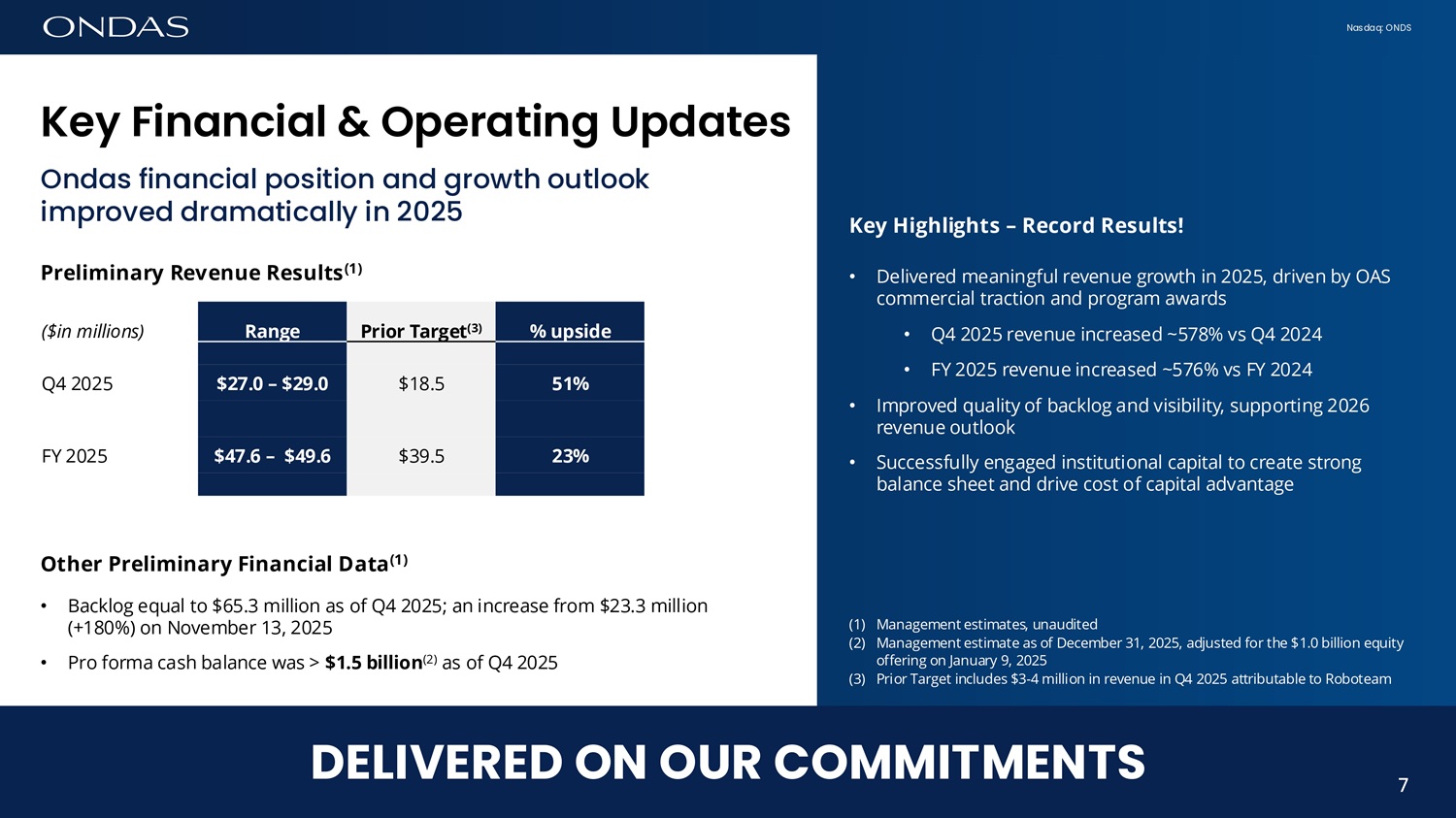

Nasdaq: ONDS Key Highlights – Record Results! • Delivered meaningful revenue growth in 2025, driven by OAS commercial traction and program awards • Q4 2025 revenue increased ~578% vs Q4 2024 • FY 2025 revenue increased ~576% vs FY 2024 • Improved quality of backlog and visibility, supporting 2026 revenue outlook • Successfully engaged institutional capital to create strong balance sheet and drive cost of capital advantage 7 DELIVERED ON OUR COMMITMENTS 7 % upside Prior Target (3) Range ($in millions) 51% $18.5 $27.0 – $29.0 Q4 2025 23% $39.5 $47.6 – $49.6 FY 2025 Other Preliminary Financial Data (1) • Backlog equal to $65.3 million as of Q4 2025; an increase from $23.3 million (+180%) on November 13, 2025 • Pro forma cash balance was > $1.5 billion (2) as of Q4 2025 (1) Management estimates, unaudited (2) Management estimate as of December 31, 2025, adjusted for the $1.0 billion equity offering on January 9, 2025 (3) Prior Target includes $3 - 4 million in revenue in Q4 2025 attributable to Roboteam Key Fifi6fici6l & Oper6tifig Upd6tes Ondas financial position and growth outlook improved dramatically in 2025 Preliminary Revenue Results (1)

Nasdaq: ONDS 2026 Revenue Target $170 – $180 million (prior target $140 million) (1) Outlook Expect significant growth supported by investments and significant market tailwinds • Expect exceptional growth within core platforms driven by • Category leadership in CUAS, ISR and UGV markets • Underlying strong adoption trends in end markets • Leveraging investments in OAS operating platform • Further potential upside: • Target markets entering significant growth curves • Large new multi - year programs being pursued • Government - to - government (G2G) programs • Execution of robust strategic investment and acquisition pipeline (1) Prior target includes $30 million attributable to Roboteam 8 ONDAS TO ACCELERATE GROWTH IN 2026 8

Nasdaq: ONDS ACCELERATE Team Supply chain Customer delivery Strategic program Ecosystem Scale C6pit6lized to Wifi What is Ondas going to do with all that cash? • Massive cash balance ~ $1.5 (1) billion + potential ~$4.9 billion from OTM warrants with strike prices of $20 and $28 • Access to large amounts of low - cost capital is a differentiator in a capital constrained sector in need of growth capital and scale • Ondas’ balance sheet is a significant competitive advantage in a high growth, consolidating sector • Customers prefer well - funded vendors • Ecosystem prefers well - funded partners • Talent prefers well - funded employers • What do we do? • USE THE CAPITAL FOR GOOD! • Invest to drive Core + Strategic growth program (1) Management estimate as of December 31, 2025, adjusted for the $1.0 billion equity offering on January 9, 2025 9 INVEST TO ACCELERATE GROWTH 9

Nasdaq: ONDS Focus ofi Sc6l6bility Executing business plan to scale across all key functions to support high growth, value for customers and high returns for investors MARKETS | CUSTOMERS Defense, homeland security, public safety, critical infrastructure and industrial OPERATING PLATFORM Sales and Marketing, Supply Chain, Production, Regulations, Field Services & Sustainment, Finance & Administration, Legal, & Gov’t FINANCIAL PLATFORM Access to Capital, FCF Reinvestment, Capital Allocation 10 10 TECHNOLOGY CAPABILITIES CUAS, ISR, UGV, C2 + AI and Strategic Roadmap “Our opportunity is to expand Ondas’ operating model; thereby capturing the rewards from meeting the market requirement for a scaled provider of critical defense and security capabilities.” - Eric Brock, CEO

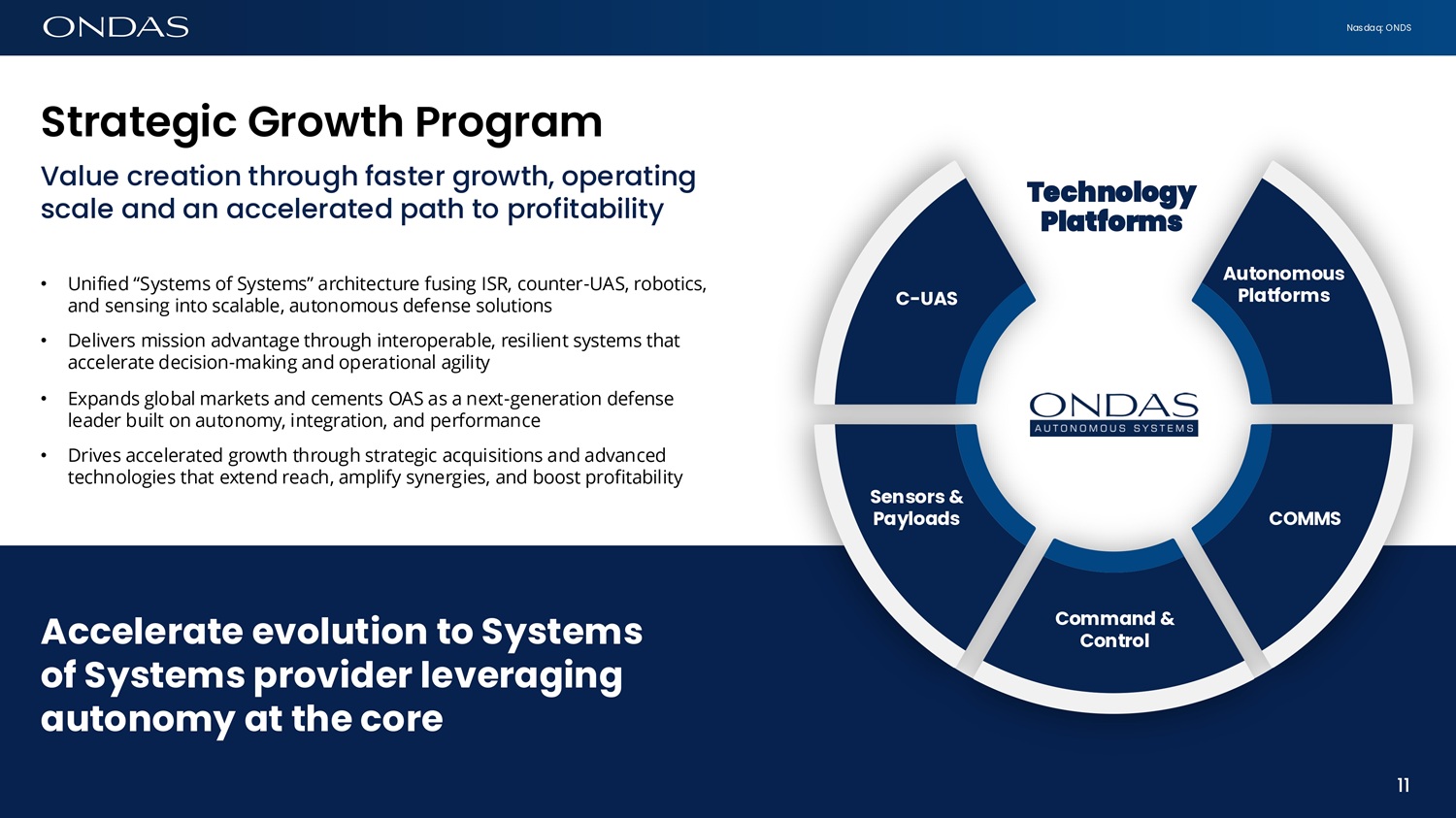

Nasdaq: ONDS Str6tegic Growth Progr6m Value creation through faster growth, operating scale and an accelerated path to profitability Command & Control Sensors & Payloads Autonomous Platforms COMMS C - UAS Technology Platforms 11 • Unified “Systems of Systems” architecture fusing ISR, counter - UAS, robotics, and sensing into scalable, autonomous defense solutions • Delivers mission advantage through interoperable, resilient systems that accelerate decision - making and operational agility • Expands global markets and cements OAS as a next - generation defense leader built on autonomy, integration, and performance • Drives accelerated growth through strategic acquisitions and advanced technologies that extend reach, amplify synergies, and boost profitability Accelerate evolution to Systems of Systems provider leveraging autonomy at the core

Nasdaq: ONDS TECHNOLOGY & CAPABILITIES

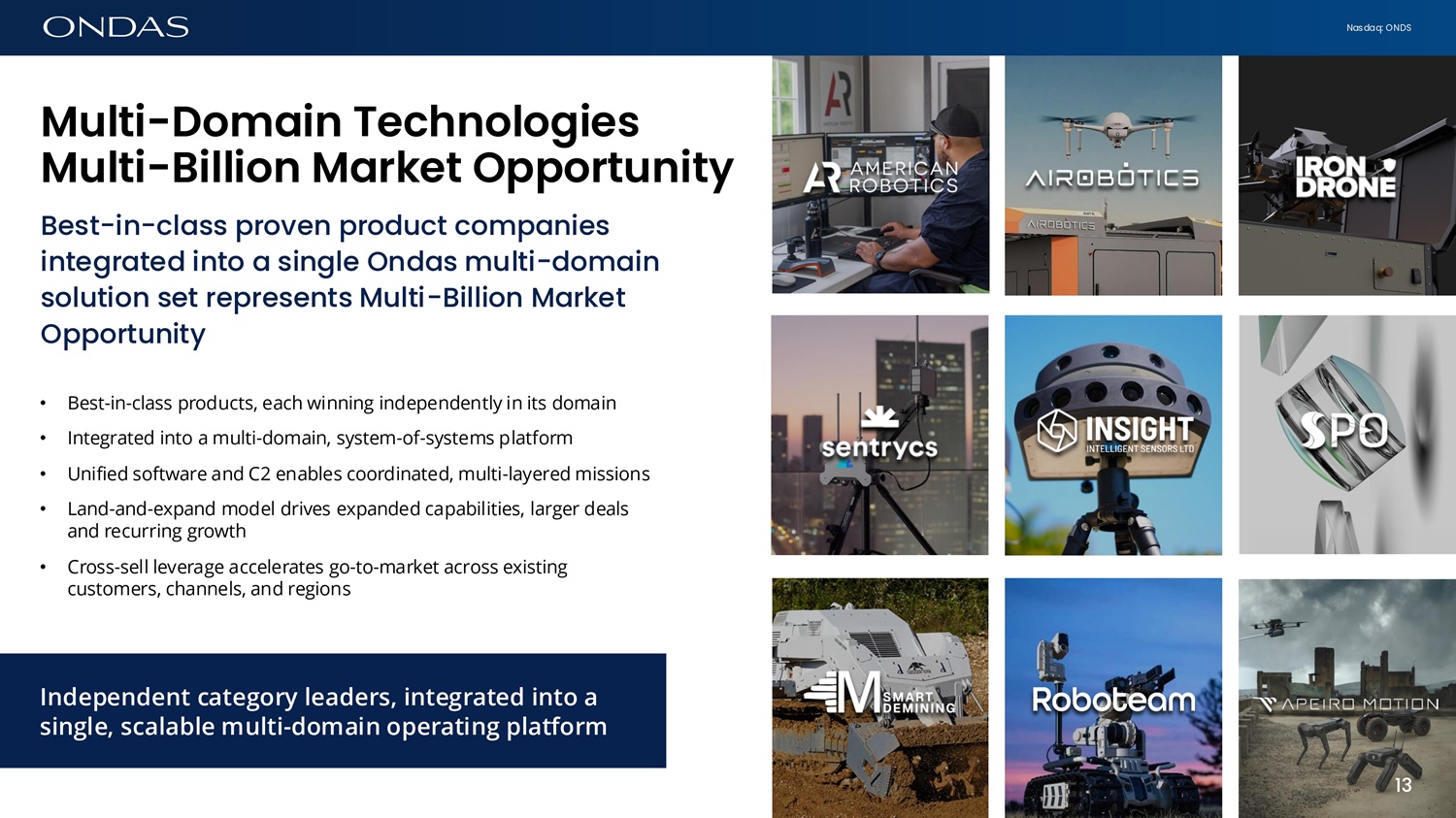

Nasdaq: ONDS 13 Multi - Dom6ifi Techfiologies Multi - Billiofi M6rket Opportufiity Best - in - class proven product companies integrated into a single Ondas multi - domain solution set represents Multi - Billion Market Opportunity • Best - in - class products, each winning independently in its domain • Integrated into a multi - domain, system - of - systems platform • Unified software and C2 enables coordinated, multi - layered missions • Land - and - expand model drives expanded capabilities, larger deals and recurring growth • Cross - sell leverage accelerates go - to - market across existing customers, channels, and regions Independent category leaders, integrated into a single, scalable multi - domain operating platform 13

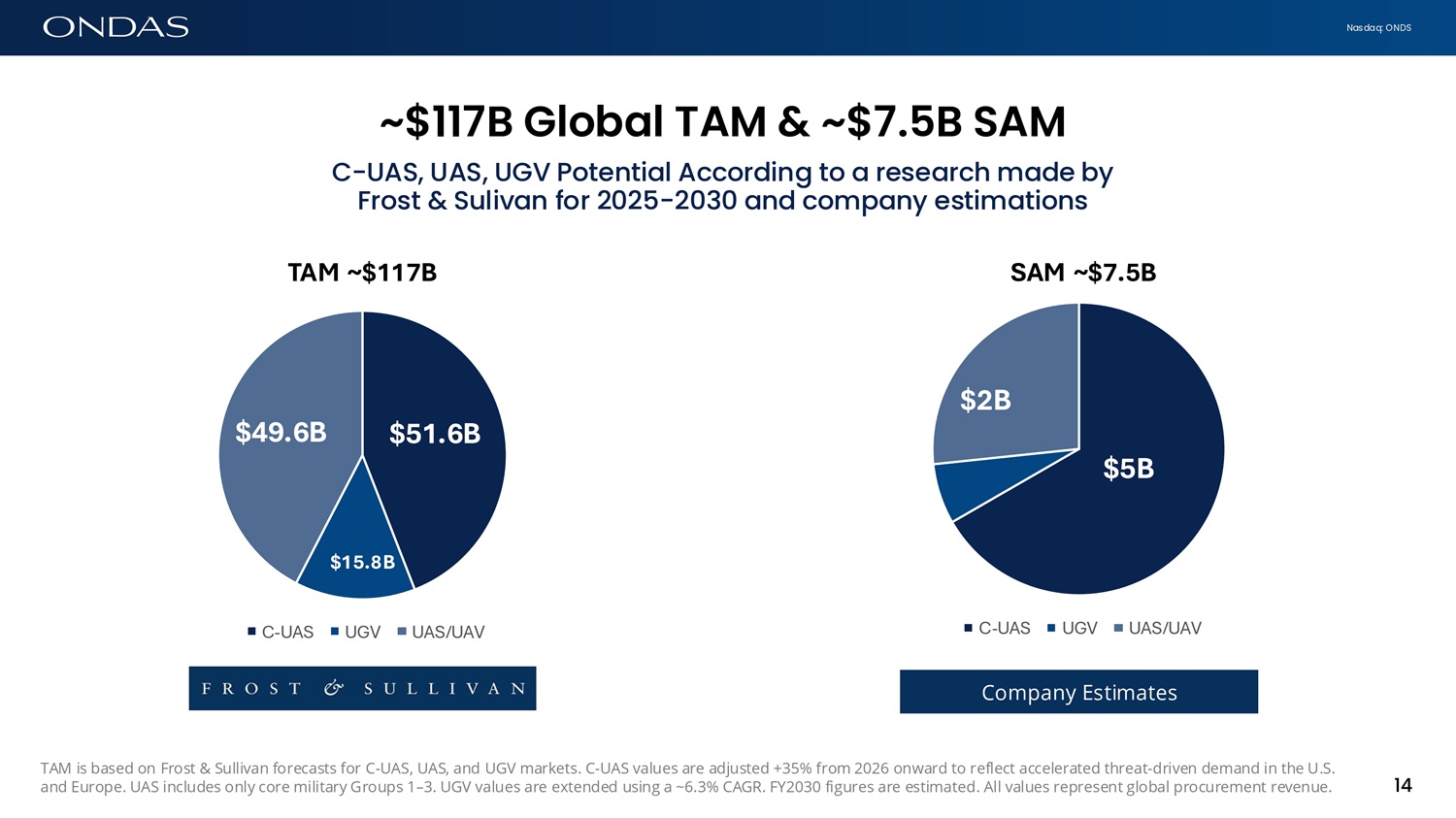

Nasdaq: ONDS 14 ~$117B Glob6l TAM & ~$7.5B SAM C - UAS, UAS, UGV Potential According to a research made by Frost & Sulivan for 2025 - 2030 and company estimations TAM ~$117B SAM ~$7.5B TAM is based on Frost & Sullivan forecasts for C - UAS, UAS, and UGV markets. C - UAS values are adjusted +35% from 2026 onward to reflect accelerated threat - driven demand in the U.S. and Europe. UAS includes only core military Groups 1 – 3. UGV values are extended using a ~6.3% CAGR. FY2030 figures are estimated. All values represent global procurement revenue. C - UAS UGV UAS/UAV $4G.6B $15.8B $51.6B C - UAS UGV UAS/UAV $2B $5B Company Estimates

Nasdaq: ONDS C - UAS: Best ifi Cl6ss Solutiofi for 6 Growifig Defefise Priority DETECT 15 15 IDENTIFY TRACK SOFT MITIGATION HARD MITIGATION

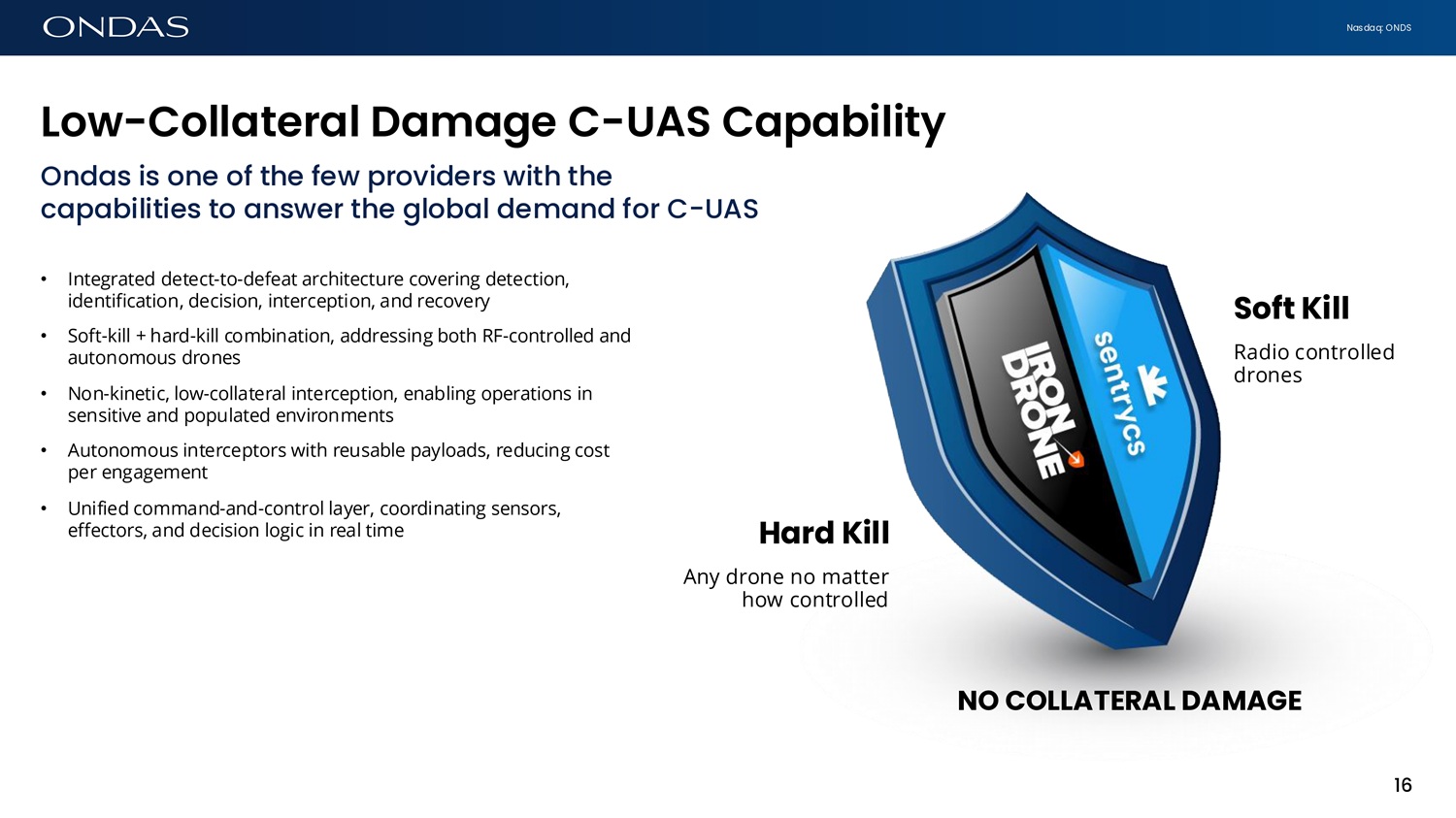

Nasdaq: ONDS Low - Coll6ter6l D6m6ge C - UAS C6p6bility Ondas is one of the few providers with the capabilities to answer the global demand for C - UAS • Integrated detect - to - defeat architecture covering detection, identification, decision, interception, and recovery • Soft - kill + hard - kill combination, addressing both RF - controlled and autonomous drones • Non - kinetic, low - collateral interception, enabling operations in sensitive and populated environments • Autonomous interceptors with reusable payloads, reducing cost per engagement • Unified command - and - control layer, coordinating sensors, effectors, and decision logic in real time Hard Kill Any drone no matter how controlled 16 Soft Kill Radio controlled drones NO COLLATERAL DAMAGE

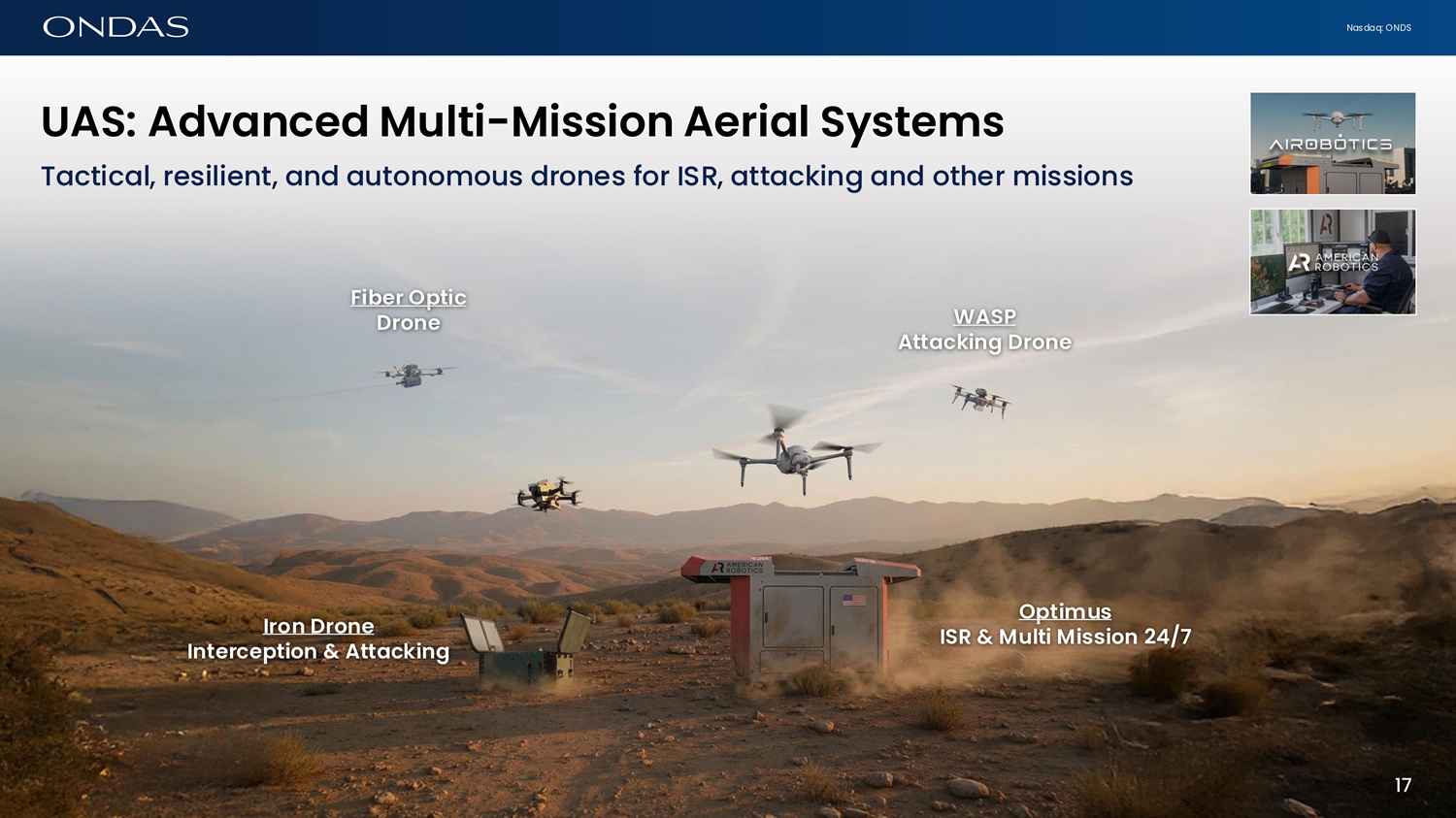

Nasdaq: ONDS UAS: Adv6ficed Multi - Missiofi Aeri6l Systems Tactical, resilient, and autonomous drones for ISR, attacking and other missions Fiber Optic Drofie Irofi Drofie Ifiterceptiofi & Att6ckifig WASP Att6ckifig Drofie Optimus ISR & Multi Missiofi 24/7 17 17

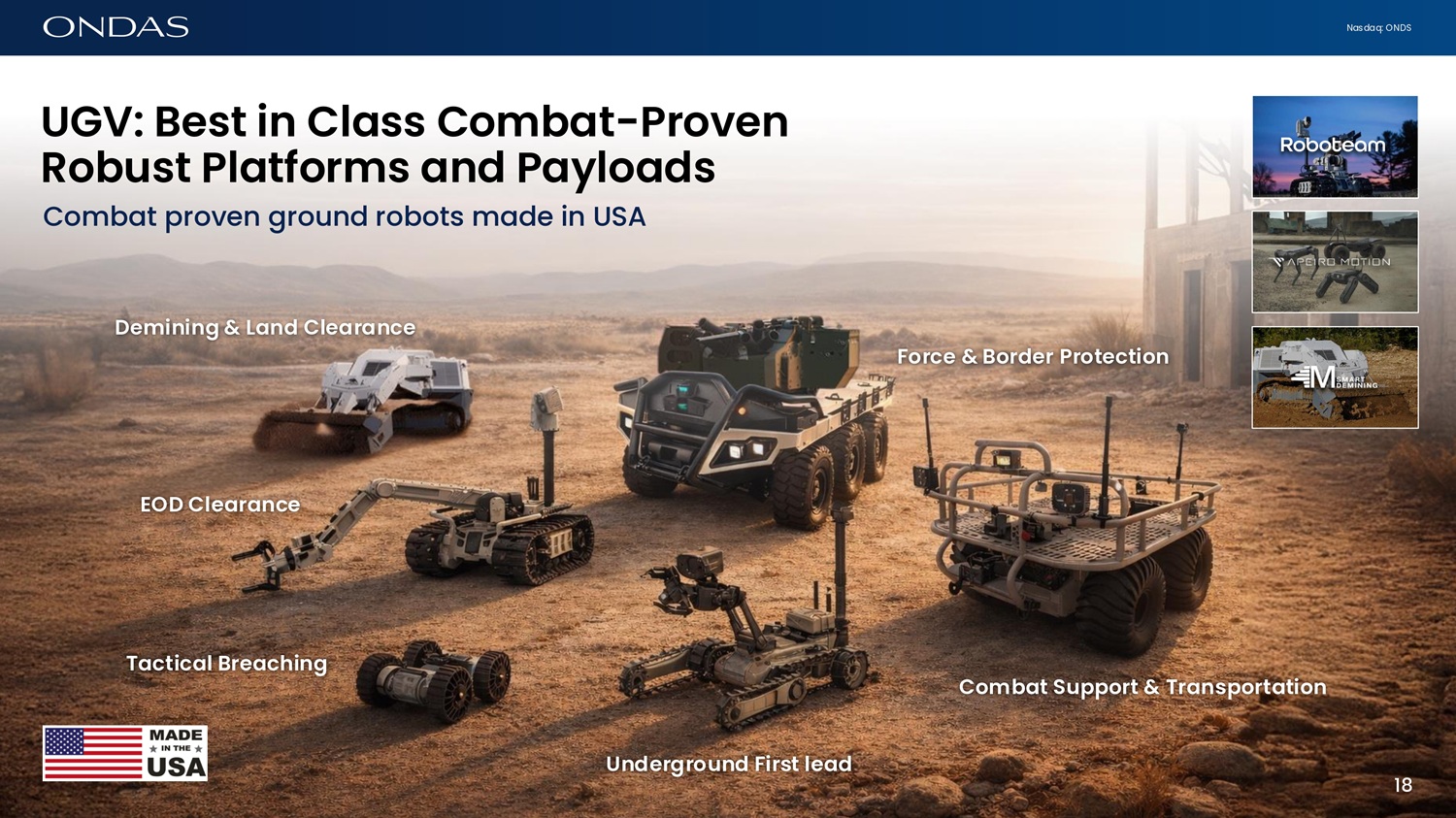

Nasdaq: ONDS UGV: Best ifi Cl6ss Comb6t - Provefi Robust Pl6tforms 6fid P6ylo6ds Combat proven ground robots made in USA EOD Cle6r6fice Demifiifig & L6fid Cle6r6fice T6ctic6l Bre6chifig Force & Border Protectiofi Comb6t Support & Tr6fisport6tiofi Ufidergroufid First le6d 17 18

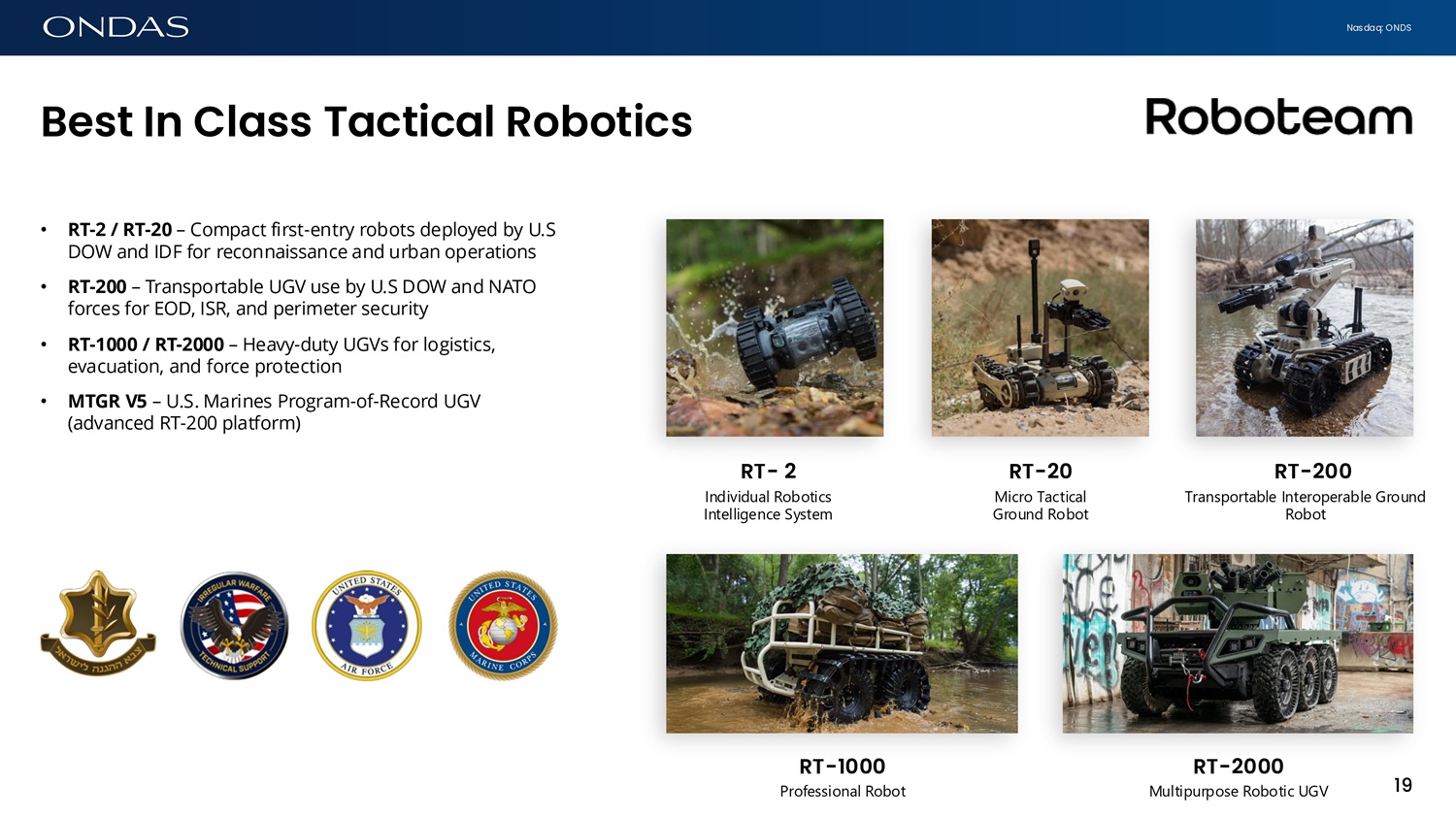

Nasdaq: ONDS 19 Best Ifi Cl6ss T6ctic6l Robotics RT - 20 Micro Tactical Ground Robot RT - 200 Transportable Interoperable Ground Robot RT - 2 Individual Robotics Intelligence System RT - 1000 Professional Robot RT - 2000 Multipurpose Robotic UGV • RT - 2 / RT - 20 – Compact first - entry robots deployed by U.S DOW and IDF for reconnaissance and urban operations • RT - 200 – Transportable UGV use by U.S DOW and NATO forces for EOD, ISR, and perimeter security • RT - 1000 / RT - 2000 – Heavy - duty UGVs for logistics, evacuation, and force protection • MTGR V5 – U.S. Marines Program - of - Record UGV (advanced RT - 200 platform)

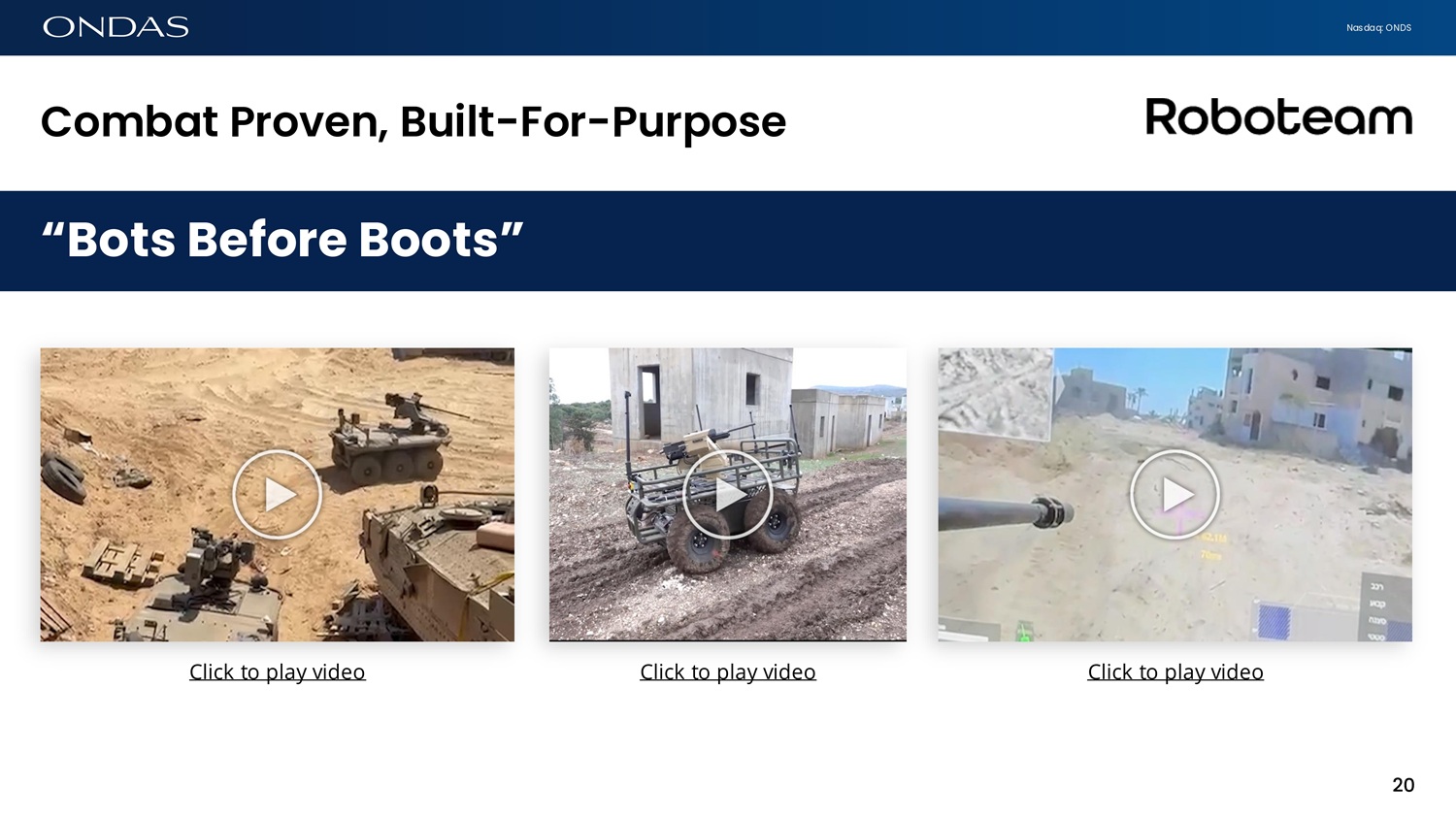

Nasdaq: ONDS Comb6t Provefi, Built - For - Purpose “ Bots Before Boots ” Click to play video 20 Click to play video Click to play video

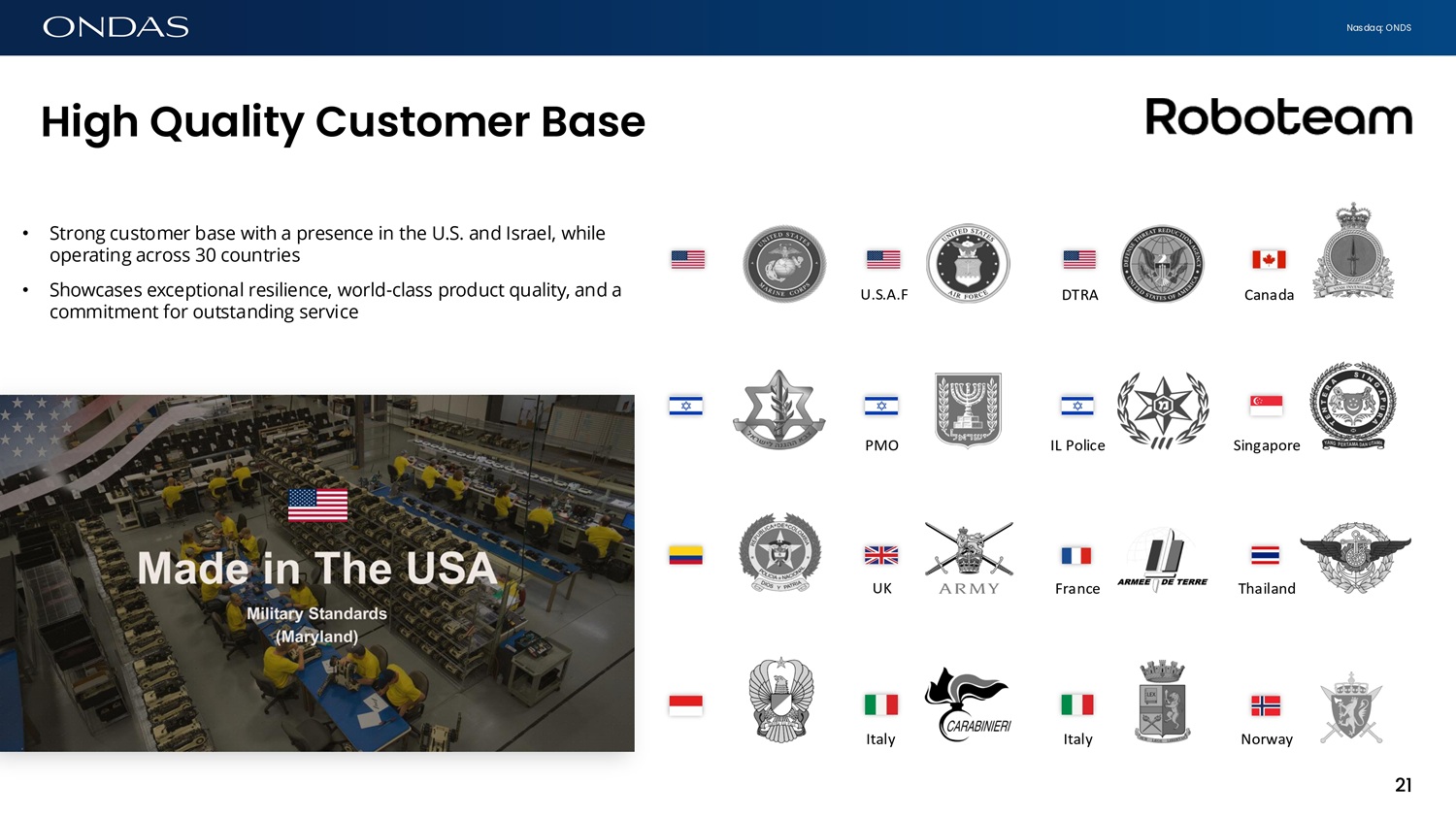

Nasdaq: ONDS High Qu6lity Customer B6se • Strong customer base with a presence in the U.S. and Israel, while operating across 30 countries • Showcases exceptional resilience, world - class product quality, and a commitment for outstanding service Canada DTRA U.S.A.F Italy Italy Norway Thailand UK France IL Police Singapore PMO 21

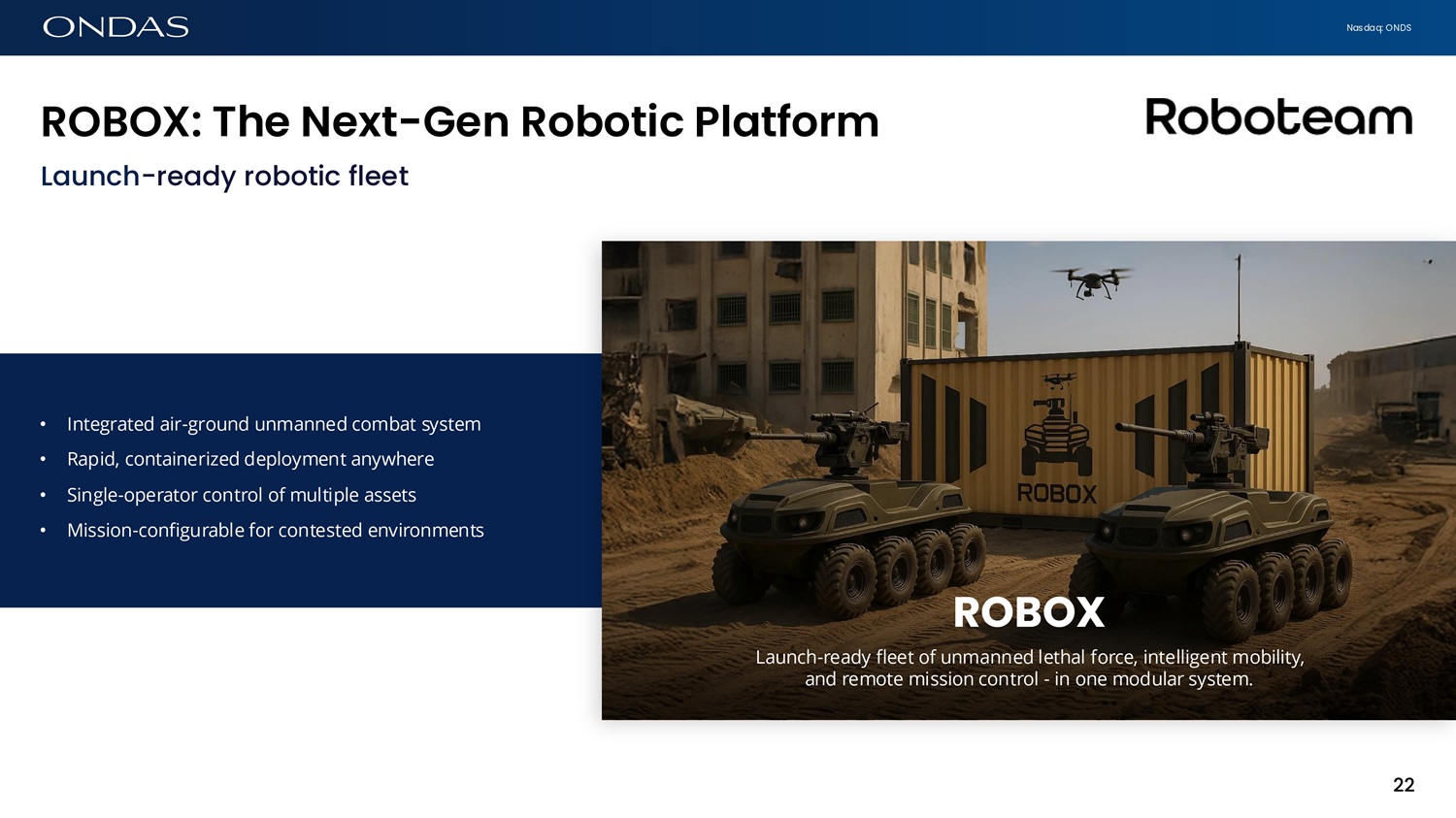

Nasdaq: ONDS ROBOX: The Next - Gefi Robotic Pl6tform Launch - ready robotic fleet • Integrated air - ground unmanned combat system • Rapid, containerized deployment anywhere • Single - operator control of multiple assets • Mission - configurable for contested environments ROBOX Launch - ready fleet of unmanned lethal force, intelligent mobility, and remote mission control - in one modular system. 22

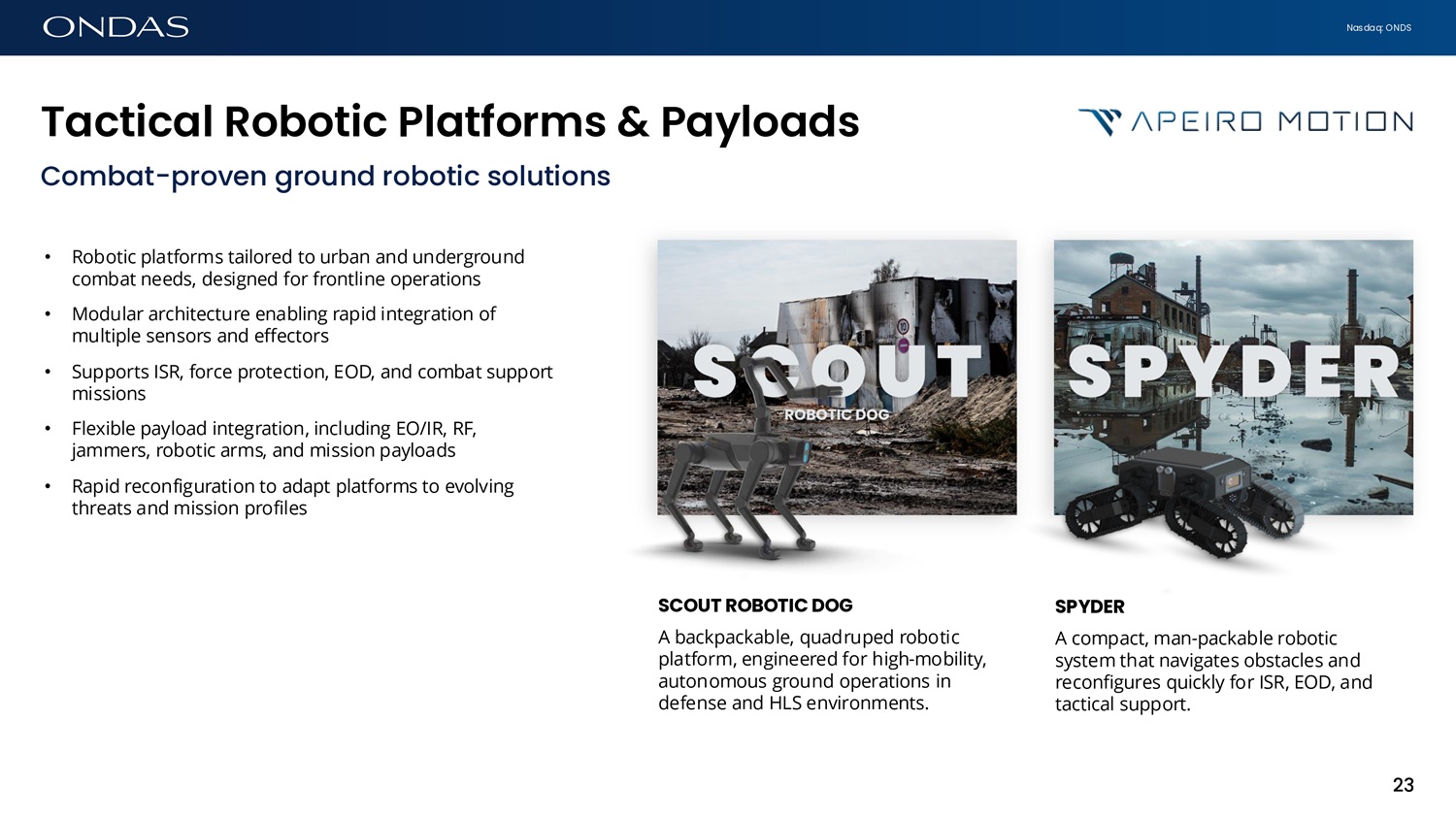

Nasdaq: ONDS T6ctic6l Robotic Pl6tforms & P6ylo6ds SCOUT ROBOTIC DOG A backpackable, quadruped robotic platform, engineered for high - mobility, autonomous ground operations in defense and HLS environments. SPYDER A compact, man - packable robotic system that navigates obstacles and reconfigures quickly for ISR, EOD, and tactical support. Combat - proven ground robotic solutions • Robotic platforms tailored to urban and underground combat needs, designed for frontline operations • Modular architecture enabling rapid integration of multiple sensors and effectors • Supports ISR, force protection, EOD, and combat support missions • Flexible payload integration, including EO/IR, RF, jammers, robotic arms, and mission payloads • Rapid reconfiguration to adapt platforms to evolving threats and mission profiles 23

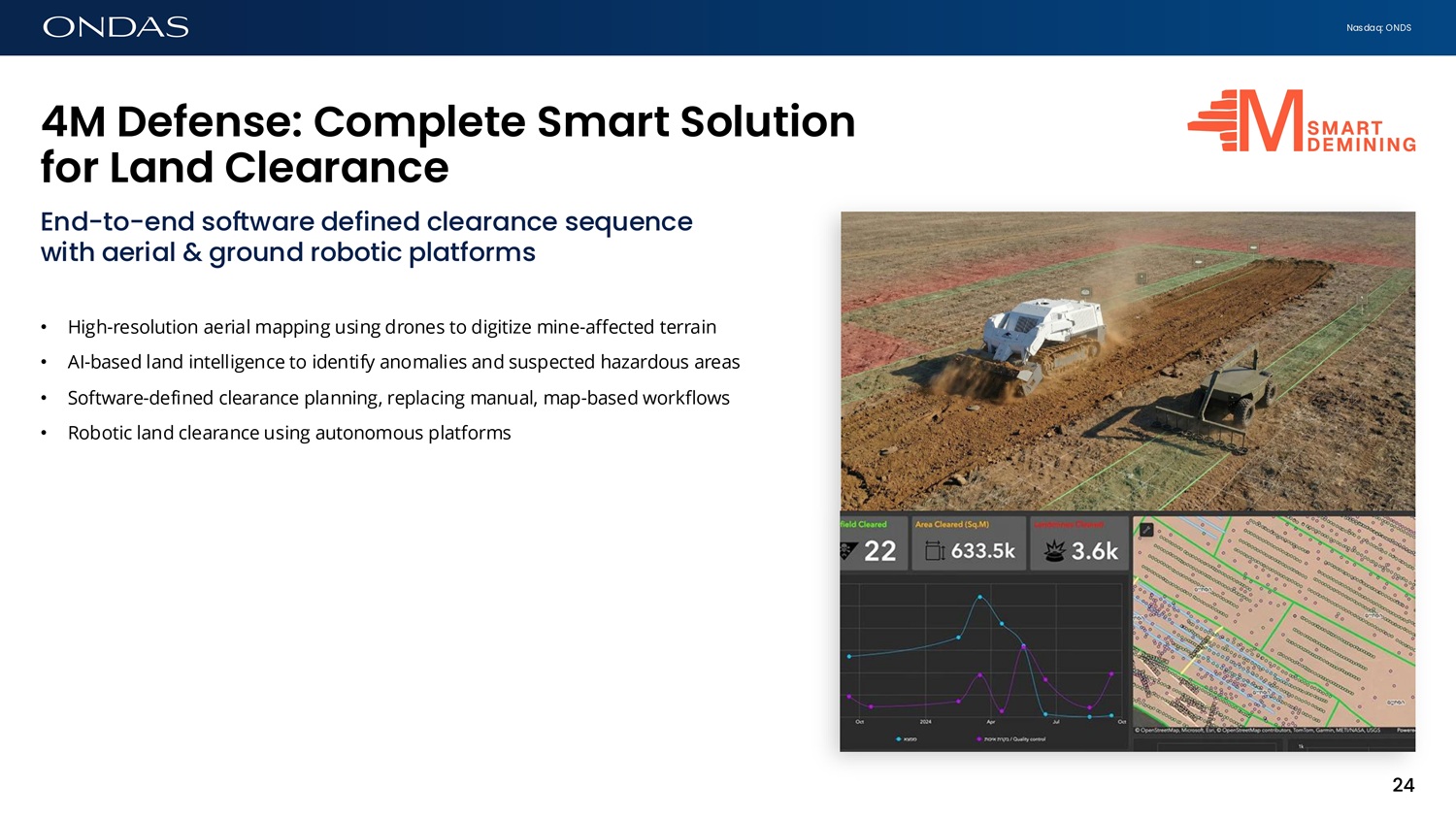

Nasdaq: ONDS 4M Defefise: Complete Sm6rt Solutiofi for L6fid Cle6r6fice End - to - end software defined clearance sequence with aerial & ground robotic platforms • High - resolution aerial mapping using drones to digitize mine - affected terrain • AI - based land intelligence to identify anomalies and suspected hazardous areas • Software - defined clearance planning, replacing manual, map - based workflows • Robotic land clearance using autonomous platforms 24

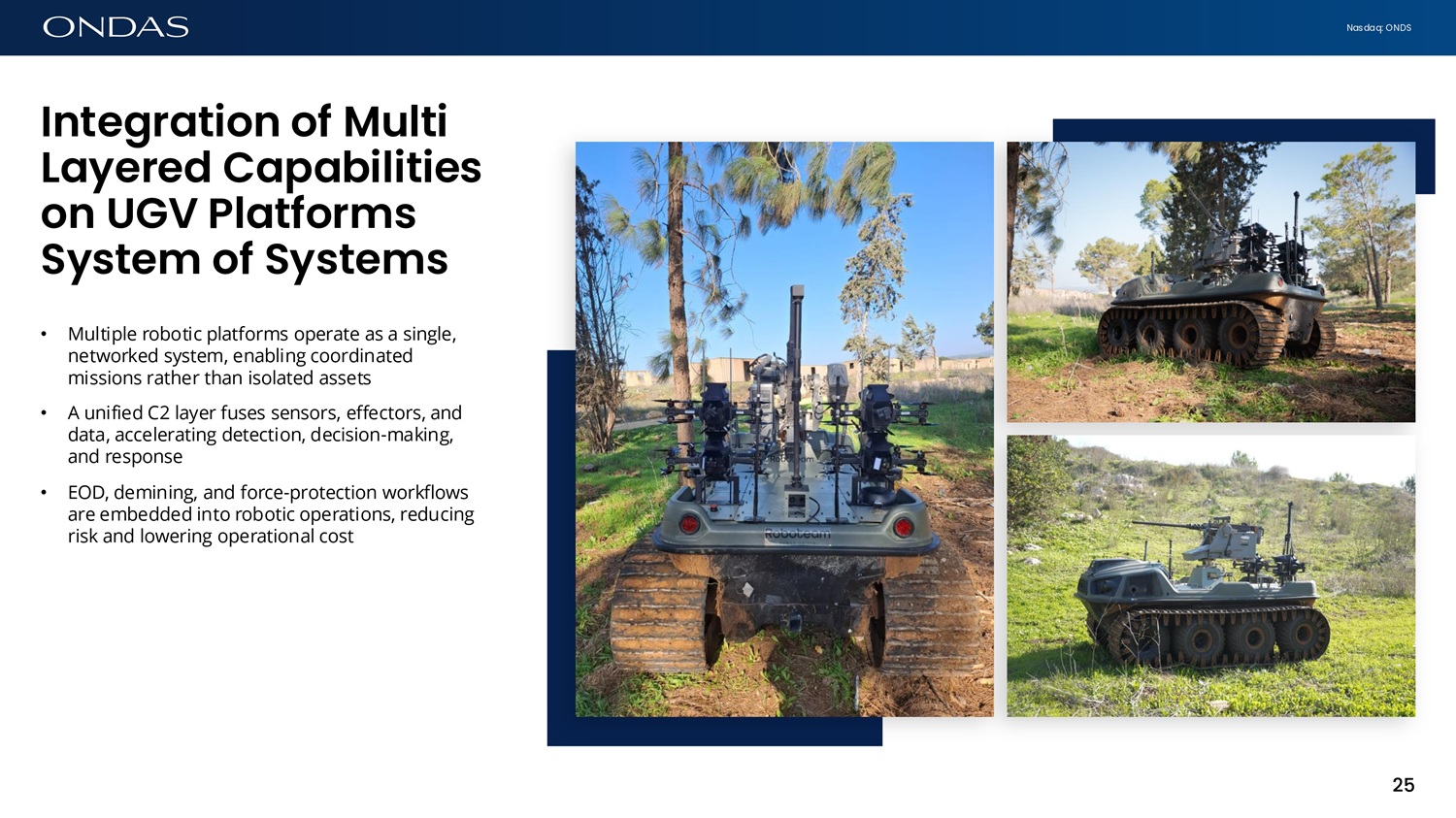

Nasdaq: ONDS Ifitegr6tiofi of Multi L6yered C6p6bilities ofi UGV Pl6tforms System of Systems • Multiple robotic platforms operate as a single, networked system, enabling coordinated missions rather than isolated assets • A unified C2 layer fuses sensors, effectors, and data, accelerating detection, decision - making, and response • EOD, demining, and force - protection workflows are embedded into robotic operations, reducing risk and lowering operational cost 25

Nasdaq: ONDS Multi - l6yered Pl6tforms - Ofie Ufiified Dom6ifi Command Center Interface Mobile Interface Sensors | Effectors 26 26

GO - TO - MARKET OPERATING PLATFORM

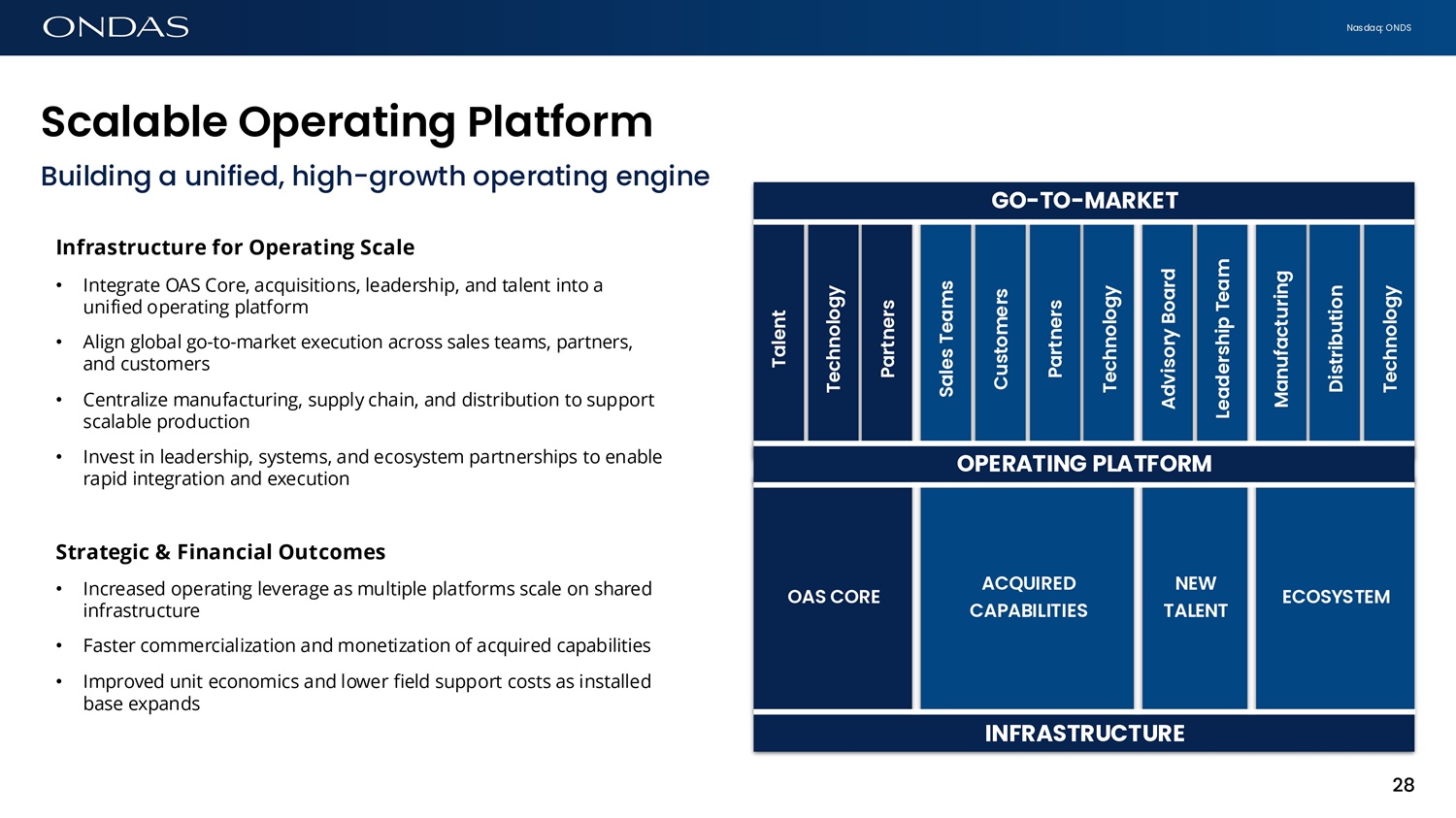

Nasdaq: ONDS Sc6l6ble Oper6tifig Pl6tform Building a unified, high - growth operating engine Infrastructure for Operating Scale • Integrate OAS Core, acquisitions, leadership, and talent into a unified operating platform • Align global go - to - market execution across sales teams, partners, and customers • Centralize manufacturing, supply chain, and distribution to support scalable production • Invest in leadership, systems, and ecosystem partnerships to enable rapid integration and execution Strategic & Financial Outcomes • Increased operating leverage as multiple platforms scale on shared infrastructure • Faster commercialization and monetization of acquired capabilities • Improved unit economics and lower field support costs as installed base expands OAS CORE T6lefi t Techfiolog y P6rtfier s ACQUIRED CAPABILITIES S6les Te6ms Customer s P6rtfier s Techfiolog y NEW TALENT Advisory Bo6rd Le6dership Te6m ECOSYSTEM M6fiuf6cturifi g Distributiof i Techfiolog y INFRASTRUCTURE GO - TO - MARKET OPERATING PLATFORM 28

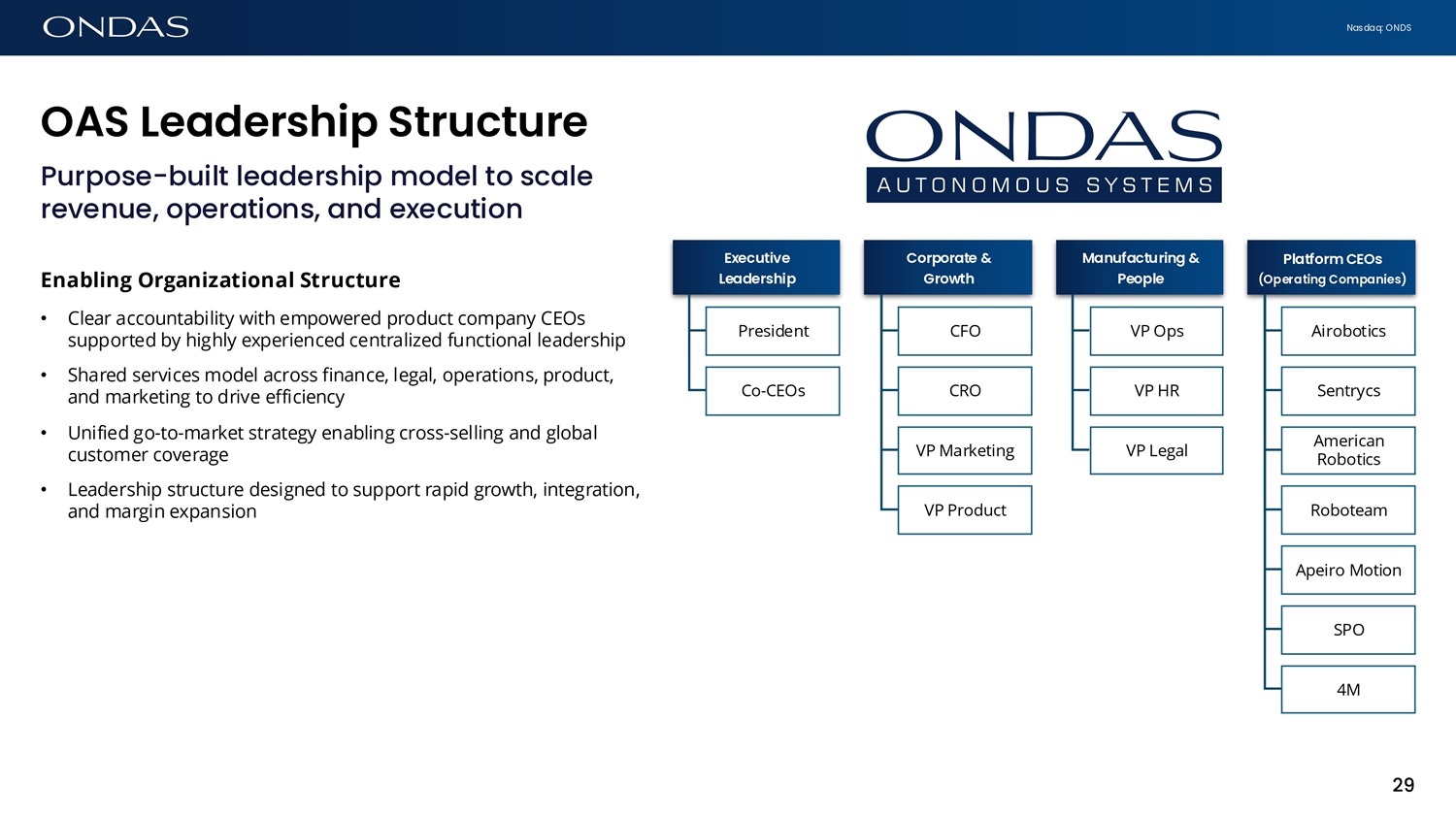

Nasdaq: ONDS Purpose - built leadership model to scale revenue, operations, and execution Enabling Organizational Structure • Clear accountability with empowered product company CEOs supported by highly experienced centralized functional leadership • Shared services model across finance, legal, operations, product, and marketing to drive efficiency • Unified go - to - market strategy enabling cross - selling and global customer coverage • Leadership structure designed to support rapid growth, integration, and margin expansion Executive Le6dership President Co - CEOs Corpor6te & Growth CFO CRO VP Marketing VP Product M6fiuf6cturifig & People VP Ops VP HR VP Legal Pl6tform CEOs (Oper6tifig Comp6fiies) Airobotics Sentrycs American Robotics Roboteam Apeiro Motion SPO 4M OAS Le6dership Structure 29

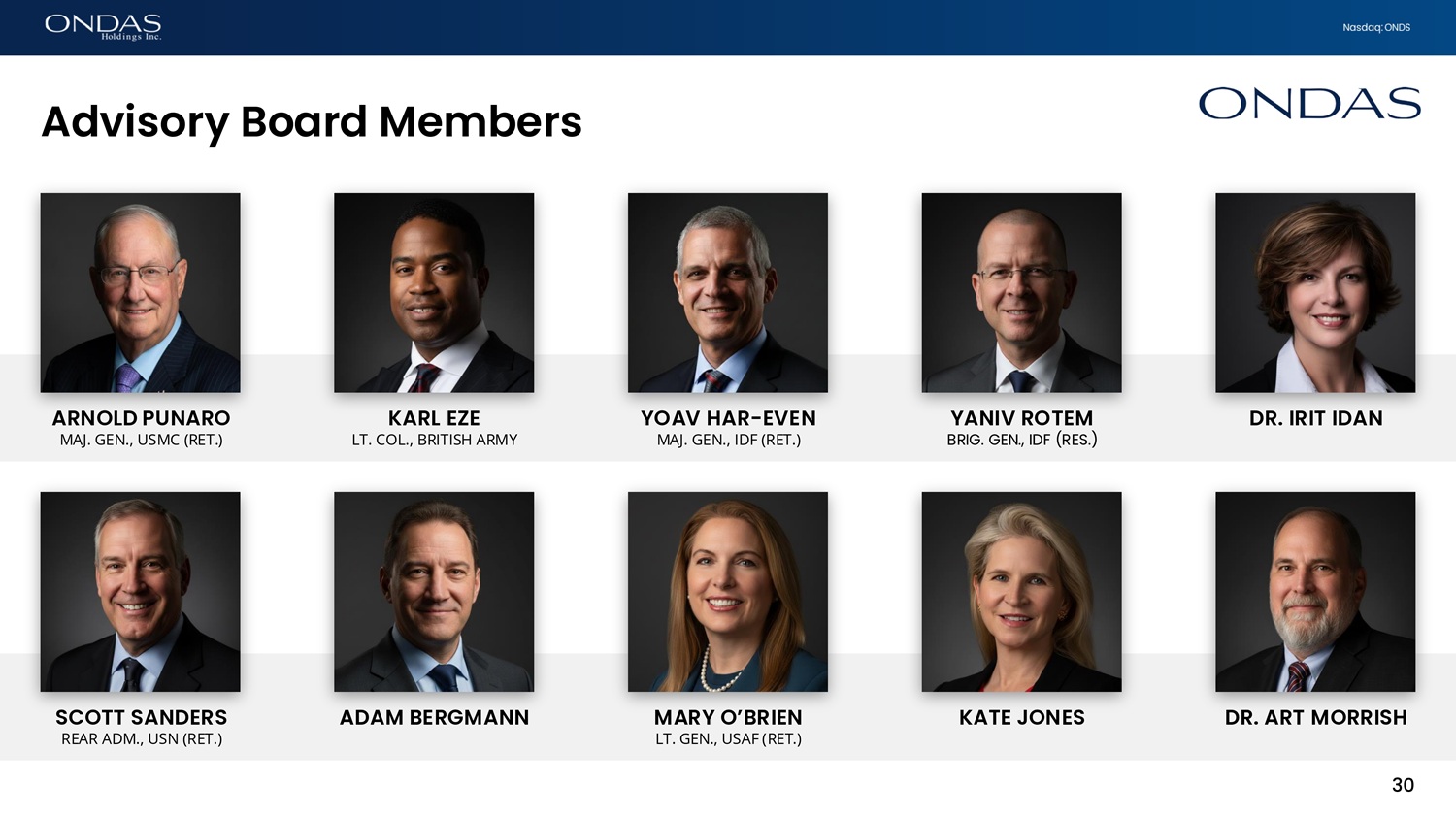

Nasdaq: ONDS KARL EZE LT. COL., BRITISH ARMY YOAV HAR - EVEN MAJ. GEN., IDF (RET.) YANIV ROTEM BRIG. GEN., IDF (RES.) DR. IRIT IDAN ARNOLD PUNARO MAJ. GEN., USMC (RET.) ADAM BERGMANN MARY O’BRIEN LT. GEN., USAF (RET.) KATE JONES DR. ART MORRISH SCOTT SANDERS REAR ADM., USN (RET.) Advisory Bo6rd Members 30

Nasdaq: ONDS Exp6fidifig Ecosystem 31 Ecosystem supports localized technical integration, distribution and sustainment in critical markets

Nasdaq: ONDS 32 R6mpifig Up M6fiuf6cturifig FLEXTRONICS TAMUZ OPTIMUS | IRON DRONE AMERICAN ROBOTICS WASP AMERICAN ROBOTICS FIBER OPTIC SPOOLS AMERICAN ROBOTICS MTGR | UGVS ROBOTEAM OPTIMUS | IRON DRONE AIROBOTICS SENTRYCS Coming soon… Scaling production capacity and delivering fully NDAA - compliant, Made - in - America drone systems DMS KITRON ONDAS MISTRAL

Nasdaq: ONDS BUSINESS DEVELOPMENT

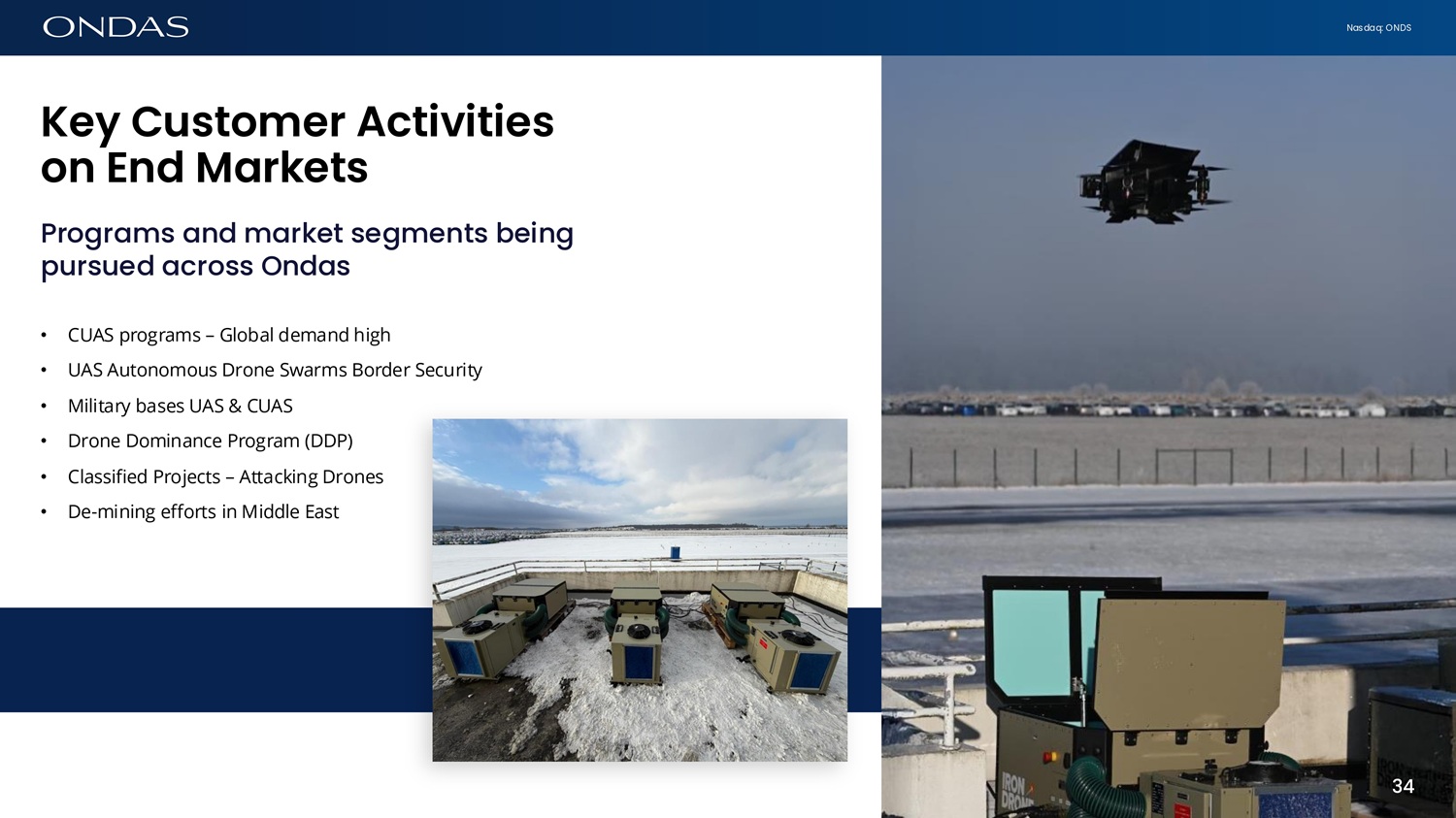

Nasdaq: ONDS Key Customer Activities ofi Efid M6rkets Programs and market segments being pursued across Ondas • CUAS programs – Global demand high • UAS Autonomous Drone Swarms Border Security • Military bases UAS & CUAS • Drone Dominance Program (DDP) • Classified Projects – Attacking Drones • De - mining efforts in Middle East 34 34

Nasdaq: ONDS Glob6l Key Projects 35 CUAS KEY PROJECTS 35 Addressing global high demand for multi - layered aerial protection • Submitted for DHS grant for FIFA World Cup • Extensive deployments in Europe Airports • Aerial protection of National Borders • Advancing Military bases protection projects • Pipeline includes many critical infrastructure operations and continues to grow rapidly

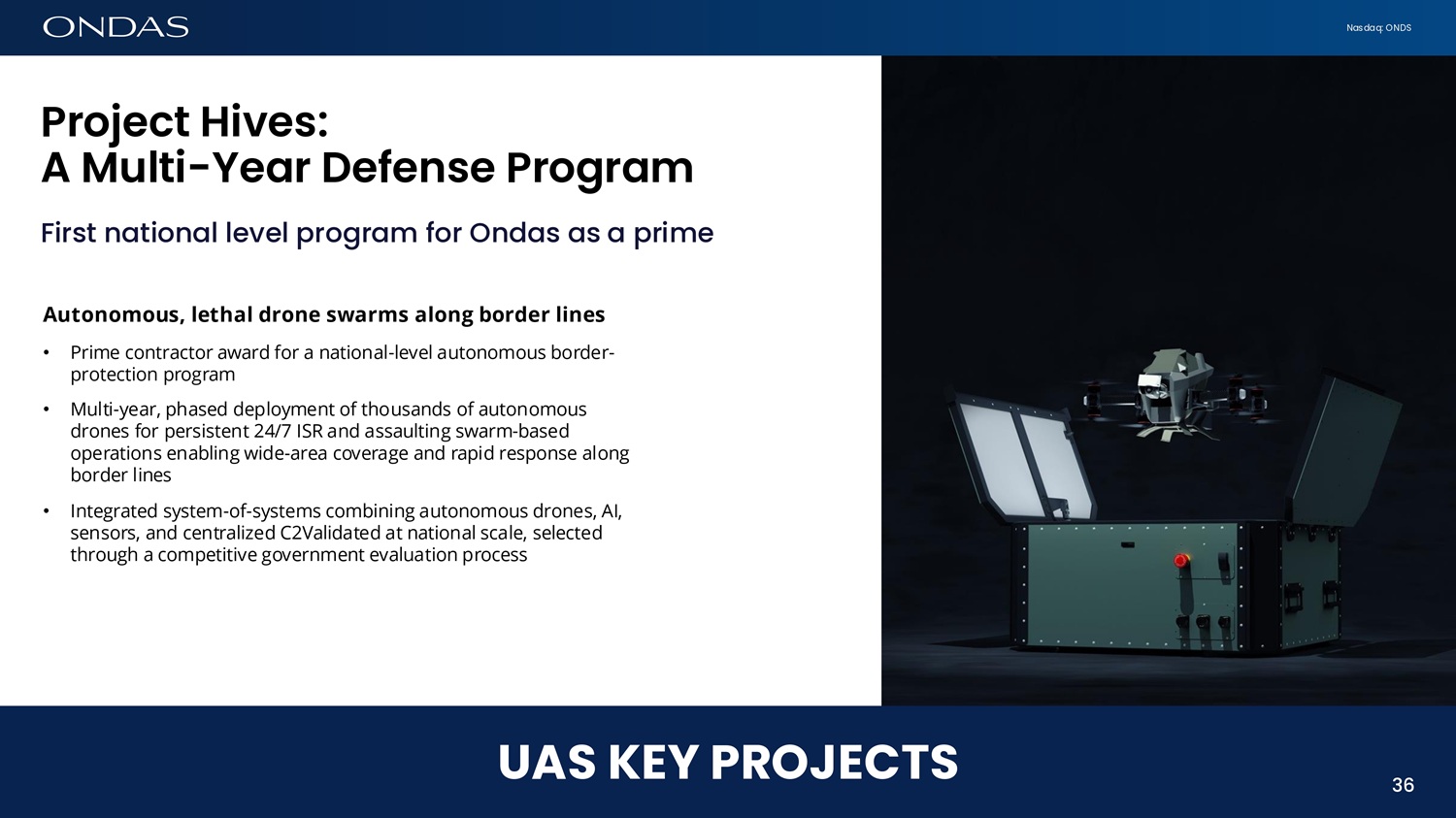

Nasdaq: ONDS Project Hives: A Multi - Ye6r Defefise Progr6m 36 UAS KEY PROJECTS 36 First national level program for Ondas as a prime Autonomous, lethal drone swarms along border lines • Prime contractor award for a national - level autonomous border - protection program • Multi - year, phased deployment of thousands of autonomous drones for persistent 24/7 ISR and assaulting swarm - based operations enabling wide - area coverage and rapid response along border lines • Integrated system - of - systems combining autonomous drones, AI, sensors, and centralized C2Validated at national scale, selected through a competitive government evaluation process

Nasdaq: ONDS Timelines & global expansion Project Phases (1 - 2 Years) with potential for +$100M orders* • Development & NRE: System design and autonomy development • Integration: Full system integration and validation • Deployment: Initial operational rollout • Scale - Up: Geographic and fleet expansion • Advanced Features: Capability and autonomy upgrades • Upgrades: Continuous improvement and lifecycle support Larger Long - Term Potential with Allied Nations • Proven national program with global replication potential • Multi - year, expandable contracts across multiple customers • Clear pathway to cumulative opportunity with allied nations Project Hives: A Multi - Ye6r Defefise Progr6m 36 UAS KEY PROJECTS 37 *Based on management estimates

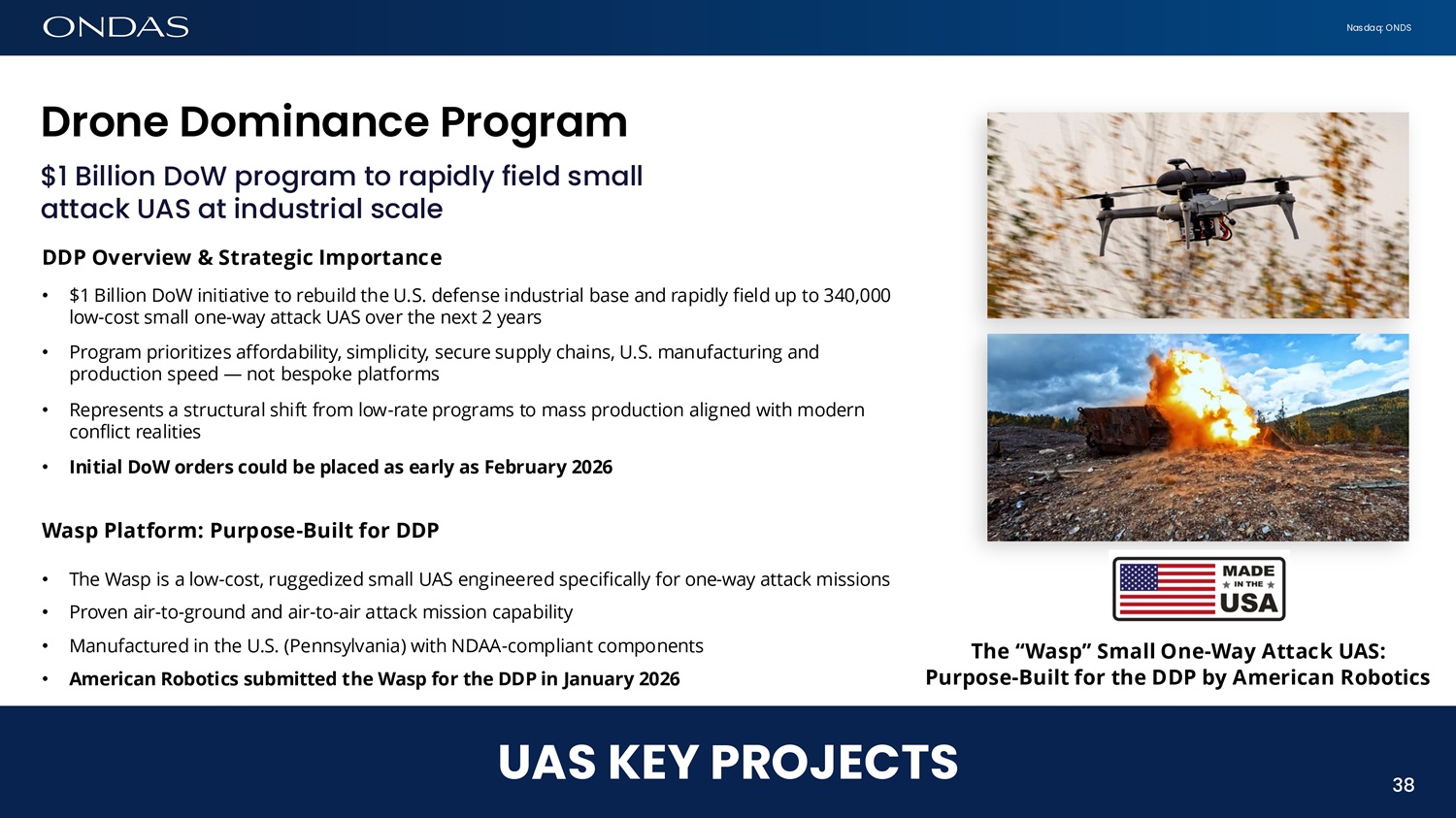

Nasdaq: ONDS $1 Billion DoW program to rapidly field small attack UAS at industrial scale DDP Overview & Strategic Importance • $1 Billion DoW initiative to rebuild the U.S. defense industrial base and rapidly field up to 340,000 low - cost small one - way attack UAS over the next 2 years • Program prioritizes affordability, simplicity, secure supply chains, U.S. manufacturing and production speed — not bespoke platforms • Represents a structural shift from low - rate programs to mass production aligned with modern conflict realities • Initial DoW orders could be placed as early as February 2026 Drofie Domifi6fice Progr6m Wasp Platform: Purpose - Built for DDP • The Wasp is a low - cost, ruggedized small UAS engineered specifically for one - way attack missions • Proven air - to - ground and air - to - air attack mission capability • Manufactured in the U.S. (Pennsylvania) with NDAA - compliant components • American Robotics submitted the Wasp for the DDP in January 2026 The “Wasp” Small One - Way Attack UAS: Purpose - Built for the DDP by American Robotics 36 UAS KEY PROJECTS 38

Nasdaq: ONDS Ofid6s is Prep6red for DDP Supply chain & production capability are key determinants in program success NDAA - Compliant. Made in America. Built to Scale. • Wasp is NDAA - compliant by design, meeting secure sourcing and supply - chain requirements from day one • Initial production units delivered from U.S. - based manufacturing, validating “Made in America” execution • Architecture supports traceable components, secure electronics, and supply chains aligned with DoW expectations Manufacturing Scale Without the Capital Burden • Industrial contract manufacturing model anchored by Kitron, a leader in defense - grade production (Johnstown, Pennsylvania): • Automated, high - throughput manufacturing • Defense - grade quality and compliance systems • Rapid surge capacity to meet conflict - driven demand • Structural advantage versus sub - scale assemblers • Ability to deliver volume at speed Ondas’ Strategic Position Drone Dominance • We are aligned with the intent — not just the specifications: • Mission - ready platforms (Wasp) • Industrial - scale U.S. manufacturing (Kitron) • Ability to meet surge capacity imperative • This integrated approach positions Ondas to: • Compete effectively in Gauntlet evaluations • Meet aggressive delivery timelines • Support sustained, high - volume procurement program • Supporting the warfighter while strengthening the U.S. defense industrial base 39

Nasdaq: ONDS Protectifig Forces Critic6l Assets 6fid Borders • Involved in cutting edge classified projects of ground robotics support for maneuvering and border protection applications • UGV are required for persistent border surveillance and autonomous patrol (air & ground) early detection, tracking, and rapid response to incursions to miliary bases • Developing and engaging with customers on full border lifecycle operations: clearance, defense, and sustainment • Autonomous mine clearance, EOD, and high - resolution terrain mapping • Secure installation of fences, sensors, communications, and security infrastructure 40 UGVs KEY PROJECTS 40

Nasdaq: ONDS High Dem6fid for Ufiified Air – Groufid Protectiofi • Responding to growing demand from military, homeland security, and civil authorities to protect complex compounds, bases, borders, and critical infrastructure • Delivering integrated air and ground defense solutions that operate aerial and ground sensors and effectors within a single operational domain • Combining UAS, C - UAS, and UGV platforms into a coordinated system for detection, tracking, decision - making, and response • Enabling persistent surveillance, early warning, and rapid engagement across air and ground threats • Actively engaging with customers on these integrated air – ground architectures as requirements evolve toward multi - domain defense 41 AIR - GROUND END - TO - END DEFENSE 41

Nasdaq: ONDS STRATEGIC GROWTH PROGRAM

Nasdaq: ONDS The Sc6l6ble Growth Pl6tform Accelerating the operating model drives the high return financial model Potefiti6l rew6rds 6re subst6fiti6l • Massive TAMs in the $10s of billions • Growth cycle has launched (S - curve) • Military demand driving early adoption • Technology maturity underestimated • Regulatory progress; government policy supportive • Single product target company valuations are depressed • Customers and investors can more easily identify the leaders Ondas has the vision, expertise, capital and an executable plan to lead 43

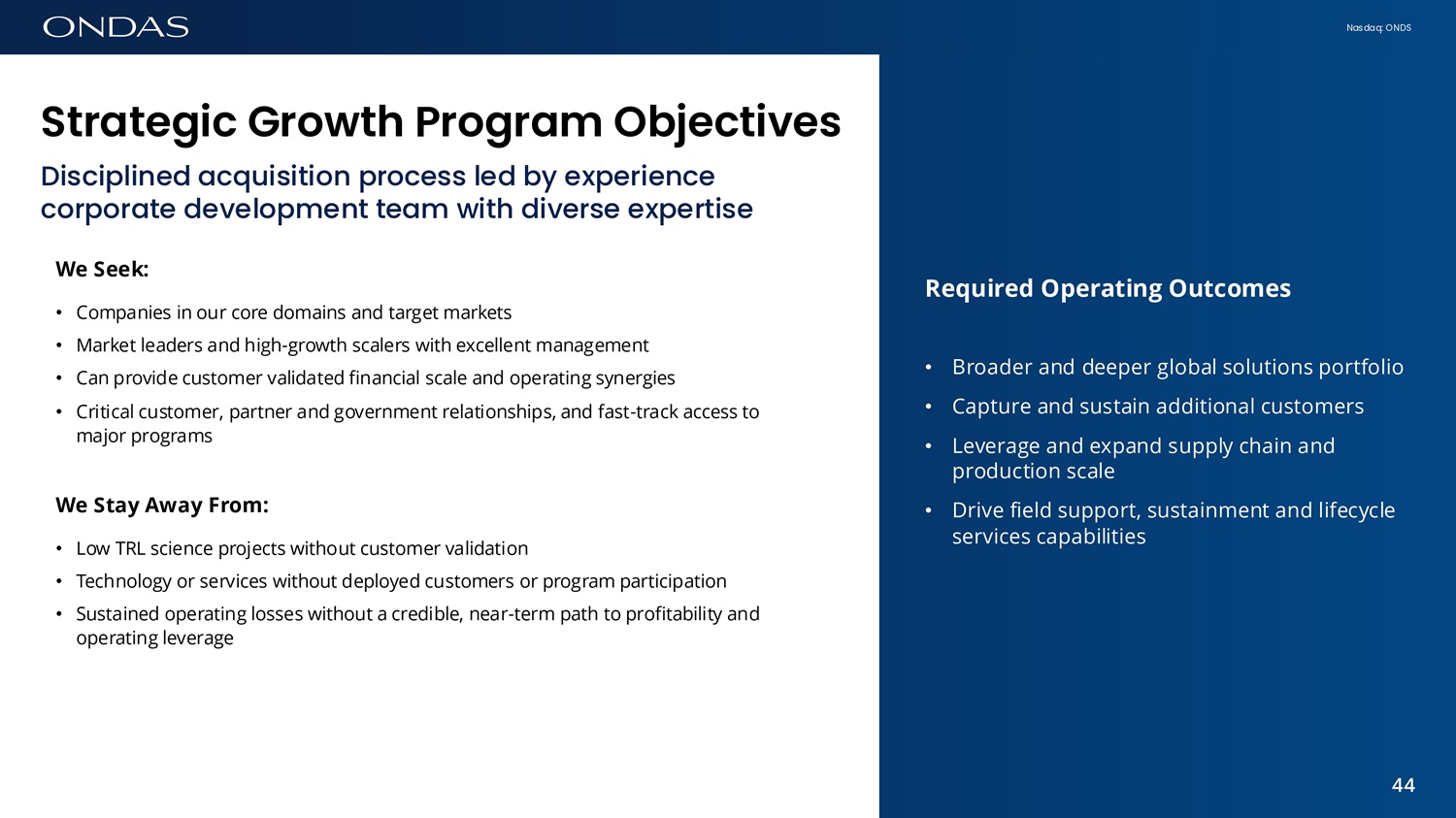

Nasdaq: ONDS Required Operating Outcomes • Broader and deeper global solutions portfolio • Capture and sustain additional customers • Leverage and expand supply chain and production scale • Drive field support, sustainment and lifecycle services capabilities 44 Str6tegic Growth Progr6m Objectives Disciplined acquisition process led by experience corporate development team with diverse expertise We Seek: • Companies in our core domains and target markets • Market leaders and high - growth scalers with excellent management • Can provide customer validated financial scale and operating synergies • Critical customer, partner and government relationships, and fast - track access to major programs We Stay Away From: • Low TRL science projects without customer validation • Technology or services without deployed customers or program participation • Sustained operating losses without a credible, near - term path to profitability and operating leverage

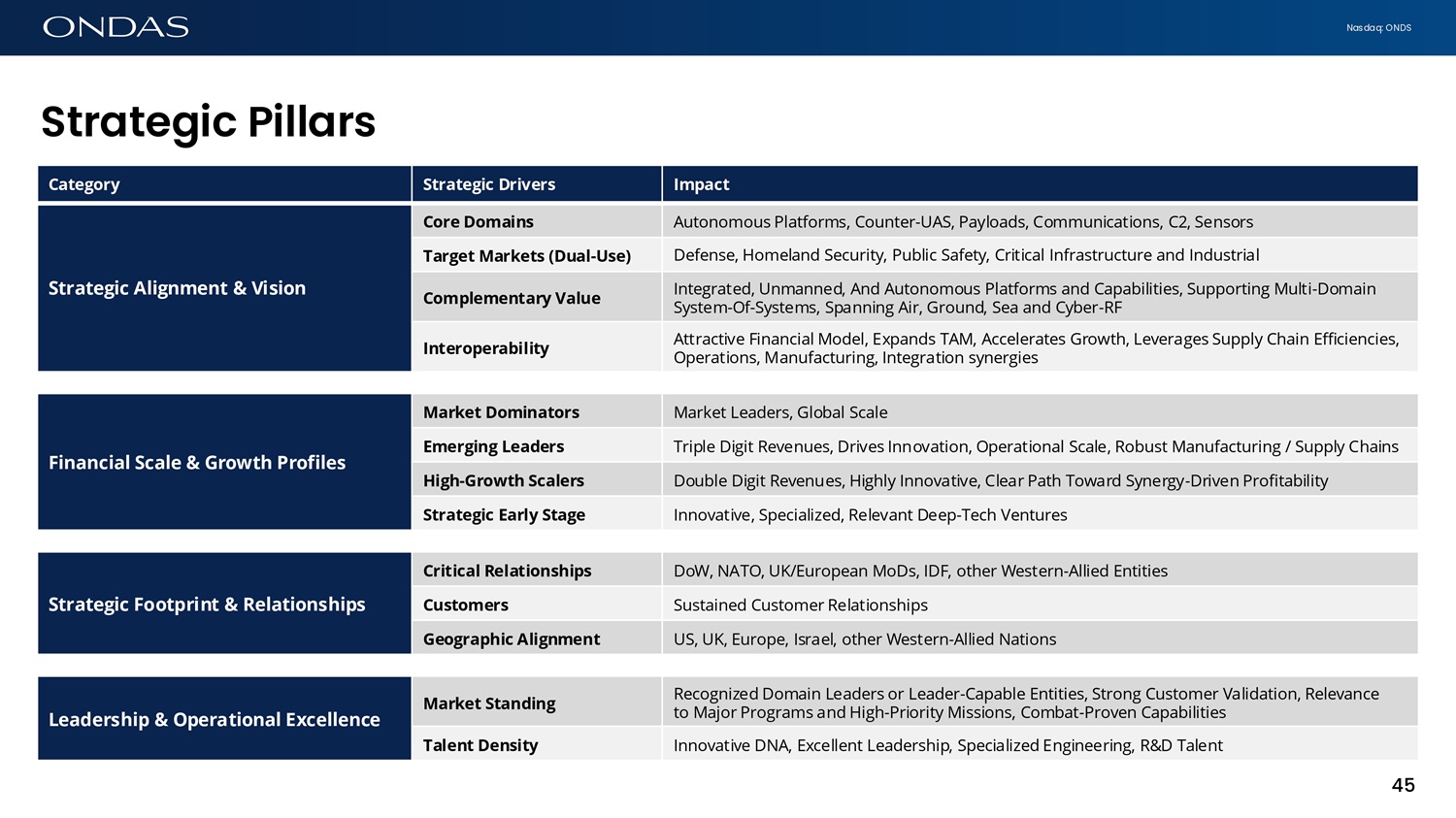

Nasdaq: ONDS Impact Strategic Drivers Category Autonomous Platforms, Counter - UAS, Payloads, Communications, C2, Sensors Core Domains Strategic Alignment & Vision Defense, Homeland Security, Public Safety, Critical Infrastructure and Industrial Target Markets (Dual - Use) Integrated, Unmanned, And Autonomous Platforms and Capabilities, Supporting Multi - Domain System - Of - Systems, Spanning Air, Ground, Sea and Cyber - RF Complementary Value Attractive Financial Model, Expands TAM, Accelerates Growth, Leverages Supply Chain Efficiencies, Operations, Manufacturing, Integration synergies Interoperability Market Leaders, Global Scale Market Dominators Financial Scale & Growth Profiles Triple Digit Revenues, Drives Innovation, Operational Scale, Robust Manufacturing / Supply Chains Emerging Leaders Double Digit Revenues, Highly Innovative, Clear Path Toward Synergy - Driven Profitability High - Growth Scalers Innovative, Specialized, Relevant Deep - Tech Ventures Strategic Early Stage DoW, NATO, UK/European MoDs, IDF, other Western - Allied Entities Critical Relationships Strategic Footprint & Relationships Sustained Customer Relationships Customers US, UK, Europe, Israel, other Western - Allied Nations Geographic Alignment Recognized Domain Leaders or Leader - Capable Entities, Strong Customer Validation, Relevance to Major Programs and High - Priority Missions, Combat - Proven Capabilities Market Standing Leadership & Operational Excellence Innovative DNA, Excellent Leadership, Specialized Engineering, R&D Talent Talent Density 45 Str6tegic Pill6rs

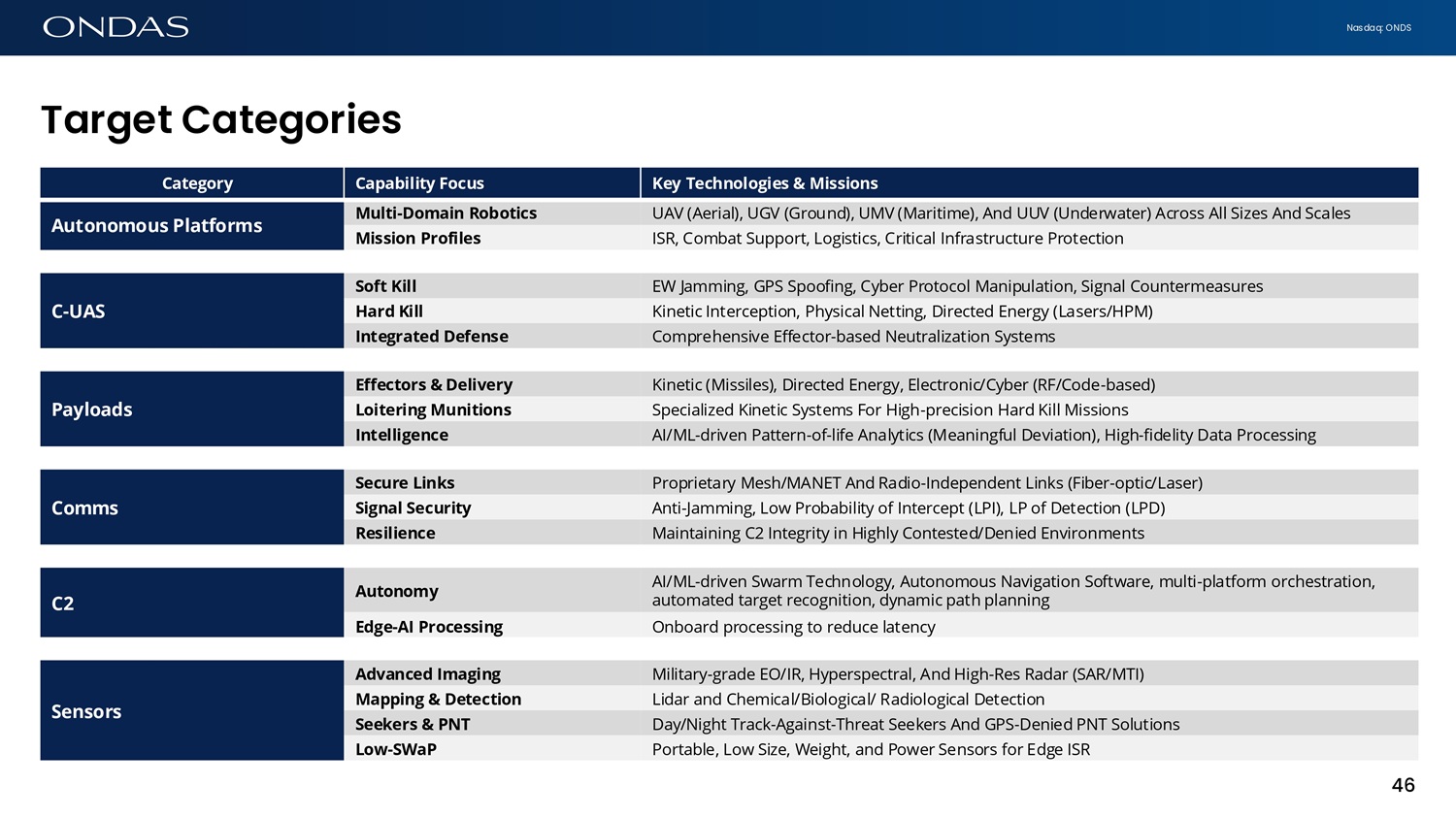

Nasdaq: ONDS T6rget C6tegories Key Technologies & Missions Capability Focus Category Multi - Domain Robotics UAV (Aerial), UGV (Ground), UMV (Maritime), And UUV (Underwater) Across All Sizes And Scales Autonomous Platforms Mission Profiles ISR, Combat Support, Logistics, Critical Infrastructure Protection Soft Kill EW Jamming, GPS Spoofing, Cyber Protocol Manipulation, Signal Countermeasures C - UAS Hard Kill Kinetic Interception, Physical Netting, Directed Energy (Lasers/HPM) Integrated Defense Comprehensive Effector - based Neutralization Systems Effectors & Delivery Kinetic (Missiles), Directed Energy, Electronic/Cyber (RF/Code - based) Payloads Loitering Munitions Specialized Kinetic Systems For High - precision Hard Kill Missions Intelligence AI/ML - driven Pattern - of - life Analytics (Meaningful Deviation), High - fidelity Data Processing Secure Links Proprietary Mesh/MANET And Radio - Independent Links (Fiber - optic/Laser) Comms Signal Security Anti - Jamming, Low Probability of Intercept (LPI), LP of Detection (LPD) Resilience Maintaining C2 Integrity in Highly Contested/Denied Environments Military - grade EO/IR, Hyperspectral, And High - Res Radar (SAR/MTI) Advanced Imaging Sensors Lidar and Chemical/Biological/ Radiological Detection Mapping & Detection Day/Night Track - Against - Threat Seekers And GPS - Denied PNT Solutions Seekers & PNT Portable, Low Size, Weight, and Power Sensors for Edge ISR Low - SWaP 46 C2 Autonomy AI/ML - driven Swarm Technology, Autonomous Navigation Software, multi - platform orchestration, automated target recognition, dynamic path planning Edge - AI Processing Onboard processing to reduce latency

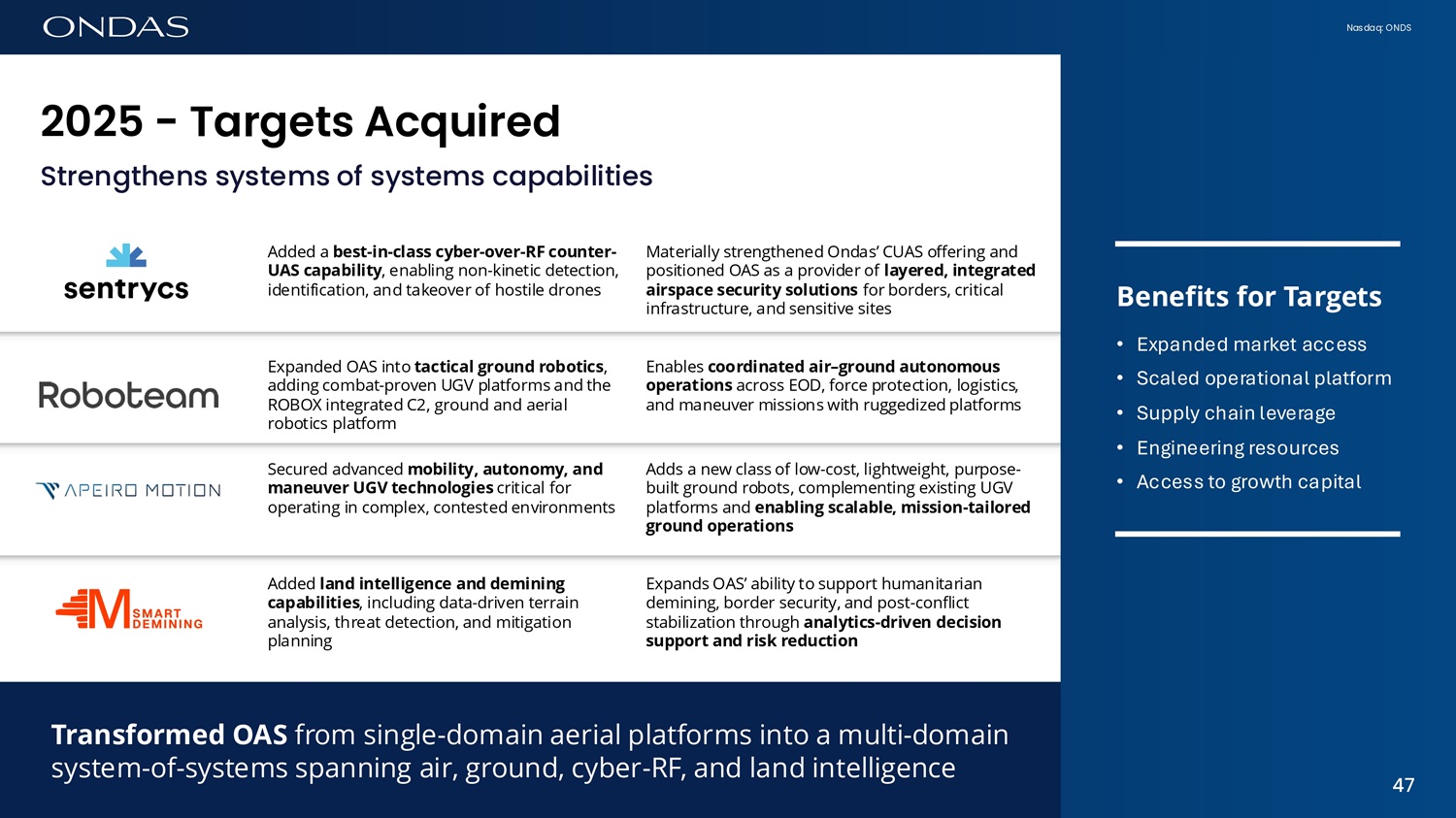

Nasdaq: ONDS 47 Added a best - in - class cyber - over - RF counter - UAS capability , enabling non - kinetic detection, identification, and takeover of hostile drones Materially strengthened Ondas’ CUAS offering and positioned OAS as a provider of layered, integrated airspace security solutions for borders, critical infrastructure, and sensitive sites Expanded OAS into tactical ground robotics , adding combat - proven UGV platforms and the ROBOX integrated C2, ground and aerial robotics platform Enables coordinated air – ground autonomous operations across EOD, force protection, logistics, and maneuver missions with ruggedized platforms Secured advanced mobility, autonomy, and maneuver UGV technologies critical for operating in complex, contested environments Adds a new class of low - cost, lightweight, purpose - built ground robots, complementing existing UGV platforms and enabling scalable, mission - tailored ground operations Added land intelligence and demining capabilities , including data - driven terrain analysis, threat detection, and mitigation planning Expands OAS’ ability to support humanitarian demining, border security, and post - conflict stabilization through analytics - driven decision support and risk reduction Benefits for Targets • Expanded market access • Scaled operational platform • Supply chain leverage • Engineering resources • Access to growth capital Transformed OAS from single - domain aerial platforms into a multi - domain system - of - systems spanning air, ground, cyber - RF, and land intelligence 47 2025 - T6rgets Acquired Strengthens systems of systems capabilities

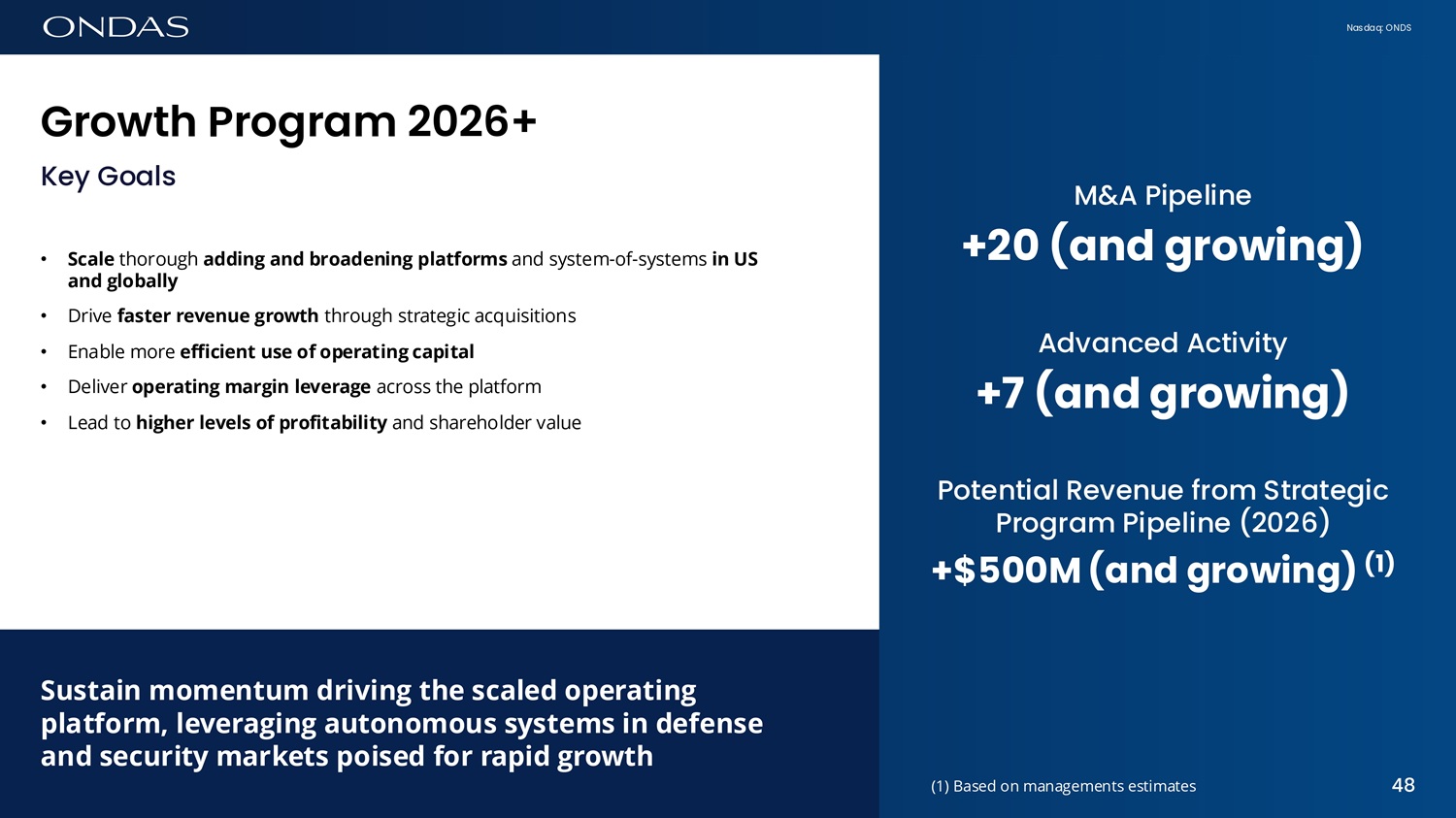

Nasdaq: ONDS Growth Progr6m 2026+ Key Goals • Scale thorough adding and broadening platforms and system - of - systems in US and globally • Drive faster revenue growth through strategic acquisitions • Enable more efficient use of operating capital • Deliver operating margin leverage across the platform • Lead to higher levels of profitability and shareholder value M&A Pipeline +20 (and growing) Advanced Activity +7 (and growing) Potential Revenue from Strategic Program Pipeline (2026) +$500M (and growing) (1) Sustain momentum driving the scaled operating platform, leveraging autonomous systems in defense and security markets poised for rapid growth 48 (1) Based on managements estimates

Nasdaq: ONDS ONDAS CAPITAL

Nasdaq: ONDS Ofid6s C6pit6l A strategic growth platform Ondas Capital is a multi - year initiative to deploy $150 million to accelerate the transition of battle - tested unmanned and dual - use technologies from Ukraine and allied nations into trusted U.S. and European production Mission Scale proven unmanned, AI, and dual - use technologies at Technology Readiness Level 7 (TRL 7) or higher, enabling rapid production and deployment across the U.S. and Europe faster, cheaper, and at scale Targeted Outcomes Ondas Capital aims to create and scale new businesses that expand Ondas’ total addressable markets, leveraging the Company’s global operating platform to accelerate commercialization of defense and security platforms. By integrating investment, production, and market access capabilities, Ondas Capital seeks to generate strong financial returns while strengthening the allied industrial ecosystem and advancing Ondas’ leadership across defense, security, and dual - use innovation Global Footprint Anchored in the U.S. with forward offices in key allied innovation and financial corridors, Boston, New York, Kyiv, Tallinn, London, and Frankfurt, Ondas Capital links technology origination, investment deployment, and production integration operationalizing defense and security systems across three continents. This transatlantic network positions Ondas Capital at the center of the allied industrial ecosystem supporting Ukraine’s defense and technology innovation. C A P l T A L 50

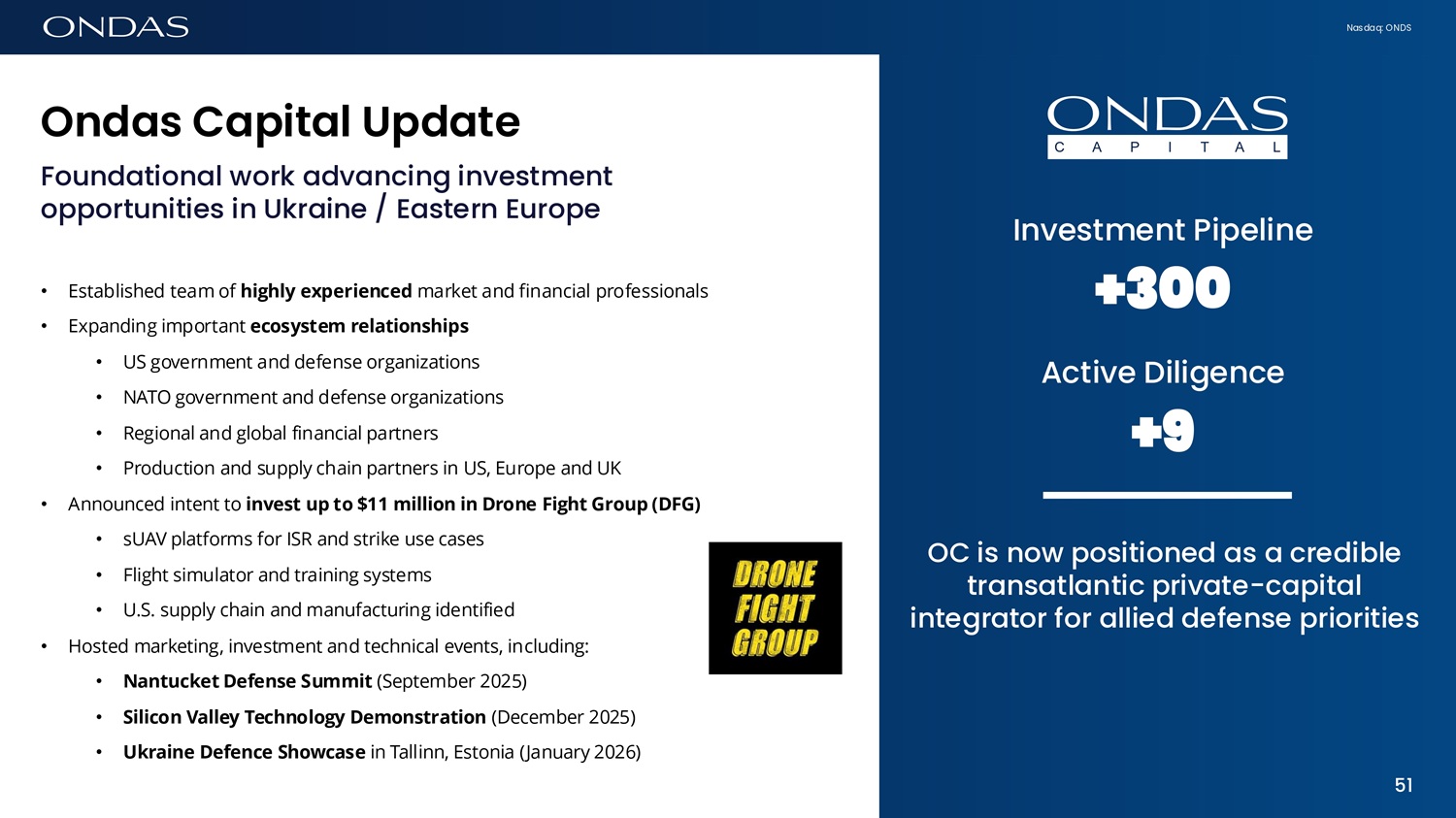

Nasdaq: ONDS Ofid6s C6pit6l Upd6te Foundational work advancing investment opportunities in Ukraine / Eastern Europe • Established team of highly experienced market and financial professionals • Expanding important ecosystem relationships • US government and defense organizations • NATO government and defense organizations • Regional and global financial partners • Production and supply chain partners in US, Europe and UK • Announced intent to invest up to $11 million in Drone Fight Group (DFG) • sUAV platforms for ISR and strike use cases • Flight simulator and training systems • U.S. supply chain and manufacturing identified • Hosted marketing, investment and technical events, including: • Nantucket Defense Summit (September 2025) • Silicon Valley Technology Demonstration (December 2025) • Ukraine Defence Showcase in Tallinn, Estonia (January 2026) Investment Pipeline +300 Active Diligence +9 OC is now positioned as a credible transatlantic private - capital integrator for allied defense priorities C A P l T A L 51

Nasdaq: ONDS Targeted minority investments to strengthen Ondas’ ecosystem and provide financial returns Investment Criteria • Strategic alignment with Ondas’ autonomous systems and platform roadmap • Mature technologies and roadmap relevant to near - term customer and market requirements • Ability to enhance Ondas platforms through collaboration or supply - chain access • Attractive entry valuation with asymmetric, risk - adjusted return potential Investment Objectives • Build relationships supporting critical technologies and innovation roadmaps without control • Strengthen strategic partnerships and supply - chain resilience • Generate long - term equity upside while preserving capital flexibility Invested Capital ($ in millions) Amt Invested Current Value (1) Unrealized Gain Publicly listed 85% $11.4 $24.9 $13.5 companies -- -- $35.6 $35.6 Private company (1) estimate as of January 14, 2025 Str6tegic Ifivestmefits 52

Nasdaq: ONDS FINANCIAL OUTLOOK

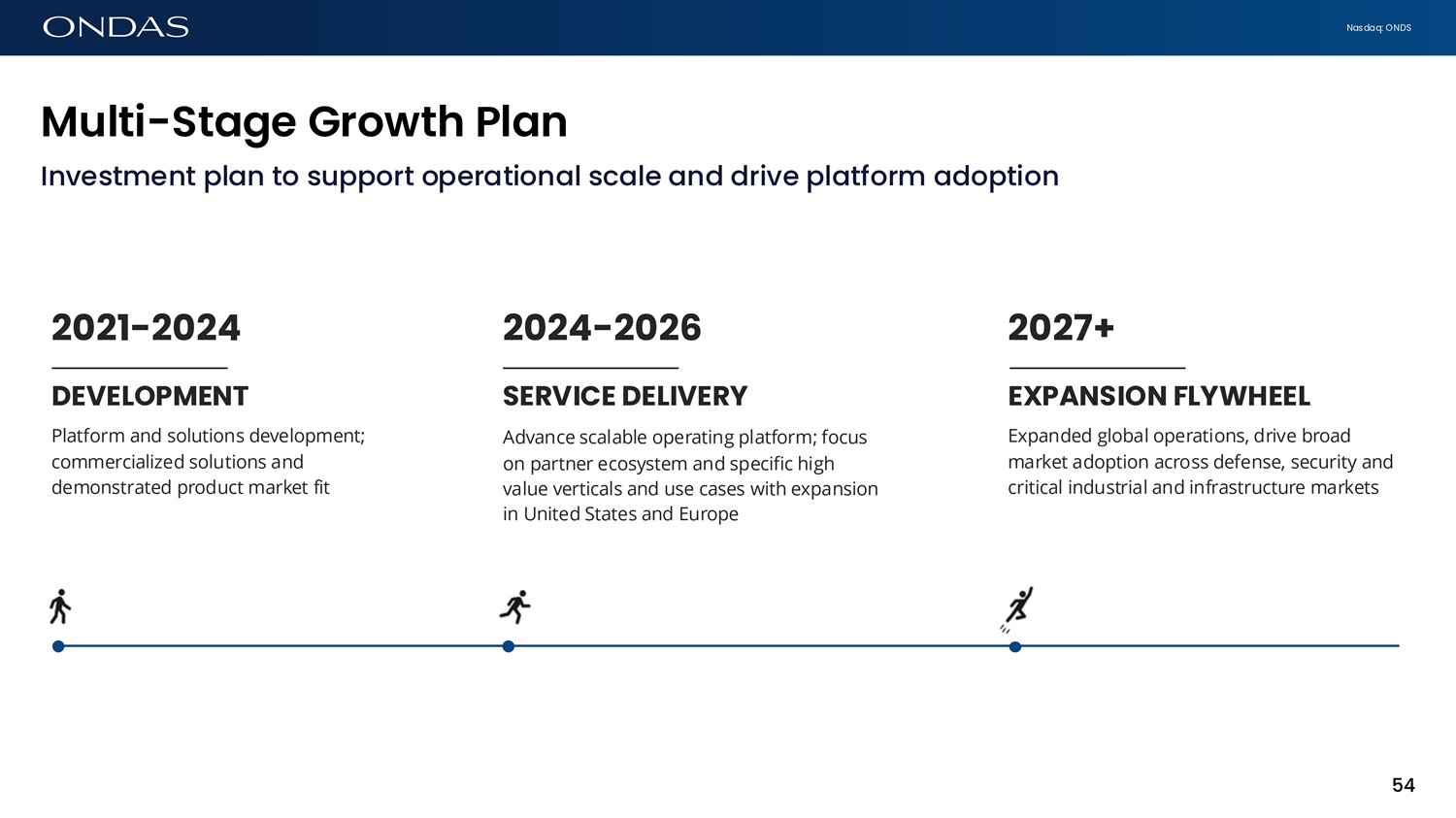

Nasdaq: ONDS 2021 - 2024 DEVELOPMENT Platform and solutions development; commercialized solutions and demonstrated product market fit 2024 - 2026 SERVICE DELIVERY Advance scalable operating platform; focus on partner ecosystem and specific high value verticals and use cases with expansion in United States and Europe 2027+ EXPANSION FLYWHEEL Expanded global operations, drive broad market adoption across defense, security and critical industrial and infrastructure markets 54 Multi - St6ge Growth Pl6fi Investment plan to support operational scale and drive platform adoption

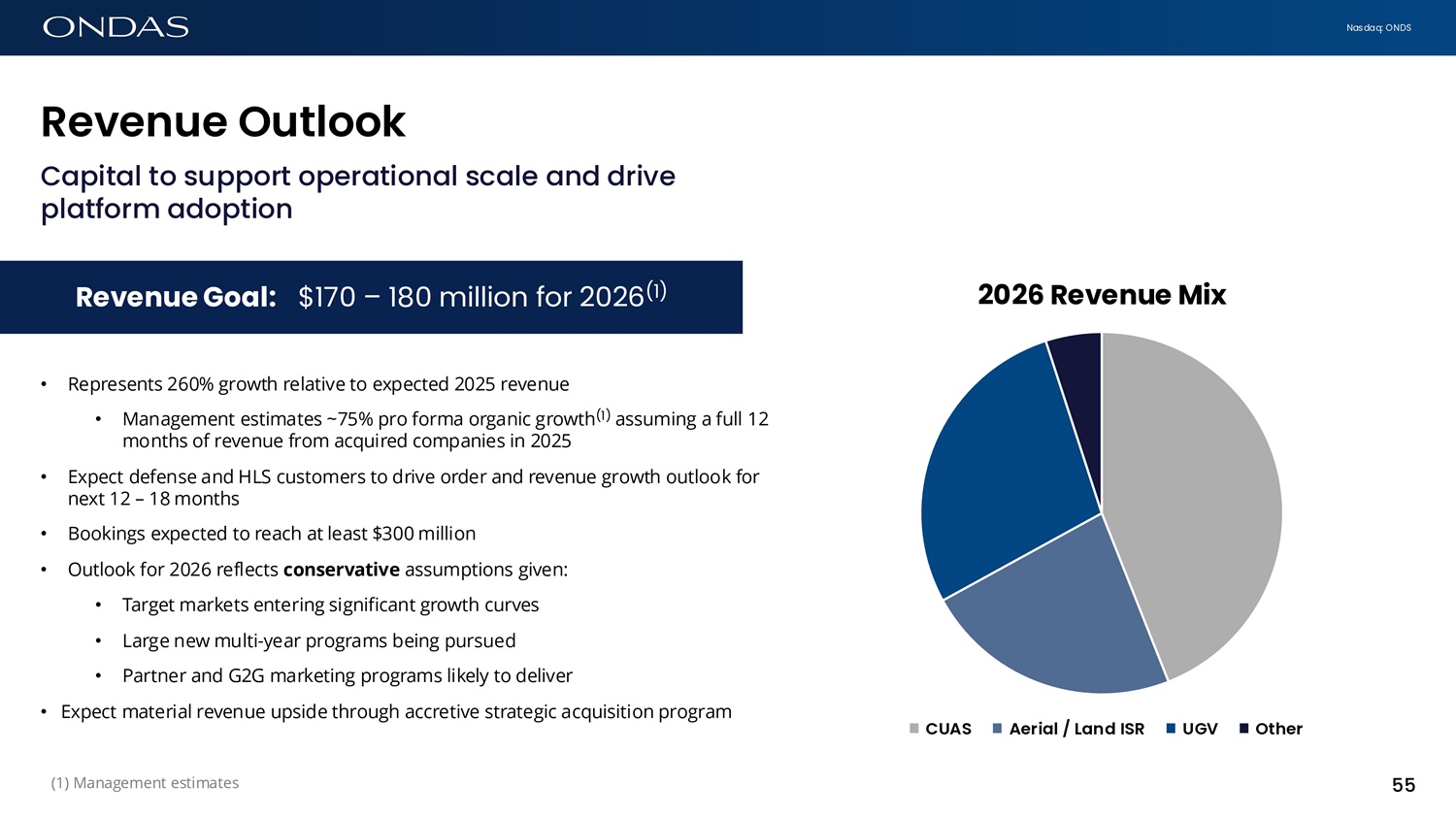

Nasdaq: ONDS 55 Revefiue Outlook Capital to support operational scale and drive platform adoption • Represents 260% growth relative to expected 2025 revenue • Management estimates ~75% pro forma organic growth (1) assuming a full 12 months of revenue from acquired companies in 2025 • Expect defense and HLS customers to drive order and revenue growth outlook for next 12 – 18 months • Bookings expected to reach at least $300 million • Outlook for 2026 reflects conservative assumptions given: • Target markets entering significant growth curves • Large new multi - year programs being pursued • Partner and G2G marketing programs likely to deliver • Expect material revenue upside through accretive strategic acquisition program Revenue Goal: $170 – 180 million for 2026 (1) 2026 Revenue Mix CUAS Aeri6l / L6fid ISR UGV Other (1) Management estimates

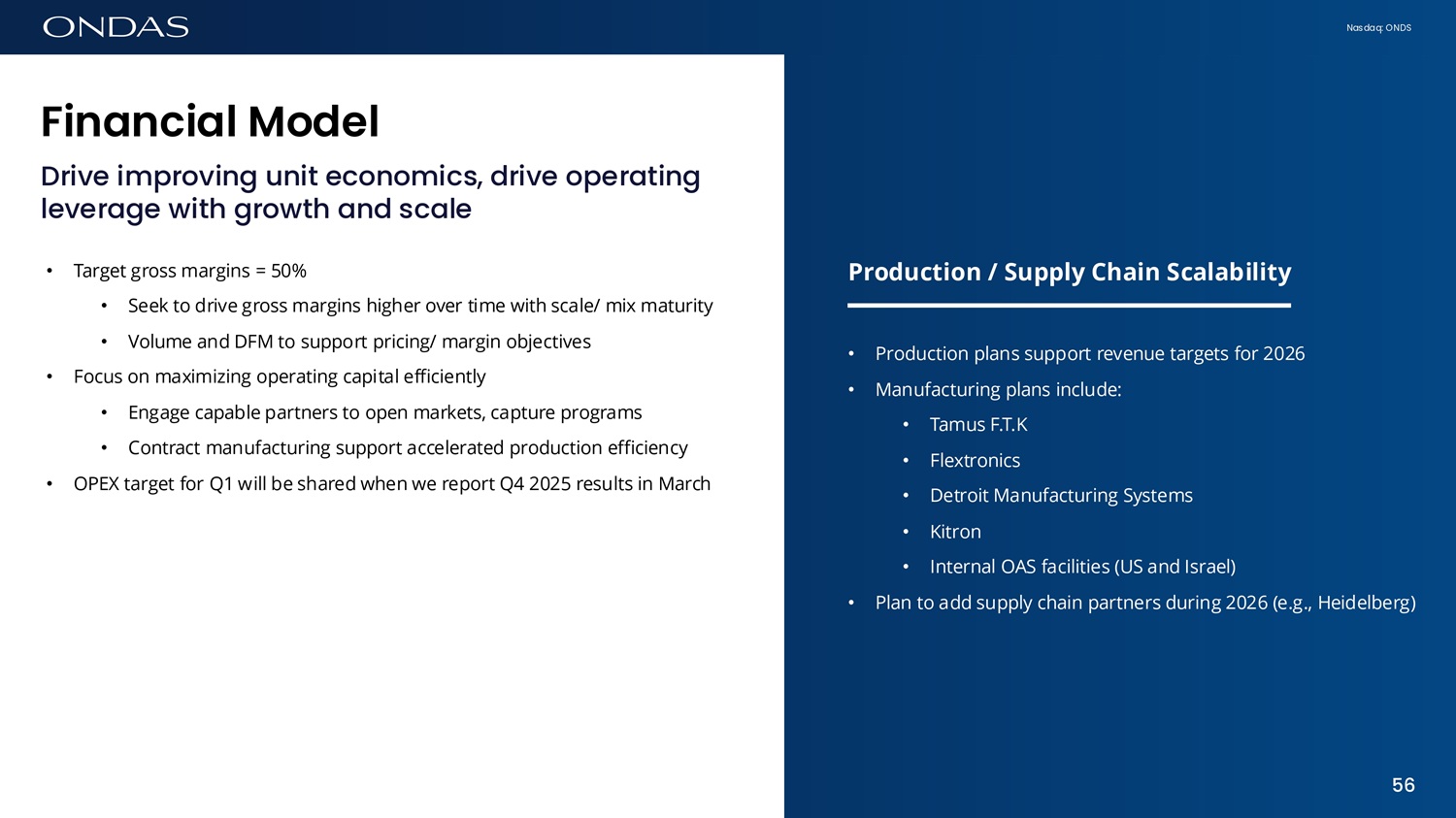

Nasdaq: ONDS Fifi6fici6l Model Drive improving unit economics, drive operating leverage with growth and scale • Target gross margins = 50% • Seek to drive gross margins higher over time with scale/ mix maturity • Volume and DFM to support pricing/ margin objectives • Focus on maximizing operating capital efficiently • Engage capable partners to open markets, capture programs • Contract manufacturing support accelerated production efficiency • OPEX target for Q1 will be shared when we report Q4 2025 results in March Production / Supply Chain Scalability • Production plans support revenue targets for 2026 • Manufacturing plans include: • Tamus F.T.K • Flextronics • Detroit Manufacturing Systems • Kitron • Internal OAS facilities (US and Israel) • Plan to add supply chain partners during 2026 (e.g., Heidelberg) 56

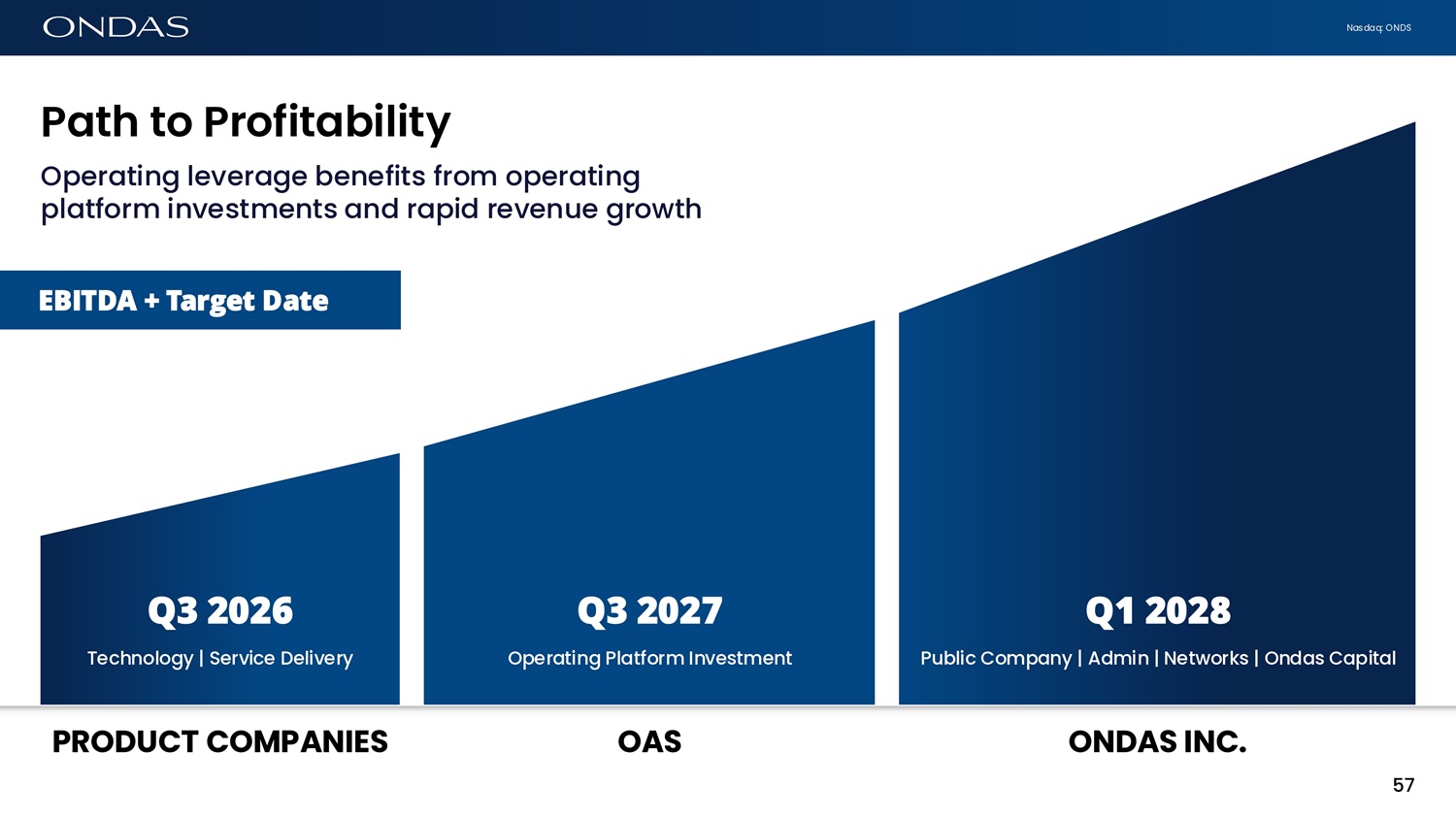

Nasdaq: ONDS Q3 2026 Technology | Service Delivery Q3 2027 Operating Platform Investment Q1 2028 Public Company | Admin | Networks | Ondas Capital 57 Operating leverage benefits from operating platform investments and rapid revenue growth P6th to Profit6bility PRODUCT COMPANIES OAS ONDAS INC. EBITDA + Target Date

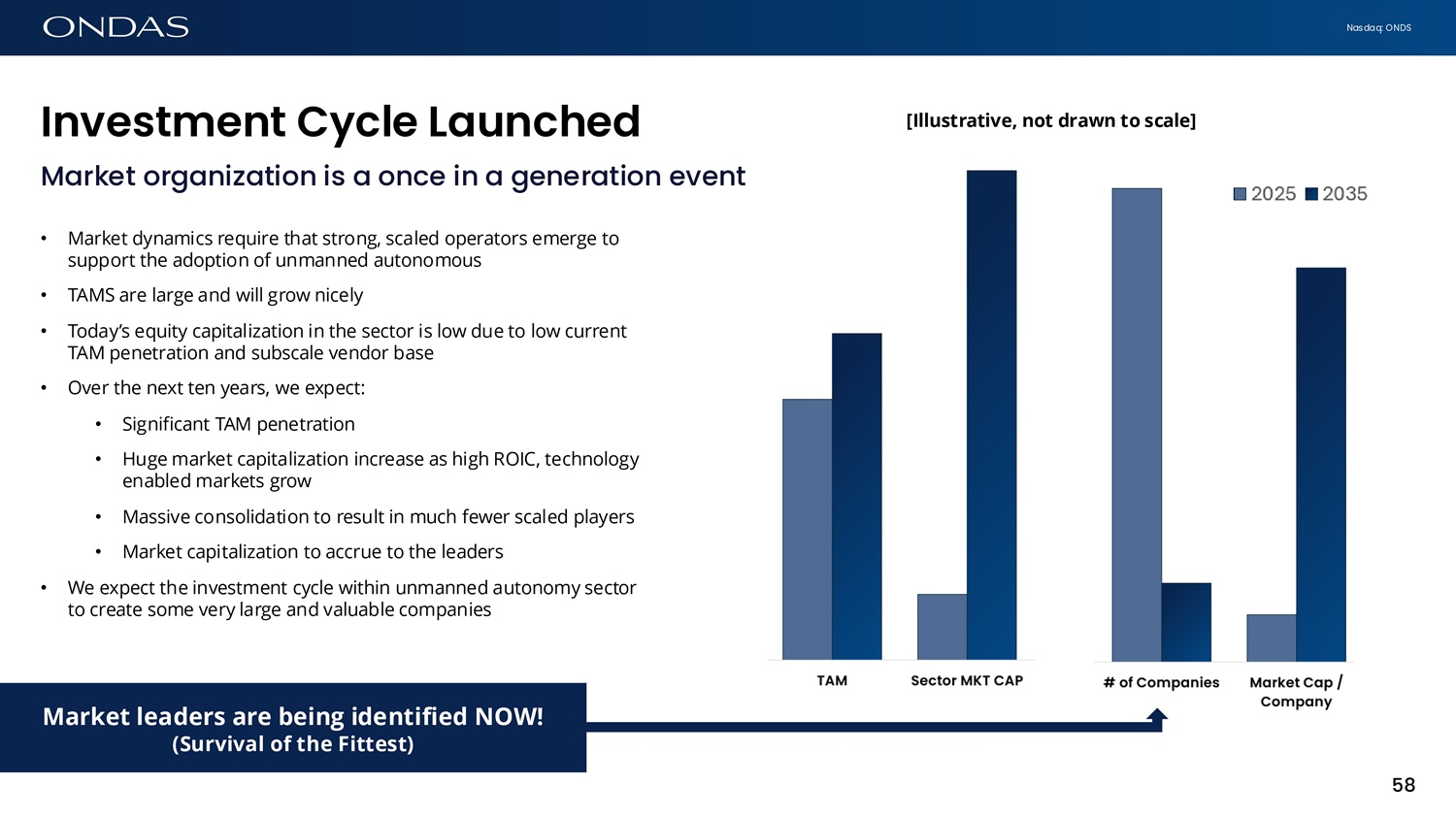

Nasdaq: ONDS Ifivestmefit Cycle L6ufiched Market organization is a once in a generation event • Market dynamics require that strong, scaled operators emerge to support the adoption of unmanned autonomous • TAMS are large and will grow nicely • Today’s equity capitalization in the sector is low due to low current TAM penetration and subscale vendor base • Over the next ten years, we expect: • Significant TAM penetration • Huge market capitalization increase as high ROIC, technology enabled markets grow • Massive consolidation to result in much fewer scaled players • Market capitalization to accrue to the leaders • We expect the investment cycle within unmanned autonomy sector to create some very large and valuable companies [Illustrative, not drawn to scale] 58 Market leaders are being identified NOW! (Survival of the Fittest)

Nasdaq: ONDS 59 Fifi6fici6l Outcome Successful execution of our Core + Strategic growth plan creates a high growth, highly profitable global company supported by a broad portfolio of integrated aerial and ground defense, security and intelligence platforms and services PATH TO $15+ BILLION MARKET CAP July 2025 Outlook $300 + million $1.5 billion + 30% EBITDA Margin 2026 2030 High Growth, Scaled Market Leader Global Operational Flywheel Engaged BUSINESS REVENUE $100 million (run rate) $170 - $180 million EBITDA Positive Q3 2026 at Product Company Layer 59

Nasdaq: ONDS INVESTOR Q&A Singapore Air Show, February 2026 | Merch Store Coming Soon 60

Nasdaq: ONDS ERIC BROCK CHAIRMAN & CEO eric.brock@ondas.com Copyright 2026 All rights reserved. NASDAQ: ONDS | January 2026